Demand for Discharge by Corporation or LLC Connecticut Form

What is the Demand For Discharge By Corporation Or LLC Connecticut

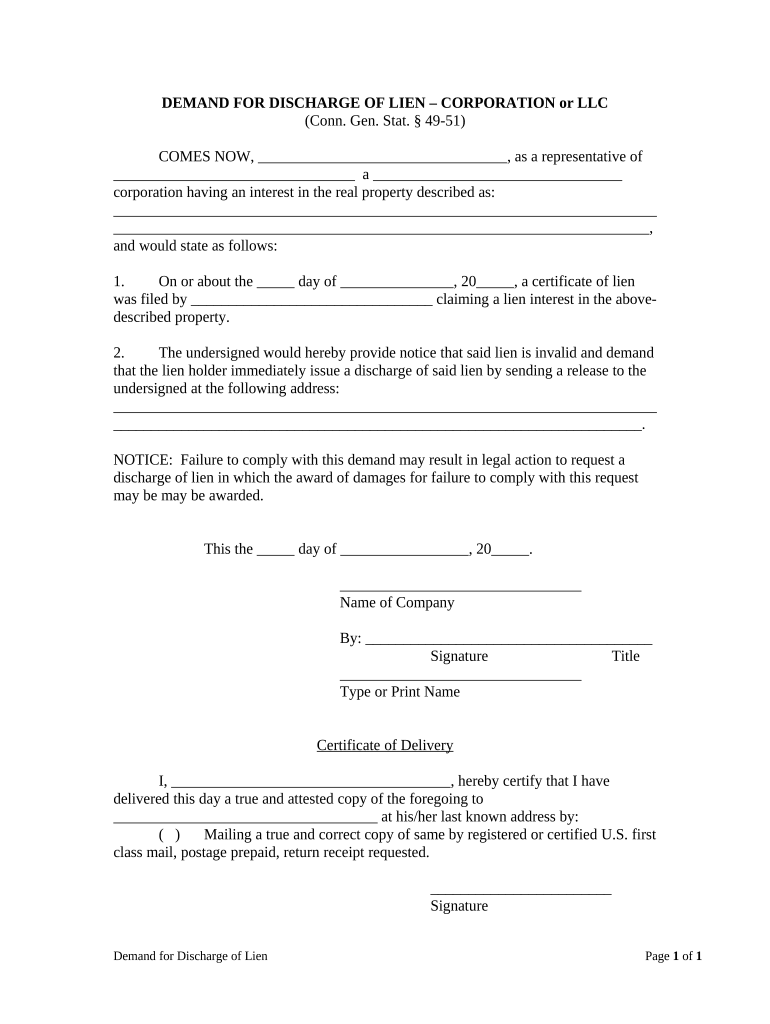

The Demand for Discharge by Corporation or LLC in Connecticut is a legal document used to formally request the release of a corporation or limited liability company from certain obligations or liabilities. This form is essential for businesses that have fulfilled their obligations and wish to dissolve or exit from certain responsibilities. It serves as a declaration that the corporation or LLC has met all necessary requirements and is seeking an official acknowledgment of discharge.

How to Use the Demand For Discharge By Corporation Or LLC Connecticut

To effectively use the Demand for Discharge by Corporation or LLC in Connecticut, businesses must first ensure that all prerequisites are met. This includes settling any outstanding debts and fulfilling statutory obligations. Once these conditions are satisfied, the form can be completed and submitted to the appropriate state authority. It is crucial to include all required information accurately to avoid delays in processing.

Steps to Complete the Demand For Discharge By Corporation Or LLC Connecticut

Completing the Demand for Discharge by Corporation or LLC in Connecticut involves several key steps:

- Gather necessary documentation, including proof of debt settlement and compliance with state regulations.

- Fill out the form with accurate details about the corporation or LLC, including its name, registration number, and the reasons for the discharge.

- Review the completed form for accuracy and completeness.

- Submit the form to the appropriate state authority, either online or by mail, ensuring that any required fees are included.

Legal Use of the Demand For Discharge By Corporation Or LLC Connecticut

The legal use of the Demand for Discharge by Corporation or LLC in Connecticut is governed by state law. This form is recognized as a formal request for discharge, and its proper completion and submission can protect the corporation or LLC from future liabilities. It is essential to adhere to all legal requirements to ensure that the discharge is valid and enforceable.

State-Specific Rules for the Demand For Discharge By Corporation Or LLC Connecticut

In Connecticut, specific rules apply to the Demand for Discharge by Corporation or LLC. These include the requirement to provide documentation proving that all debts have been settled and compliance with state laws has been achieved. Additionally, the form must be submitted within certain time frames to ensure its validity, and any fees associated with the submission must be paid promptly.

Eligibility Criteria

Eligibility to file the Demand for Discharge by Corporation or LLC in Connecticut typically requires that the business entity has fulfilled all obligations, including the payment of taxes and settlement of debts. Furthermore, the corporation or LLC must be in good standing with the state, meaning it has complied with all regulatory requirements and has not been subject to any legal actions that would impede its ability to request a discharge.

Quick guide on how to complete demand for discharge by corporation or llc connecticut

Effortlessly Prepare Demand For Discharge By Corporation Or LLC Connecticut on Any Device

Digital document management has become increasingly favored by both organizations and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Manage Demand For Discharge By Corporation Or LLC Connecticut on any device with the airSlate SignNow Android or iOS applications and enhance any document-based process today.

The Simplest Method to Alter and eSign Demand For Discharge By Corporation Or LLC Connecticut Without Stress

- Obtain Demand For Discharge By Corporation Or LLC Connecticut and click on Get Form to initiate.

- Utilize the features we provide to fill out your document.

- Highlight important sections of your documents or conceal sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which only takes a few seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow manages all your document management needs in just a few clicks from any device you prefer. Edit and eSign Demand For Discharge By Corporation Or LLC Connecticut and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Demand For Discharge By Corporation Or LLC in Connecticut?

A Demand For Discharge By Corporation Or LLC in Connecticut is a formal request made by a business entity to terminate its financial obligations. This document serves to notify creditors and stakeholders that the corporation or LLC has fulfilled all its obligations. Understanding this process is crucial for maintaining good standing in the state.

-

How does airSlate SignNow facilitate the Demand For Discharge By Corporation Or LLC process in Connecticut?

airSlate SignNow provides an easy-to-use platform for creating, sending, and signing the Demand For Discharge By Corporation Or LLC documents. With its user-friendly interface, businesses can streamline their document workflows efficiently. This ensures compliance and saves time for your corporation or LLC.

-

What are the pricing options for using airSlate SignNow for Demand For Discharge By Corporation Or LLC in Connecticut?

airSlate SignNow offers various pricing plans that cater to different business needs, including options for small businesses and large corporations. Each plan includes features for processing Demand For Discharge By Corporation Or LLC documents effectively. Pricing is competitive and designed to deliver value for the essential functions required.

-

Can airSlate SignNow integrate with other software for filing Demand For Discharge By Corporation Or LLC in Connecticut?

Yes, airSlate SignNow integrates seamlessly with various CRM and accounting software, making it easier to manage the Demand For Discharge By Corporation Or LLC process. You can import data and documents directly from other platforms, enhancing productivity. This integration simplifies operations and reduces the likelihood of errors.

-

What are the key features of airSlate SignNow for managing a Demand For Discharge By Corporation Or LLC in Connecticut?

Key features of airSlate SignNow include document templates, customizable workflows, and secure e-signature options. These tools help businesses create specific documents like the Demand For Discharge By Corporation Or LLC efficiently. Additionally, the platform ensures compliance with Connecticut regulations, giving peace of mind to users.

-

How can businesses benefit from using airSlate SignNow for Demand For Discharge By Corporation Or LLC in Connecticut?

Businesses can benefit from increased efficiency and reduced operational costs by using airSlate SignNow for Demand For Discharge By Corporation Or LLC. The platform allows for faster document turnaround, which helps in maintaining compliance and good standing in the state. Overall, it simplifies complex legal processes for corporations and LLCs.

-

Is it safe to use airSlate SignNow for creating Demand For Discharge By Corporation Or LLC documents?

Absolutely, airSlate SignNow prioritizes security and offers advanced encryption for all documents, including Demand For Discharge By Corporation Or LLC. This ensures that sensitive information remains protected throughout the process. Users can trust the platform to safeguard their critical business information.

Get more for Demand For Discharge By Corporation Or LLC Connecticut

Find out other Demand For Discharge By Corporation Or LLC Connecticut

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement