NC 3 Annual Withholding Reconciliation NOTE Form Has

What is the NC 3 Annual Withholding Reconciliation Form?

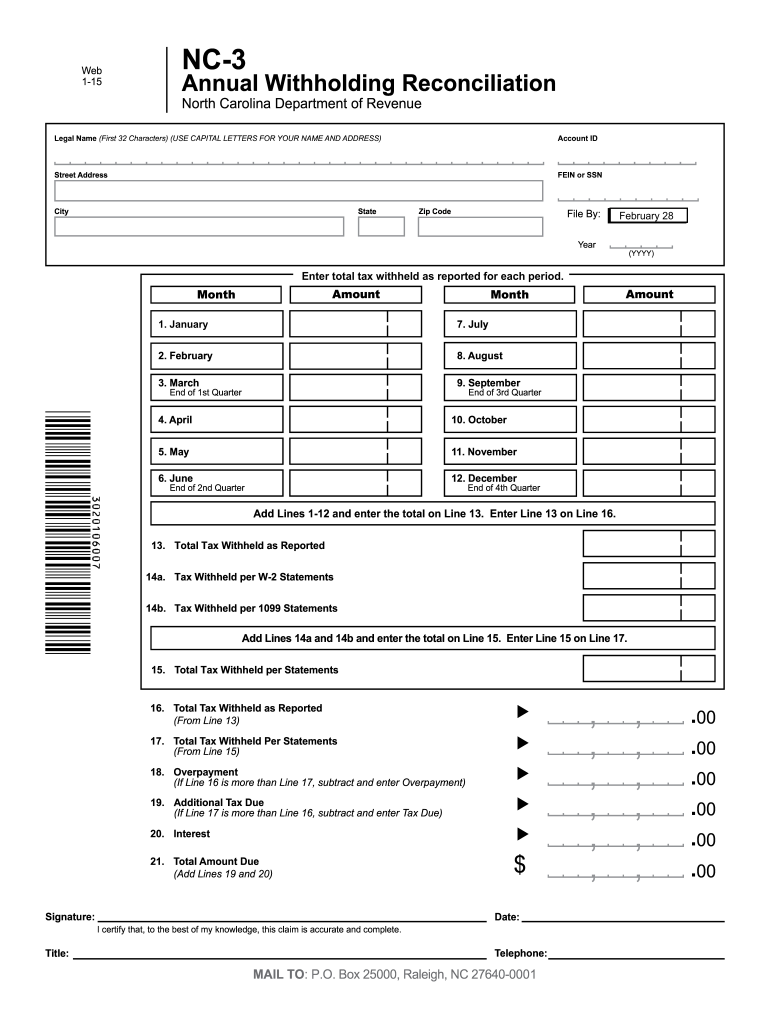

The NC 3 Annual Withholding Reconciliation Form is a crucial document used by employers in North Carolina to report the total amount of state income tax withheld from employees’ wages throughout the year. This form consolidates withholding information and ensures compliance with state tax regulations. Employers are required to submit this form annually, detailing the total wages paid and the total taxes withheld, which helps the state verify that the correct amounts have been reported and remitted.

Steps to Complete the NC 3 Annual Withholding Reconciliation Form

Completing the NC 3 form involves several key steps that ensure accuracy and compliance. First, gather all necessary payroll records for the year, including total wages and withholding amounts. Next, accurately fill out the form by entering the total wages paid and the total state income tax withheld. It is essential to double-check all entries for correctness. After completing the form, sign and date it before submission. Finally, ensure that the form is submitted by the specified deadline to avoid penalties.

Filing Deadlines / Important Dates for the NC 3 Form

The NC 3 Annual Withholding Reconciliation Form must be filed by January 31 of the following year after the tax year ends. This deadline is critical for employers to meet to avoid late filing penalties. Additionally, employers should be aware of any changes in deadlines that may occur due to state regulations or holidays, ensuring timely submission of the form.

Legal Use of the NC 3 Annual Withholding Reconciliation Form

The NC 3 form serves as a legally binding document that employers must submit to fulfill their tax obligations in North Carolina. It is essential that the information provided is accurate and complete, as discrepancies can lead to audits or penalties. The form must be filed in accordance with the North Carolina Department of Revenue guidelines, which include compliance with electronic filing requirements when applicable.

Form Submission Methods for the NC 3

Employers have several options for submitting the NC 3 Annual Withholding Reconciliation Form. The form can be filed electronically through the North Carolina Department of Revenue's online portal, which is often the preferred method due to its efficiency and convenience. Alternatively, employers may choose to submit the form via mail or in person at designated state offices. It is important to retain a copy of the submitted form for record-keeping purposes, regardless of the submission method chosen.

Key Elements of the NC 3 Annual Withholding Reconciliation Form

Understanding the key elements of the NC 3 form is vital for accurate completion. The form typically includes sections for reporting total wages, total state income tax withheld, and employer identification information. Additionally, it may require details about the number of employees and any adjustments made throughout the year. Each section must be filled out carefully to ensure compliance with state tax laws.

Who Issues the NC 3 Annual Withholding Reconciliation Form?

The NC 3 Annual Withholding Reconciliation Form is issued by the North Carolina Department of Revenue. This agency is responsible for overseeing tax collection and ensuring compliance with state tax laws. Employers can access the form and any accompanying instructions directly from the Department of Revenue's official website, where they can also find resources for assistance in completing the form correctly.

Quick guide on how to complete nc 3 annual withholding reconciliation note form has

Effortlessly Prepare NC 3 Annual Withholding Reconciliation NOTE Form Has on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any holdups. Manage NC 3 Annual Withholding Reconciliation NOTE Form Has on any platform with the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The simplest method to alter and electronically sign NC 3 Annual Withholding Reconciliation NOTE Form Has with ease

- Find NC 3 Annual Withholding Reconciliation NOTE Form Has and select Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize relevant sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional pen-and-ink signature.

- Verify the information and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and electronically sign NC 3 Annual Withholding Reconciliation NOTE Form Has and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

If a senior citizen has an annual income of more than 3 lakh, are they eligible to fill the form 15H?

As per section 197A(1C), no deduction of tax shall be made in the case of an individual resident in India, who is of the age of sixty years or more at any time during the previous year, if such individual furnishes to the person responsible for paying any income a declaration in writing in duplicate in the prescribed form (i.e. Form 15H) and verified in the prescribed manner to the effect that the tax on his estimated total income of the previous year in which such income is to be included in computing his total income will be nil.For Senior Citizens (60 to 80 years of age) Nil tax shall be charged if the Income is upto ₹3 lacs.So Form 15H shall be eligible if a person has income in the previous year upto the basic exemption limit.However in your case the annual income is more than ₹3 lacs so Form 15H shall become ineligible.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

How can I create an auto-fill JavaScript file to fill out a Google form which has dynamic IDs that change every session?

Is it possible to assign IDs on the radio buttons as soon as the page loads ?

-

How can I apply to Thapar University if I haven't filled out the form, and the last date for filling it out has passed?

Form filling was the most important thing. So, now you have only one option:- Contact the authorities and if they tell you to visit the campus, then don’t look for any other chance. Just come to campus.

Create this form in 5 minutes!

How to create an eSignature for the nc 3 annual withholding reconciliation note form has

How to make an eSignature for the Nc 3 Annual Withholding Reconciliation Note Form Has in the online mode

How to create an electronic signature for the Nc 3 Annual Withholding Reconciliation Note Form Has in Chrome

How to create an eSignature for putting it on the Nc 3 Annual Withholding Reconciliation Note Form Has in Gmail

How to generate an eSignature for the Nc 3 Annual Withholding Reconciliation Note Form Has from your smartphone

How to create an electronic signature for the Nc 3 Annual Withholding Reconciliation Note Form Has on iOS devices

How to create an electronic signature for the Nc 3 Annual Withholding Reconciliation Note Form Has on Android devices

People also ask

-

What is an NC3 form?

An NC3 form is a specific type of document used in various industries for tracking and managing specific compliance or reporting requirements. It assists businesses in maintaining accurate records and ensuring a smooth workflow. By utilizing airSlate SignNow, you can easily create, send, and e-sign NC3 forms securely.

-

How does airSlate SignNow simplify the process of managing NC3 forms?

airSlate SignNow streamlines the management of NC3 forms by providing an intuitive platform for document creation, sharing, and e-signatures. It eliminates the need for physical paperwork and manual processes, thereby saving time and reducing errors. With automated workflows, businesses can handle NC3 forms more efficiently.

-

What are the key features of airSlate SignNow for NC3 forms?

Key features of airSlate SignNow for NC3 forms include the ability to create custom templates, capture electronic signatures, and automate approval workflows. Additionally, it supports real-time tracking and notifications, allowing users to stay informed about the status of NC3 forms. This integration of features enhances productivity and compliance.

-

Is airSlate SignNow cost-effective for handling NC3 forms?

Yes, airSlate SignNow is a cost-effective solution for managing NC3 forms. With competitive pricing plans, businesses can choose a package that fits their needs without overspending. The reduction in paper costs and increased efficiency can lead to signNow savings over time.

-

Can I integrate airSlate SignNow with other applications to manage NC3 forms?

Absolutely! airSlate SignNow offers integrations with various popular applications, such as Google Drive and Dropbox, making it easier to manage NC3 forms within your existing workflow. This seamless integration enhances collaboration and data management, ensuring you have everything you need in one place.

-

How secure are NC3 forms handled through airSlate SignNow?

Security is a top priority with airSlate SignNow, especially for handling NC3 forms. Our platform employs industry-standard encryption, secure servers, and strict access controls to ensure that your sensitive documents are protected. You can confidently manage NC3 forms knowing they are stored securely.

-

What benefits do I gain from using airSlate SignNow for NC3 forms?

Using airSlate SignNow for NC3 forms provides numerous benefits, including faster turnaround times for document processing, improved accuracy, and enhanced collaboration among team members. The electronic signature feature also ensures that NC3 forms are legally binding and verifiable. This leads to greater efficiency and professionalism in document handling.

Get more for NC 3 Annual Withholding Reconciliation NOTE Form Has

- Municipal courtcortez co official website city of cortez form

- Instructions and forms are available for this type of action

- Self help forms divorce family matters colorado judicial branch

- What is a motion to restrict parenting timegriffiths law form

- There are different procedures for a forcible entry and detainer form

- Residential lease v5 number 1 broker llc form

- Petitioner the people of the state of colorado in the interest of minor form

- Self helpforms colorado municipal judges association

Find out other NC 3 Annual Withholding Reconciliation NOTE Form Has

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe