Illinois Estates Form

What is the Illinois Estates

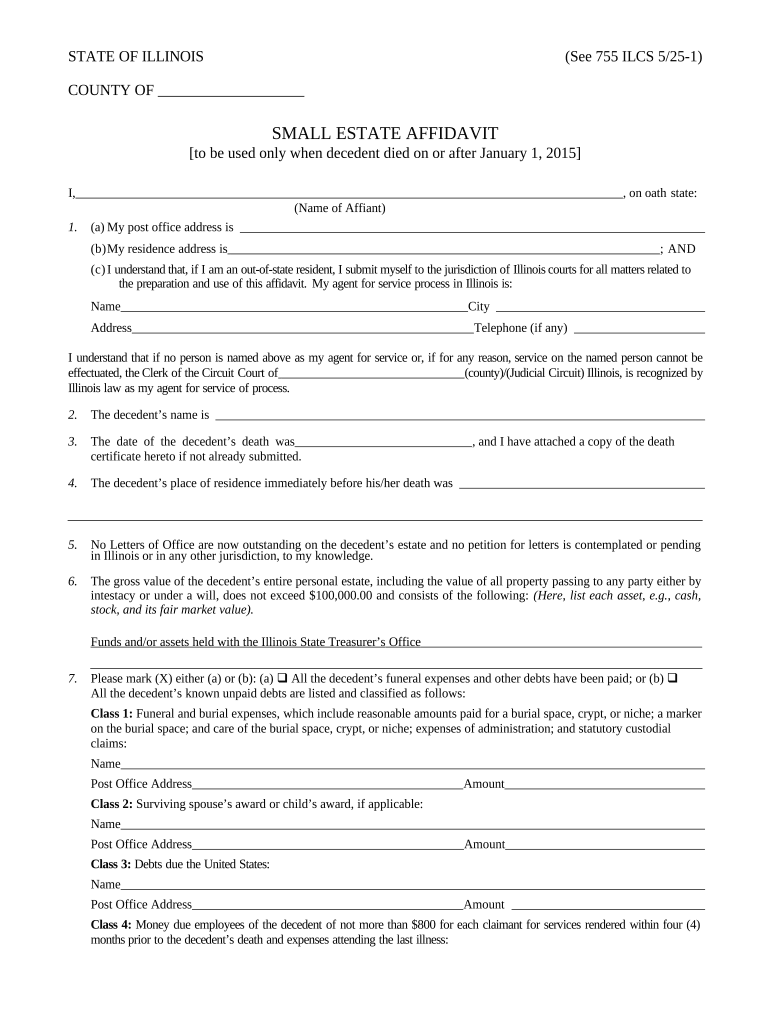

The Illinois Estates form is a legal document used in the state of Illinois to manage the distribution of a deceased person's assets. This form is essential for individuals involved in the probate process, as it outlines how the estate's assets will be allocated to beneficiaries. Understanding the specifics of the Illinois Estates form is crucial for ensuring compliance with state laws and facilitating a smooth transition of assets.

How to use the Illinois Estates

Using the Illinois Estates form involves several key steps. First, gather all necessary information regarding the deceased’s assets, debts, and beneficiaries. This information is vital for accurately completing the form. Next, fill out the Illinois Estates form with the required details, ensuring that all information is correct and complete. Once completed, the form must be submitted to the appropriate probate court in Illinois for review and approval. It's important to follow any additional instructions provided by the court to avoid delays.

Steps to complete the Illinois Estates

To complete the Illinois Estates form effectively, follow these steps:

- Collect all relevant documents, including the deceased's will, asset lists, and any outstanding debts.

- Fill out the Illinois Estates form with accurate details about the deceased and their estate.

- Review the form for any errors or missing information.

- Sign the form and have it notarized if required.

- Submit the completed form to the probate court along with any necessary supporting documents.

Legal use of the Illinois Estates

The legal use of the Illinois Estates form is governed by state probate laws. This form must be used in accordance with these laws to ensure that the distribution of assets is valid and recognized by the court. Failing to adhere to legal requirements can result in delays or complications in the probate process. It's advisable to consult with a legal professional to ensure that all aspects of the Illinois Estates form are handled correctly.

Key elements of the Illinois Estates

Key elements of the Illinois Estates form include:

- Identification of the deceased, including their full name and date of death.

- A detailed list of assets and liabilities of the estate.

- Information about beneficiaries and their respective shares of the estate.

- Signatures of the executor and any necessary witnesses.

State-specific rules for the Illinois Estates

Illinois has specific rules governing the use of the Illinois Estates form. These include requirements for filing deadlines, necessary documentation, and the process for notifying beneficiaries. Understanding these rules is essential for ensuring compliance and avoiding potential legal issues. It's important to stay informed about any changes in state laws that may affect the probate process.

Quick guide on how to complete illinois estates

Effortlessly Create Illinois Estates on Any Device

Managing documents online has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the features you require to create, alter, and electronically sign your documents quickly and without any hold-ups. Manage Illinois Estates on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to Modify and eSign Illinois Estates with Ease

- Locate Illinois Estates and click Get Form to begin.

- Use the tools we offer to complete your form.

- Select important parts of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal significance as a traditional ink signature.

- Review the details and then click the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tiresome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Illinois Estates to ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are Illinois estates, and why are they important?

Illinois estates refer to the assets and properties owned by individuals at the time of their death. Understanding Illinois estates is crucial for proper estate planning to ensure that your assets are distributed according to your wishes and comply with state laws.

-

How does airSlate SignNow help with managing Illinois estates?

AirSlate SignNow streamlines the document signing process for Illinois estates, enabling users to create, send, and eSign essential estate planning documents quickly. This ease of use allows for efficient management of estates, saving time and reducing the stress typically associated with estate administration.

-

What features does airSlate SignNow offer for Illinois estates?

AirSlate SignNow provides features like customizable document templates, secure cloud storage, and real-time tracking for signatures. These tools are designed to simplify and enhance the documentation process involved in managing Illinois estates, ensuring that all paperwork is completed swiftly and accurately.

-

Is airSlate SignNow affordable for managing Illinois estates?

Yes, airSlate SignNow offers a cost-effective solution for individuals and businesses managing Illinois estates. With various pricing plans available, users can choose an option that best suits their budget while benefiting from comprehensive eSignature capabilities.

-

What integrations does airSlate SignNow provide for Illinois estates?

AirSlate SignNow integrates seamlessly with popular applications like Google Drive, Dropbox, and Microsoft Office, making it easier to manage documentation related to Illinois estates. This connectivity ensures that all your estate planning documents are accessible and organized in one place.

-

Can airSlate SignNow assist with the legal compliance of Illinois estates?

Absolutely, airSlate SignNow is designed to help users comply with the legal requirements involved in handling Illinois estates. By providing legally binding eSignatures and ensuring that all documents meet state regulations, businesses can feel confident in their estate planning efforts.

-

Is there a mobile app available for managing Illinois estates with airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows users to manage Illinois estates from anywhere. This functionality empowers users to send and sign documents on the go, making estate management more accessible and convenient.

Get more for Illinois Estates

Find out other Illinois Estates

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form