Illinois Deed to Form

What is the Illinois Deed To

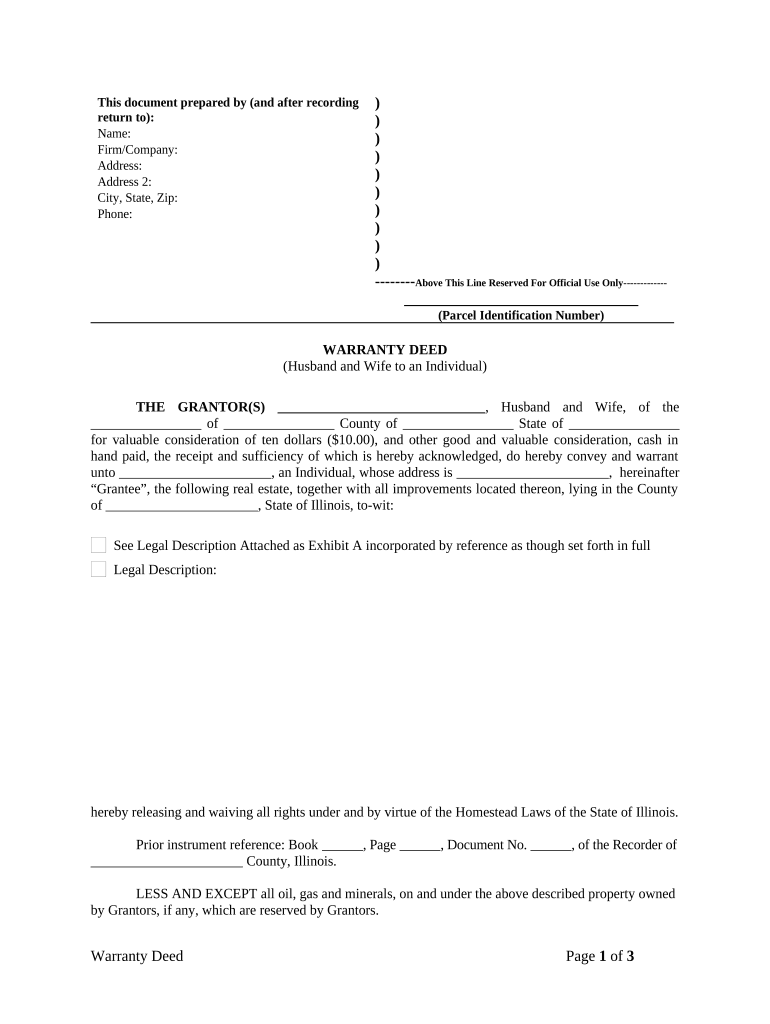

The Illinois Deed To is a legal document used to transfer ownership of real property in the state of Illinois. This form serves as a formal record of the change in property ownership and outlines the details of the transaction, including the names of the grantor (seller) and grantee (buyer), the legal description of the property, and any relevant terms of the transfer. Understanding the purpose and function of this deed is essential for anyone involved in real estate transactions in Illinois.

How to use the Illinois Deed To

Using the Illinois Deed To involves several key steps to ensure that the transfer of property is legally valid. First, both the grantor and grantee must complete the form accurately, providing all necessary information, such as the property description and the names of the parties involved. Once completed, the deed must be signed by the grantor in the presence of a notary public. After notarization, the deed should be filed with the appropriate county recorder's office to make the transfer official and public.

Steps to complete the Illinois Deed To

Completing the Illinois Deed To requires careful attention to detail. Follow these steps:

- Obtain the Illinois Deed To form from a reliable source.

- Fill in the names of the grantor and grantee, ensuring correct spelling.

- Provide a legal description of the property, which can often be found on previous deeds or property tax documents.

- Sign the form in front of a notary public to validate the signature.

- File the completed deed with the county recorder's office where the property is located.

Key elements of the Illinois Deed To

The Illinois Deed To includes several critical elements that must be present for the document to be valid. These elements are:

- The full names and addresses of the grantor and grantee.

- A clear legal description of the property being transferred.

- The date of the transfer.

- The signature of the grantor, notarized to confirm authenticity.

- Any specific conditions or terms related to the transfer, if applicable.

Legal use of the Illinois Deed To

The Illinois Deed To must comply with state laws to be considered legally binding. This includes proper execution, notarization, and filing with the county recorder's office. Failure to adhere to these legal requirements can result in disputes over property ownership or challenges to the validity of the deed. Understanding these legal parameters is essential for both buyers and sellers in real estate transactions.

State-specific rules for the Illinois Deed To

Illinois has specific regulations governing the use of the Deed To. For instance, the deed must be executed in accordance with Illinois law, which includes requirements for notarization and filing. Additionally, certain disclosures may be necessary depending on the nature of the property transfer. Familiarity with these state-specific rules can help ensure a smooth transaction and avoid potential legal issues.

Quick guide on how to complete illinois deed to

Prepare Illinois Deed To effortlessly on any device

The online management of documents has become increasingly popular among organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed forms, as you can easily locate the right template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Illinois Deed To on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Illinois Deed To with ease

- Locate Illinois Deed To and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign tool, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your PC.

Eliminate worries about lost or misplaced files, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Illinois Deed To and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Illinois deed to and how can airSlate SignNow help?

An Illinois deed to is a legal document that transfers property ownership in the state of Illinois. airSlate SignNow simplifies the process by allowing you to easily create, sign, and manage these documents online, ensuring a smooth transaction.

-

How much does it cost to use airSlate SignNow for an Illinois deed to?

The pricing for airSlate SignNow varies depending on the plan you choose. However, it offers a cost-effective solution that provides you with all the necessary features to handle Illinois deeds to efficiently and affordably.

-

What features does airSlate SignNow offer for managing Illinois deeds to?

airSlate SignNow includes various features such as customizable templates, electronic signatures, and document tracking specifically designed for managing Illinois deeds to. These tools streamline the signing process and enhance document security.

-

Is airSlate SignNow compliant with Illinois regulations for deeds?

Yes, airSlate SignNow is compliant with Illinois regulations regarding electronic signatures and deed transfers. This ensures that your Illinois deed to is legally recognized and can be securely executed online.

-

Can I integrate airSlate SignNow with other tools for my Illinois deed to?

Absolutely! airSlate SignNow offers integrations with various applications and software that can help you manage your Illinois deed to seamlessly. This includes CRM systems, document storage solutions, and more to streamline your workflow.

-

What benefits will I gain from using airSlate SignNow for an Illinois deed to?

By using airSlate SignNow for your Illinois deed to, you gain efficiency, improved document security, and a user-friendly platform. This means you can focus more on your transactions than on paperwork.

-

How can I get started with airSlate SignNow for my Illinois deed to?

Getting started with airSlate SignNow for your Illinois deed to is easy! Simply sign up for an account, explore the templates available, and begin creating your documents quickly and efficiently.

Get more for Illinois Deed To

Find out other Illinois Deed To

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy