Financial Account Transfer to Living Trust Delaware Form

What is the Financial Account Transfer To Living Trust Delaware

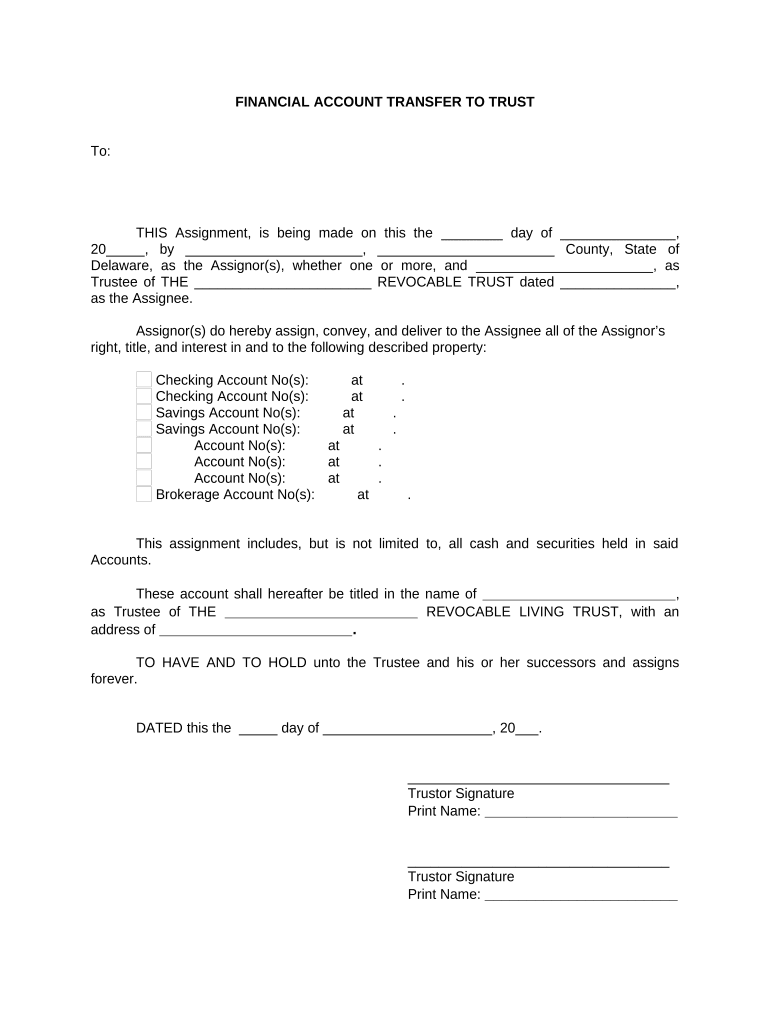

The Financial Account Transfer To Living Trust Delaware is a legal document that facilitates the transfer of financial assets into a living trust. This process is essential for estate planning, allowing individuals to manage their assets during their lifetime and ensure a smooth transition to beneficiaries upon death. By transferring accounts into a living trust, individuals can avoid probate, maintain privacy, and potentially reduce estate taxes. This form is particularly relevant for residents of Delaware, as it adheres to the state’s specific legal requirements regarding trusts and asset management.

Steps to Complete the Financial Account Transfer To Living Trust Delaware

Completing the Financial Account Transfer To Living Trust Delaware involves several key steps:

- Gather Necessary Information: Collect all relevant details about the financial accounts you wish to transfer, including account numbers and institution names.

- Review Trust Documents: Ensure that your living trust document is up-to-date and accurately reflects your wishes regarding asset distribution.

- Fill Out the Transfer Form: Complete the Financial Account Transfer To Living Trust Delaware form, ensuring that all information is accurate and matches your trust documents.

- Obtain Signatures: Sign the form as required, and ensure that any necessary witnesses or notaries are present, as per Delaware law.

- Submit the Form: Send the completed form to your financial institution, either online, by mail, or in person, depending on their submission guidelines.

Legal Use of the Financial Account Transfer To Living Trust Delaware

The legal use of the Financial Account Transfer To Living Trust Delaware is governed by Delaware state law, which recognizes living trusts as valid estate planning tools. This form must comply with specific legal standards to ensure its validity. It is crucial that the form is executed properly, with appropriate signatures and any required notarizations. Failure to adhere to these legal requirements may result in disputes regarding the trust or the assets contained within it.

State-Specific Rules for the Financial Account Transfer To Living Trust Delaware

Delaware has unique regulations regarding the establishment and management of living trusts. Key state-specific rules include:

- Trustee Requirements: The trustee must be a competent adult or a qualified institution authorized to act in Delaware.

- Asset Types: Certain types of assets, such as real estate, may require additional documentation for transfer into a living trust.

- Tax Implications: Understanding Delaware’s tax laws regarding living trusts is essential for effective estate planning.

Required Documents for the Financial Account Transfer To Living Trust Delaware

To successfully complete the Financial Account Transfer To Living Trust Delaware, several documents are typically required:

- Living Trust Document: A copy of the trust agreement that outlines the terms and conditions of the trust.

- Financial Account Statements: Recent statements for the accounts being transferred.

- Identification: Valid identification for the trustee, such as a driver's license or passport.

Who Issues the Financial Account Transfer To Living Trust Delaware

The Financial Account Transfer To Living Trust Delaware form is typically issued by financial institutions, such as banks or investment firms. These institutions provide their own versions of the form to ensure compliance with their policies and state regulations. It is important to request the correct form directly from the institution where the accounts are held to ensure all specific requirements are met.

Quick guide on how to complete financial account transfer to living trust delaware

Effortlessly Prepare Financial Account Transfer To Living Trust Delaware on Any Device

Digital document management has gained traction among businesses and individuals. It presents an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to easily find the right form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly and without delays. Manage Financial Account Transfer To Living Trust Delaware on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Financial Account Transfer To Living Trust Delaware effortlessly

- Find Financial Account Transfer To Living Trust Delaware and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight necessary sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any chosen device. Edit and eSign Financial Account Transfer To Living Trust Delaware and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for a Financial Account Transfer To Living Trust Delaware?

The process for a Financial Account Transfer To Living Trust Delaware typically involves drafting a trust document, listing your financial accounts, and completing the necessary paperwork to re-title those accounts in the name of the trust. It is important to work with a legal professional to ensure compliance with state laws. airSlate SignNow can help streamline document management during this process.

-

What are the benefits of transferring financial accounts to a living trust in Delaware?

Transferring financial accounts to a living trust in Delaware provides numerous benefits such as avoiding probate, ensuring privacy, and providing a clear plan for asset management. This transfer also allows for seamless management of your assets during incapacitation. Using airSlate SignNow simplifies the necessary document processes needed for this transfer.

-

How much does it cost to transfer financial accounts to a living trust in Delaware?

The cost to transfer financial accounts to a living trust in Delaware can vary based on factors like attorney fees, document preparation costs, and any associated bank or account fees. Using online services like airSlate SignNow can minimize costs by providing an affordable document eSigning solution without sacrificing quality.

-

What types of financial accounts can be transferred to a living trust?

Most types of financial accounts can be transferred to a living trust, including bank accounts, investment accounts, and retirement accounts. However, it’s crucial to consult with a professional to understand specific rules and requirements in Delaware. airSlate SignNow helps facilitate the necessary documentation for all account types in this transfer process.

-

Are there any tax implications to consider when transferring financial accounts to a living trust in Delaware?

Generally, transferring financial accounts to a living trust in Delaware does not trigger immediate tax implications, as it is considered a non-taxable event. However, estate and inheritance tax laws should be reviewed with a tax advisor. airSlate SignNow can aid in keeping your documents organized and compliant during these discussions.

-

Can I manage my financial accounts in a living trust in Delaware while I'm still alive?

Yes, you can manage your financial accounts in a living trust in Delaware while you are still alive. As the trustee, you maintain full control over the assets and can make changes as needed. Using airSlate SignNow, you can easily handle all required documentation online, ensuring your trust is accurately maintained.

-

How can airSlate SignNow help with the Financial Account Transfer To Living Trust Delaware process?

airSlate SignNow simplifies the Financial Account Transfer To Living Trust Delaware by providing a user-friendly eSigning platform for all related documents. This efficient process allows for secure signatures and easy collaboration with your legal advisors, ensuring that your financial accounts are properly transferred and managed within your living trust.

Get more for Financial Account Transfer To Living Trust Delaware

Find out other Financial Account Transfer To Living Trust Delaware

- Electronic signature New Jersey Rental lease agreement template Free

- Electronic signature New Jersey Rental lease agreement template Secure

- Electronic signature Vermont Rental lease agreement Mobile

- Electronic signature Maine Residential lease agreement Online

- Electronic signature Minnesota Residential lease agreement Easy

- Electronic signature Wyoming Rental lease agreement template Simple

- Electronic signature Rhode Island Residential lease agreement Online

- Electronic signature Florida Rental property lease agreement Free

- Can I Electronic signature Mississippi Rental property lease agreement

- Can I Electronic signature New York Residential lease agreement form

- eSignature Pennsylvania Letter Bankruptcy Inquiry Computer

- Electronic signature Virginia Residential lease form Free

- eSignature North Dakota Guarantee Agreement Easy

- Can I Electronic signature Indiana Simple confidentiality agreement

- Can I eSignature Iowa Standstill Agreement

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract