Living Trust for Individual, Who is Single, Divorced or Widow or Widower with Children Idaho Form

What is the Living Trust for Individual, Who Is Single, Divorced or Widow or Widower With Children in Idaho

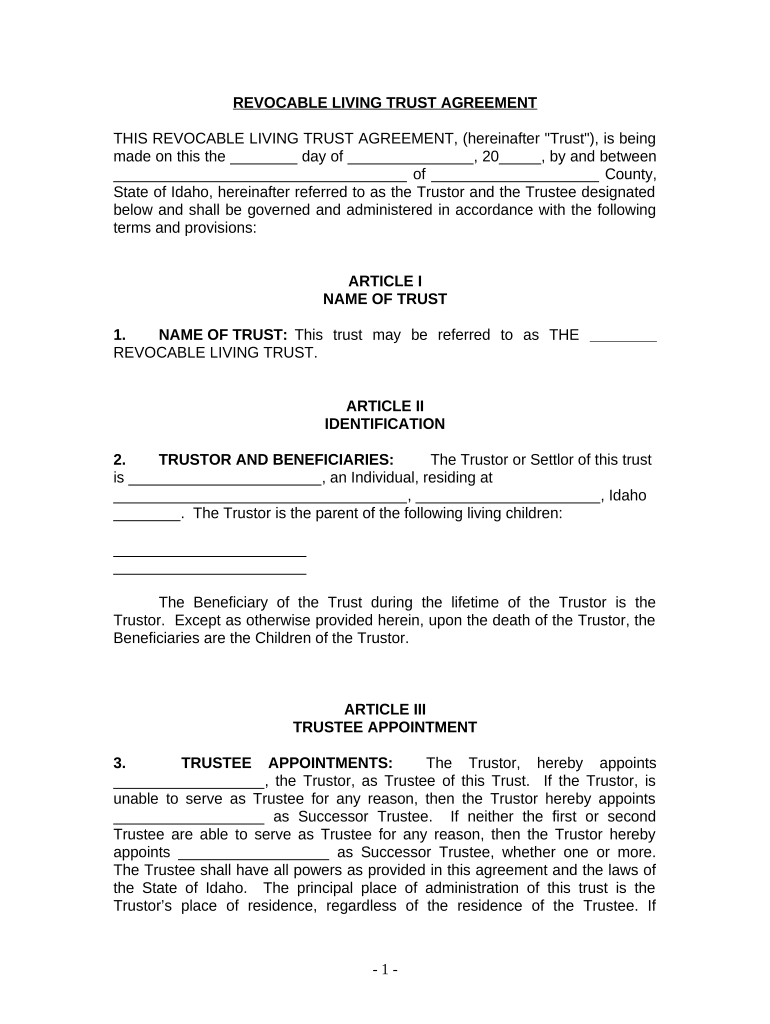

A living trust for individuals who are single, divorced, or widowed with children in Idaho is a legal document that allows a person to manage their assets during their lifetime and specify how those assets should be distributed upon their death. This type of trust is particularly beneficial for individuals with children, as it provides a clear framework for asset distribution, ensuring that the children's needs are met. A living trust can help avoid the probate process, which can be lengthy and costly, allowing for a smoother transition of assets to beneficiaries.

Steps to Complete the Living Trust for Individual, Who Is Single, Divorced or Widow or Widower With Children in Idaho

Completing a living trust involves several important steps to ensure that it is legally binding and effective. Here are the key steps:

- Identify your assets: List all assets you wish to include in the trust, such as real estate, bank accounts, and investments.

- Choose a trustee: Select a trustworthy individual or institution to manage the trust.

- Draft the trust document: This document outlines the terms of the trust, including how assets will be managed and distributed.

- Sign the document: Ensure that the trust document is signed in accordance with Idaho law, which may require witnesses or notarization.

- Fund the trust: Transfer ownership of your assets into the trust to make it effective.

Legal Use of the Living Trust for Individual, Who Is Single, Divorced or Widow or Widower With Children in Idaho

The legal use of a living trust in Idaho is governed by state laws that dictate how trusts must be established and managed. A living trust is recognized as a valid legal entity, allowing the trustee to manage the assets on behalf of the beneficiaries. It is essential to comply with Idaho's specific requirements, such as proper execution and funding of the trust, to ensure its validity. Additionally, a living trust can be modified or revoked at any time during the grantor's lifetime, providing flexibility to adapt to changing circumstances.

Key Elements of the Living Trust for Individual, Who Is Single, Divorced or Widow or Widower With Children in Idaho

Several key elements are crucial for a living trust to function effectively:

- Grantor: The individual who creates the trust and transfers assets into it.

- Trustee: The person or entity responsible for managing the trust assets and fulfilling the terms of the trust.

- Beneficiaries: The individuals or entities that will receive the trust assets upon the grantor's death.

- Trust document: The legal document that outlines the terms, conditions, and instructions for managing the trust.

State-Specific Rules for the Living Trust for Individual, Who Is Single, Divorced or Widow or Widower With Children in Idaho

Idaho has specific rules governing the creation and management of living trusts. These include requirements for the trust document to be in writing, the necessity of having the document signed by the grantor, and potential witness or notarization requirements. Additionally, Idaho law allows for the revocation or amendment of a living trust at any time, provided that the grantor is competent. Understanding these state-specific rules is essential for ensuring that the trust is valid and enforceable.

How to Use the Living Trust for Individual, Who Is Single, Divorced or Widow or Widower With Children in Idaho

Using a living trust effectively involves understanding its purpose and how to manage it. After establishing the trust, the grantor can transfer assets into it, which may include real estate, bank accounts, and personal property. The trustee will manage these assets according to the terms of the trust, ensuring that they are used for the benefit of the beneficiaries. Upon the grantor's death, the trustee will distribute the assets to the beneficiaries as outlined in the trust document, bypassing the probate process and providing a more efficient transfer of wealth.

Quick guide on how to complete living trust for individual who is single divorced or widow or widower with children idaho

Prepare Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Idaho effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, as you can easily find the necessary template and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents swiftly without any hold-ups. Manage Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Idaho on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to modify and eSign Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Idaho with ease

- Obtain Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Idaho and click Get Form to initiate.

- Make use of the tools available to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that task.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to finalize your changes.

- Select how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow satisfies your document management needs in just a few clicks from any device of your choosing. Modify and eSign Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Idaho and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust for an individual who is single, divorced, or a widow or widower with children in Idaho?

A Living Trust for an individual who is single, divorced, or a widow or widower with children in Idaho is a legal arrangement that allows you to manage and distribute your assets during and after your lifetime. This type of trust can simplify the estate planning process, ensuring your children receive their inheritance smoothly and without delay.

-

How much does it cost to create a Living Trust for individuals who are single, divorced, or widowed in Idaho?

The cost to create a Living Trust for individuals who are single, divorced, or widowed with children in Idaho can vary based on the complexity of your estate and whether you use online services or hire an attorney. Generally, online platforms may offer more affordable rates, allowing you to set up a trust at a fraction of the typical legal fees.

-

What are the benefits of having a Living Trust for a single, divorced, or widowed person with children in Idaho?

Having a Living Trust for an individual who is single, divorced, or a widow or widower with children in Idaho provides several benefits, including avoiding probate, maintaining privacy, and having control over asset distribution. This trust can help ensure that your children are taken care of according to your wishes without lengthy legal delays.

-

How does a Living Trust protect my children after my passing in Idaho?

A Living Trust can protect your children by clearly outlining how and when your assets will be distributed after your passing. This legal framework ensures that your children receive their inheritance according to your specific preferences, reducing the risk of disputes among family members.

-

Can I modify my Living Trust if my circumstances change in Idaho?

Yes, you can modify your Living Trust at any time as long as you are mentally competent. This flexibility is particularly beneficial for individuals who are single, divorced, or widowed with children in Idaho, allowing them to update their trust in response to changing circumstances such as remarriage or the birth of additional children.

-

What documents do I need to establish a Living Trust for an individual in Idaho?

To establish a Living Trust for an individual who is single, divorced, or a widow or widower with children in Idaho, you will typically need to provide personal identification, a list of your assets, and any existing estate planning documents. Having these documents prepared in advance can streamline the process of setting up your trust.

-

Is my Living Trust valid in other states if I move from Idaho?

A Living Trust created in Idaho is generally portable and may remain valid in other states; however, different states have varying laws. If you move from Idaho, it's advisable to consult with a legal professional to ensure that your Living Trust remains compliant and effective in your new location.

Get more for Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Idaho

- Masonic scholarships west virginia form

- Printable section 8 application form montgomery county

- Seychelles visa application form

- Commendationcomplaint form police department

- Plea in abeyance agreement form

- West virginia respondents divorce answer packet instructions form

- Umass boston mens soccer media guide indd form

- Images not to scalecoppertype of iudkyleenacompa form

Find out other Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Idaho

- How Can I eSign Texas Sublease Agreement Template

- eSign Texas Lodger Agreement Template Free

- eSign Utah Lodger Agreement Template Online

- eSign Hawaii Rent to Own Agreement Mobile

- How To eSignature Colorado Postnuptial Agreement Template

- How Do I eSignature Colorado Postnuptial Agreement Template

- Help Me With eSignature Colorado Postnuptial Agreement Template

- eSignature Illinois Postnuptial Agreement Template Easy

- eSignature Kentucky Postnuptial Agreement Template Computer

- How To eSign California Home Loan Application

- How To eSign Florida Home Loan Application

- eSign Hawaii Home Loan Application Free

- How To eSign Hawaii Home Loan Application

- How To eSign New York Home Loan Application

- How To eSign Texas Home Loan Application

- eSignature Indiana Prenuptial Agreement Template Now

- eSignature Indiana Prenuptial Agreement Template Simple

- eSignature Ohio Prenuptial Agreement Template Safe

- eSignature Oklahoma Prenuptial Agreement Template Safe

- eSignature Kentucky Child Custody Agreement Template Free