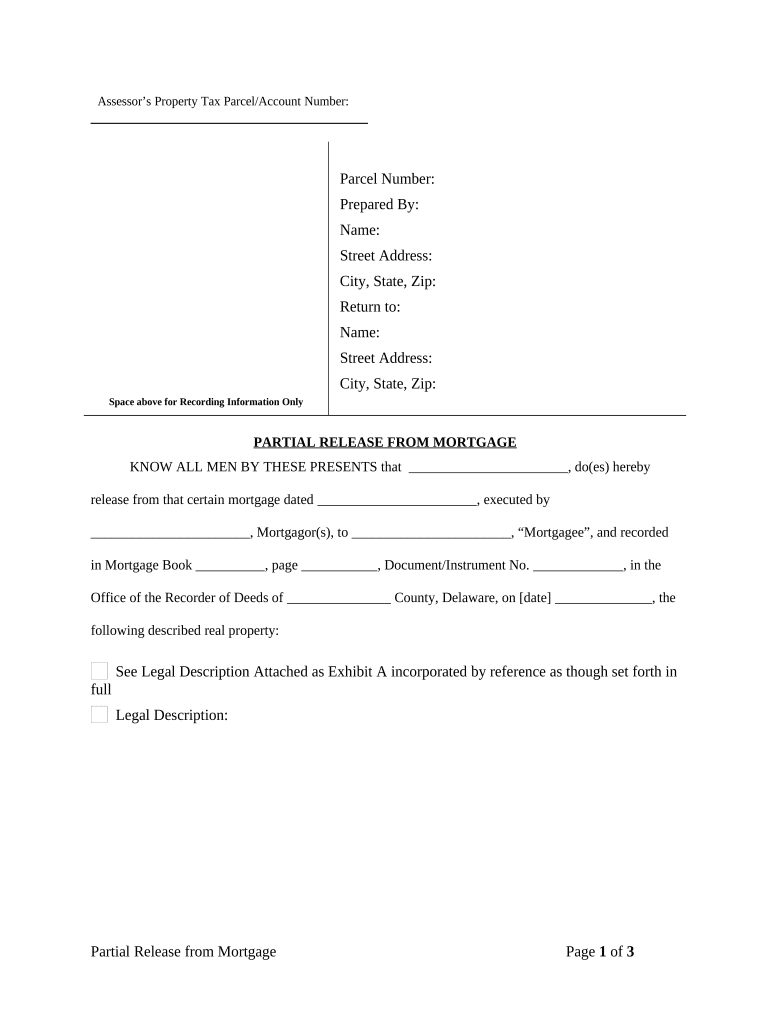

Partial Release of Property from Mortgage by Individual Holder Delaware Form

Understanding the Home Loan Disbursement Letter

A home loan disbursement letter serves as a formal document issued by a lender, confirming the release of loan funds to a borrower. This letter is crucial in the home buying process, as it outlines the terms of disbursement, including the amount being released and the purpose of the funds. It typically includes details such as the borrower’s name, loan number, and property address. Understanding this document is essential for borrowers to ensure they are receiving the correct amount and that the funds are allocated appropriately for their intended use, such as purchasing a home or making renovations.

Key Elements of a Home Loan Disbursement Letter

The home loan disbursement letter should contain several key elements to be considered valid. These include:

- Borrower Information: Full name and contact details of the borrower.

- Lender Information: Name and contact details of the lending institution.

- Loan Details: Loan number, amount disbursed, and interest rate.

- Property Information: Address and description of the property involved.

- Disbursement Purpose: Clear statement of how the funds will be used.

- Signatures: Required signatures from both the lender and the borrower to validate the document.

Steps to Complete a Home Loan Disbursement Request Letter

Completing a home loan disbursement request letter involves several steps to ensure accuracy and compliance. Here’s a simple guide:

- Gather Information: Collect all necessary details about the loan, borrower, and property.

- Use the Correct Format: Ensure the letter follows the standard loan disbursement letter format, including all key elements.

- Specify the Purpose: Clearly state how the funds will be used to avoid any confusion.

- Review for Accuracy: Double-check all information for correctness before submission.

- Obtain Signatures: Ensure that both the lender and borrower sign the document to make it legally binding.

- Submit the Letter: Send the completed letter to the lender as per their submission guidelines.

Legal Considerations for Home Loan Disbursement Letters

Home loan disbursement letters must adhere to specific legal requirements to be enforceable. These include compliance with federal and state regulations governing lending practices. The letter should also meet the standards set by the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA) if signed electronically. Ensuring that the letter is legally sound protects both the lender and the borrower in case of disputes regarding the loan funds.

Protecting Your Home Loan Disbursement Letter When Completing Online

When filling out a home loan disbursement letter online, it is vital to ensure the security of your document. Utilize platforms that offer robust security measures, such as:

- Encryption: Ensure that your data is encrypted during transmission to prevent unauthorized access.

- Two-Factor Authentication: Use two-factor authentication to add an extra layer of security to your online account.

- Audit Trails: Choose a service that provides an audit trail to track who accessed the document and when.

- Compliance with Regulations: Ensure the platform complies with relevant privacy laws and regulations.

Quick guide on how to complete partial release of property from mortgage by individual holder delaware

Effortlessly Prepare Partial Release Of Property From Mortgage By Individual Holder Delaware on Any Device

Web-based document administration has gained traction among businesses and individuals alike. It offers a stellar eco-friendly substitute for traditional printed and signed papers, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents rapidly, without any holdups. Handle Partial Release Of Property From Mortgage By Individual Holder Delaware on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Edit and eSign Partial Release Of Property From Mortgage By Individual Holder Delaware with Ease

- Locate Partial Release Of Property From Mortgage By Individual Holder Delaware and click on Get Form to initiate the process.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Produce your eSignature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, and errors that necessitate printing additional copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Partial Release Of Property From Mortgage By Individual Holder Delaware to ensure effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a loan disbursement letter?

A loan disbursement letter is a formal document provided by a lender to a borrower, confirming the approval and details of a loan. This letter typically includes the amount of the loan, repayment terms, and any conditions associated with the loan disbursement. Understanding its elements can help ensure you manage the loan effectively.

-

How can airSlate SignNow help with loan disbursement letters?

airSlate SignNow streamlines the creation and signing process of loan disbursement letters, making it easy to generate professionally formatted documents. With our eSigning feature, stakeholders can sign the letter electronically, expediting the overall loan approval and funding process. This helps reduce delays associated with physical signatures.

-

What are the benefits of using airSlate SignNow for loan disbursement letters?

Using airSlate SignNow for loan disbursement letters offers several benefits including improved efficiency, reduced paper use, and faster turnaround times. Our platform saves you time by automating document workflows and minimizing the need for manual tasks. Additionally, you can track the status of the document in real-time.

-

Is there a cost associated with creating a loan disbursement letter using airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including businesses that require loan disbursement letters. Our pricing is competitive and designed to provide value through increased efficiency and reduced processing times. You can choose a plan that best fits your business requirements.

-

Can I customize my loan disbursement letter using airSlate SignNow?

Absolutely! airSlate SignNow allows you to easily customize your loan disbursement letters to meet the specific needs of your business or clients. You can modify templates to include logos, terms, and conditions, ensuring that the document aligns with your branding and legal requirements.

-

Does airSlate SignNow integrate with other software for managing loan documents?

Yes, airSlate SignNow integrates seamlessly with various third-party applications that can help manage your loan documents, including CRM systems and accounting software. This integration facilitates easy access to your loan disbursement letters and enhances your overall document management workflow. Look for our integrations section for a full list of compatible software.

-

How secure are the loan disbursement letters I create with airSlate SignNow?

The security of your loan disbursement letters is a priority at airSlate SignNow. We utilize advanced encryption methods and secure data storage practices to ensure that your documents are protected. Additionally, our platform complies with industry standards to keep your information safe during the signing process.

Get more for Partial Release Of Property From Mortgage By Individual Holder Delaware

- Santa contract form

- Orientation packet template form

- Application for notary public commission cnmi office of the oagcnmi form

- Staff record form fill and sign printable template onlineus legal

- Wisconsin and child support form

- Building inspection report licensed child care centers dcf f cfs2344 e form

- Jamaica social investment fund form

- Httpsapply07 grants govapplyformsschemas

Find out other Partial Release Of Property From Mortgage By Individual Holder Delaware

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors