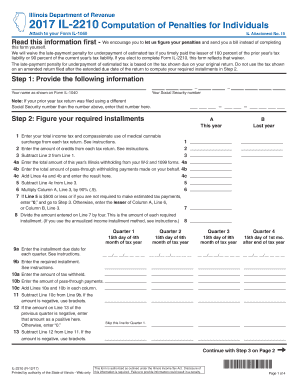

IL 2210, Computation of Penalties for Individuals Form

What is the IL 2210?

The IL 2210 is a form used by individuals in Illinois to calculate any underpayment penalties related to their state income tax. This form is particularly relevant for taxpayers who may not have paid enough tax throughout the year, either through withholding or estimated payments. The penalties are assessed based on the amount of tax owed and the timing of payments made. Understanding the IL 2210 is essential for ensuring compliance with state tax regulations and avoiding unnecessary penalties.

Steps to complete the IL 2210

Completing the IL 2210 involves several key steps. First, gather your financial documents, including income statements and previous tax returns. Next, determine your total tax liability for the year. Then, calculate your total payments made, including withholding and estimated payments. Using the form, you will compare these amounts to identify any underpayment. Follow the instructions carefully, ensuring you fill out each section accurately to avoid errors that could lead to penalties.

Filing Deadlines / Important Dates

It is crucial to be aware of filing deadlines when submitting the IL 2210. Typically, the form must be filed along with your annual state income tax return. For most taxpayers, this means the due date is April 15. However, if you file for an extension, ensure you submit the IL 2210 by the extended deadline. Missing these dates can result in additional penalties, so keeping track of them is essential for compliance.

Penalties for Non-Compliance

Failing to file the IL 2210 or underpaying your taxes can result in significant penalties. The state of Illinois imposes a penalty based on the amount of underpayment and the duration of the underpayment period. These penalties can accumulate quickly, leading to a higher tax bill than anticipated. Understanding the consequences of non-compliance can motivate timely and accurate filing, helping you avoid unnecessary financial strain.

Legal use of the IL 2210

The IL 2210 serves a legal purpose in the context of tax compliance. It is recognized by the Illinois Department of Revenue as an official document for calculating underpayment penalties. When properly completed and submitted, it provides a legal basis for addressing any discrepancies in tax payments. Ensuring that the form is filled out correctly is vital for its acceptance by tax authorities and for protecting your rights as a taxpayer.

How to use the IL 2210

Using the IL 2210 effectively requires understanding its structure and purpose. Start by reviewing the instructions provided with the form to familiarize yourself with the required calculations. Input your total tax liability and payments made into the designated sections. The form will guide you through the computation of any penalties owed. Once completed, ensure that you retain a copy for your records, as it may be needed for future reference or audits.

Quick guide on how to complete 2017 il 2210 computation of penalties for individuals

Accomplish IL 2210, Computation Of Penalties For Individuals seamlessly on any device

Digital document management has grown increasingly favored by businesses and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed paperwork, as you can access the appropriate format and securely store it online. airSlate SignNow provides you with all the features necessary to create, edit, and electronically sign your documents swiftly without any holdups. Manage IL 2210, Computation Of Penalties For Individuals on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign IL 2210, Computation Of Penalties For Individuals effortlessly

- Locate IL 2210, Computation Of Penalties For Individuals and click on Get Form to begin.

- Utilize the resources we offer to finalize your form.

- Emphasize pertinent sections of the documents or conceal sensitive details with tools that airSlate SignNow provides specifically for this task.

- Create your electronic signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional ink signature.

- Verify the details and click on the Done button to preserve your changes.

- Select your preferred method of sending your document, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you select. Modify and electronically sign IL 2210, Computation Of Penalties For Individuals and ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Do we have to separately fill out the application forms of medial institutions like AMU apart from the NEET application form for 2017?

No there's no separate exam to get into AMU , the admission will be based on your NEET score.

-

How can I get a lot of people to fill out my Google form survey for a research paper?

