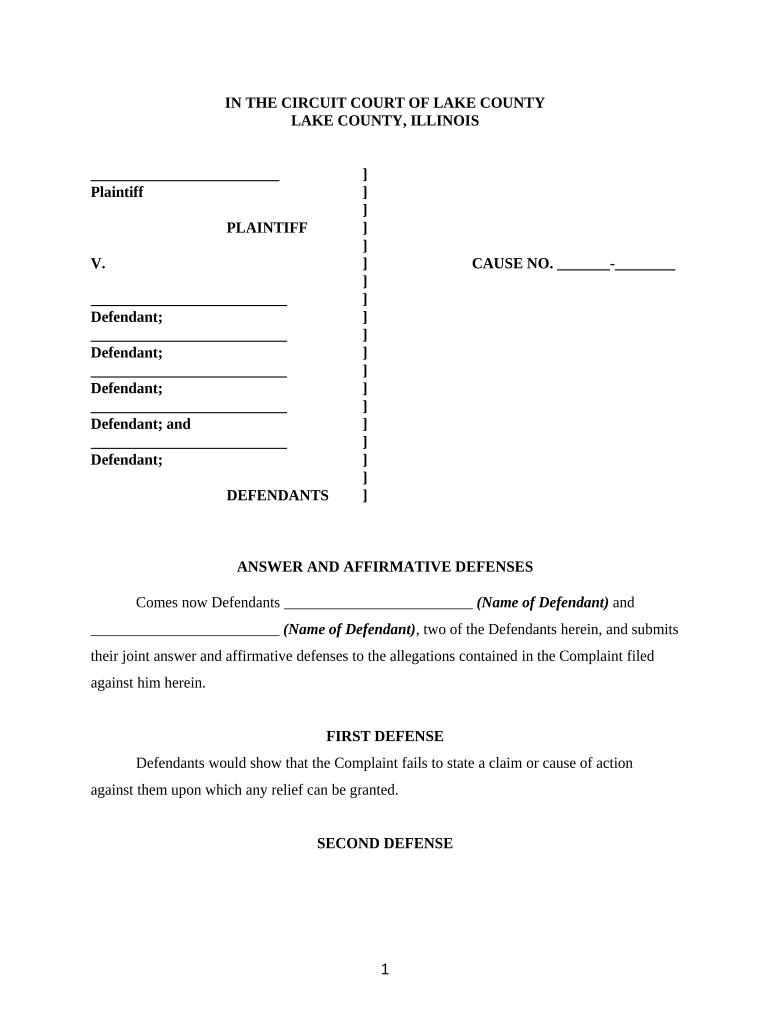

Illinois Foreclosure Form

What is the Illinois Foreclosure

The Illinois foreclosure process refers to the legal procedure that allows lenders to reclaim property when a borrower fails to meet mortgage obligations. This process is initiated when a borrower defaults on their loan, leading to a court proceeding to determine the fate of the property. In Illinois, foreclosures can be judicial, meaning they must go through the court system, which adds layers of legal requirements and timelines that must be adhered to. Understanding this process is crucial for both borrowers and lenders to navigate the complexities of property rights and obligations.

Steps to Complete the Illinois Foreclosure

Completing the Illinois foreclosure process involves several key steps that must be followed carefully. Initially, the lender must file a complaint in court, detailing the reasons for the foreclosure. Following this, the borrower is served with a summons and complaint, which allows them to respond, typically within a specified timeframe. If the borrower does not respond, the lender may proceed to obtain a default judgment. If the borrower does respond, a trial may ensue where both parties present their cases. Ultimately, if the court rules in favor of the lender, a judgment of foreclosure is issued, leading to the sale of the property at auction.

Legal Use of the Illinois Foreclosure

The legal framework surrounding the Illinois foreclosure process is governed by state laws that ensure both borrowers' and lenders' rights are respected. It is essential for all parties involved to understand the legal implications of foreclosure, including the rights to contest a foreclosure and the potential for redemption periods where the borrower can reclaim the property. Compliance with the Illinois Mortgage Foreclosure Law is necessary to ensure that all actions taken during the process are legally binding and enforceable.

Required Documents

To initiate a foreclosure in Illinois, specific documents must be prepared and submitted. These typically include the mortgage agreement, the note evidencing the debt, and any relevant correspondence regarding the default. Additionally, the lender must provide proof of service to demonstrate that the borrower was properly notified of the proceedings. Accurate documentation is critical, as any errors can lead to delays or challenges in the foreclosure process.

Form Submission Methods (Online / Mail / In-Person)

In Illinois, submitting foreclosure-related documents can be done through various methods. Many courts now allow electronic filing, which streamlines the process and can reduce processing times. Alternatively, documents can be submitted via mail or in person at the appropriate courthouse. It is important to verify the submission method accepted by the specific court handling the case, as this can vary by jurisdiction.

Filing Deadlines / Important Dates

Timely filing of documents is crucial in the Illinois foreclosure process. There are strict deadlines for responding to a summons and complaint, typically set at 30 days. Additionally, if a borrower wishes to contest the foreclosure, they must adhere to specific timelines to file their answer or any motions. Missing these deadlines can result in a default judgment against the borrower, making it essential to stay informed about all relevant dates throughout the process.

Quick guide on how to complete illinois foreclosure

Effortlessly Prepare Illinois Foreclosure on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Illinois Foreclosure on any device using airSlate SignNow apps for Android or iOS and streamline any document-related process today.

Edit and eSign Illinois Foreclosure with Ease

- Obtain Illinois Foreclosure and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Select important sections of the document or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which only takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Decide how you wish to send your form—via email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, cumbersome form navigation, or errors that require reprinting documents. airSlate SignNow accommodates your document management requirements in just a few clicks from any device you prefer. Modify and eSign Illinois Foreclosure while ensuring exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process to file an Illinois answer complaint?

Filing an Illinois answer complaint typically involves completing the required documents and submitting them to the court. With airSlate SignNow, you can easily fill out and eSign the necessary forms online, streamlining the process. This digital solution saves time and ensures that everything is filed correctly.

-

How does airSlate SignNow help with responding to an Illinois answer complaint?

AirSlate SignNow simplifies the process of responding to an Illinois answer complaint by allowing you to collaborate with your team and clients in real-time. You can create, edit, and eSign your response directly within the platform. This ensures that the response is accurate and submitted on time.

-

Are there any costs associated with using airSlate SignNow for Illinois answer complaints?

Yes, airSlate SignNow offers several pricing plans, making it a cost-effective solution for handling Illinois answer complaints. Plans vary based on the features you need, such as unlimited eSigning or advanced integrations. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow provide for managing legal documents like Illinois answer complaints?

AirSlate SignNow offers features such as document templates, secure eSignatures, and robust tracking to manage legal documents like an Illinois answer complaint efficiently. You can also set reminders for important deadlines, which helps ensure your response is submitted on time. These features enhance your workflow and improve accuracy.

-

Can I integrate airSlate SignNow with other tools I use for legal management?

Absolutely! AirSlate SignNow supports integration with various legal management tools, including CRM and document management systems. This means you can seamlessly incorporate eSigning capabilities into your existing workflows when handling Illinois answer complaints. Such integrations help streamline your processes.

-

Is airSlate SignNow secure for handling sensitive legal documents like an Illinois answer complaint?

Yes, airSlate SignNow prioritizes security for sensitive legal documents, including Illinois answer complaints. The platform employs encryption and advanced authentication measures to protect your data. You can confidently use airSlate SignNow to store and manage your legal documents.

-

How can airSlate SignNow improve my efficiency when dealing with Illinois answer complaints?

Using airSlate SignNow improves efficiency by reducing manual paperwork and allowing electronic transactions. The user-friendly interface enables quick document creation and eSigning, which signNowly speeds up the response process for Illinois answer complaints. You can manage everything in one place, ensuring a smoother workflow.

Get more for Illinois Foreclosure

- Pathfinder charakterbogen form

- Romans road bible study pdf form

- Mukhyamantri state health care scheme form

- Exploring science 7 test papers form

- Procedural reliability form

- Email application to finance customerservicelaci form

- Form tx comptroller 50 283 fill online printable

- Declaraciones juradas de exencin fiscal de la residencia form

Find out other Illinois Foreclosure

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document