Living Trust for Individual, Who is Single, Divorced or Widow or Widower with Children Iowa Form

What is the Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Iowa

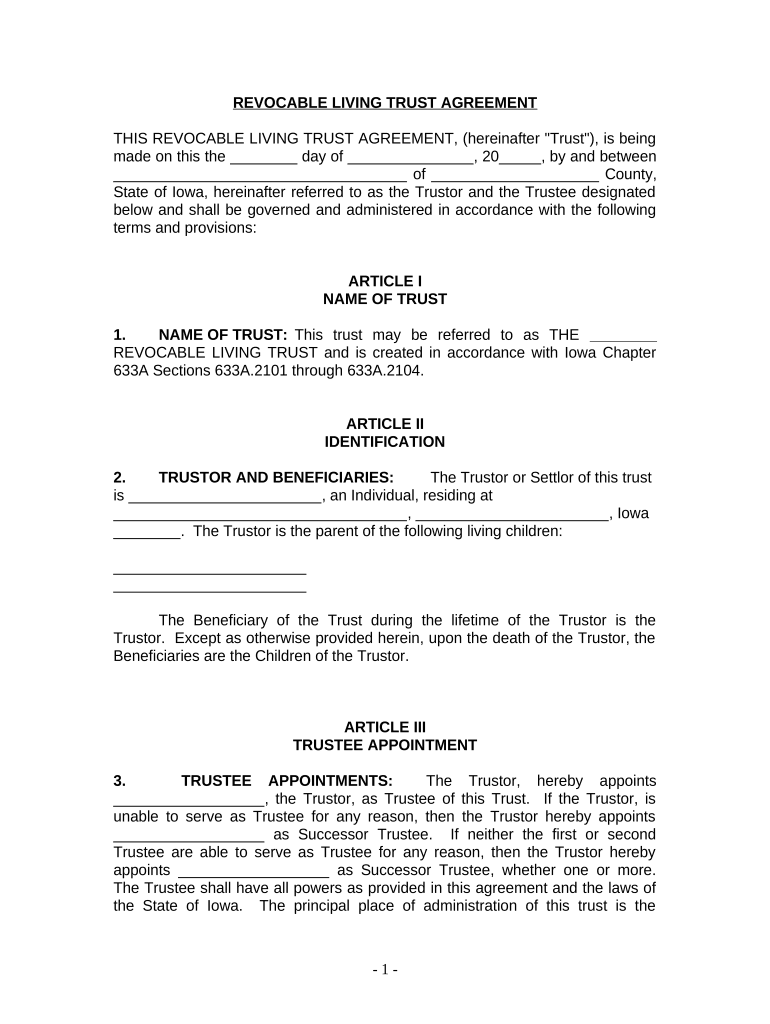

A living trust for individuals who are single, divorced, or widowed with children in Iowa is a legal arrangement that allows a person to manage their assets during their lifetime and designate how those assets will be distributed after their death. This type of trust is particularly beneficial for individuals with children, as it provides a clear plan for asset distribution, ensuring that the children's needs are prioritized. The trust becomes effective immediately upon creation, allowing the grantor to maintain control over their assets while also providing for their children’s future. It can help avoid probate, which can be a lengthy and costly process, ensuring a smoother transition of assets to beneficiaries.

How to use the Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Iowa

Using a living trust involves several steps to ensure it is set up correctly and serves its intended purpose. First, the individual must gather information about their assets, including real estate, bank accounts, and personal property. Next, they need to decide who will serve as the trustee, which can be themselves or another trusted individual. After that, the individual will draft the trust document, outlining the terms of the trust, including how assets will be managed and distributed. Once the document is completed, it must be signed and notarized to be legally binding. Finally, the individual should transfer ownership of their assets into the trust, which may involve changing titles or account names to reflect the trust as the owner.

Steps to complete the Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Iowa

Completing a living trust involves a clear sequence of steps:

- Identify and list all assets, including properties, bank accounts, and investments.

- Select a trustee who will manage the trust, which can be the individual or someone else.

- Draft the trust document, specifying the terms and conditions for asset management and distribution.

- Sign the trust document in the presence of a notary public to ensure its validity.

- Transfer assets into the trust by changing titles and account ownership to the trust's name.

- Review and update the trust periodically to reflect any changes in personal circumstances or laws.

Key elements of the Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Iowa

Several key elements define a living trust for individuals in Iowa:

- Trustee: The person or entity responsible for managing the trust and its assets.

- Beneficiaries: Individuals or entities designated to receive the trust assets upon the grantor's death.

- Terms of Distribution: Specific instructions on how and when the assets will be distributed to beneficiaries.

- Revocability: Most living trusts are revocable, allowing the grantor to change the terms or dissolve the trust as needed.

- Asset Management: Guidelines on how the trustee should manage the trust assets during the grantor's lifetime.

State-specific rules for the Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Iowa

In Iowa, certain rules apply to living trusts that individuals must follow to ensure their validity. The trust must be in writing and signed by the grantor and a notary public. Additionally, Iowa law requires that the trust document clearly outline the powers of the trustee and the rights of the beneficiaries. It is also important to comply with state tax regulations regarding the transfer of assets into the trust. Individuals should consider consulting with a legal professional familiar with Iowa trust laws to ensure compliance and proper execution of the trust.

Legal use of the Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Iowa

The legal use of a living trust in Iowa allows individuals to manage their assets and provide for their children without going through probate. This type of trust is recognized by the state and can be enforced in court if necessary. The trust document serves as a legally binding agreement that outlines the grantor's wishes regarding asset distribution. It is important to ensure that the trust is properly funded and maintained to uphold its legal standing. Additionally, the trust can be used to protect assets from creditors and ensure that they are passed on to beneficiaries according to the grantor's wishes.

Quick guide on how to complete living trust for individual who is single divorced or widow or widower with children iowa

Effortlessly Prepare Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Iowa on Any Device

Digital document management has become increasingly preferred by businesses and individuals alike. It offers an excellent environmentally-friendly substitute for conventional printed and signed paperwork, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly and without complications. Manage Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Iowa on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to Edit and eSign Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Iowa with Ease

- Locate Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Iowa and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes only a few seconds and carries the same legal validity as a traditional wet signature.

- Review the details and click on the Done button to finalize your changes.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate the printing of new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Iowa to ensure excellent communication throughout every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust for an Individual, Who Is Single, Divorced or Widow or Widower with Children in Iowa?

A Living Trust for an Individual, Who Is Single, Divorced or Widow or Widower With Children Iowa, is a legal arrangement that allows individuals to manage their assets while providing for their children in case of their passing. This trust helps avoid probate, ensuring a smoother transfer of assets. Moreover, it can be customized to meet specific family needs and provides peace of mind.

-

What are the benefits of a Living Trust for Individuals in Iowa?

The key benefits of a Living Trust for an Individual, Who Is Single, Divorced or Widow or Widower With Children Iowa, include avoiding probate, maintaining privacy, and managing assets during incapacity. It also allows for controlled distribution of assets tailored to personal circumstances. This can be crucial for individuals who wish to secure their children’s financial future.

-

How much does it cost to set up a Living Trust in Iowa?

The cost of setting up a Living Trust for an Individual, Who Is Single, Divorced or Widow or Widower With Children Iowa can vary depending on several factors, such as the complexity of the trust and legal fees. Generally, prices may range from a few hundred to several thousand dollars. However, investing in a trust can save your loved ones time and money in the long run.

-

Can a Living Trust be changed or revoked in Iowa?

Yes, a Living Trust for an Individual, Who Is Single, Divorced or Widow or Widower With Children Iowa can be modified or revoked at any time as long as the individual is alive and mentally competent. This flexibility allows for adjustments as life circumstances change, such as through divorce or the birth of a child. It's advisable to retain legal assistance to ensure that modifications comply with state laws.

-

What assets can be placed in a Living Trust in Iowa?

In Iowa, various assets can be placed in a Living Trust for an Individual, Who Is Single, Divorced or Widow or Widower With Children Iowa, including real estate, bank accounts, investments, and personal property. Properly funding your trust with these assets ensures they are managed according to your wishes. Always consult a professional to ensure proper asset transfer.

-

How does a Living Trust protect children in Iowa?

A Living Trust for an Individual, Who Is Single, Divorced or Widow or Widower With Children Iowa, can provide specific instructions regarding the financial care of children after an individual's death. It can stipulate when and how children receive their inheritance, ensuring they are financially supported and protected. This approach is especially important for single parents and those who wish to control asset distribution.

-

Is a Living Trust or a Will better for protecting assets in Iowa?

Both a Living Trust for an Individual, Who Is Single, Divorced or Widow or Widower With Children Iowa and a Will serve important roles, but a trust generally offers greater benefits for asset protection. A trust avoids probate and provides privacy, while a Will is subject to public scrutiny and probate. Evaluating personal circumstances with a legal expert can help determine the best approach.

Get more for Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Iowa

Find out other Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Iowa

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement