Transfer Death Deed Form

What is the Transfer Death Deed

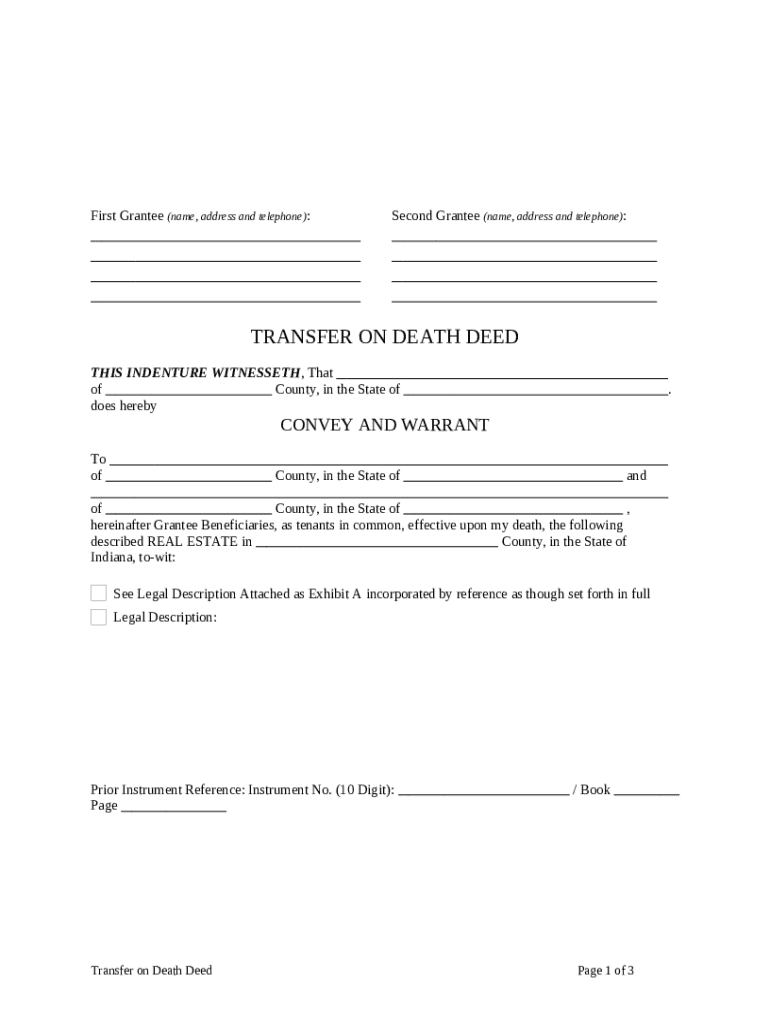

The transfer death deed, often referred to as the Indiana TOD, is a legal document that allows an individual to designate a beneficiary who will receive their real estate upon the individual's death. This deed is particularly useful as it bypasses the probate process, allowing for a more straightforward transfer of property to the designated beneficiary. The Indiana transfer death deed must be executed according to specific legal requirements to ensure its validity and effectiveness.

How to use the Transfer Death Deed

To utilize the Indiana transfer death deed, the property owner must complete the deed form, clearly identifying the property and the intended beneficiary. Once the form is filled out, it must be signed in the presence of a notary public. After notarization, the deed should be recorded with the county recorder's office where the property is located. This step is crucial, as it makes the transfer official and protects the beneficiary's rights to the property upon the owner's death.

Steps to complete the Transfer Death Deed

Completing the Indiana transfer death deed involves several key steps:

- Obtain the Indiana TOD form from a reliable source.

- Fill out the form with accurate property details and beneficiary information.

- Sign the form in front of a notary public to ensure legal validity.

- File the completed deed with the county recorder's office in the appropriate jurisdiction.

Following these steps carefully will help ensure that the transfer of property is executed smoothly and legally.

Key elements of the Transfer Death Deed

Several key elements must be included in the Indiana transfer death deed for it to be legally binding:

- The name and address of the property owner.

- A clear description of the property being transferred.

- The name of the designated beneficiary.

- The signature of the property owner, along with a notary's acknowledgment.

Including all these elements is essential to avoid any potential disputes or complications during the transfer process.

Legal use of the Transfer Death Deed

The Indiana transfer death deed is legally recognized under Indiana law, provided it meets the statutory requirements. It serves as a means for property owners to ensure that their assets are passed on to their chosen beneficiaries without the delays associated with probate. To maintain its legal standing, it is important to keep the deed updated, especially if there are changes in beneficiaries or property ownership.

State-specific rules for the Transfer Death Deed

In Indiana, specific rules govern the execution and recording of the transfer death deed. These include:

- The deed must be signed by the property owner and notarized.

- It must be recorded with the county recorder's office to be effective.

- Beneficiaries can be individuals or entities, such as trusts.

Understanding these state-specific rules is vital for ensuring the deed's enforceability and the smooth transfer of property upon the owner's death.

Quick guide on how to complete transfer death deed 497306741

Prepare Transfer Death Deed effortlessly on any device

Digital document management has become popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, allowing you to obtain the appropriate format and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and electronically sign your documents swiftly without delays. Manage Transfer Death Deed on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The most effective way to modify and eSign Transfer Death Deed with ease

- Find Transfer Death Deed and then select Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and then click on the Done button to store your modifications.

- Decide how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Alter and eSign Transfer Death Deed and ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a transfer on death deed Indiana?

A transfer on death deed Indiana is a legal instrument that allows property owners to transfer their real estate to beneficiaries upon their death, avoiding the probate process. This deed is effective immediately but does not affect the owner's rights during their lifetime. It can simplify estate planning and ensure a smooth transition of assets.

-

How do I create a transfer on death deed Indiana?

To create a transfer on death deed Indiana, you need to complete the deed form provided by the state and have it signNowd. It's essential to include a legal description of the property and designate beneficiaries clearly. Once prepared, the deed must be filed with the county recorder’s office to be effective.

-

What are the benefits of using a transfer on death deed Indiana?

The primary benefits of a transfer on death deed Indiana include avoiding probate, maintaining control over your property during your lifetime, and ensuring a hassle-free transfer to beneficiaries after your death. It can also help reduce legal costs associated with property transfer, making it a cost-effective solution for estate planning.

-

Is there a cost associated with a transfer on death deed Indiana?

Yes, there are costs associated with a transfer on death deed Indiana, including potential notary fees and recording fees charged by the county. However, the overall expenses are typically lower than those incurred during the probate process, making it a financially smart choice for property owners.

-

Can I revoke a transfer on death deed Indiana?

Yes, a transfer on death deed Indiana can be revoked at any time during the property owner’s lifetime. To revoke, the original deed must be recorded, along with a revocation form, at the county recorder's office. This flexibility allows property owners to change their estate plan as needed.

-

Are there any limitations to a transfer on death deed Indiana?

Yes, a transfer on death deed Indiana has some limitations, such as it cannot be used for all types of property. Additionally, it does not automatically transfer certain assets such as jointly owned property or those with a designated beneficiary. Consulting with an estate planning attorney can help clarify these limitations.

-

Does a transfer on death deed Indiana impact taxes?

A transfer on death deed Indiana generally does not affect property tax liabilities until the transfer occurs at the owner’s death. However, beneficiaries may incur capital gains taxes based on the property's value at the time of transfer. It's advisable to consult with a tax professional for personalized advice.

Get more for Transfer Death Deed

Find out other Transfer Death Deed

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter

- eSign Indiana Car Dealer Separation Agreement Simple

- eSign Iowa Car Dealer Agreement Free

- eSign Iowa Car Dealer Limited Power Of Attorney Free

- eSign Iowa Car Dealer Limited Power Of Attorney Fast

- eSign Iowa Car Dealer Limited Power Of Attorney Safe

- How Can I eSign Iowa Car Dealer Limited Power Of Attorney

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter