Indiana Widow in Form

What is the Indiana Widow In

The Indiana Widow In form is a legal document used primarily for estate management and inheritance matters in the state of Indiana. This form is essential for widows seeking to claim their deceased spouse's assets, ensuring that the transition of ownership is handled according to state laws. It serves to formalize the process of transferring property and other assets without the need for extensive probate proceedings, streamlining the legal requirements for the surviving spouse.

How to use the Indiana Widow In

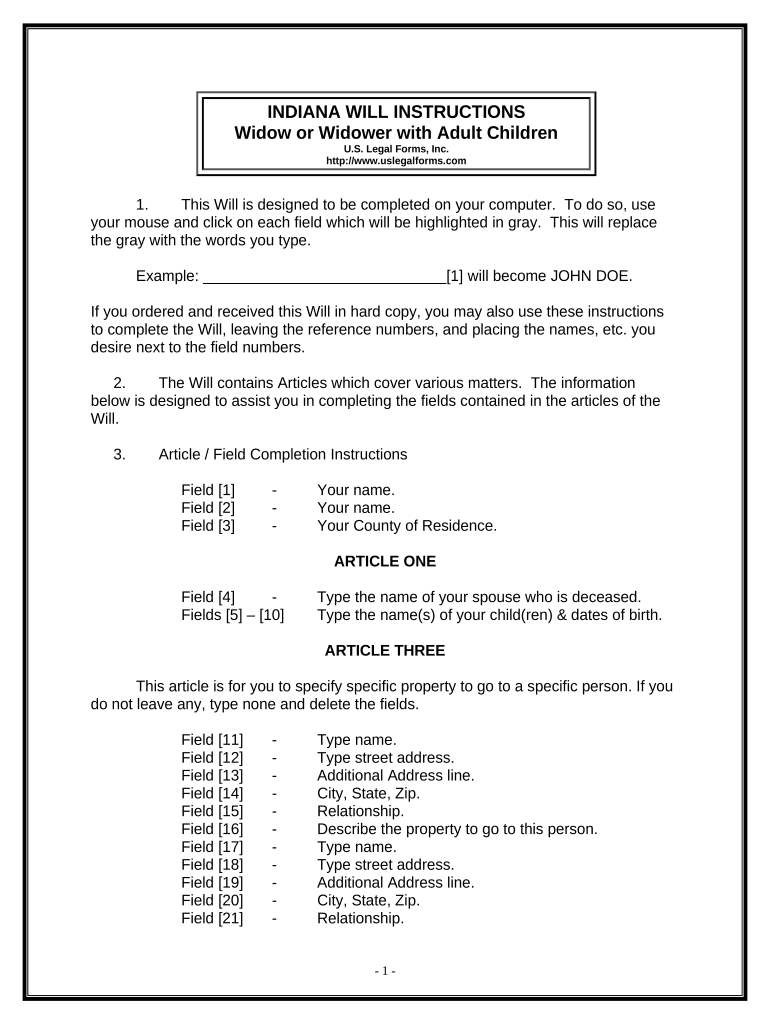

Using the Indiana Widow In form involves several key steps. First, the widow must gather necessary information, including details about the deceased spouse and any assets involved. Next, the form should be filled out accurately, ensuring that all required fields are completed. Once the form is completed, it must be signed and dated by the widow. Depending on the specific requirements, it may also need to be notarized or submitted to a local court to finalize the asset transfer.

Steps to complete the Indiana Widow In

Completing the Indiana Widow In form requires careful attention to detail. Follow these steps for successful completion:

- Gather all necessary documents, including the death certificate and any relevant property titles.

- Fill out the form with accurate information about the deceased and the assets being claimed.

- Review the form to ensure all details are correct and complete.

- Sign and date the form in the designated areas.

- If required, have the form notarized to validate the signature.

- Submit the form to the appropriate local authority or court as per Indiana state regulations.

Legal use of the Indiana Widow In

The Indiana Widow In form is legally recognized under Indiana law, allowing widows to claim their rights to their deceased spouse's assets. To ensure its legal validity, the form must be completed in compliance with state laws governing inheritance and property transfer. This includes adhering to any stipulations regarding signatures and notarization. Proper use of the form can help prevent disputes and ensure a smooth transition of assets.

Required Documents

To successfully complete the Indiana Widow In form, certain documents are required. These typically include:

- The death certificate of the deceased spouse.

- Proof of the widow's identity, such as a driver's license or state ID.

- Any existing wills or trust documents that may affect asset distribution.

- Titles or deeds for any property being claimed.

Who Issues the Form

The Indiana Widow In form is typically issued by local county clerks or probate courts in Indiana. These offices provide the necessary legal documents and guidance for widows navigating the estate management process. It is advisable for individuals to consult with these offices to ensure they have the correct version of the form and understand any specific local requirements that may apply.

Quick guide on how to complete indiana widow in

Complete Indiana Widow In effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to access the required form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Indiana Widow In on any device with airSlate SignNow Android or iOS applications and simplify any document-dependent task today.

The easiest way to modify and electronically sign Indiana Widow In without hassle

- Find Indiana Widow In and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and has the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to submit your form, by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Modify and electronically sign Indiana Widow In and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it benefit Indiana widows in estate management?

airSlate SignNow is a digital document signing platform that simplifies the process of eSigning and managing important documents. For Indiana widows in estate management, it streamlines the execution of wills and other legal documents efficiently. This allows for quicker access to necessary signatures and can signNowly reduce the stress often associated with handling such matters.

-

How much does airSlate SignNow cost for Indiana widows in need of eSignatures?

The pricing for airSlate SignNow varies based on the plan chosen, with options available to fit different budgets. Indiana widows in need of eSignatures can find cost-effective plans that cater specifically to their document signing needs. It's a worthy investment that saves time and hassle associated with traditional signing methods.

-

What features does airSlate SignNow offer for Indiana widows in document management?

airSlate SignNow offers a range of features including templates, custom workflows, and real-time tracking of document status. For Indiana widows in managing their affairs, these features enable an organized and efficient approach to handling essential paperwork. The ease of use enhances the overall user experience.

-

Is airSlate SignNow secure for Indiana widows in handling sensitive information?

Yes, airSlate SignNow employs robust security measures to ensure the protection of sensitive information. Indiana widows in particular can rest assured that their personal documents are encrypted and securely stored. This commitment to security allows for peace of mind while managing crucial documents.

-

Can Indiana widows in integrate airSlate SignNow with other applications?

Absolutely, airSlate SignNow supports integrations with various applications that Indiana widows in may already be using, such as Google Drive and Dropbox. This makes it easier to import and export documents for signing. The seamless integration capabilities enhance overall productivity in document management.

-

How does airSlate SignNow streamline the signing process for Indiana widows in?

AirSlate SignNow streamlines the signing process by allowing users to send documents for eSignature via email or shared links. For Indiana widows in, this means that important documents can be signed from anywhere, at any time, thus eliminating delays attributable to physical paperwork. It's a simple yet effective solution.

-

What support does airSlate SignNow offer for Indiana widows in their document signing needs?

airSlate SignNow offers comprehensive customer support through various channels such as email, chat, and phone assistance. Indiana widows in can rely on this support whenever they encounter issues or have queries about the platform. This ensures a smooth experience while using the service.

Get more for Indiana Widow In

Find out other Indiana Widow In

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter