Connecticut Conveyance Form

What is the Connecticut Conveyance

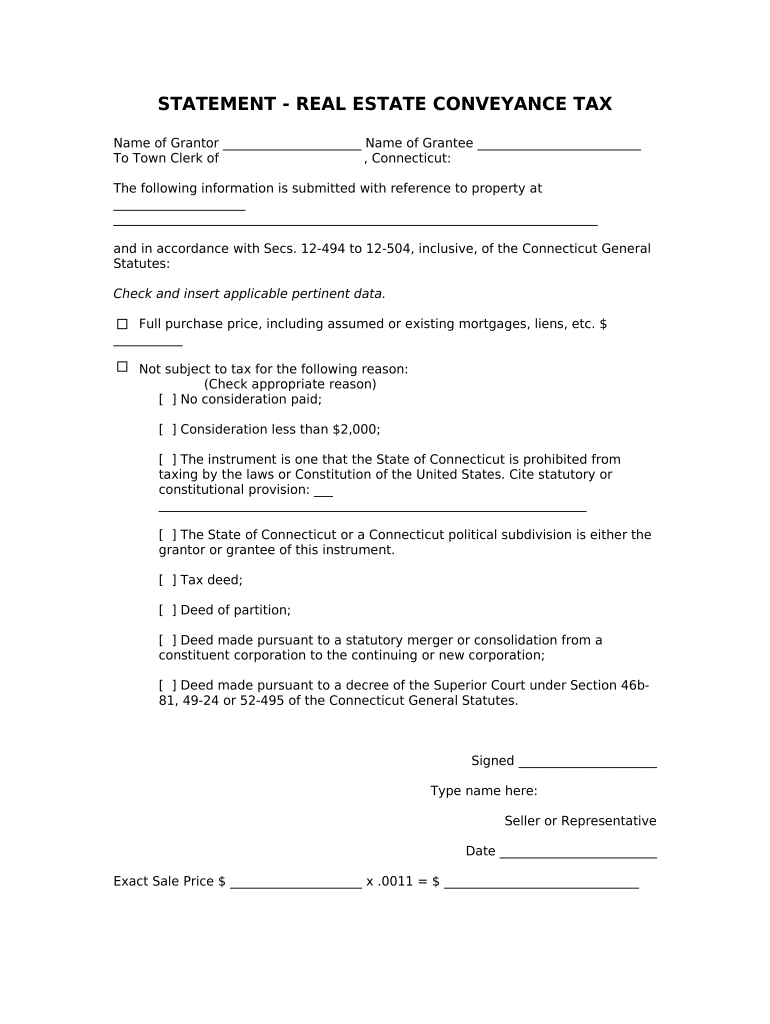

The Connecticut conveyance tax form is a legal document required when real estate is transferred in the state of Connecticut. This form serves to report the sale or transfer of property and ensures that the appropriate taxes are assessed and collected. The conveyance tax is typically based on the sale price of the property and is an essential part of the real estate transaction process. Understanding this form is crucial for both buyers and sellers to comply with state tax regulations.

Steps to Complete the Connecticut Conveyance

Completing the Connecticut conveyance tax form involves several key steps:

- Gather necessary information, including the property address, sale price, and details of the buyer and seller.

- Obtain the correct form, which can be accessed online or through local tax offices.

- Fill out the form accurately, ensuring all required fields are completed, including signatures from both parties.

- Calculate the conveyance tax based on the sale price, adhering to the current tax rates set by the state.

- Submit the completed form to the appropriate local tax authority, either online, by mail, or in person.

Legal Use of the Connecticut Conveyance

The Connecticut conveyance tax form is legally binding when completed correctly. To ensure its validity, the form must be signed by both the buyer and seller, and it must comply with state regulations regarding conveyance tax. Utilizing a reliable electronic signature tool can enhance the legal standing of the document, as it provides a secure method for signing and storing the form. Compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA) is essential for eSignatures to be legally recognized.

Required Documents

When preparing to file the Connecticut conveyance tax form, certain documents are necessary:

- The sales contract or agreement detailing the terms of the property transfer.

- Identification documents for both the buyer and seller, such as a driver’s license or passport.

- Any prior conveyance documents if the property has changed hands multiple times.

- Proof of payment for the conveyance tax, which may include a receipt or confirmation from the local tax authority.

Form Submission Methods

The Connecticut conveyance tax form can be submitted through various methods, providing flexibility for users:

- Online: Many local tax offices allow for electronic submission through their websites, streamlining the process.

- By Mail: Completed forms can be mailed to the appropriate local tax authority, ensuring they are sent well before any deadlines.

- In Person: Individuals may also choose to deliver the form directly to their local tax office for immediate processing.

Penalties for Non-Compliance

Failing to file the Connecticut conveyance tax form or submitting it inaccurately can result in penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential for both buyers and sellers to understand the importance of timely and accurate submission to avoid these consequences. Consulting with a tax professional can provide further guidance on compliance and help mitigate risks associated with non-compliance.

Quick guide on how to complete connecticut conveyance

Complete Connecticut Conveyance effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the features you need to draft, modify, and electronically sign your documents swiftly without complications. Manage Connecticut Conveyance on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign Connecticut Conveyance with ease

- Obtain Connecticut Conveyance and select Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and eSign Connecticut Conveyance and ensure outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the CT conveyance tax form?

The CT conveyance tax form is a document required for the transfer of real estate in Connecticut. It must be completed and submitted to ensure compliance with state tax regulations. Using airSlate SignNow can simplify the process of filling out and sending this form securely.

-

How can airSlate SignNow help with the CT conveyance tax form?

airSlate SignNow offers an easy-to-use platform for completing and eSigning the CT conveyance tax form digitally. This not only saves time but also ensures that your documents are securely stored and easily accessible. With airSlate SignNow, you can streamline the entire process from start to finish.

-

Is there a cost associated with using airSlate SignNow for the CT conveyance tax form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs when handling the CT conveyance tax form. These plans are cost-effective, aiming to provide value for businesses of all sizes. A free trial is also available, allowing you to test the service before committing.

-

Are there any features specific to the CT conveyance tax form in airSlate SignNow?

airSlate SignNow includes features tailored for the CT conveyance tax form, such as template creation and automated reminders. These features help ensure that you complete and submit the form accurately and on time. Additionally, you can track the status of your document in real-time.

-

What are the benefits of using airSlate SignNow for legal documents like the CT conveyance tax form?

Using airSlate SignNow for legal documents such as the CT conveyance tax form offers numerous benefits, including increased efficiency and enhanced security. The platform allows easy collaboration with multiple parties while ensuring that sensitive information is protected. Plus, you can manage all your documents in one secure location.

-

Can I integrate airSlate SignNow with other software for the CT conveyance tax form?

Yes, airSlate SignNow offers integrations with various software and tools, making it easier to incorporate the CT conveyance tax form into your existing workflows. Whether you use CRM systems or document management tools, airSlate SignNow can enhance your overall productivity. This integration capability streamlines the document handling process.

-

What types of businesses can benefit from using airSlate SignNow for the CT conveyance tax form?

Any business involved in real estate transactions can benefit from using airSlate SignNow for the CT conveyance tax form. This includes real estate agents, law firms, and mortgage companies that handle property transfers. By utilizing airSlate SignNow, they can ensure speed and compliance in their transaction processes.

Get more for Connecticut Conveyance

Find out other Connecticut Conveyance

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document

- How Do I Sign New Mexico Banking Form

- How To Sign New Mexico Banking Presentation

- How Do I Sign New York Banking PPT

- Help Me With Sign Ohio Banking Document

- How To Sign Oregon Banking PDF

- Help Me With Sign Oregon Banking Presentation

- Can I Sign Pennsylvania Banking Form

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation