Installments Fixed Rate Promissory Note Secured by Residential Real Estate for Idaho Idaho Form

What is the Installments Fixed Rate Promissory Note Secured By Residential Real Estate For Idaho Idaho

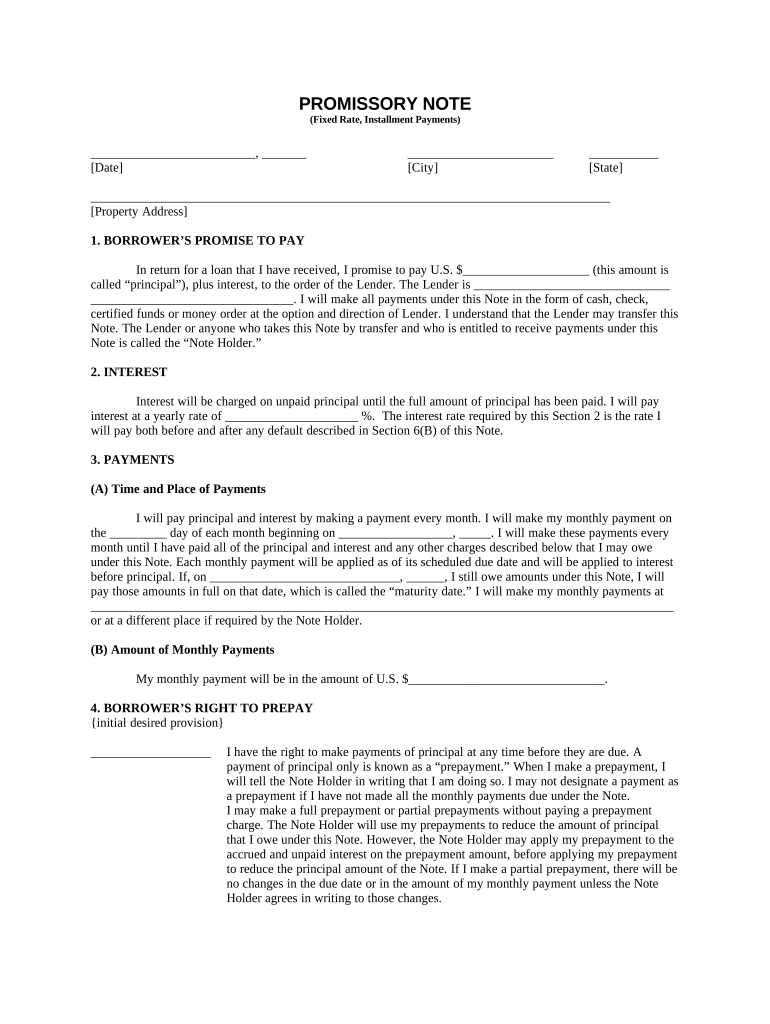

The Installments Fixed Rate Promissory Note Secured By Residential Real Estate For Idaho Idaho is a legal document that outlines a borrower's promise to repay a loan over a specified period, with a fixed interest rate. This note is secured by residential real estate, meaning the property serves as collateral for the loan. If the borrower fails to meet the repayment terms, the lender has the right to take possession of the property. This type of promissory note is often used in real estate transactions to ensure that both parties understand their obligations and rights regarding the loan.

Key Elements of the Installments Fixed Rate Promissory Note Secured By Residential Real Estate For Idaho Idaho

Several key elements must be included in the Installments Fixed Rate Promissory Note to ensure its effectiveness and legality. These elements typically include:

- Borrower and Lender Information: Names and addresses of both parties.

- Loan Amount: The total amount being borrowed.

- Interest Rate: The fixed rate applied to the loan.

- Payment Schedule: Details on how and when payments will be made.

- Collateral Description: A clear description of the residential real estate securing the loan.

- Default Terms: Conditions under which the borrower would be considered in default.

- Governing Law: Specification that Idaho law governs the agreement.

Steps to Complete the Installments Fixed Rate Promissory Note Secured By Residential Real Estate For Idaho Idaho

Completing the Installments Fixed Rate Promissory Note involves several important steps to ensure that the document is accurate and legally binding:

- Gather Information: Collect all necessary details about the borrower, lender, and property.

- Draft the Note: Use a template or create a document that includes all required elements.

- Review the Terms: Ensure that the terms of the loan, including interest rate and payment schedule, are clearly defined.

- Sign the Document: Both parties should sign the note in the presence of a notary public to enhance its legality.

- Secure Copies: Make copies of the signed note for both the borrower and lender for their records.

Legal Use of the Installments Fixed Rate Promissory Note Secured By Residential Real Estate For Idaho Idaho

The legal use of the Installments Fixed Rate Promissory Note is critical for ensuring that the agreement is enforceable in court. To be legally valid, the document must meet specific requirements set forth by Idaho law. This includes having clear terms, being signed by both parties, and being notarized. Additionally, the note must comply with federal regulations regarding lending practices. Understanding these legal requirements helps protect both the lender's and borrower's interests.

State-Specific Rules for the Installments Fixed Rate Promissory Note Secured By Residential Real Estate For Idaho Idaho

Idaho has specific regulations governing promissory notes secured by residential real estate. These rules often address the maximum allowable interest rates, requirements for disclosures, and procedures for foreclosure in the event of default. It is essential for both lenders and borrowers to familiarize themselves with these state-specific rules to ensure compliance and avoid potential legal issues. Consulting with a legal professional can provide further guidance tailored to individual situations.

How to Use the Installments Fixed Rate Promissory Note Secured By Residential Real Estate For Idaho Idaho

Using the Installments Fixed Rate Promissory Note involves understanding its purpose and the implications of signing it. Borrowers should carefully review the terms of the note, including the payment schedule and interest rate, to ensure they can meet their obligations. Lenders should verify the borrower's financial stability and the value of the collateral property. Once both parties agree to the terms, the note can be signed and executed, providing a clear framework for the loan agreement.

Quick guide on how to complete installments fixed rate promissory note secured by residential real estate for idaho idaho

Easily prepare Installments Fixed Rate Promissory Note Secured By Residential Real Estate For Idaho Idaho on any device

Digital document management has become increasingly favored by organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and safely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly and without delays. Manage Installments Fixed Rate Promissory Note Secured By Residential Real Estate For Idaho Idaho on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to edit and electronically sign Installments Fixed Rate Promissory Note Secured By Residential Real Estate For Idaho Idaho effortlessly

- Locate Installments Fixed Rate Promissory Note Secured By Residential Real Estate For Idaho Idaho and click on Get Form to begin.

- Utilize the tools at your disposal to complete your document.

- Highlight essential sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Edit and electronically sign Installments Fixed Rate Promissory Note Secured By Residential Real Estate For Idaho Idaho and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Installments Fixed Rate Promissory Note Secured By Residential Real Estate For Idaho Idaho?

An Installments Fixed Rate Promissory Note Secured By Residential Real Estate For Idaho Idaho is a legal document that outlines a borrower’s obligation to repay a loan secured by residential property. This note establishes a fixed interest rate and payment schedule, making it an excellent choice for those looking for predictable financial planning. It benefits both lenders and borrowers, ensuring clarity and security in the transaction.

-

How does airSlate SignNow facilitate the creation of Installments Fixed Rate Promissory Notes?

airSlate SignNow offers an intuitive platform that simplifies the process of creating Installments Fixed Rate Promissory Notes Secured By Residential Real Estate For Idaho Idaho. Users can easily customize templates, add necessary terms, and include their specific conditions. The platform makes it easier to generate legally binding documents quickly and efficiently.

-

What are the benefits of using airSlate SignNow for Installments Fixed Rate Promissory Notes?

Using airSlate SignNow for Installments Fixed Rate Promissory Notes Secured By Residential Real Estate For Idaho Idaho provides several advantages, including an easy-to-use interface, cost-effectiveness, and enhanced security features. The ability to eSign documents remotely expedites the process, allowing for quicker transactions. Additionally, the platform’s compliance with legal standards ensures that your documents are valid.

-

Are there any integration options available with airSlate SignNow for managing Installments Fixed Rate Promissory Notes?

Yes, airSlate SignNow offers seamless integration with various platforms that can enhance the management of Installments Fixed Rate Promissory Notes Secured By Residential Real Estate For Idaho Idaho. This includes CRM systems, cloud storage services, and financial software. Integrating these tools can streamline your workflow and improve document management efficiency.

-

What is the cost associated with using airSlate SignNow for Installments Fixed Rate Promissory Notes?

The pricing for airSlate SignNow varies based on the plan chosen, providing flexible options suitable for individuals and businesses. The cost-effective solutions ensure that you can manage your Installments Fixed Rate Promissory Notes Secured By Residential Real Estate For Idaho Idaho without overspending. A free trial may also be available for testing out features before committing.

-

How can I ensure my Installments Fixed Rate Promissory Notes are legally binding?

To ensure that your Installments Fixed Rate Promissory Notes Secured By Residential Real Estate For Idaho Idaho are legally binding, it’s important to use a platform that complies with electronic signature laws. airSlate SignNow adheres to these regulations, allowing you to eSign documents securely. Always double-check that all parties involved properly sign and receive copies of the note to maintain validity.

-

Can I store and manage my Installments Fixed Rate Promissory Notes securely with airSlate SignNow?

Absolutely! airSlate SignNow offers secure cloud storage for your Installments Fixed Rate Promissory Notes Secured By Residential Real Estate For Idaho Idaho, ensuring that your documents are kept safe and organized. The platform provides encryption and access controls, allowing you to manage who can view or edit your documents at any time.

Get more for Installments Fixed Rate Promissory Note Secured By Residential Real Estate For Idaho Idaho

Find out other Installments Fixed Rate Promissory Note Secured By Residential Real Estate For Idaho Idaho

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple