Connecticut Installments Fixed Rate Promissory Note Secured by Commercial Real Estate Connecticut Form

What is the Connecticut Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Connecticut

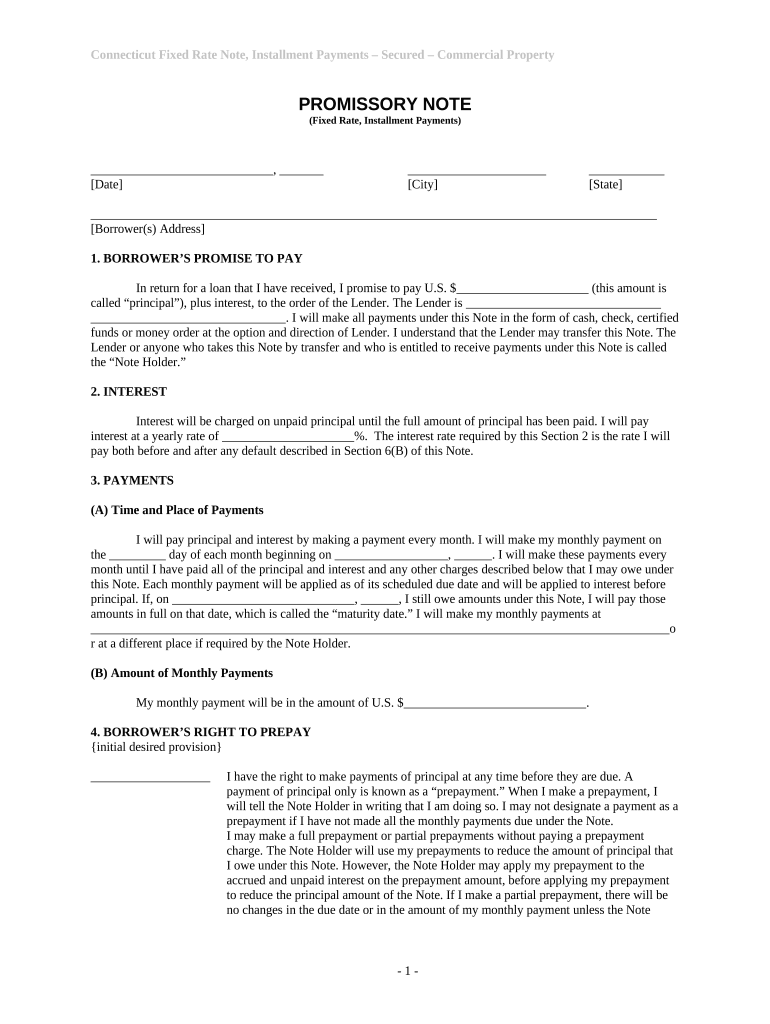

The Connecticut Installments Fixed Rate Promissory Note Secured By Commercial Real Estate is a legal document that outlines the terms of a loan secured by commercial property in Connecticut. This type of promissory note specifies the fixed interest rate, repayment schedule, and the obligations of the borrower. It serves as a formal agreement between the lender and the borrower, ensuring that the lender has a claim against the property in case of default. This document is essential for both parties to understand their rights and responsibilities regarding the loan.

Key elements of the Connecticut Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Connecticut

Several key elements are crucial in the Connecticut Installments Fixed Rate Promissory Note. These include:

- Loan Amount: The total amount borrowed by the borrower.

- Interest Rate: The fixed rate at which interest will accrue on the principal amount.

- Repayment Schedule: Details on how and when payments will be made, including any grace periods.

- Collateral Description: A clear description of the commercial real estate securing the loan.

- Default Terms: Conditions under which the borrower would be considered in default and the lender's rights in such cases.

Steps to complete the Connecticut Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Connecticut

Completing the Connecticut Installments Fixed Rate Promissory Note involves several important steps:

- Gather Information: Collect all necessary details about the loan, including the amount, interest rate, and repayment terms.

- Draft the Document: Use a template or legal software to create the promissory note, ensuring all key elements are included.

- Review the Terms: Both parties should carefully review the terms to ensure clarity and mutual agreement.

- Sign the Document: Both the lender and borrower must sign the note, preferably in the presence of a notary public for added legal validity.

- Store the Document: Keep a signed copy of the promissory note in a safe place for future reference.

Legal use of the Connecticut Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Connecticut

The legal use of this promissory note is governed by state laws in Connecticut. It must comply with the Uniform Commercial Code (UCC) and other relevant statutes. The note is enforceable in court, provided it meets all legal requirements, such as proper signatures and clear terms. It is advisable for both parties to seek legal counsel to ensure that the document adheres to all applicable laws and protects their interests.

How to use the Connecticut Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Connecticut

This promissory note can be used in various scenarios involving the financing of commercial properties. Lenders can utilize it to secure their investment, while borrowers can use it to formalize their loan agreements. It is essential to ensure that the note is filled out accurately and reflects the agreed-upon terms to avoid disputes in the future. Digital tools can facilitate the completion and signing of this document, making the process more efficient.

Quick guide on how to complete connecticut installments fixed rate promissory note secured by commercial real estate connecticut

Complete Connecticut Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Connecticut effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents rapidly without delays. Manage Connecticut Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Connecticut on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

Ways to adjust and eSign Connecticut Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Connecticut with ease

- Obtain Connecticut Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Connecticut and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to preserve your changes.

- Select how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Forget about lost or misplaced files, tedious form navigation, or mistakes that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Connecticut Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Connecticut and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Connecticut Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Connecticut?

A Connecticut Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Connecticut is a financial instrument that allows borrowers to secure loans backed by commercial real estate assets. This type of promissory note establishes fixed installment payments over a specified period, providing predictability in repayment. Businesses utilize these notes to manage cash flow while leveraging their real estate assets.

-

What are the benefits of using a Connecticut Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Connecticut?

Using a Connecticut Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Connecticut offers several advantages including predictable payment schedules and potentially lower interest rates compared to unsecured loans. This financing method also provides access to larger loan amounts, enabling businesses to make signNow investments or improvements in their commercial properties. Additionally, the security of real estate backing increases the likelihood of loan approval.

-

How do I determine the interest rate for a Connecticut Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Connecticut?

The interest rate for a Connecticut Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Connecticut typically depends on various factors including market conditions, borrower creditworthiness, and the value of the secured property. Lenders will assess these factors to offer competitive rates that reflect the risk involved in the loan. It's advisable to compare multiple offers to find the best possible interest rate.

-

What is the typical duration for a Connecticut Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Connecticut?

The duration for a Connecticut Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Connecticut can vary but commonly falls between 5 to 30 years. The length of the note often aligns with the expected cash flow from the commercial property and the repayment capability of the borrower. Longer terms may provide smaller monthly payments, while shorter terms could reduce total interest paid over the life of the loan.

-

Can I use a Connecticut Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Connecticut for refinancing?

Yes, you can use a Connecticut Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Connecticut for refinancing existing commercial loans. This option allows businesses to secure better terms, lower interest rates, or access additional capital based on the equity of the property. Refinancing can lead to improved cash flow and financial flexibility.

-

What types of properties can secure a Connecticut Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Connecticut?

A variety of commercial properties can secure a Connecticut Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Connecticut, including office buildings, retail spaces, warehouses, and industrial properties. Lenders typically assess the property's value, location, and marketability when determining eligibility. Quality properties with stable income streams are often favored for these loans.

-

Are there any specific qualifications needed to apply for a Connecticut Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Connecticut?

To apply for a Connecticut Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Connecticut, borrowers must generally demonstrate a good credit history, financial stability, and the ability to repay the loan. Lenders may also evaluate the commercial property's value and income potential. Different lenders have varying qualification criteria, so it's crucial to check with them directly.

Get more for Connecticut Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Connecticut

- Asplundh portal form

- Cousins subs menu pdf form

- Principles of instrumental analysis solutions manual pdf form

- Application for vacant seat admission form

- Coolsculpting consent form

- Full discharge refinance authority form

- Adac kaufvertrag fr den privaten verkauf eines form

- Aanvraag voor het verblijfsdoel medische behandeling ind form

Find out other Connecticut Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Connecticut

- How Do I eSign New York Quitclaim Deed

- eSign New Hampshire Warranty Deed Fast

- eSign Hawaii Postnuptial Agreement Template Later

- eSign Kentucky Postnuptial Agreement Template Online

- eSign Maryland Postnuptial Agreement Template Mobile

- How Can I eSign Pennsylvania Postnuptial Agreement Template

- eSign Hawaii Prenuptial Agreement Template Secure

- eSign Michigan Prenuptial Agreement Template Simple

- eSign North Dakota Prenuptial Agreement Template Safe

- eSign Ohio Prenuptial Agreement Template Fast

- eSign Utah Prenuptial Agreement Template Easy

- eSign Utah Divorce Settlement Agreement Template Online

- eSign Vermont Child Custody Agreement Template Secure

- eSign North Dakota Affidavit of Heirship Free

- How Do I eSign Pennsylvania Affidavit of Heirship

- eSign New Jersey Affidavit of Residence Free

- eSign Hawaii Child Support Modification Fast

- Can I eSign Wisconsin Last Will and Testament

- eSign Wisconsin Cohabitation Agreement Free

- How To eSign Colorado Living Will