Living Trust for Individual, Who is Single, Divorced or Widow or Widower with Children Indiana Form

What is the Living Trust for Individual, Who Is Single, Divorced or Widow or Widower with Children in Indiana

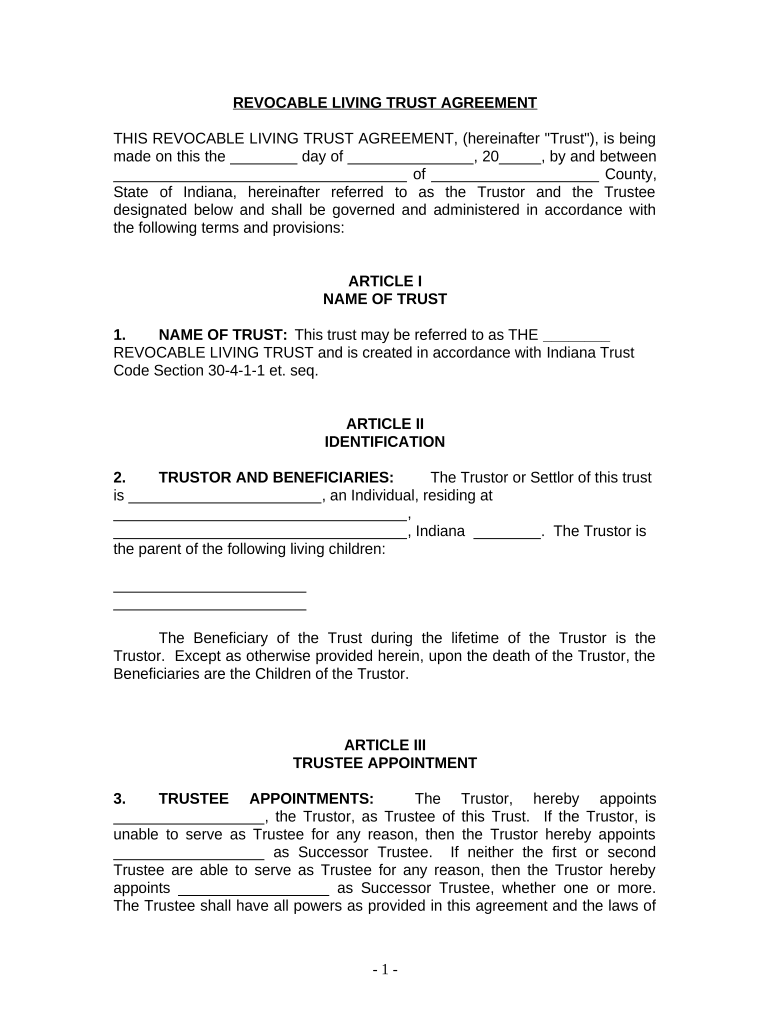

A living trust is a legal document that allows individuals to manage their assets during their lifetime and specify how those assets should be distributed after their death. For individuals who are single, divorced, or widowed with children in Indiana, a living trust can provide a way to ensure that their children are cared for and that their assets are passed on according to their wishes. This type of trust can help avoid the probate process, which can be lengthy and costly, allowing for a smoother transition of assets to beneficiaries.

How to Use the Living Trust for Individual, Who Is Single, Divorced or Widow or Widower with Children in Indiana

Using a living trust involves several steps, starting with drafting the document itself. Individuals must outline their assets and decide how they want them distributed. It is essential to name a trustee, who will manage the trust according to the individual's wishes. This can be the individual themselves or someone they trust. Once the trust is established, assets must be transferred into the trust to ensure they are managed according to the terms laid out in the document.

Steps to Complete the Living Trust for Individual, Who Is Single, Divorced or Widow or Widower with Children in Indiana

Completing a living trust involves a series of steps:

- Identify all assets, including property, bank accounts, and investments.

- Draft the living trust document, specifying terms and conditions for asset distribution.

- Choose a trustee to manage the trust.

- Transfer ownership of assets into the trust.

- Sign the document in front of a notary public to make it legally binding.

Legal Use of the Living Trust for Individual, Who Is Single, Divorced or Widow or Widower with Children in Indiana

The legal use of a living trust in Indiana allows individuals to maintain control over their assets while providing instructions for their distribution upon death. This type of trust is recognized by Indiana law, making it a valid estate planning tool. It is important to ensure that the trust complies with state laws and regulations to avoid any legal challenges in the future.

Key Elements of the Living Trust for Individual, Who Is Single, Divorced or Widow or Widower with Children in Indiana

Key elements of a living trust include:

- Grantor: The individual creating the trust.

- Trustee: The person or entity responsible for managing the trust.

- Beneficiaries: Individuals or entities who will receive assets from the trust.

- Terms of Distribution: Specific instructions on how and when assets are to be distributed.

State-Specific Rules for the Living Trust for Individual, Who Is Single, Divorced or Widow or Widower with Children in Indiana

In Indiana, living trusts must adhere to specific state laws, including how they are created and executed. The trust must be signed by the grantor and notarized to be legally binding. Additionally, Indiana does not impose a specific tax on living trusts, which can provide a financial advantage for individuals looking to manage their estate efficiently. Understanding these state-specific regulations is crucial for ensuring that the trust operates as intended.

Quick guide on how to complete living trust for individual who is single divorced or widow or widower with children indiana

Prepare Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Indiana easily on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, as you can find the right form and securely keep it online. airSlate SignNow equips you with all the resources you need to create, edit, and electronically sign your documents quickly without hold-ups. Handle Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Indiana on any platform with airSlate SignNow mobile apps for Android or iOS and enhance any document-focused process today.

How to edit and electronically sign Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Indiana effortlessly

- Find Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Indiana and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Indiana and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Indiana?

A Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Indiana is a legal arrangement that allows you to manage your assets during your lifetime and dictate their distribution after your passing. This type of trust is particularly beneficial for individuals with children, ensuring that your assets are protected and allocated according to your wishes.

-

How much does a Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Indiana cost?

The cost of setting up a Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Indiana can vary depending on the complexity of your assets and the attorney's fees. However, creating a trust is generally a cost-effective solution compared to the potential expenses of probate. It's advisable to consult with a legal professional for a precise quote.

-

What are the benefits of a Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Indiana?

A Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Indiana can provide several benefits, including avoiding probate, maintaining privacy, and allowing for seamless asset management. Additionally, it can reduce stress for your loved ones during difficult times by clearly outlining your asset distribution wishes.

-

Can I modify my Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Indiana?

Yes, a Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Indiana is flexible, allowing you to make changes as your situation evolves. This includes adding or removing beneficiaries, changing trustee powers, or modifying asset allocations. It is essential to follow the proper legal procedures to ensure the modifications are valid.

-

How does a Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Indiana compare to a will?

A Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Indiana differs from a will primarily in how assets are managed and distributed. While a will goes through probate, a living trust allows for direct transfer of assets, thereby bypassing probate entirely. This can lead to quicker distribution to your heirs and greater privacy.

-

What assets can be included in my Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Indiana?

You can include various assets in your Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Indiana, such as real estate, bank accounts, investments, and personal property. It's crucial to ensure that these assets are properly transferred into the trust to achieve the intended benefits. Consulting with an attorney can help you identify all suitable assets.

-

How do I set up a Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Indiana?

Setting up a Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Indiana typically involves preparing the trust document, naming your beneficiaries, and transferring assets into the trust. It's highly recommended to work with an attorney who can guide you through the technical aspects and ensure compliance with Indiana laws.

Get more for Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Indiana

- The oxygen treasure map form

- Cobb county absentee ballot application form

- Mcs 720b kansas manual application for duplicate formsend

- Church purchase request form

- U s department of justice process receipt and return united states form

- Form 8952 application for voluntary classification

- Printable roofing warranty template form

- Administrative complaint form

Find out other Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Indiana

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast