Assignment to Living Trust Georgia Form

What is the Assignment To Living Trust Georgia

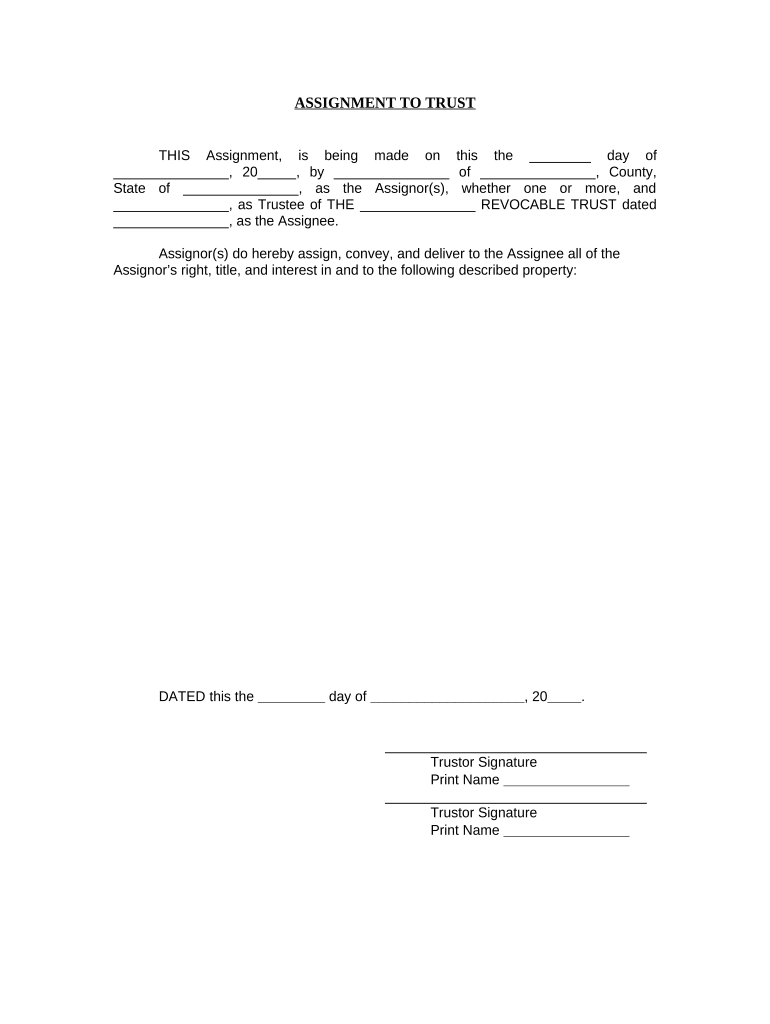

The Assignment To Living Trust Georgia is a legal document used to transfer ownership of assets into a living trust. This process ensures that the assets are managed according to the terms outlined in the trust agreement, allowing for smoother management during the grantor's lifetime and facilitating the distribution of assets upon their death. The assignment is crucial in establishing the trust's control over the assets, which can include real estate, bank accounts, and personal property.

How to use the Assignment To Living Trust Georgia

Using the Assignment To Living Trust Georgia involves several steps to ensure that the transfer of assets is legally binding. First, identify the assets you wish to transfer into the trust. Next, complete the assignment form with accurate details regarding the assets and the trust. It is essential to sign the document in the presence of a notary public to validate the assignment. Once completed, the document should be stored securely with other trust documents and copies provided to relevant parties.

Steps to complete the Assignment To Living Trust Georgia

Completing the Assignment To Living Trust Georgia involves a series of straightforward steps:

- Gather all necessary information about the assets being transferred.

- Obtain the Assignment To Living Trust Georgia form.

- Fill out the form with accurate details, including asset descriptions and trust information.

- Sign the document in front of a notary public to ensure its legality.

- Store the signed document with your trust documents and inform relevant parties.

Key elements of the Assignment To Living Trust Georgia

Key elements of the Assignment To Living Trust Georgia include the identification of the grantor, the trustee, and the beneficiaries. Additionally, the document must clearly describe the assets being transferred into the trust. It should also include the date of the assignment and the signatures of the involved parties, ensuring that all legal requirements are met for the assignment to be valid.

State-specific rules for the Assignment To Living Trust Georgia

In Georgia, specific rules govern the Assignment To Living Trust. These include the requirement for the document to be notarized and the necessity to adhere to state laws regarding living trusts. It is important to ensure that the trust complies with Georgia's Uniform Trust Code, which outlines the rights and responsibilities of trustees and beneficiaries, as well as the procedures for amending or revoking the trust.

Legal use of the Assignment To Living Trust Georgia

The legal use of the Assignment To Living Trust Georgia is to facilitate the transfer of assets into a living trust, which can help avoid probate and simplify the estate settlement process. This assignment is recognized by courts as a legitimate means of establishing trust ownership over the assets listed. Proper execution of the assignment ensures that the grantor's intentions are honored and that the trust operates effectively according to its terms.

Quick guide on how to complete assignment to living trust georgia

Complete Assignment To Living Trust Georgia seamlessly on any device

Digital document management has gained traction with companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Assignment To Living Trust Georgia on any platform using airSlate SignNow’s Android or iOS applications and simplify your document-related tasks today.

The easiest way to modify and eSign Assignment To Living Trust Georgia with ease

- Locate Assignment To Living Trust Georgia and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Craft your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Modify and eSign Assignment To Living Trust Georgia and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for executing an Assignment To Living Trust in Georgia?

The process for executing an Assignment To Living Trust in Georgia involves preparing the necessary trust documents, including the Assignment form. Once the documents are ready, they should be signed by the grantor and signNowd as required by Georgia law. airSlate SignNow offers an easy-to-use platform to manage this process efficiently.

-

How does airSlate SignNow help with Assignments To Living Trusts in Georgia?

airSlate SignNow simplifies the creation and execution of Assignments To Living Trusts in Georgia by providing a user-friendly interface for document preparation and electronic signatures. With our platform, you can securely store your documents and access them anytime, ensuring that your trust assignments remain organized and compliant with state requirements.

-

Are there any costs associated with using airSlate SignNow for Assignment To Living Trust in Georgia?

Yes, there are costs associated with using airSlate SignNow for managing Assignments To Living Trust in Georgia. Our pricing plans are designed to be cost-effective, catering to both individual users and businesses. You can choose from various subscription tiers depending on your needs, with transparent pricing visible on our website.

-

Can I integrate airSlate SignNow with other tools for managing my Assignment To Living Trust in Georgia?

Absolutely! airSlate SignNow offers integrations with a variety of software tools commonly used in legal and financial environments. This allows you to streamline your workflow and manage your Assignment To Living Trust in Georgia more effectively by connecting with platforms like Google Drive, Dropbox, and more.

-

What features does airSlate SignNow offer for the Assignment To Living Trust process in Georgia?

airSlate SignNow offers several features specifically for the Assignment To Living Trust process in Georgia, including customizable templates, reusable document fields, and secure e-signing capabilities. These features save time and ensure that your trust assignments are executed correctly and efficiently, without the hassle of physical paperwork.

-

Is airSlate SignNow legally compliant for executing Assignment To Living Trust documents in Georgia?

Yes, airSlate SignNow is designed to be legally compliant for executing Assignment To Living Trust documents in Georgia. Our electronic signature solutions are compliant with federal and state laws, ensuring that your trust documents are valid and enforceable. You can have peace of mind knowing your documents meet all legal requirements.

-

What are the benefits of using airSlate SignNow for my Assignment To Living Trust in Georgia?

Using airSlate SignNow for your Assignment To Living Trust in Georgia offers numerous benefits, including time savings, reduced paperwork, and enhanced security. With our digital platform, you can easily prepare, sign, and store your trust assignments, making the entire process smoother and more convenient.

Get more for Assignment To Living Trust Georgia

- Cash verification form 42776657

- Illness or misadventure claim form cronulla high school web1 cronulla h schools nsw edu

- Fort hare online application 48053484 form

- Lien waiver form pdf

- Breastfeeding assessment form

- Implementation plan example form

- E bundesagentur fr arbeit zentrale auslands und fachvermittlung form

- Texas irp acceptable distance records for audit form

Find out other Assignment To Living Trust Georgia

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo