Connecticut Trust Form

What is the Connecticut Trust

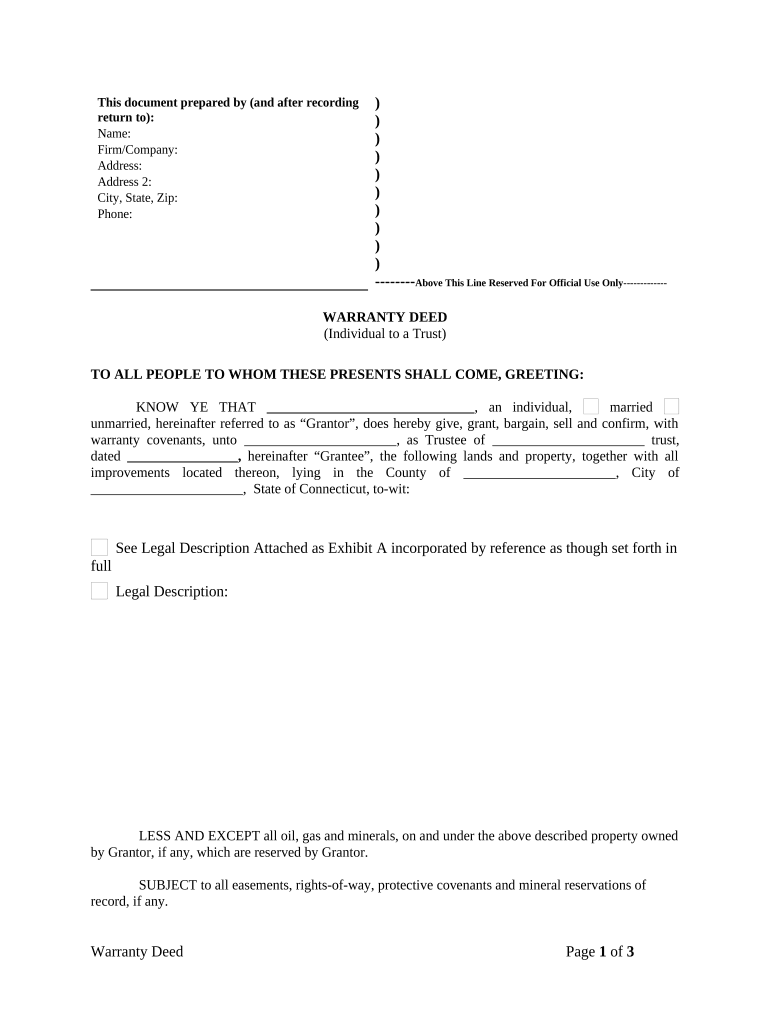

The Connecticut Trust is a legal arrangement that allows individuals to manage their assets, protect their wealth, and ensure that their wishes are carried out after their passing. This type of trust can help avoid probate, which is the legal process of distributing a deceased person's assets. Establishing a Connecticut Trust can provide peace of mind, knowing that your assets will be handled according to your specifications.

How to use the Connecticut Trust

Using a Connecticut Trust involves several steps. First, you must decide on the type of trust that best suits your needs, such as a revocable or irrevocable trust. Next, you will need to draft the trust document, which outlines the terms and conditions of the trust, including the beneficiaries and the trustee. Once the document is prepared, assets can be transferred into the trust. This process ensures that the trust operates effectively and according to your intentions.

Steps to complete the Connecticut Trust

Completing a Connecticut Trust involves a systematic approach:

- Determine the purpose of the trust and identify the beneficiaries.

- Select a trustee who will manage the trust assets.

- Draft the trust document with specific terms and conditions.

- Transfer assets into the trust, including real estate, bank accounts, and investments.

- Review and update the trust regularly to reflect any changes in circumstances.

Legal use of the Connecticut Trust

The Connecticut Trust is legally recognized and can be used for various purposes, including estate planning, asset protection, and tax planning. It is essential to ensure that the trust complies with state laws to maintain its validity. Proper execution of the trust document and adherence to legal requirements are crucial for its effectiveness.

Key elements of the Connecticut Trust

Key elements of a Connecticut Trust include:

- Trustee: The individual or entity responsible for managing the trust.

- Beneficiaries: Those who will benefit from the trust assets.

- Trust document: The legal document that outlines the terms of the trust.

- Assets: The property and funds placed into the trust.

State-specific rules for the Connecticut Trust

Connecticut has specific laws governing the creation and administration of trusts. These rules dictate how trusts must be established, the rights of beneficiaries, and the responsibilities of trustees. Understanding these regulations is vital for ensuring that the trust operates within the legal framework and achieves its intended purposes.

Quick guide on how to complete connecticut trust 497300956

Accomplish Connecticut Trust effortlessly on any device

Digital document management has become favored by enterprises and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can locate the right form and securely preserve it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents swiftly without delays. Manage Connecticut Trust on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Connecticut Trust seamlessly

- Obtain Connecticut Trust and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent parts of your documents or conceal confidential information with the tools that airSlate SignNow supplies specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and bears the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign Connecticut Trust and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Connecticut trust and why is it important?

A Connecticut trust is a legal entity that allows individuals to manage their assets effectively while ensuring privacy and protection from creditors. Utilizing a Connecticut trust can provide tax benefits and help in estate planning, making it an essential tool for managing generational wealth.

-

How can airSlate SignNow assist with managing a Connecticut trust?

AirSlate SignNow provides a streamlined platform for creating, sending, and eSigning documents related to your Connecticut trust. Our user-friendly interface enables easy collaboration with trustees and beneficiaries, ensuring that your trust documentation is securely handled and stored.

-

What are the costs associated with setting up a Connecticut trust?

The costs for setting up a Connecticut trust can vary depending on several factors, including the complexity of the trust and professional fees for legal assistance. With airSlate SignNow, you can reduce documentation costs and expenses by using our efficient electronic signing services.

-

What features does airSlate SignNow offer for Connecticut trust management?

AirSlate SignNow offers features that include document templates, real-time tracking, and secure cloud storage specifically designed to support Connecticut trust management. These features help ensure that all trust-related documents are processed efficiently and securely.

-

Are there specific regulations for Connecticut trusts I should know?

Yes, Connecticut trusts are governed by state laws that dictate how they must be structured and managed. Understanding these regulations is crucial, and using airSlate SignNow can simplify compliance by providing access to secure and legally binding eSignatures for all trust documents.

-

Can airSlate SignNow integrate with other tools for managing a Connecticut trust?

Absolutely! AirSlate SignNow can seamlessly integrate with various tools and platforms you may be using for managing your Connecticut trust. This ensures that all your legal and financial documents can be handled efficiently without switching between multiple applications.

-

What are the benefits of using airSlate SignNow for a Connecticut trust?

Using airSlate SignNow for a Connecticut trust offers several benefits, including reduced paperwork, faster turnaround times, and enhanced security. Our platform empowers you to manage your documentation effortlessly, allowing more time to focus on your trust's long-term goals.

Get more for Connecticut Trust

- New jersey form w 2 ampamp nj w 3m filing requirements expressefile

- Form 306 income tax withholding return north dakota office of state

- 2022 inventory of taxable property due on or before form

- Form new hampshire department of revenue administration cd 57 s real

- Florida department of revenue child support e serviceschild support in florida 2021 florida family lawchild support in florida form

- Understanding your cp14 noticeinternal revenue service irs tax forms

- Fillable online massachusetts form 3m income tax return

- Massachusetts department of revenue form m 4868

Find out other Connecticut Trust

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast