Idaho Garnishment Form

What is the Idaho Garnishment?

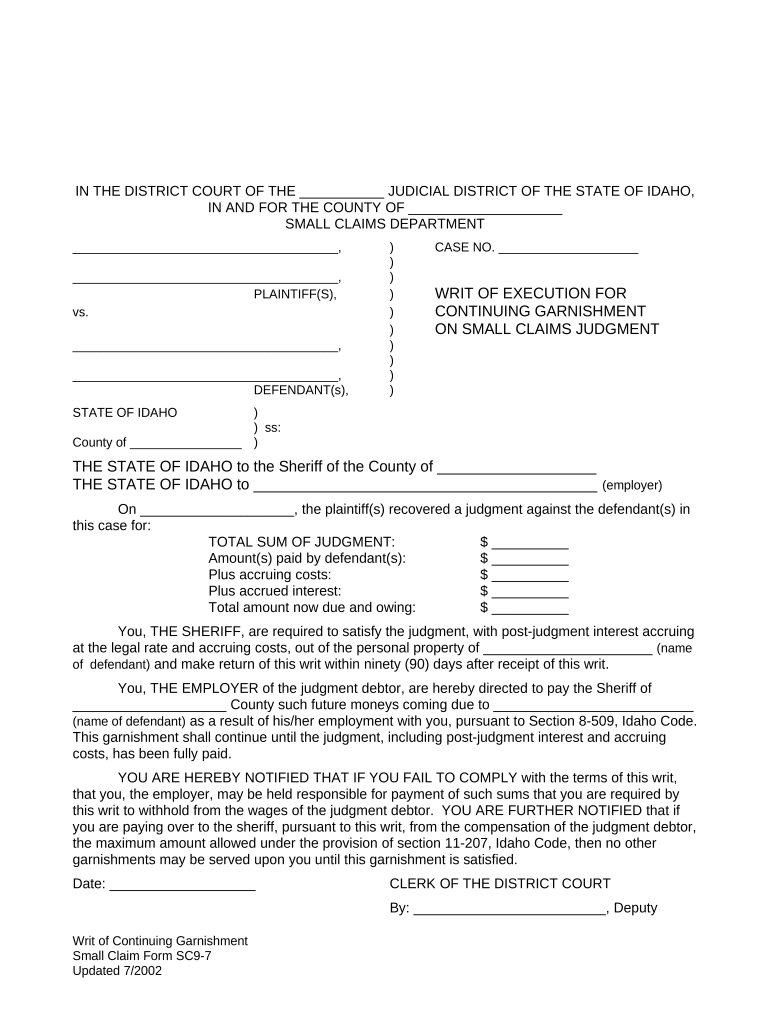

The Idaho garnishment refers to a legal process that allows a creditor to collect a debt by obtaining a court order to seize a debtor's wages or bank account funds. This process is initiated through a writ garnishment judgment, which is a formal request to the court to enforce the collection of a debt. The garnishment can apply to various types of debts, including unpaid loans, credit card debts, and child support obligations. Understanding the specifics of the Idaho garnishment is essential for both creditors seeking to recover debts and debtors wanting to know their rights and obligations.

How to Use the Idaho Garnishment

Using the Idaho garnishment involves several steps. First, a creditor must obtain a judgment against the debtor in court. Once the judgment is secured, the creditor can file for a writ garnishment judgment, which allows them to collect the owed amount directly from the debtor's wages or bank accounts. It is crucial for creditors to follow the proper legal procedures to ensure that the garnishment is enforceable. Debtors should be aware of their rights during this process, including the ability to contest the garnishment if they believe it is unjust.

Steps to Complete the Idaho Garnishment

Completing the Idaho garnishment process requires careful attention to detail. The following steps outline the general procedure:

- Obtain a judgment: Creditors must first win a court judgment against the debtor.

- File for a writ garnishment judgment: After obtaining the judgment, the creditor files the necessary paperwork with the court.

- Serve the garnishment papers: The creditor must serve the writ garnishment judgment to the debtor's employer or bank.

- Await response: The employer or bank must respond to the garnishment request, typically within a specified timeframe.

- Receive payments: Funds will be withheld from the debtor’s wages or accounts and sent to the creditor as per the court's order.

Legal Use of the Idaho Garnishment

The legal use of the Idaho garnishment is governed by state laws that dictate how and when a creditor can initiate garnishment proceedings. It is essential for creditors to comply with these regulations to avoid legal repercussions. For example, there are limits on the amount that can be garnished from a debtor's wages, ensuring that the debtor retains enough income for basic living expenses. Debtors also have legal protections and can seek advice if they believe their rights are being violated during the garnishment process.

Key Elements of the Idaho Garnishment

Several key elements define the Idaho garnishment process. These include:

- Judgment requirement: A creditor must have a valid court judgment against the debtor.

- Writ garnishment judgment: This document is essential for initiating the garnishment process.

- Notification: Debtors must be notified of the garnishment action, providing them with the opportunity to respond.

- Limits on garnishment: State laws set limits on how much can be garnished from wages or accounts.

Eligibility Criteria

Eligibility for garnishment in Idaho is determined by several factors. Creditors must have a legally enforceable judgment against the debtor. Additionally, the type of debt may affect eligibility, as certain debts, like child support, may have different rules governing garnishment. Debtors may also have defenses against garnishment, such as proving financial hardship or disputing the validity of the debt. Understanding these criteria is crucial for both creditors and debtors navigating the garnishment process.

Quick guide on how to complete idaho garnishment

Complete Idaho Garnishment effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Idaho Garnishment on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Idaho Garnishment without stress

- Obtain Idaho Garnishment and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Select relevant sections of the documents or black out sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Edit and electronically sign Idaho Garnishment to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a writ garnishment judgment and how can airSlate SignNow help with it?

A writ garnishment judgment is a legal order that allows a creditor to collect debts directly from a debtor's wages or bank accounts. airSlate SignNow streamlines the process of creating and signing such documents, ensuring that you can quickly implement garnishment orders and manage them effectively.

-

How does airSlate SignNow ensure secure handling of documents related to writ garnishment judgments?

airSlate SignNow employs advanced security measures, including encryption and secure access controls, to protect sensitive documents such as writ garnishment judgments. This ensures that both creditors and debtors can trust that their information is handled with the utmost confidentiality and security.

-

What features does airSlate SignNow offer that are beneficial for managing writ garnishment judgments?

With airSlate SignNow, you can utilize features like templates for writ garnishment judgments, instant signing capabilities, and automated notifications. These features save time and reduce the hassle associated with the lengthy paperwork required for garnishments.

-

Is airSlate SignNow cost-effective for businesses needing to manage writ garnishment judgments?

Yes, airSlate SignNow provides a cost-effective solution for businesses managing writ garnishment judgments. Our pricing plans cater to various business sizes, ensuring you get the tools you need without overspending.

-

Can airSlate SignNow integrate with other tools for managing writ garnishment judgments?

Absolutely! airSlate SignNow integrates seamlessly with popular business tools and systems, allowing you to efficiently manage writ garnishment judgments in your existing workflow. This integration facilitates collaboration and enhances overall productivity.

-

How can airSlate SignNow help expedite the processing of writ garnishment judgments?

airSlate SignNow speeds up the processing of writ garnishment judgments by providing an easy-to-use interface for document creation and signing. Additionally, automation features help ensure that all necessary steps are completed promptly, reducing delays in execution.

-

What support does airSlate SignNow offer for users dealing with writ garnishment judgments?

airSlate SignNow offers dedicated customer support for users managing writ garnishment judgments. Our team is available to assist with any questions or concerns, ensuring that you can navigate the process smoothly and efficiently.

Get more for Idaho Garnishment

Find out other Idaho Garnishment

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple