Living Trust Property Record Iowa Form

What is the Living Trust Property Record Iowa

The Living Trust Property Record Iowa is a legal document that outlines the assets held in a living trust within the state of Iowa. A living trust is a financial arrangement that allows an individual to place assets into a trust during their lifetime, enabling easier management and transfer of those assets upon their passing. This record serves as an official declaration of the assets included in the trust, which can include real estate, bank accounts, and investments. It is essential for ensuring that the assets are distributed according to the trustor's wishes without the need for probate.

How to use the Living Trust Property Record Iowa

Using the Living Trust Property Record Iowa involves several key steps. First, individuals must gather all relevant information regarding the assets they wish to include in the trust. This includes property addresses, account numbers, and descriptions of the assets. Next, the individual must complete the record form accurately, ensuring that all details are correct. Once completed, the form should be signed and dated in accordance with Iowa state laws. It is advisable to keep a copy of the record for personal records and provide copies to relevant parties, such as beneficiaries or legal representatives.

Steps to complete the Living Trust Property Record Iowa

Completing the Living Trust Property Record Iowa involves a systematic approach:

- Gather all necessary information about the assets to be included in the trust.

- Obtain the official Living Trust Property Record form from a reliable source.

- Fill out the form, ensuring all details are accurate and complete.

- Sign and date the form, following Iowa's legal requirements for signatures.

- Store the completed form in a safe place and provide copies as needed.

Legal use of the Living Trust Property Record Iowa

The Living Trust Property Record Iowa is legally binding when executed according to state laws. It serves as proof of the trust's existence and the assets it holds. This document is crucial for estate planning, as it helps avoid probate and ensures that assets are distributed according to the trustor's wishes. It is important to ensure that the form is completed correctly and that all legal requirements are met to uphold its validity in court if necessary.

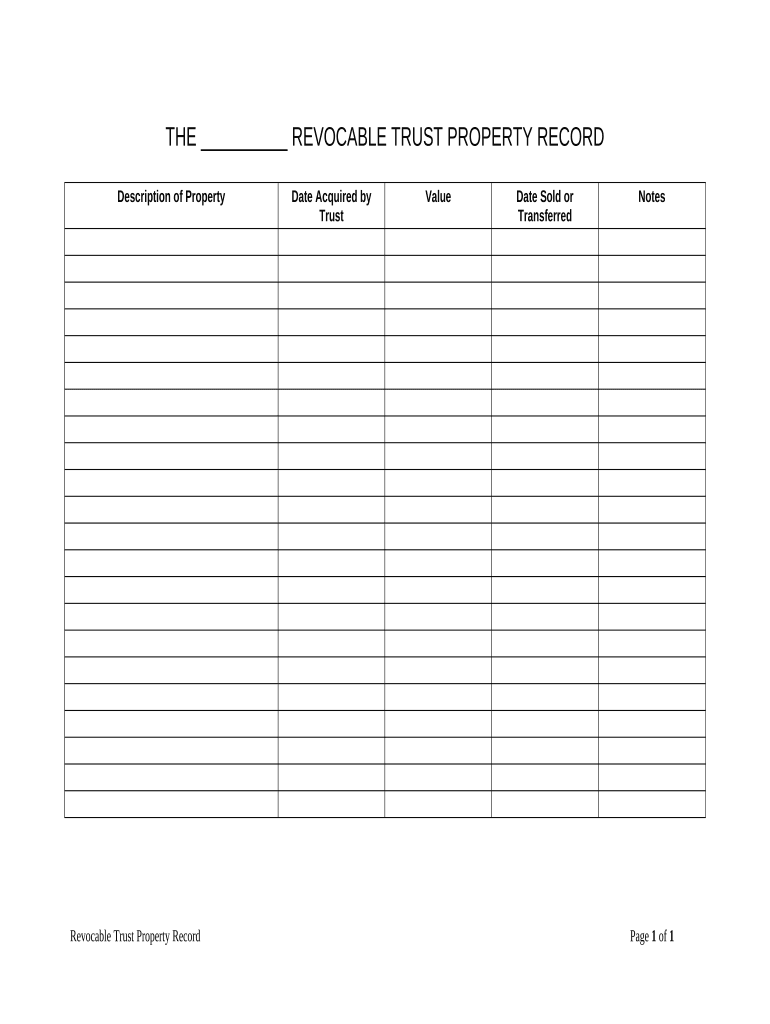

Key elements of the Living Trust Property Record Iowa

Several key elements must be included in the Living Trust Property Record Iowa to ensure its effectiveness:

- The name of the trustor (the person creating the trust).

- A detailed list of all assets included in the trust.

- Identification of the trustee (the person managing the trust).

- Signatures of the trustor and any witnesses, if required.

- The date the trust was established.

State-specific rules for the Living Trust Property Record Iowa

Iowa has specific rules governing the creation and execution of living trusts. These include requirements for signatures, the necessity of witnesses in certain cases, and the need for the trust to be in writing. Additionally, the assets included in the trust must be clearly identified to avoid any confusion during the distribution process. It is essential for individuals to be aware of these regulations to ensure compliance and the legal standing of their trust.

Quick guide on how to complete living trust property record iowa

Accomplish Living Trust Property Record Iowa effortlessly on any device

Digital document management has gained traction with both businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, allowing you to obtain the correct form and securely save it online. airSlate SignNow provides all the tools needed to create, modify, and electronically sign your documents swiftly without holdups. Manage Living Trust Property Record Iowa on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The easiest way to alter and electronically sign Living Trust Property Record Iowa without hassle

- Locate Living Trust Property Record Iowa and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to missing or misplaced documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Living Trust Property Record Iowa to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust Property Record in Iowa?

A Living Trust Property Record in Iowa is a legal document that outlines how a person's assets will be managed and distributed during their lifetime and after their death. It helps avoid probate and allows for a smoother transition of property ownership. Understanding your Living Trust Property Record in Iowa is crucial for effective estate planning.

-

How can airSlate SignNow assist with Living Trust Property Records in Iowa?

airSlate SignNow simplifies the process of creating and signing Living Trust Property Records in Iowa. Our platform allows users to easily draft documents, collect eSignatures, and store records securely. This enables a faster, efficient, and legally binding approach to managing your trust documentation.

-

What are the benefits of using airSlate SignNow for Living Trust Property Records in Iowa?

Using airSlate SignNow for your Living Trust Property Record in Iowa streamlines the entire document management process. It provides a cost-effective solution that reduces paper usage and storage needs while ensuring compliance and security. Additionally, our user-friendly interface makes it easy to manage your estate planning documents.

-

Is there a cost associated with using airSlate SignNow for Living Trust Property Records in Iowa?

airSlate SignNow offers flexible pricing plans suitable for different needs, including those looking to manage Living Trust Property Records in Iowa. We have a variety of subscription options to accommodate both individual and business users, ensuring that you only pay for what you need to streamline your documentation process.

-

Can I integrate airSlate SignNow with other tools for my Living Trust Property Records in Iowa?

Yes, airSlate SignNow offers integrations with numerous applications to enhance the management of your Living Trust Property Records in Iowa. You can connect it with popular tools such as Google Drive, Dropbox, and many more. This allows for seamless workflows and ensures documents are easily accessible across platforms.

-

What features does airSlate SignNow offer for managing Living Trust Property Records in Iowa?

airSlate SignNow provides a suite of features tailored for managing Living Trust Property Records in Iowa, including multi-party signing, document templates, and a secure cloud storage system. These features help ensure that your documents are easily customizable, securely stored, and ready for quick access when needed.

-

Are Living Trust Property Records in Iowa public documents?

In Iowa, Living Trust Property Records are generally not public documents. They remain private and are usually only accessible to the individuals involved in the trust and their representatives. This confidentiality offers an advantage for those managing estate planning without public scrutiny.

Get more for Living Trust Property Record Iowa

- Lic995a form

- Maths mate 7 answers pdf form

- Dic 23 43671437 form

- Scientific notation word problems worksheet with answers pdf 361928630 form

- Form c see rule 14 arrival report of foreigner in ernakulamrural keralapolice gov

- Test ipp r gratis form

- Account opening form 26676790

- Authorization to use andor disclose educational and form

Find out other Living Trust Property Record Iowa

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free