Notice Default Contract Form

What is the Notice Default Contract

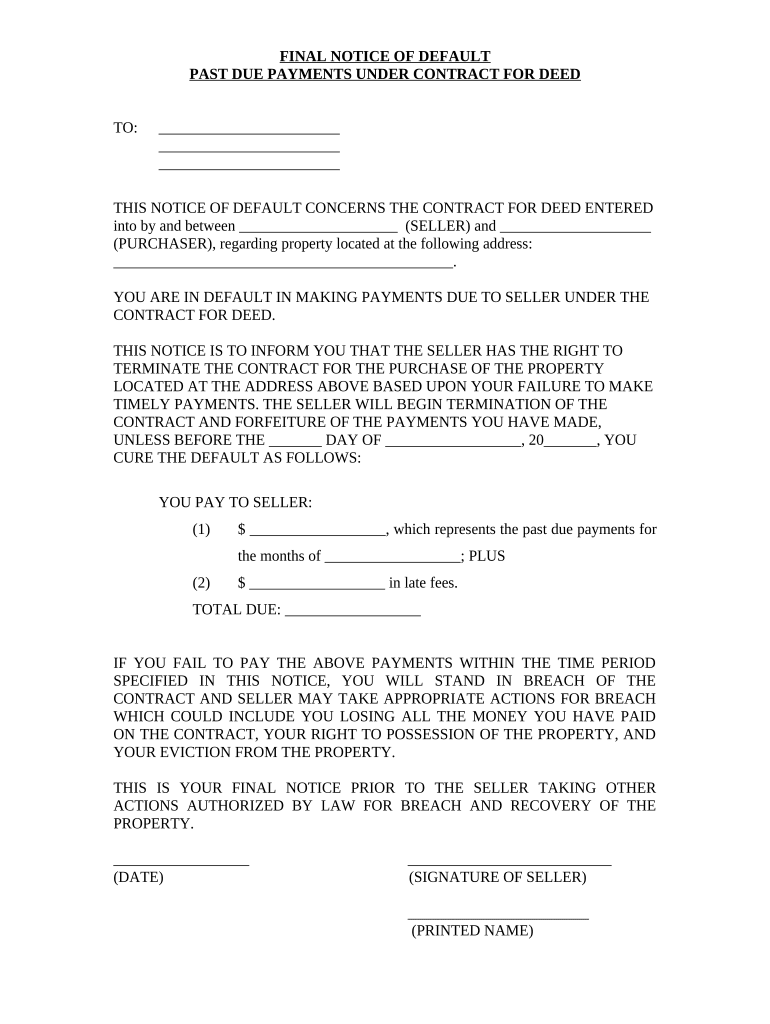

The Notice Default Contract is a legal document utilized in Illinois to formally notify a party of a default on a contractual obligation. This document serves as a crucial step in the process of enforcing contractual rights and may be necessary for various types of agreements, including leases and loans. By outlining the specifics of the default, such as the nature of the breach and any required actions to remedy the situation, this contract helps to ensure transparency and provides a clear record of the default event.

How to use the Notice Default Contract

Using the Notice Default Contract effectively involves a few key steps. First, identify the specific terms of the contract that have been breached. Next, fill out the Notice Default Contract with accurate information regarding the defaulting party, the nature of the breach, and any applicable deadlines for remedying the situation. Once completed, the document should be delivered to the defaulting party, either through certified mail or in person, to ensure proper notification. Keeping a copy of the notice for your records is also advisable.

Steps to complete the Notice Default Contract

Completing the Notice Default Contract requires careful attention to detail. Follow these steps:

- Gather all relevant documents related to the original contract.

- Clearly identify the party or parties involved in the contract.

- Specify the exact nature of the default, including dates and specific clauses breached.

- Outline any actions required to cure the default, along with a reasonable deadline.

- Sign and date the document to validate it.

- Deliver the notice to the defaulting party and retain proof of delivery.

Legal use of the Notice Default Contract

The legal use of the Notice Default Contract is essential for enforcing rights under a contract. In Illinois, this document must comply with state laws governing contracts and defaults. The notice serves as a formal warning, allowing the defaulting party an opportunity to rectify the situation before further legal action is pursued. It is important to ensure that the contract is drafted clearly and accurately to avoid potential disputes over its validity.

Key elements of the Notice Default Contract

Several key elements must be included in the Notice Default Contract to ensure its effectiveness:

- Identification of Parties: Clearly state the names and addresses of all parties involved.

- Description of Default: Provide a detailed account of the breach, including specific contract terms violated.

- Remedy Requirements: Outline what actions must be taken to cure the default.

- Deadline for Remedy: Specify a reasonable timeframe for the defaulting party to respond.

- Signature: Include the signature of the notifying party to authenticate the document.

State-specific rules for the Notice Default Contract

In Illinois, specific rules govern the use of the Notice Default Contract. It is important to be aware of any state-specific requirements, such as the format of the notice, the method of delivery, and any mandatory waiting periods before pursuing further action. Familiarizing yourself with these regulations can help ensure compliance and strengthen the enforceability of the contract.

Quick guide on how to complete notice default contract

Effortlessly Prepare Notice Default Contract on Any Device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Notice Default Contract on any device with the airSlate SignNow applications for Android or iOS and enhance any document-driven process today.

How to Edit and Electronically Sign Notice Default Contract Effortlessly

- Obtain Notice Default Contract and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or conceal sensitive details with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to record your modifications.

- Choose how you wish to send your form—via email, SMS, an invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow satisfies your needs in document management with just a few clicks from any chosen device. Modify and electronically sign Notice Default Contract to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it assist with Illinois payments?

airSlate SignNow is an eSigning solution that simplifies the process of sending and signing documents electronically. For businesses dealing with Illinois payments, it ensures quick and secure transactions by streamlining the documentation process, which is essential for maintaining compliance and efficiency.

-

What features does airSlate SignNow offer for managing Illinois payments?

airSlate SignNow offers a range of features including customizable templates, workflow automation, and advanced reporting tools, all designed to enhance the efficiency of managing Illinois payments. These features allow businesses to automate repetitive tasks and track payment processes seamlessly.

-

How is pricing structured for using airSlate SignNow for Illinois payments?

airSlate SignNow provides flexible pricing plans tailored to different business needs. For those focusing on Illinois payments, the plans are designed to offer cost-effective solutions, allowing businesses to select a package that aligns best with their transaction volume and feature requirements.

-

Can airSlate SignNow integrate with other payment systems for Illinois payments?

Yes, airSlate SignNow can integrate with various payment systems to facilitate Illinois payments. This integration ensures that you can handle all aspects of document management and payment processing in one centralized platform, making operations smoother and more efficient.

-

What benefits does airSlate SignNow provide for businesses in Illinois?

Businesses in Illinois can benefit signNowly from airSlate SignNow by enhancing their document workflow, reducing processing times, and ensuring compliance. The solution’s user-friendly interface and robust features empower companies to focus more on core activities while confidently managing Illinois payments.

-

Is airSlate SignNow secure for handling Illinois payments?

Absolutely. airSlate SignNow prioritizes security, utilizing industry-standard encryption and compliance measures to protect sensitive information associated with Illinois payments. This commitment to security helps build trust with clients and ensures safe transactions.

-

How does airSlate SignNow compare to traditional signing methods for Illinois payments?

Compared to traditional signing methods, airSlate SignNow offers a much faster and more efficient way to handle Illinois payments. The electronic signing process eliminates the need for physical paperwork, reduces turnaround time, and minimizes errors, ultimately leading to better business outcomes.

Get more for Notice Default Contract

Find out other Notice Default Contract

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate