Form 1040N Instructions Nebraska Department of Revenue

What is the Form 1040N?

The Form 1040N is a state tax form used by residents of Nebraska to report their income and calculate their state tax liability. This form is specifically designed for individual taxpayers and is essential for filing state income taxes. The 1040N instructions provide detailed guidance on how to accurately complete the form, ensuring compliance with Nebraska tax laws.

Steps to Complete the Form 1040N

Completing the Form 1040N involves several steps that ensure all required information is accurately reported. Start by gathering all necessary documents, including W-2s, 1099s, and any other income statements. Follow these steps:

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income from all sources, including wages, interest, and dividends.

- Calculate your adjustments to income, which may include contributions to retirement accounts or student loan interest.

- Determine your taxable income by subtracting deductions and exemptions from your total income.

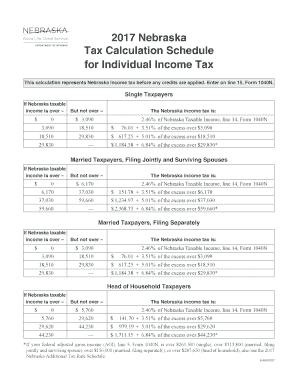

- Calculate your tax liability using the Nebraska tax tables provided in the instructions.

- Complete any additional schedules or forms if necessary.

- Sign and date the form before submission.

Legal Use of the Form 1040N

The Form 1040N is legally binding when completed and submitted according to Nebraska tax regulations. It is crucial to ensure that all information provided is accurate and truthful, as any discrepancies can lead to penalties or legal consequences. The use of electronic signatures through a trusted platform can enhance the legal validity of the submitted form.

Filing Deadlines / Important Dates

Taxpayers in Nebraska must adhere to specific deadlines for submitting the Form 1040N. Generally, the form is due on April 15 of each year, coinciding with the federal tax filing deadline. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any updates or changes to these dates annually.

Required Documents for Form 1040N

To complete the Form 1040N, taxpayers need to gather several key documents:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of other income, such as rental income or dividends.

- Documentation for deductions, such as mortgage interest statements or medical expenses.

Having these documents ready will streamline the completion of the form and help ensure accuracy in reporting.

State-Specific Rules for the Form 1040N

Nebraska has specific rules that govern the use of the Form 1040N. These rules include eligibility criteria for various deductions and credits available to state taxpayers. It is important to review the Nebraska Department of Revenue guidelines to understand any changes in tax laws that may affect your filing. Familiarity with state-specific regulations can help minimize tax liability and ensure compliance.

Quick guide on how to complete 1040n instructions 2018

Complete 1040n instructions 2018 seamlessly on any gadget

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, enabling you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage nebraska 1040n on any platform using airSlate SignNow's Android or iOS applications and simplify any document-focused task today.

How to alter and eSign 1040n form effortlessly

- Obtain 1040n and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as an original wet ink signature.

- Verify the details and click on the Done button to preserve your changes.

- Choose how you'd like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, time-consuming form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and eSign 2017 ne tax forms and ensure superior communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs 2017 form 1040 instructions

-

What's the best way to get users to read a set of instructions for filling out a form?

Your question confuses me a bit. What's missing is "WHY are the instructions displayed?" What makes them so important? More to the point, what makes them so important to the user?You say it's a simple form, but also say they must read the instructions before filling it out. If it's simple, what are all the instructions for? I haven't seen the form and already I'm confused.People will do things if they understand (and agree with) the purpose for doing them. If they don't understand the need for the instructions (e.g. because the form appears to be simple), you'll have a hard time getting users to read them (they won't see the need).My suggestion would be to take a step back from the design a bit and look at the form's purpose. If the instructions are to minimize data entry errors, look for ways in your design to do that and eliminate an instruction or two. For example, do real-time validation of things like zip codes, phone numbers, usernames, and anything else your web page can do.If the instructions are to educate the user on some specific process, look at the process to see if it can be made simpler or more obvious such that it doesn't need any explanation.Finally, don't forget user testing--ask some potential (or representative) users what they think works for them.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

How do I understand the 1040 U.S. tax form in terms of an equation instead of a ton of boxes to fill in and instructions to read?

First the 1040 is an exercise in sets:Gross Income - A collection and summation of all your income types.Adjustments - A collection of deductions the tax law allow you to deduct before signNowing AGI. (AGI is used as a threshold for another set of deductions).ExemptionsDeductions - A collection of allowed deductions.Taxes - A Collection of Different collected along with Income TaxesCredits - A collection of allowed reductions in tax owed.Net Tax Owed or Refundable - Hopefully Self Explanatory.Now the formulas:[math]Gross Income - Adjustments = Adjusted Gross Income (AGI)[/math][math]AGI - Exemptions - Deductions = Taxable Income[/math][math]Tax Function (Taxable Income ) = Income Tax[/math][math]Taxes - Credits = Net Tax Owed or Refundable[/math]Please Note each set of lines is meant as a means to make collecting and summing the subsidiary information easier.It would probably be much easier to figure out if everyone wanted to pay more taxes instead of less.

Related searches to 1040 n form

Create this form in 5 minutes!

How to create an eSignature for the 1040 n

How to make an electronic signature for your Form 1040n Instructions Nebraska Department Of Revenue online

How to create an electronic signature for your Form 1040n Instructions Nebraska Department Of Revenue in Chrome

How to create an eSignature for signing the Form 1040n Instructions Nebraska Department Of Revenue in Gmail

How to make an electronic signature for the Form 1040n Instructions Nebraska Department Of Revenue from your mobile device

How to generate an eSignature for the Form 1040n Instructions Nebraska Department Of Revenue on iOS

How to generate an electronic signature for the Form 1040n Instructions Nebraska Department Of Revenue on Android

People also ask 2017 nebraska tax form

-

What are the Nebraska 1040 instructions for filing my state taxes?

The Nebraska 1040 instructions provide detailed guidance on how to complete your state tax return accurately. These instructions cover essential topics such as income reporting, deductions, credits, and filing deadlines. Familiarizing yourself with the Nebraska 1040 instructions ensures you comply with state tax regulations and maximize potential refunds.

-

How can I access the Nebraska 1040 instructions online?

You can access the Nebraska 1040 instructions online through the Nebraska Department of Revenue's official website. They provide downloadable PDF versions of the forms along with comprehensive instructions for each section. This makes it convenient to review and fill out your forms as needed.

-

What documents do I need to follow the Nebraska 1040 instructions correctly?

To follow the Nebraska 1040 instructions correctly, you will need documents such as your W-2 forms, 1099 forms, and records of any deductible expenses. It's also important to have your previous year's tax return for reference. Organizing these documents beforehand will streamline the completion of your state tax return.

-

Are there any common mistakes to avoid when using the Nebraska 1040 instructions?

Yes, common mistakes when following the Nebraska 1040 instructions include incorrect filing status, miscalculating taxable income, and overlooking credits or deductions. Double-checking your calculations and ensuring all information is accurately reported can help you avoid these pitfalls. Utilizing software or assistance can also signNowly reduce errors.

-

Is there a deadline for filing according to the Nebraska 1040 instructions?

Yes, the Nebraska 1040 instructions indicate that individual income tax returns are typically due by April 15 each year. If you need additional time, you can request an extension, but be aware that any taxes owed must still be paid by the original deadline to avoid penalties. Always check for any changes that may affect filing due dates.

-

Can I e-file my Nebraska 1040 using airSlate SignNow?

Yes, you can e-file your Nebraska 1040 using airSlate SignNow. Our platform offers seamless document eSigning capabilities that simplify the process of filing state taxes. Complete your forms electronically and securely submit them to the Nebraska Department of Revenue with ease using airSlate SignNow.

-

What features does airSlate SignNow offer for managing Nebraska 1040 documents?

airSlate SignNow offers features such as customizable templates, secure cloud storage, and integration with various platforms. These tools enable you to efficiently manage your Nebraska 1040 documents while ensuring compliance with state requirements. The platform improves collaboration and speeds up the signature process.

Get more for 1040n form 2022

Find out other 1040n instructions

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe

- Sign Massachusetts Leave of Absence Agreement Simple

- Sign Connecticut Acknowledgement of Resignation Fast

- How To Sign Massachusetts Resignation Letter

- Sign New Mexico Resignation Letter Now

- How Do I Sign Oklahoma Junior Employment Offer Letter

- Sign Oklahoma Resignation Letter Simple

- How Do I Sign Oklahoma Acknowledgement of Resignation

- Can I Sign Pennsylvania Resignation Letter

- How To Sign Rhode Island Resignation Letter

- Sign Texas Resignation Letter Easy

- Sign Maine Alternative Work Offer Letter Later

- Sign Wisconsin Resignation Letter Free

- Help Me With Sign Wyoming Resignation Letter

- How To Sign Hawaii Military Leave Policy