Ks Form

What is the KS Form

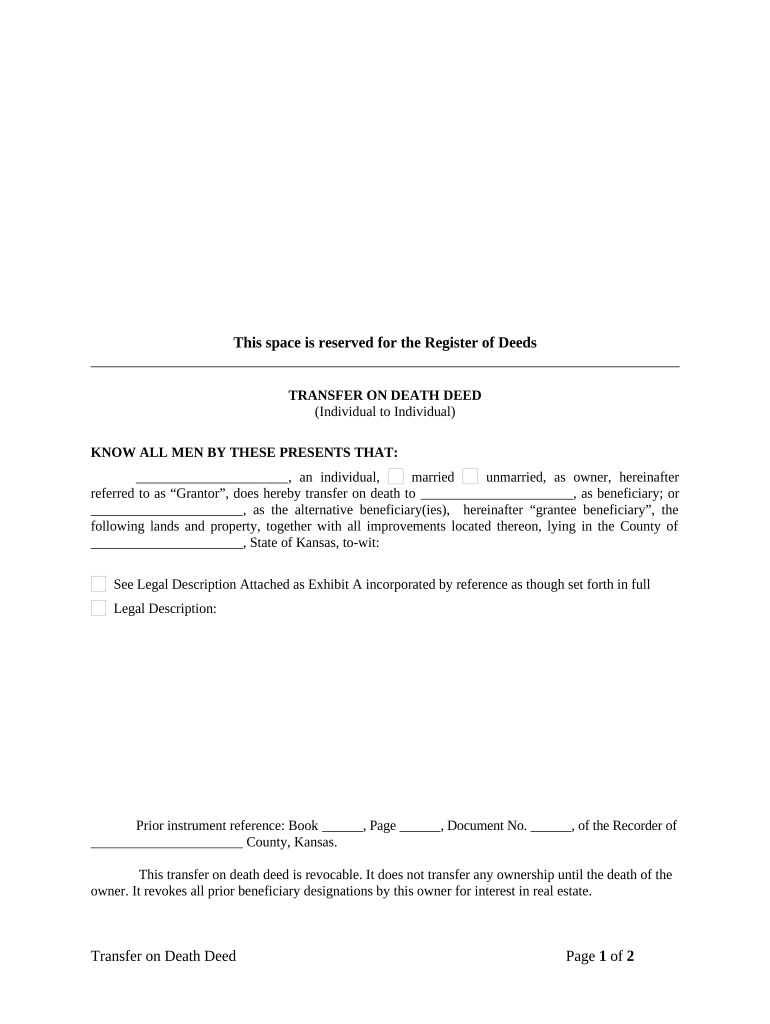

The KS Form is a legal document used primarily in the state of Kansas for the transfer of property upon the death of an individual. This form is essential for ensuring that the transfer of assets is executed according to the deceased's wishes and complies with state laws. It serves as a formal declaration of the transfer of ownership from the deceased to the designated beneficiaries, streamlining the process of estate management.

How to Use the KS Form

To effectively use the KS Form, you must first ensure that you have the correct version applicable to your situation. The form should be filled out with accurate information regarding the deceased, the beneficiaries, and the property being transferred. Once completed, the form needs to be signed by the appropriate parties, which may include witnesses or a notary, depending on state requirements. After signing, the form should be filed with the appropriate county office to finalize the transfer.

Steps to Complete the KS Form

Completing the KS Form involves several important steps:

- Gather necessary information, including the deceased's details and property descriptions.

- Fill out the form accurately, ensuring all fields are completed.

- Obtain signatures from all required parties, which may include witnesses or a notary.

- Submit the completed form to the relevant county office for processing.

Legal Use of the KS Form

The KS Form is legally binding when completed in accordance with Kansas law. It must meet specific requirements, such as proper signatures and notarization, to be considered valid. This ensures that the transfer of property is recognized by the court and can help prevent disputes among beneficiaries. Understanding the legal implications of the form is crucial for ensuring compliance and protecting the rights of all parties involved.

State-Specific Rules for the KS Form

Each state has its own regulations regarding the use of transfer forms like the KS Form. In Kansas, it is essential to adhere to local laws governing property transfers, including any required documentation and filing procedures. Familiarizing yourself with these state-specific rules can help avoid delays and ensure that the transfer process is smooth and legally sound.

Required Documents

When completing the KS Form, you may need to provide several supporting documents, including:

- A copy of the deceased's death certificate.

- Proof of ownership for the property being transferred.

- Identification for the beneficiaries involved in the transfer.

Having these documents ready can facilitate a more efficient completion and submission process.

Quick guide on how to complete ks form 497307370

Effortlessly Prepare Ks Form on Any Device

Digital document management has surged in popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without interruptions. Handle Ks Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

Editing and eSigning Ks Form with Ease

- Locate Ks Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize key sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it directly to your computer.

Eliminate the hassle of lost or misplaced files, tedious document searches, and mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs within a few clicks from any device of your choice. Modify and eSign Ks Form to guarantee excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a ks form and how can airSlate SignNow help with it?

A ks form is a document required for various transactions and approvals. airSlate SignNow simplifies the process of creating, sending, and signing ks forms electronically, ensuring that you can manage your documentation seamlessly and efficiently.

-

What are the features of airSlate SignNow for handling ks forms?

airSlate SignNow offers a variety of features for ks forms, including customizable templates, real-time tracking, and streamlined workflows. These tools enable users to automate repetitive tasks, minimize errors, and accelerate the signing process for ks forms.

-

Is there a cost associated with using airSlate SignNow for ks forms?

Yes, airSlate SignNow provides various pricing plans that cater to different business needs for managing ks forms. You can choose from monthly or annual subscriptions, each designed to be budget-friendly while offering robust features for eSignature solutions.

-

Can I integrate airSlate SignNow with other applications for my ks forms?

Absolutely! airSlate SignNow integrates with popular applications such as Salesforce, Google Drive, and Dropbox. This allows you to manage your ks forms and related documents seamlessly within your existing workflow and enhance productivity.

-

What benefits does using airSlate SignNow provide for ks forms?

Using airSlate SignNow for your ks forms offers several benefits, including faster turnaround times, enhanced security, and reduced paper usage. The electronic signing process ensures that you can obtain approvals swiftly, facilitating business operations.

-

How secure is airSlate SignNow when it comes to ks forms?

Security is a top priority for airSlate SignNow. The platform employs robust encryption and secure cloud storage for all ks forms, protecting sensitive data from unauthorized access and ensuring compliance with industry standards.

-

Is it easy to use airSlate SignNow for my ks forms?

Yes, airSlate SignNow is designed with user-friendliness in mind. Its intuitive interface allows users of all skill levels to create, send, and manage ks forms effortlessly without the need for extensive training.

Get more for Ks Form

Find out other Ks Form

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple