Living Trust Property Record District of Columbia Form

What is the Living Trust Property Record District Of Columbia

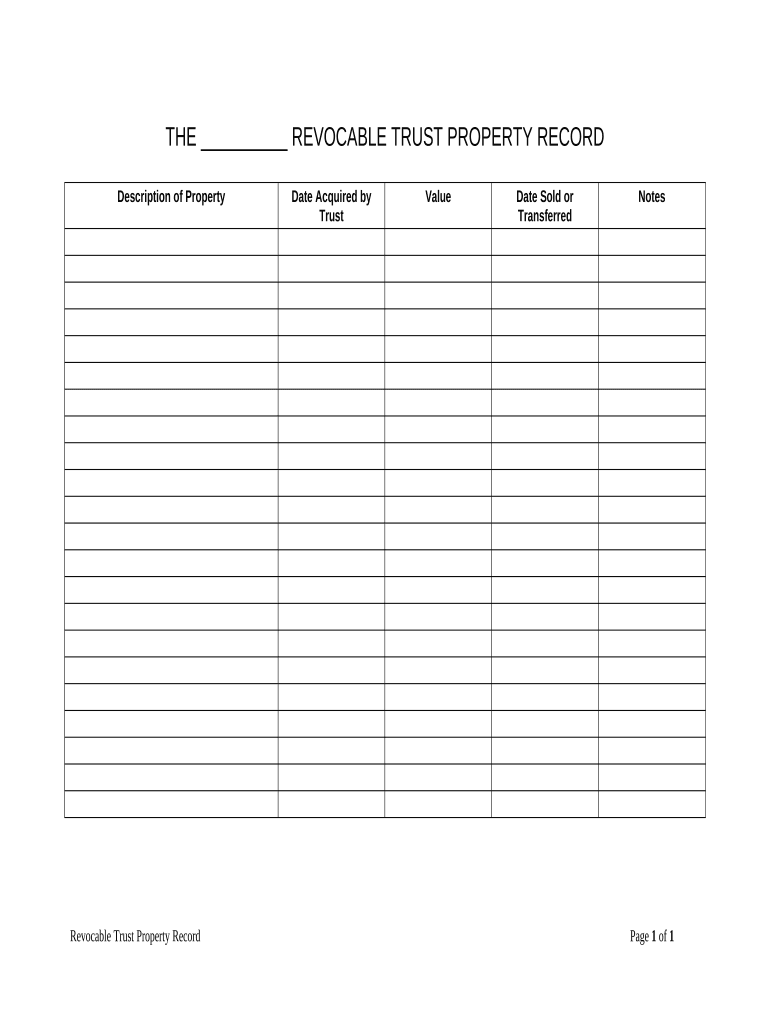

The Living Trust Property Record District Of Columbia is a legal document that outlines the assets held in a living trust within the jurisdiction of Washington, D.C. This record serves as an official declaration of ownership and management of property, ensuring that the assets are handled according to the wishes of the trust creator. It provides clarity and protection for both the grantor and beneficiaries, facilitating the transfer of property without the need for probate.

How to use the Living Trust Property Record District Of Columbia

Using the Living Trust Property Record involves several key steps. First, individuals must gather all relevant information about the assets included in the trust. This includes property descriptions, titles, and any pertinent legal documents. Once this information is compiled, it should be accurately recorded in the property record form. After completing the form, it can be submitted to the appropriate district office for official recognition. This process ensures that the living trust is legally acknowledged and that the assets are protected under D.C. law.

Steps to complete the Living Trust Property Record District Of Columbia

Completing the Living Trust Property Record requires careful attention to detail. Here are the steps to follow:

- Collect all necessary documents related to the trust and its assets.

- Fill out the Living Trust Property Record form with accurate information.

- Review the completed form to ensure all details are correct.

- Sign and date the form as required.

- Submit the form to the appropriate district office, either online or in person.

Legal use of the Living Trust Property Record District Of Columbia

The Living Trust Property Record is legally binding and serves multiple purposes. It provides evidence of ownership, helps avoid probate, and ensures that the assets are distributed according to the trust creator's wishes. Additionally, it protects the privacy of the trust assets, as they do not become part of the public probate record. Understanding the legal implications of this document is essential for anyone looking to establish a living trust in the District of Columbia.

Required Documents

To complete the Living Trust Property Record, certain documents are typically required. These may include:

- The original trust document outlining the terms of the living trust.

- Property deeds or titles for all assets included in the trust.

- Identification documents for the trust creator and any beneficiaries.

- Any additional legal documents that may pertain to the trust or its assets.

Who Issues the Form

The Living Trust Property Record form is issued by the District of Columbia's Office of the Recorder of Deeds. This office is responsible for maintaining public records related to property ownership and trusts. Individuals seeking to file this record must ensure they are using the most current version of the form, as requirements may change over time.

Quick guide on how to complete living trust property record district of columbia

Complete Living Trust Property Record District Of Columbia seamlessly on any device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the needed form and securely keep it online. airSlate SignNow provides all the resources necessary to create, modify, and eSign your documents quickly and without interruptions. Manage Living Trust Property Record District Of Columbia on any device with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to alter and eSign Living Trust Property Record District Of Columbia with ease

- Find Living Trust Property Record District Of Columbia and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize key sections of the documents or conceal sensitive data with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Decide how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing additional copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choice. Alter and eSign Living Trust Property Record District Of Columbia and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust Property Record in the District of Columbia?

A Living Trust Property Record in the District of Columbia is a legal document that helps manage and protect property assets during an individual's lifetime and after their death. It outlines the distribution of assets according to the grantor's wishes, ensuring a smooth transfer to beneficiaries while avoiding the probate process.

-

How can I create a Living Trust Property Record in the District of Columbia?

To create a Living Trust Property Record in the District of Columbia, you can use airSlate SignNow's eSigning platform, which streamlines the document preparation process. It allows you to easily draft, customize, and execute the necessary legal documents electronically, ensuring compliance with state laws.

-

What are the benefits of using airSlate SignNow for my Living Trust Property Record in the District of Columbia?

Using airSlate SignNow for your Living Trust Property Record in the District of Columbia offers numerous benefits including ease of use, cost-effectiveness, and guaranteed legal validity. The platform simplifies document management, allowing you to store, share, and eSign documents securely.

-

Is there a specific fee involved in creating a Living Trust Property Record in the District of Columbia with airSlate SignNow?

Yes, airSlate SignNow has a subscription model that varies based on the features you select. However, it is known for being a cost-effective solution for managing your Living Trust Property Record in the District of Columbia, providing excellent value for the services offered.

-

Can I integrate airSlate SignNow with other software for managing my Living Trust Property Record in the District of Columbia?

Absolutely! airSlate SignNow offers seamless integrations with various third-party applications that enhance workflow efficiency. You can connect it with popular CRM tools and document management systems, making it easier to manage your Living Trust Property Record in the District of Columbia.

-

How secure is my Living Trust Property Record in the District of Columbia with airSlate SignNow?

airSlate SignNow prioritizes security by implementing advanced encryption technologies to protect your Living Trust Property Record in the District of Columbia. Their platform also complies with industry standards and regulations to ensure your data is safe and secure.

-

Can multiple parties eSign my Living Trust Property Record in the District of Columbia?

Yes, multiple parties can eSign your Living Trust Property Record in the District of Columbia using airSlate SignNow. The platform allows for collaborative signing, making it easy for all necessary parties to add their signatures quickly and securely.

Get more for Living Trust Property Record District Of Columbia

- Mississippi medicaid hospice forms a b c

- Allergens chef recipe cards form

- Cobb county expungement form

- Caricom skills certificate application form barbados

- Longrich registration form

- Watch d o g s registration form

- Eform 16 immigration act chapter 133 immigration

- Www judiciary ukwp contentuploadsin the family court no case number sitting at court name form

Find out other Living Trust Property Record District Of Columbia

- eSignature Alabama Trademark License Agreement Secure

- Electronic signature Maryland Rental agreement lease Myself

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms

- Can I Electronic signature New Mexico Rental lease agreement forms

- How Can I Electronic signature Minnesota Rental lease agreement

- Electronic signature Arkansas Rental lease agreement template Computer

- Can I Electronic signature Mississippi Rental lease agreement

- Can I Electronic signature Missouri Rental lease contract

- Electronic signature New Jersey Rental lease agreement template Free

- Electronic signature New Jersey Rental lease agreement template Secure

- Electronic signature Vermont Rental lease agreement Mobile

- Electronic signature Maine Residential lease agreement Online

- Electronic signature Minnesota Residential lease agreement Easy

- Electronic signature Wyoming Rental lease agreement template Simple

- Electronic signature Rhode Island Residential lease agreement Online

- Electronic signature Florida Rental property lease agreement Free

- Can I Electronic signature Mississippi Rental property lease agreement

- Can I Electronic signature New York Residential lease agreement form

- eSignature Pennsylvania Letter Bankruptcy Inquiry Computer