Living Trust for Individual, Who is Single, Divorced or Widow or Widower with Children Hawaii Form

What is the Living Trust for Individual, Who Is Single, Divorced or Widow or Widower With Children in Hawaii

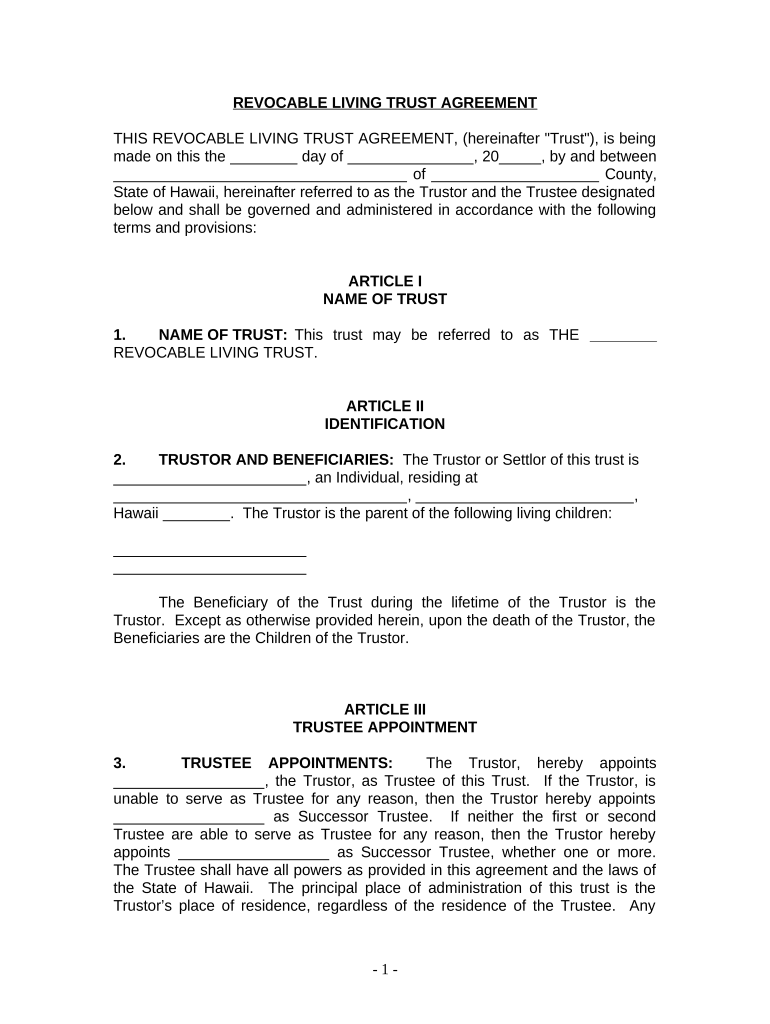

A living trust is a legal arrangement that allows an individual to place their assets into a trust during their lifetime. For those who are single, divorced, or widowed with children in Hawaii, a living trust can provide a way to manage and distribute assets efficiently. This type of trust helps avoid probate, ensuring that your children receive their inheritance without unnecessary delays or legal complications. It allows you to specify how and when your assets should be distributed, providing peace of mind for both you and your beneficiaries.

Steps to Complete the Living Trust for Individual, Who Is Single, Divorced or Widow or Widower With Children in Hawaii

Completing a living trust involves several key steps:

- Identify your assets: Make a comprehensive list of all assets you wish to include in the trust, such as real estate, bank accounts, and personal property.

- Select a trustee: Choose a trustworthy individual or institution to manage the trust on your behalf.

- Draft the trust document: This document outlines the terms of the trust, including how assets will be managed and distributed.

- Fund the trust: Transfer ownership of your assets into the trust, which may involve changing titles or account names.

- Review and update: Regularly review the trust to ensure it reflects your current wishes and circumstances.

Legal Use of the Living Trust for Individual, Who Is Single, Divorced or Widow or Widower With Children in Hawaii

The legal framework for living trusts in Hawaii allows individuals to create a trust that is valid and enforceable. This means that the trust must comply with state laws regarding trust formation and execution. A properly established living trust can provide legal protection for your assets and ensure that your wishes regarding asset distribution are honored. It is advisable to consult with a legal professional to ensure that your trust meets all legal requirements and adequately protects your interests.

State-Specific Rules for the Living Trust for Individual, Who Is Single, Divorced or Widow or Widower With Children in Hawaii

Hawaii has specific regulations governing living trusts that individuals should be aware of. These include:

- Trustee requirements: The trustee must be a competent adult or a qualified institution.

- Asset transfer laws: Proper procedures must be followed when transferring assets into the trust to ensure they are legally recognized as part of the trust.

- Tax implications: Understanding the tax responsibilities associated with living trusts in Hawaii is essential for compliance and financial planning.

How to Obtain the Living Trust for Individual, Who Is Single, Divorced or Widow or Widower With Children in Hawaii

Obtaining a living trust typically involves consulting with a legal professional who specializes in estate planning. They can help you draft the necessary documents and ensure compliance with Hawaii laws. Additionally, there are online resources and software available that can assist in creating a living trust. However, it is crucial to ensure that any documents created meet the legal standards required in Hawaii to avoid potential issues in the future.

Key Elements of the Living Trust for Individual, Who Is Single, Divorced or Widow or Widower With Children in Hawaii

Several key elements define a living trust:

- Revocability: Most living trusts are revocable, meaning you can alter or dissolve the trust during your lifetime.

- Beneficiaries: Clearly identifying beneficiaries ensures that your children receive their intended inheritance.

- Trustee authority: Outlining the powers and responsibilities of the trustee is essential for effective trust management.

- Distribution terms: Specifying how and when assets will be distributed to beneficiaries can help avoid conflicts and confusion.

Quick guide on how to complete living trust for individual who is single divorced or widow or widower with children hawaii

Handle Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Hawaii seamlessly on any device

Digital document administration has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, as you can easily locate the appropriate form and safely keep it online. airSlate SignNow equips you with all the resources necessary to create, amend, and eSign your documents swiftly without hindrances. Manage Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Hawaii on any device with the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to alter and eSign Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Hawaii effortlessly

- Obtain Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Hawaii and click on Get Form to initiate.

- Utilize the features we offer to complete your document.

- Emphasize key sections of the documents or conceal sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or by downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Edit and eSign Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Hawaii and ensure optimal communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children in Hawaii?

A Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children in Hawaii is a legal arrangement that allows you to manage your assets during your lifetime and dictate how they will be distributed after your death. This type of trust is especially beneficial for individuals in unique personal situations, ensuring that your children are taken care of according to your wishes.

-

How does a Living Trust differ from a will in Hawaii?

A Living Trust does not go through probate, which can save time and money compared to a will. It provides a more straightforward way to control your assets and ensures that they are distributed as you intend, especially important for a Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children in Hawaii.

-

What are the main benefits of setting up a Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Hawaii?

The main benefits include avoiding probate, maintaining privacy, and maximizing control over asset distribution. For individuals in these situations, a Living Trust provides peace of mind knowing your children’s needs will be addressed after your passing.

-

How much does it cost to create a Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children in Hawaii?

The cost of creating a Living Trust can vary widely based on complexity, but it is generally more affordable than going through probate. Investing in a Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children in Hawaii is a proactive way to ensure efficient asset management.

-

Can I change my Living Trust after it has been created?

Yes, one of the great features of a Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children in Hawaii is that it can be modified or revoked at any time during your lifetime. This flexibility allows you to update it as your circumstances change, such as the birth of a child or changes in financial status.

-

How do I fund my Living Trust in Hawaii?

Funding your Living Trust involves transferring your assets into the trust, which can include property, bank accounts, and investments. It's essential for a Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children in Hawaii to be properly funded to ensure all intended benefits are realized.

-

Are there any tax benefits to establishing a Living Trust in Hawaii?

While a Living Trust itself does not provide tax benefits, it can help you manage your estate in a tax-efficient manner. Consulting with a tax advisor can highlight how a Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children in Hawaii might fit into your overall tax strategy.

Get more for Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Hawaii

- Pt 61 form printable 100116156

- Clothing feedback form

- Northwood university transcript edu form

- Pr04 form

- Rams form

- Oregon notary acknowledgement form

- Ecology choice board form

- Documentation of history of varicella chickenpox disease documentation of history of varicella chickenpox disease dphhs mt form

Find out other Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Hawaii

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist