Harrington Health Flexible Spending 2010-2026

What is the Harrington Health Flexible Spending

The Harrington Health Flexible Spending Account (FSA) is a financial tool that allows employees to set aside pre-tax dollars for eligible health care expenses. This account is designed to help manage out-of-pocket costs associated with medical, dental, and vision care. Funds contributed to the FSA can be used for a variety of expenses, including co-pays, prescriptions, and certain medical supplies. Understanding the specific provisions and benefits of the Harrington Health FSA can empower individuals to make informed decisions about their health care spending.

How to use the Harrington Health Flexible Spending

Using the Harrington Health Flexible Spending Account involves a straightforward process. First, employees need to enroll in the FSA during the open enrollment period or when they first become eligible. Once enrolled, they can contribute a portion of their paycheck to the account. When incurring eligible expenses, users can pay directly from the FSA using a debit card linked to the account or submit claims for reimbursement. It is important to keep receipts and documentation for all expenditures to ensure compliance and facilitate reimbursement.

Steps to complete the Harrington Health Flexible Spending

Completing the Harrington Health Flexible Spending process requires several key steps:

- Enroll in the FSA during the designated enrollment period.

- Determine the amount to contribute based on anticipated health care expenses.

- Use the FSA debit card or submit claims for eligible expenses.

- Keep all receipts and documentation for submitted claims.

- Review account statements regularly to track spending and remaining balance.

Legal use of the Harrington Health Flexible Spending

The Harrington Health Flexible Spending Account is governed by specific legal frameworks that ensure its proper use. Compliance with IRS regulations is crucial, as these guidelines dictate what constitutes eligible expenses and the tax advantages associated with the FSA. Additionally, the account must adhere to the provisions outlined in the Employee Retirement Income Security Act (ERISA). Understanding these legal requirements helps users maximize their benefits while avoiding potential penalties.

Eligibility Criteria

To participate in the Harrington Health Flexible Spending Account, employees must meet certain eligibility criteria. Generally, this includes being a full-time employee and enrolling during an open enrollment period or qualifying life event. Employers may have specific requirements, so it is advisable to review the plan details. Additionally, only qualified medical expenses as defined by the IRS can be reimbursed through the FSA, making it essential for users to familiarize themselves with these guidelines.

Required Documents

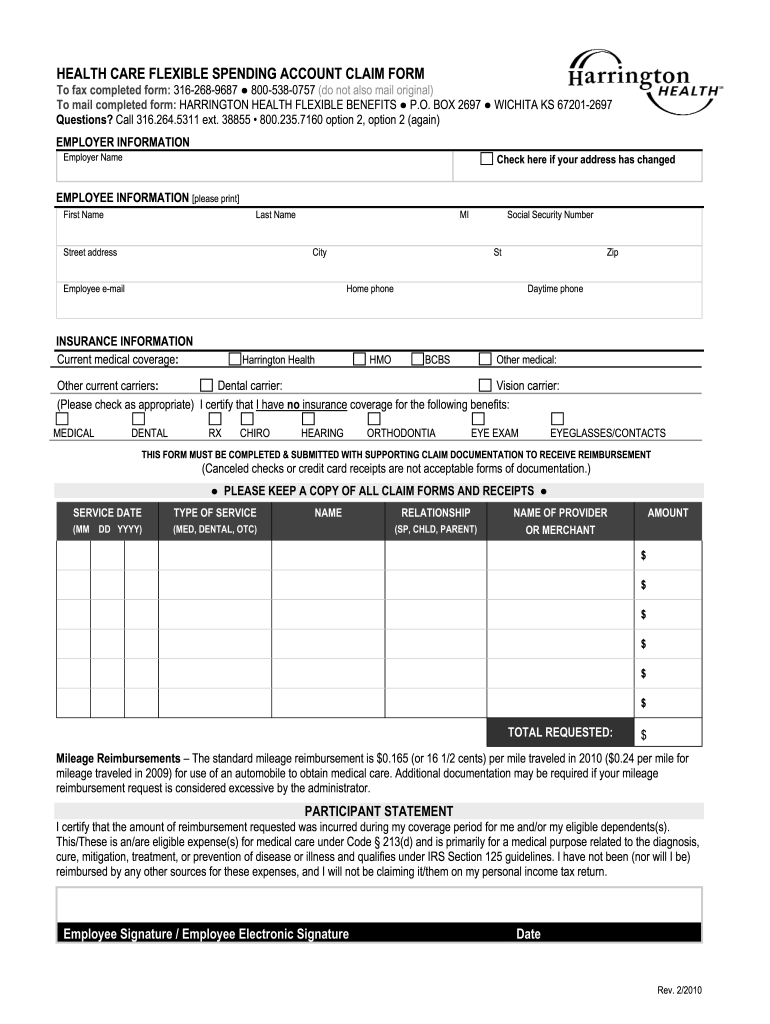

When utilizing the Harrington Health Flexible Spending Account, specific documents are necessary to support claims for reimbursement. These typically include:

- Receipts for eligible medical expenses.

- Claim forms, which may vary by employer.

- Proof of payment, such as bank statements or credit card statements.

Having these documents readily available can streamline the reimbursement process and ensure compliance with the plan's requirements.

Filing Deadlines / Important Dates

Being aware of filing deadlines and important dates is crucial for maximizing the benefits of the Harrington Health Flexible Spending Account. Typically, claims must be submitted by a specified deadline after the end of the plan year, often within a grace period. Employees should consult their plan documents for exact dates and ensure timely submission of all claims to avoid losing any unused funds. Keeping a calendar of these dates can help in managing health care expenses effectively.

Quick guide on how to complete health care flexible spending account claim form

The simplest method to obtain and authorize Harrington Health Flexible Spending

Across the breadth of your entire organization, cumbersome workflows surrounding document authorization can eat up signNow working hours. Approving documents such as Harrington Health Flexible Spending is an inherent aspect of operations in any firm, which is why the effectiveness of each agreement’s lifecycle is crucial to the company’s overall productivity. With airSlate SignNow, authorizing your Harrington Health Flexible Spending can be as straightforward and swift as possible. This platform provides you with the latest version of nearly any form. Even better, you can sign it instantly without having to install external software on your device or print anything out as physical copies.

Steps to obtain and authorize your Harrington Health Flexible Spending

- Browse our library by category or utilize the search bar to find the document you need.

- Check the form preview by clicking on Learn more to ensure it’s the correct one.

- Click Get form to begin editing immediately.

- Fill out your form and enter any necessary information using the toolbar.

- When finished, click the Sign tool to authorize your Harrington Health Flexible Spending.

- Choose the signing option that suits you best: Draw, Generate initials, or upload an image of your handwritten signature.

- Click Done to finish editing and proceed to document-sharing options as required.

With airSlate SignNow, you have everything required to manage your documents efficiently. You can find, complete, edit, and even send your Harrington Health Flexible Spending in a single tab without any difficulty. Optimize your workflows by employing a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

Is it better to pay for child-care expenses using a flexible spending account or to claim the dependent-care credit on my tax return?

The IRS Tax Code provides for a "Dependent Care Tax Credit" for those paying for dependent care of a child under age 13.The credit can also be used for a spouse or dependent (such as an elder) who cannot care for themselves and requires care. The expense must be absolutely medically necessary in such cases to allow the taxpayer (and spouse, if applicable) to work, seek work, or attend school.To determine any available credit, you might consider up to $3000 annually of child care expenses for a single dependent, and a maximum of $6000 annually for 2 or 2+ dependents. Depending on the your AGI or adjusted gross income, the maximum credit (dollar-for-dollar offset of tax liability) is: 30% ($720 annually for 1 child) IF you less than $10,000 per year.It decreases by 1% for each $2000 of additional annual income to 20% ($480 annually for 1 child) for you if your annual earning is over $28,000.The higher your earnings, the lower your tax credit. If your income is more than $43k annually, you'll qualify for the 20% break.The IRS Section 129 Dependent Care Assistance Plans (DCAP), are a form of employer-provided assistance for dependent care needs of employees. The most popular: Dependent Care Flexible Spending Account usually offered through a flexible benefit plan. Employees with this benefit may salary reduce on a pre-tax basis up to $5000 annually into a flexible spending account (FSA) for dependent care. Again, the care must be for a child under age 13 or a disabled dependent meeting certain other requirements. Not all employers offer a flexible spending option.These types of salary reduction contributions are exempt from federal income tax, state income tax, and social security tax. Once you've covered such an expense, you are required to submit an reasonable receipt in order to gain a reimbursement. Upon approval of the expense, a tax-free reimbursement is made to the employee. Not all employees are offered such benefits by the employer and the third party receipt usually cannot be as simple as a handwritten note from say, a family member you asked to babysit. Ask your employer about this and find a professional in your area as it is contingent on your specific tax situation.Say you have $5,000 in child-care expenses, you will get a tax break of only 1000.00. You can set aside up to $5,000 in pretax money in your FSA, and claim the dependent-care credit for up to $1,000 in additional expenses. (sources: IRS; Kiplinger's Tax Education; ProBenefits)Obviously some of these little known benefits are rarely provided by employers and it can be rather complicated if you're not doing financial planning or using unlicensed care vendors.So I would recommend you locate a licensed professional in your area and schedule an appointment if your benefits package has such an option and you're keeping your care providers at a corporate facility for example or an at home care medical professional.Usually if you'd like to take advantage of such credits you would have to hire an qualified Enrolled Agent, CPA, or tax professional with the type of software needed to reflect more intricate tax credits on your return. In other words, don't expect Turbo Tax or your local church free return preparation weekend to know about how to help you take advantage as it does require some financial planning and cooperation from your employer.If you're on a 1099 or work several jobs resulting in many W2s per year obviously such a solution would very difficult especially if you have a friend or family member who is not licensed providing cash basis care. In that case you're probably better off keeping your taxes simple rather than taking credits you might not qualify for and sticking with the general EITC refundable credit if you qualify.Not all tax credits are refundable meaning it will only offset the tax you owe by that amount and cause a nominal, if any change in your refund or owed amount. Complicating your return in some scenarios will only cost you more at filing time and it may well offset any benefit.

-

Do the HIPAA laws prohibit Health Insurance companies from allowing members to fill out and submit medical claim forms on line?

No, nothing in HIPAA precludes collecting the claim information online.However, the information needs to be protected at rest as well as in-flight. This is typically done by encrypting the connection (HTTPS) as well the storage media

-

I’ve been staying out of India for 2 years. I have an NRI/NRO account in India and my form showed TDS deduction of Rs. 1 lakh. Which form should I fill out to claim that?

The nature of your income on which TDS has been deducted will decide the type of ITR to be furnished by you for claiming refund of excess TDS. ITR for FY 2017–18 only can be filed now with a penalty of Rs. 5000/- till 31.12.2018 and Rs. 10,000/- from 01.01.2019 to 31.03.2019. So if your TDS relates to any previous year, then just forget the refund.

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

How can I claim the VAT amount for items purchased in the UK? Do I need to fill out any online forms or formalities to claim?

Easy to follow instructions can be found here Tax on shopping and servicesThe process works like this.Get a VAT 407 form from the retailer - they might ask for proof that you’re eligible, for example your passport.Show the goods, the completed form and your receipts to customs at the point when you leave the EU (this might not be in the UK).Customs will approve your form if everything is in order. You then take the approved form to get paid.The best place to get the form is from a retailer on the airport when leaving.

-

How long does it take for Facebook to get back to you after you fill out your account form when you got locked out?

Up to 48 hrs.

Create this form in 5 minutes!

How to create an eSignature for the health care flexible spending account claim form

How to generate an electronic signature for your Health Care Flexible Spending Account Claim Form in the online mode

How to create an eSignature for your Health Care Flexible Spending Account Claim Form in Google Chrome

How to create an electronic signature for signing the Health Care Flexible Spending Account Claim Form in Gmail

How to generate an eSignature for the Health Care Flexible Spending Account Claim Form right from your smart phone

How to create an electronic signature for the Health Care Flexible Spending Account Claim Form on iOS

How to make an electronic signature for the Health Care Flexible Spending Account Claim Form on Android OS

People also ask

-

What is Harrington Health Flexible Spending?

Harrington Health Flexible Spending is a benefits program that allows employees to set aside pre-tax dollars for eligible health expenses. This program can help reduce taxable income and maximize savings on medical costs. With Harrington Health Flexible Spending, employees can manage their healthcare finances more effectively.

-

How does Harrington Health Flexible Spending work?

Employees enrolled in Harrington Health Flexible Spending can allocate a portion of their paycheck to a flexible spending account (FSA). These funds can be used for qualified medical expenses throughout the year, making healthcare more affordable. This approach not only improves budgeting for health costs but also offers tax advantages.

-

What are the benefits of using Harrington Health Flexible Spending?

One of the key benefits of Harrington Health Flexible Spending is the tax savings it provides. By contributing pre-tax income, employees can lower their taxable income while accessing funds for medical expenses. Additionally, it encourages proactive health management by allowing employees to budget for healthcare needs.

-

Are there any fees associated with Harrington Health Flexible Spending?

Generally, there are no fees directly associated with using Harrington Health Flexible Spending accounts. However, employers may charge administrative fees for managing the plan. It’s best to consult with your HR department for specific details regarding any potential fees.

-

Can I use Harrington Health Flexible Spending for dental and vision expenses?

Yes, Harrington Health Flexible Spending can be used for a wide array of eligible expenses, including dental and vision costs. This allows employees to cover expenses like routine check-ups, glasses, and orthodontics, making it a versatile option for comprehensive healthcare management.

-

How do I enroll in Harrington Health Flexible Spending?

Enrollment in Harrington Health Flexible Spending typically occurs during your employer's open enrollment period. Employees should check with their HR department for specific enrollment procedures and deadlines to ensure they can take advantage of this valuable benefit.

-

Is Harrington Health Flexible Spending compatible with health savings accounts (HSAs)?

Harrington Health Flexible Spending accounts are generally not compatible with health savings accounts (HSAs) if both are used simultaneously. However, individuals can utilize either one based on their healthcare needs and financial goals. It's important to review the rules and eligibility criteria for each account type.

Get more for Harrington Health Flexible Spending

- Mri andor other radiological tests of you form

- Confined in a hospital andor clinic treated by a physician andor other health form

- Resolution of members form

- Of drawn upon and payable to has been dishonored form

- Attp99 11893 pika technicians landerjob details tab form

- Check the box in front of field 29 and then type the name of the person to receive in field form

- With links to web based paternity statutes and resources for wyoming form

- City wyoming or a form

Find out other Harrington Health Flexible Spending

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy