Indiana Renunciation and Disclaimer of Property Received by Intestate Succession Indiana Form

What is the Indiana Renunciation And Disclaimer Of Property Received By Intestate Succession Indiana

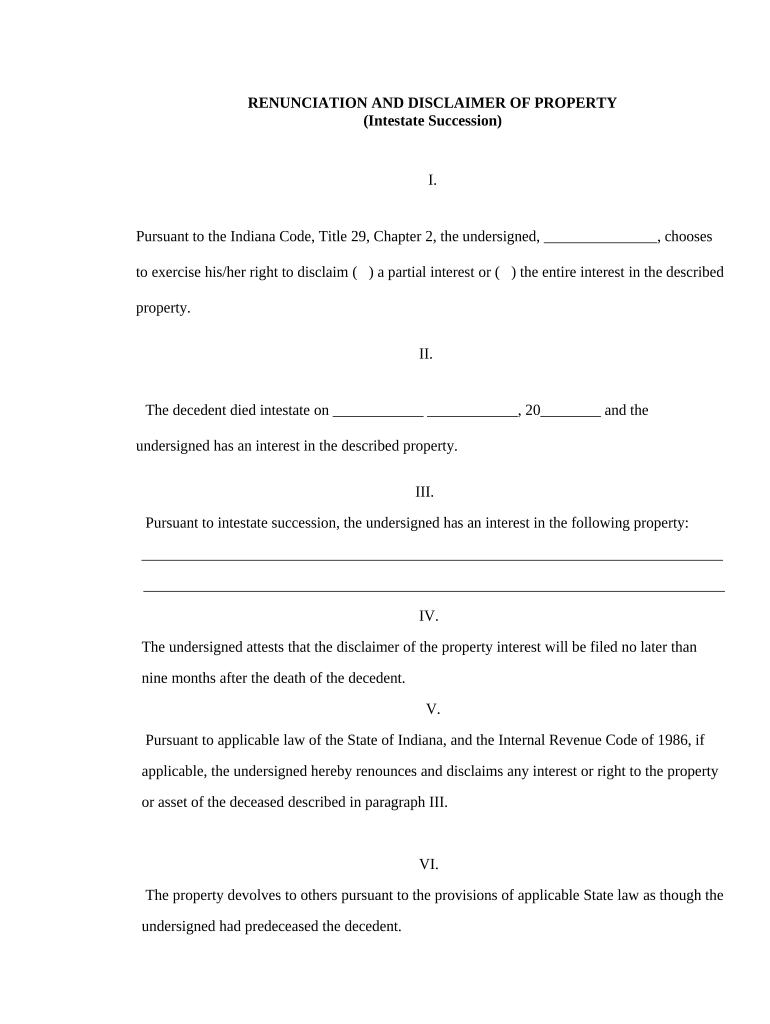

The Indiana Renunciation and Disclaimer of Property Received by Intestate Succession is a legal document that allows individuals to formally refuse inheritance from a deceased person's estate when that estate is distributed according to intestate succession laws. This process can be important for those wishing to decline property that they may not want or cannot manage. By executing this document, individuals can ensure that the property passes to other heirs as dictated by Indiana law, rather than being accepted and potentially creating tax or liability issues for the disclaimant.

Steps to complete the Indiana Renunciation And Disclaimer Of Property Received By Intestate Succession Indiana

Completing the Indiana Renunciation and Disclaimer of Property Received by Intestate Succession involves several key steps:

- Obtain the form: The form can typically be acquired from legal resources or state websites.

- Fill out the form: Provide necessary information, including the decedent's details and the property being disclaimed.

- Sign the document: Ensure that you sign the form in the presence of a notary public to validate it.

- Submit the form: File the completed form with the appropriate probate court or estate administrator.

Legal use of the Indiana Renunciation And Disclaimer Of Property Received By Intestate Succession Indiana

This document serves a critical legal function in Indiana, allowing individuals to renounce their right to inherit property. Legally, it must comply with specific requirements under Indiana law to be valid. The renunciation must be made in writing, signed, and executed within a certain timeframe following the decedent's passing. It is essential to understand that once the disclaimer is filed, it is irrevocable, meaning the individual cannot later change their mind about the decision.

Key elements of the Indiana Renunciation And Disclaimer Of Property Received By Intestate Succession Indiana

Several key elements must be included in the Indiana Renunciation and Disclaimer of Property Received by Intestate Succession:

- Identification of the disclaimant: The full legal name and address of the individual renouncing the inheritance.

- Details of the decedent: The name of the deceased person and relevant information regarding their estate.

- Description of the property: A clear description of the property being disclaimed, including any relevant identifiers.

- Signature and notarization: The document must be signed by the disclaimant and notarized to ensure authenticity.

How to use the Indiana Renunciation And Disclaimer Of Property Received By Intestate Succession Indiana

Using the Indiana Renunciation and Disclaimer of Property Received by Intestate Succession involves a straightforward process. After obtaining and completing the form, the disclaimant must sign it in front of a notary. Once notarized, the form should be filed with the appropriate court or estate representative. It is advisable to keep a copy for personal records. This process allows the disclaimant to formally refuse their inheritance, ensuring that the property is redirected according to state laws.

State-specific rules for the Indiana Renunciation And Disclaimer Of Property Received By Intestate Succession Indiana

Indiana has specific rules governing the renunciation and disclaimer of property. The disclaimer must be filed within nine months after the decedent's death. Additionally, the disclaimant must not have accepted any benefits from the property or estate prior to filing the disclaimer. Understanding these state-specific rules is crucial for ensuring that the renunciation is valid and legally recognized.

Quick guide on how to complete indiana renunciation and disclaimer of property received by intestate succession indiana

Complete Indiana Renunciation And Disclaimer Of Property Received By Intestate Succession Indiana effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Indiana Renunciation And Disclaimer Of Property Received By Intestate Succession Indiana on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to alter and eSign Indiana Renunciation And Disclaimer Of Property Received By Intestate Succession Indiana with ease

- Obtain Indiana Renunciation And Disclaimer Of Property Received By Intestate Succession Indiana and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes merely seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device of your choice. Modify and eSign Indiana Renunciation And Disclaimer Of Property Received By Intestate Succession Indiana and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Indiana Renunciation And Disclaimer Of Property Received By Intestate Succession Indiana?

The Indiana Renunciation And Disclaimer Of Property Received By Intestate Succession Indiana is a legal document that allows individuals to renounce their rights to property or assets inherited from a decedent. This process can help simplify the distribution of property among heirs, especially when the inheritor does not want to accept the inheritance.

-

How does airSlate SignNow facilitate the Indiana Renunciation And Disclaimer Of Property Received By Intestate Succession Indiana?

airSlate SignNow simplifies the process of creating, sending, and signing the Indiana Renunciation And Disclaimer Of Property Received By Intestate Succession Indiana document. With our user-friendly interface, users can easily fill out the necessary information, ensuring that their renunciation is legally compliant and efficient.

-

What is the cost of using airSlate SignNow for the Indiana Renunciation And Disclaimer Of Property Received By Intestate Succession Indiana?

airSlate SignNow offers flexible pricing plans that cater to different needs and budgets, making it an affordable solution for managing the Indiana Renunciation And Disclaimer Of Property Received By Intestate Succession Indiana. Pricing may vary based on features selected, so it's best to visit our pricing page for detailed information.

-

What features does airSlate SignNow provide for processing legal documents like the Indiana Renunciation And Disclaimer Of Property Received By Intestate Succession Indiana?

airSlate SignNow includes essential features such as document templates, eSignature capabilities, and secure cloud storage that ensure your Indiana Renunciation And Disclaimer Of Property Received By Intestate Succession Indiana is processed smoothly. Additionally, our platform allows for tracking and managing documents from initiation to completion.

-

Can airSlate SignNow integrate with other applications for legal document management?

Yes, airSlate SignNow offers integrations with various third-party applications, making it easier to manage your Indiana Renunciation And Disclaimer Of Property Received By Intestate Succession Indiana alongside your other legal documents. Popular integrations include CRM systems, cloud storage services, and productivity tools.

-

Is airSlate SignNow secure for handling sensitive documents like the Indiana Renunciation And Disclaimer Of Property Received By Intestate Succession Indiana?

Absolutely! airSlate SignNow prioritizes the security of your documents. We utilize advanced encryption technologies and adhere to strict compliance standards to ensure that your Indiana Renunciation And Disclaimer Of Property Received By Intestate Succession Indiana and other sensitive files are kept safe and confidential.

-

What are the advantages of using airSlate SignNow for the Indiana Renunciation And Disclaimer Of Property Received By Intestate Succession Indiana?

Using airSlate SignNow for the Indiana Renunciation And Disclaimer Of Property Received By Intestate Succession Indiana offers several advantages, including speed, efficiency, and reduced paper usage. Our platform streamlines the entire process from drafting to signing, allowing users to finalize their documents faster.

Get more for Indiana Renunciation And Disclaimer Of Property Received By Intestate Succession Indiana

Find out other Indiana Renunciation And Disclaimer Of Property Received By Intestate Succession Indiana

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word