First of all, to get a lot of responses for your survey don't forget to follow main rules of creating a survey. Here are some of them:Create and design an invitation page, sett the information about why it is so important for you to get the answers there; also write the purpose of your survey.Make your survey short. Remember that people spend their time answering questions.Preset your goal, decide what information you want to get in the end. Prepare list of questions, which would be the most important for you.Give your respondents enough time to answer a survey.Don't forget to say "Thank you!", be polite.Besides, if you want to get more responses, you can use these tips:1.The first one is to purchase responses from survey panel. You can use MySurveyLab’s survey panel for it. In this case you will get reliable and useful results. You can read more about it here.2.If you don’t want to spent money for responses, you can use the second solution. The mentioned tool enables sharing the survey via different channels: email (invitations and e-mail embedded surveys, SMS, QR codes, as a link.You can share the link on different social media, like Twitter, Facebook, Facebook groups, different forums could be also useful, Pinterest, LinkedIn, VKontakte and so on… I think that if you use all these channels, you could get planned number of responses.Hope to be helpful! Good luck!

Create this form in 5 minutes!

How to create an eSignature for the 2017 il 2210 computation of penalties for individuals

How to create an eSignature for your 2017 Il 2210 Computation Of Penalties For Individuals in the online mode

How to make an electronic signature for the 2017 Il 2210 Computation Of Penalties For Individuals in Google Chrome

How to generate an eSignature for putting it on the 2017 Il 2210 Computation Of Penalties For Individuals in Gmail

How to make an electronic signature for the 2017 Il 2210 Computation Of Penalties For Individuals straight from your mobile device

How to create an electronic signature for the 2017 Il 2210 Computation Of Penalties For Individuals on iOS devices

How to make an eSignature for the 2017 Il 2210 Computation Of Penalties For Individuals on Android OS

People also ask

-

What is IL 2210, Computation Of Penalties For Individuals?

IL 2210, Computation Of Penalties For Individuals, refers to the guidelines set by the IRS for calculating penalties on underpayments of estimated taxes. This computation is essential for individuals to avoid unnecessary penalties when filing their tax returns. Understanding these rules can help you manage your tax obligations effectively.

-

How can airSlate SignNow help with IL 2210, Computation Of Penalties For Individuals?

airSlate SignNow provides a seamless way to manage and sign tax-related documents, including those pertaining to IL 2210, Computation Of Penalties For Individuals. By using our electronic signature solution, you can ensure timely submission of your tax forms, reducing the risk of penalties due to late filings.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers competitive pricing plans that cater to various business needs, allowing you to choose the best fit for your budget. Each plan includes features that can assist with IL 2210, Computation Of Penalties For Individuals, ensuring you have access to the necessary tools for compliance and document management.

-

Is airSlate SignNow compliant with tax regulations?

Yes, airSlate SignNow is designed to comply with all relevant tax regulations, including those related to IL 2210, Computation Of Penalties For Individuals. Our platform ensures that all electronic signatures and document submissions meet legal standards, providing you peace of mind when handling sensitive tax information.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers a variety of features for effective document management, including templates, automated workflows, and secure storage. These features are particularly useful when dealing with forms related to IL 2210, Computation Of Penalties For Individuals, making your document processes efficient and organized.

-

Can I integrate airSlate SignNow with other software tools?

Absolutely! airSlate SignNow integrates seamlessly with numerous business applications, such as CRM systems and accounting software. This integration can help streamline your processes related to IL 2210, Computation Of Penalties For Individuals, by allowing you to manage all your documents in one place.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents provides numerous benefits, including enhanced security, reduced processing time, and improved accuracy. Specifically for IL 2210, Computation Of Penalties For Individuals, our platform ensures that your documents are signed and submitted on time, minimizing the risk of incurring penalties.

Get more for IL 2210, Computation Of Penalties For Individuals

Find out other IL 2210, Computation Of Penalties For Individuals

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile