Non Foreign Affidavit under IRC 1445 Hawaii Form

What is the Non Foreign Affidavit Under IRC 1445 Hawaii

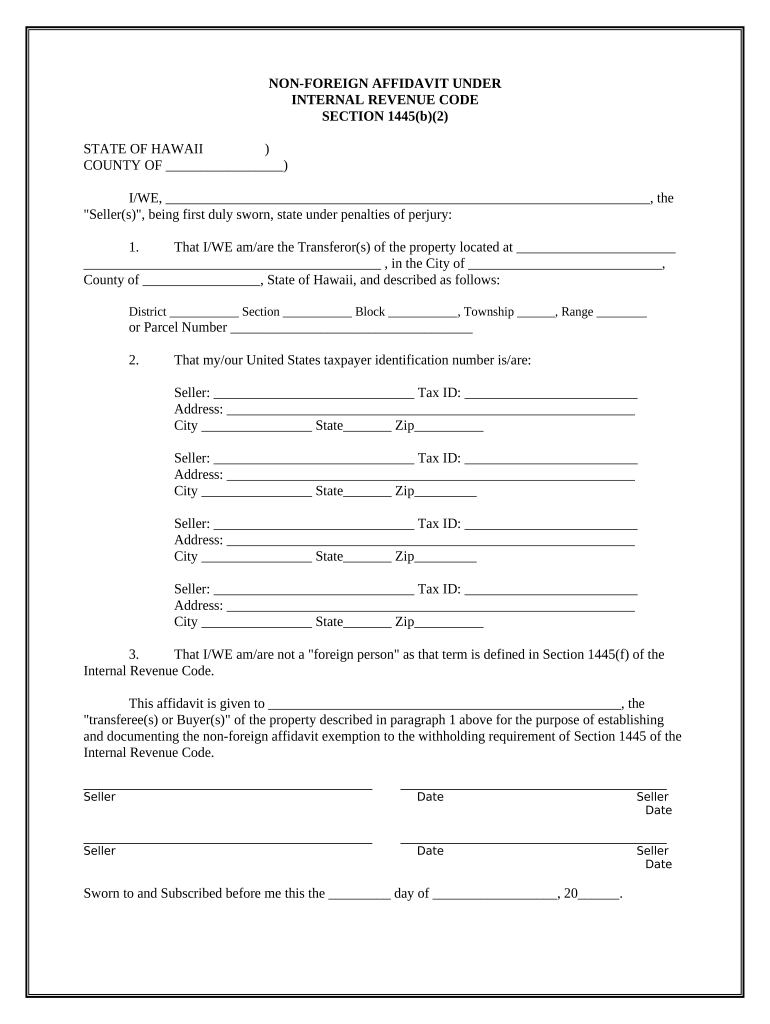

The Non Foreign Affidavit Under IRC 1445 Hawaii is a legal document required by the Internal Revenue Code to certify that a seller of real property is not a foreign person. This affidavit is crucial in real estate transactions, as it helps the buyer avoid withholding taxes that apply to foreign sellers. By completing this form, sellers affirm their status as U.S. citizens or residents, ensuring compliance with federal tax regulations.

How to use the Non Foreign Affidavit Under IRC 1445 Hawaii

Using the Non Foreign Affidavit Under IRC 1445 Hawaii involves several steps. First, the seller must fill out the affidavit accurately, providing necessary personal information and confirming their non-foreign status. Next, the completed affidavit should be presented to the buyer during the closing process of the real estate transaction. This document must be signed and dated to be considered valid, and it is typically retained by the buyer for their records and tax purposes.

Steps to complete the Non Foreign Affidavit Under IRC 1445 Hawaii

Completing the Non Foreign Affidavit Under IRC 1445 Hawaii involves the following steps:

- Gather necessary information, including your full name, address, and taxpayer identification number.

- Clearly state that you are not a foreign person as defined by the Internal Revenue Code.

- Sign and date the affidavit in the designated areas.

- Provide the completed affidavit to the buyer or their representative during the transaction.

Legal use of the Non Foreign Affidavit Under IRC 1445 Hawaii

The legal use of the Non Foreign Affidavit Under IRC 1445 Hawaii is essential for ensuring compliance with U.S. tax laws. By submitting this affidavit, sellers protect themselves from potential withholding taxes that could arise from the sale of real estate. It serves as a formal declaration of their tax status and helps streamline the closing process by providing necessary documentation to buyers and tax authorities.

Key elements of the Non Foreign Affidavit Under IRC 1445 Hawaii

Key elements of the Non Foreign Affidavit Under IRC 1445 Hawaii include:

- The seller's full name and address.

- A statement confirming the seller's non-foreign status.

- The seller's taxpayer identification number.

- The date of the affidavit and the seller's signature.

State-specific rules for the Non Foreign Affidavit Under IRC 1445 Hawaii

In Hawaii, specific rules apply to the Non Foreign Affidavit Under IRC 1445. Sellers must ensure that the affidavit complies with both federal and state regulations. Additionally, any local requirements for real estate transactions should be reviewed to avoid complications. It is advisable for sellers to consult with a real estate attorney or tax professional to ensure complete compliance with all applicable laws.

Quick guide on how to complete non foreign affidavit under irc 1445 hawaii

Effortlessly prepare Non Foreign Affidavit Under IRC 1445 Hawaii on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly and without delays. Manage Non Foreign Affidavit Under IRC 1445 Hawaii on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

The simplest way to modify and eSign Non Foreign Affidavit Under IRC 1445 Hawaii effortlessly

- Find Non Foreign Affidavit Under IRC 1445 Hawaii and then click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Alter and eSign Non Foreign Affidavit Under IRC 1445 Hawaii and guarantee exceptional communication at any point of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Non Foreign Affidavit Under IRC 1445 Hawaii?

A Non Foreign Affidavit Under IRC 1445 Hawaii is a crucial document that certifies that a seller is not a foreign person, ensuring compliance with the Internal Revenue Code. This affidavit helps avoid withholding tax on the gain from the sale of real property in Hawaii. It's essential for understanding tax implications when transferring property.

-

How can airSlate SignNow help with Non Foreign Affidavit Under IRC 1445 Hawaii?

airSlate SignNow simplifies the process of creating and signing a Non Foreign Affidavit Under IRC 1445 Hawaii. Our platform allows users to effortlessly prepare, send, and eSign the affidavit online, saving time and eliminating errors. This ensures that your documentation is accurate and compliant for property transactions.

-

What are the pricing options for using airSlate SignNow for Non Foreign Affidavit Under IRC 1445 Hawaii?

airSlate SignNow offers flexible pricing plans that cater to different business needs when dealing with Non Foreign Affidavit Under IRC 1445 Hawaii. From individual plans to business solutions, users can choose a pricing option that best fits their transaction volume and requirements. This cost-effective approach makes document management accessible to everyone.

-

What features does airSlate SignNow include for managing Non Foreign Affidavit Under IRC 1445 Hawaii?

airSlate SignNow includes features like customizable templates, document sharing, and in-app eSigning that streamline the management of Non Foreign Affidavit Under IRC 1445 Hawaii. Additionally, users can track document status and receive notifications, ensuring the process is efficient and organized. These features enhance productivity and reduce paperwork.

-

Is airSlate SignNow compliant with legal standards for Non Foreign Affidavit Under IRC 1445 Hawaii?

Yes, airSlate SignNow is compliant with all legal standards required for signing and managing a Non Foreign Affidavit Under IRC 1445 Hawaii. Our platform meets electronic signature laws, making it a legally binding option for digital documentation. This compliance assures users that their transactions are secure and valid.

-

Can I integrate airSlate SignNow with other applications for Non Foreign Affidavit Under IRC 1445 Hawaii?

Absolutely! airSlate SignNow offers seamless integrations with various applications that enhance your workflow while handling Non Foreign Affidavit Under IRC 1445 Hawaii. Whether you use CRM tools or cloud storage services, our platform can connect easily, providing a comprehensive solution for all your document needs.

-

What benefits does eSigning provide for Non Foreign Affidavit Under IRC 1445 Hawaii?

eSigning through airSlate SignNow for Non Foreign Affidavit Under IRC 1445 Hawaii provides convenience and speed, allowing users to sign documents from anywhere, at any time. It eliminates the need for printing, signing, and scanning, reducing turnaround time signNowly. This electronic solution also improves security and maintains an audit trail.

Get more for Non Foreign Affidavit Under IRC 1445 Hawaii

Find out other Non Foreign Affidavit Under IRC 1445 Hawaii

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors