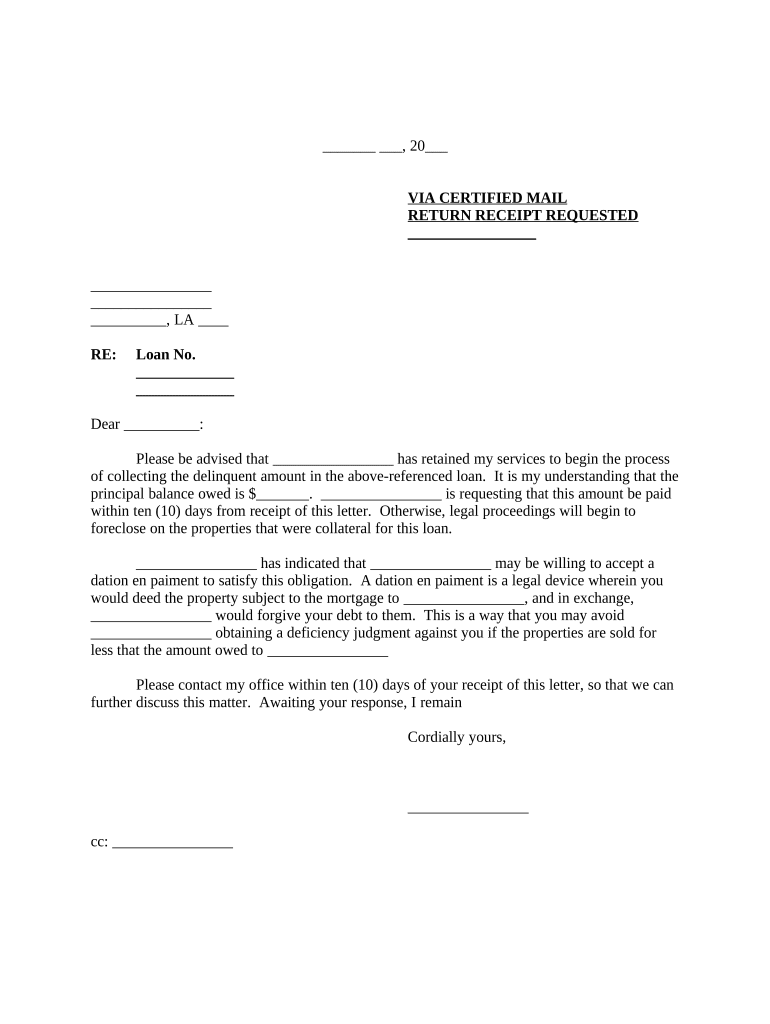

Demand Letter Loan Form

What is the demand letter loan?

A demand letter loan is a formal request for repayment of a loan that has not been paid back by the borrower. This document outlines the amount owed, the terms of the loan, and the deadline for repayment. It serves as a crucial tool for lenders to communicate their expectations and initiate the process of recovering funds. The demand letter is not only a reminder but also a legal document that can be used in court if necessary.

How to use the demand letter loan

Using a demand letter loan involves several key steps. First, gather all relevant information, including the loan agreement, payment history, and any correspondence related to the loan. Next, draft the letter by clearly stating the amount owed, the original loan terms, and the due date for repayment. It is essential to maintain a professional tone throughout the letter. Once completed, send the letter to the borrower via a method that provides proof of delivery, such as certified mail or a digital signature service.

Key elements of the demand letter loan

Several critical elements must be included in a demand letter loan to ensure its effectiveness. These include:

- Borrower's information: Full name and contact details.

- Lender's information: Your name and contact details.

- Loan details: Amount borrowed, interest rate, and repayment terms.

- Deadline for repayment: A clear date by which the payment should be made.

- Consequences of non-payment: Potential legal actions or penalties.

Steps to complete the demand letter loan

Completing a demand letter loan involves a systematic approach:

- Collect all necessary documentation related to the loan.

- Draft the demand letter, ensuring clarity and professionalism.

- Review the letter for accuracy and completeness.

- Send the letter using a reliable delivery method.

- Keep a copy of the letter and proof of delivery for your records.

Legal use of the demand letter loan

The legal use of a demand letter loan is significant, as it may serve as evidence in court if the borrower fails to repay the loan. To ensure its legal validity, the letter must include all relevant details and be sent in a manner that confirms receipt. Adhering to state-specific laws regarding loan agreements and repayment requests is also crucial. This ensures that the demand letter is enforceable and complies with applicable regulations.

Examples of using the demand letter loan

Examples of scenarios where a demand letter loan may be used include:

- A friend who borrowed money for a personal expense and has not repaid it.

- A business loan that has gone unpaid beyond the agreed terms.

- A family member who has defaulted on a loan for a shared investment.

In each case, the demand letter serves as a formal reminder and a step toward resolving the financial obligation.

Quick guide on how to complete demand letter loan

Complete Demand Letter Loan effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the correct form and securely store it online. airSlate SignNow provides all the resources needed to create, modify, and eSign your documents quickly without delays. Manage Demand Letter Loan on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Demand Letter Loan effortlessly

- Locate Demand Letter Loan and click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Highlight key parts of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and eSign Demand Letter Loan and ensure excellent communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a demand letter loan?

A demand letter loan is a type of financial agreement where a lender can request repayment at any time, usually after a specified period. It is commonly used in situations where the borrower needs quick access to funds. Understanding the nature of a demand letter loan can help businesses manage their finances effectively.

-

How can airSlate SignNow help with demand letter loans?

airSlate SignNow streamlines the process of creating and signing demand letter loans with its user-friendly eSigning platform. By using our solution, businesses can easily draft, send, and securely sign demand letter loan documents, saving time and reducing paperwork.

-

What are the pricing options for using airSlate SignNow for demand letter loans?

airSlate SignNow offers flexible pricing plans suitable for businesses of all sizes. Depending on your needs, you can choose from various subscription models that fit your budget while effectively managing your demand letter loan documents.

-

Is airSlate SignNow secure for demand letter loan documents?

Yes, airSlate SignNow employs advanced security measures, including encryption and secure storage, to ensure that all demand letter loan documents are protected. You can trust that your sensitive financial information remains confidential and secure.

-

What features does airSlate SignNow provide for managing demand letter loans?

airSlate SignNow provides a variety of features to facilitate demand letter loans, including customizable templates, automated reminders, and an intuitive dashboard. These tools help businesses keep track of their documents and improve the efficiency of their loan processes.

-

Can I integrate airSlate SignNow with other software for demand letter loans?

Absolutely! airSlate SignNow offers seamless integrations with various business applications, which allows you to manage your demand letter loan documents alongside existing workflows. Popular integrations include CRM platforms, accounting software, and more.

-

What are the benefits of using airSlate SignNow for demand letter loans?

Using airSlate SignNow for demand letter loans provides numerous benefits, such as increased efficiency, reduced processing times, and improved document tracking. Our platform simplifies the entire loan process, allowing you to focus more on your business rather than paperwork.

Get more for Demand Letter Loan

- Preliminary change of ownership report county of san luis form

- Cottage rental application form

- Q pregnancy release and x ray consent form

- Hotel reservation form indonesia rendezvous 23rd

- Work permit 1 of 2 north olmsted city schools form

- Form sp 1 ampquotpromoters application for permitampquot rhode island

- Form 538 h claim for credit or refund of property tax

- Change of circumstance form renfrewshire council renfrewshire gov

Find out other Demand Letter Loan

- Sign Indiana Basketball Registration Form Now

- Sign Iowa Gym Membership Agreement Later

- Can I Sign Michigan Gym Membership Agreement

- Sign Colorado Safety Contract Safe

- Sign North Carolina Safety Contract Later

- Sign Arkansas Application for University Free

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy