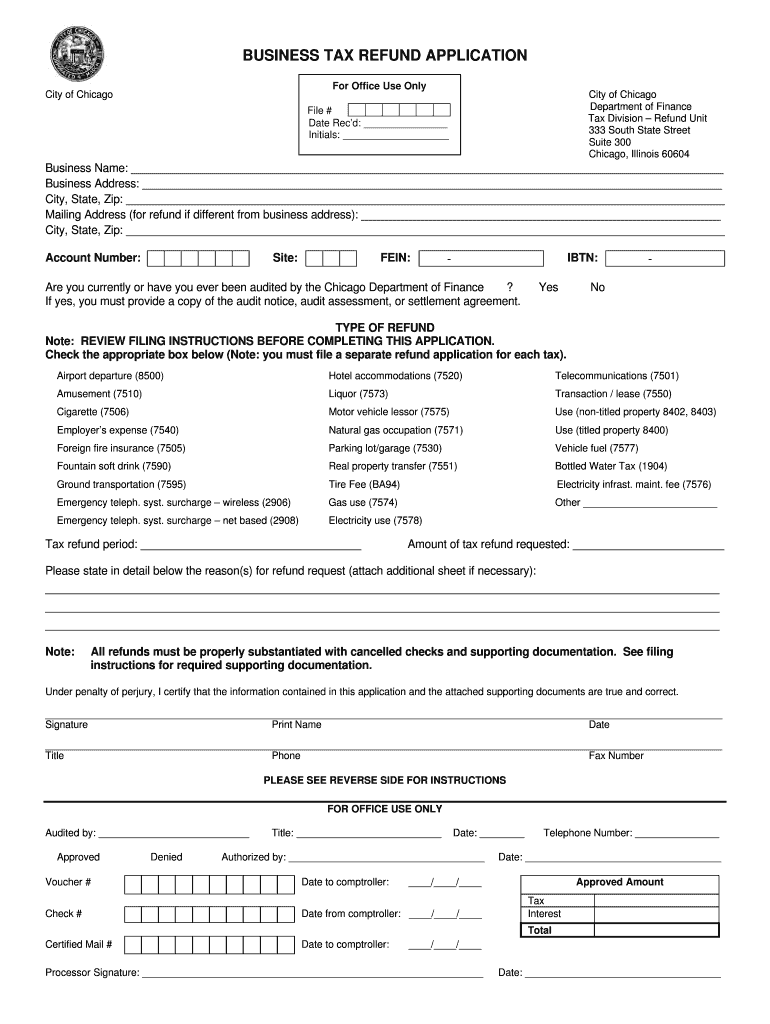

BUSINESS TAX REFUND APPLICATION Illinois Department of Tax Illinois Form

Understanding the Illinois Property Tax Rebate Form

The Illinois property tax rebate form is designed for residents who wish to claim a rebate on property taxes paid. This form is essential for ensuring that eligible homeowners receive financial relief based on their property tax payments. It is important to understand the specific requirements and eligibility criteria set forth by the Illinois Department of Revenue to successfully complete and submit this form.

Eligibility Criteria for the Property Tax Rebate

To qualify for the Illinois property tax rebate, applicants must meet certain criteria. Generally, homeowners must have paid property taxes on their principal residence and must have a valid Illinois income tax return for the year in which they are applying. Additionally, the property must be located in Illinois, and the applicant must be the owner of the property for which the rebate is being claimed. It is advisable to review the specific eligibility requirements outlined by the Illinois Department of Revenue to ensure compliance.

Steps to Complete the Illinois Property Tax Rebate Form

Completing the Illinois property tax rebate form involves several key steps. First, gather all necessary documentation, including proof of property tax payments and your Illinois income tax return. Next, accurately fill out the form, ensuring that all information is correct and complete. Pay close attention to any specific instructions provided on the form regarding calculations and required signatures. Finally, review the completed form for accuracy before submitting it to the Illinois Department of Revenue.

Required Documents for Submission

When submitting the Illinois property tax rebate form, certain documents are required to support your application. These typically include a copy of your property tax bill, proof of payment, and your most recent Illinois income tax return. It is essential to keep copies of all submitted documents for your records. Failure to provide the necessary documentation may result in delays or denial of your rebate application.

Form Submission Methods

The Illinois property tax rebate form can be submitted through various methods. Applicants have the option to file online through the Illinois Department of Revenue's website, which allows for a quicker processing time. Alternatively, the form can be mailed to the appropriate address provided on the form, or submitted in person at local revenue offices. Each method has its own processing times and requirements, so it is important to choose the one that best fits your needs.

Legal Use of the Property Tax Rebate Form

The Illinois property tax rebate form is legally binding when completed and submitted in accordance with state regulations. It is crucial to ensure that all information is accurate and truthful, as providing false information can lead to penalties or legal repercussions. The form must also be signed and dated by the applicant to validate the submission. Understanding the legal implications of the form can help ensure that applicants are fully compliant with state laws.

Quick guide on how to complete business tax refund application illinois department of tax illinois

Manage BUSINESS TAX REFUND APPLICATION Illinois Department Of Tax Illinois effortlessly on any device

Web-based document handling has gained traction among companies and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the right form and securely save it online. airSlate SignNow provides you with all the tools necessary to generate, modify, and eSign your papers quickly without obstacles. Manage BUSINESS TAX REFUND APPLICATION Illinois Department Of Tax Illinois on any device using the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

How to update and eSign BUSINESS TAX REFUND APPLICATION Illinois Department Of Tax Illinois with ease

- Find BUSINESS TAX REFUND APPLICATION Illinois Department Of Tax Illinois and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Mark important sections of the documents or redact sensitive data with tools that airSlate SignNow provides specifically for that task.

- Create your eSignature through the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form, by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced paperwork, tedious form navigation, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Update and eSign BUSINESS TAX REFUND APPLICATION Illinois Department Of Tax Illinois and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What form does a J1 visa student who worked over the summer need to fill out to get a tax refund from the US government?

You need form 1040NR (or 1040NR-EZ) and form 8843.See Publication 519 (2014), U.S. Tax Guide for Aliens for some help as well as Page on irs.gov. You may have to file a nonresident state tax return as well but that depends on your state.Be careful when using web-based software (such as TurboTax) because not all of them support nonresident forms.

-

Forming an LLC for a web design business in Illinois. What are the taxes that I have to pay?

Hi, keep in mind you do not have to incorporate your LLC in Illinois, there are other states that offer advantages tax wiseBest State to Incorporatethis is what I found though on Illinois taxes for LLC'sIllinois: Taxes on Business IncomeCorporations Are Subject to Corporate Income TaxAll C corporations are required to pay an annual corporate tax of 7 percent on the amount of income that the corporation reports to the IRS. In addition, Illinois assesses a personal property tax replacement income tax based on net income. The rate is 2.5 percent for corporations and 1.5 percent for S corporations and all other business entities, even if they are not corporations.S Corporation Income Is Taxed on Shareholders' ReturnsIf you meet the federal tax law requirements to operate as an S corporation, the IRS allows your business to "pass through" its income to the shareholders. This means that your business will not pay any federal corporate level income tax. However, you'll have to claim your entire share of the business income on your personal federal income tax return even if you did not take any money out of the business.Illinois extends this favorable tax treatment to state corporate income tax liability, but only with respect to the 7 percent corporate income tax. The income your S corporation makes will still be subject to a 1.5 percent personal property replacement tax.Partnership Income Is Passed Through to Partners' ReturnsIf you operate your business as a partnership, you will be subject to a 1.5 percent personal property replacement tax on your partnership's net income.LLC Taxation Is Based Upon Federal ClassificationIllinois law recognizes businesses operating as limited liability companies (LLCs). As an LLC, your business will be treated, for tax purposes, exactly like a partnership. Accordingly, your LLC's net income will be subject to a 1.5 percent personal property replacement tax. However, if you have elected to have the LLC treated as a corporation for federal tax purposes, it will be treated as a corporation by the state of Illinois.

-

Can you pay to have your refund rushed but paid out of your tax return when filling?

Neither the IRS nor, as far as I know, any US state with a state income tax, has any sort of program that allows you to pay extra to have your return processed expeditiously. All returns are processed in the order received (more or less), and the IRS provides no guarantees on when your refund will be issued, if indeed ever.If you pay a tax preparer to prepare your return, the preparer may offer you to pay a fee to receive your refund “faster”. This is what is called a “refund anticipation loan”: the preparer is offering to give you a short-term loan, similar to a payday loan, in exchange for you handing over your tax return to them. They will deduct fees and interest up front.Refund anticipation loans are almost always a bad deal for the consumer; there are often large fees on such loans and the interest rates can exceed 100% APR. This is an abusive form of predatory lending. Many states have laws that attempt to curtail such practices, but preparers violate these laws on a depressingly frequent basis. State Attorneys General and other consumer financial advocates regularly warn consumers against refund anticipation loans. See, for example, Illinois Attorney General - Refund Anticipation Loans:The busy tax season often brings a wide variety of scams aimed at defrauding consumers of their hard-earned tax refunds. Attorney General Madigan is warning consumers to be wary of refund anticipation products that promise a faster refund. Tax preparers pitch a variety of these products – tax refund anticipation loans, checks or debit cards – as a way to receive a tax refund instantly. In reality, they are short-term loans that often saddle consumers with high interest rates and fees that are deducted from their tax refund.It’s Your Refund—Here’s How to Keep More of It!You probably do not need a tax refund loan. If you file your tax return electronically, you can get your refund very quickly—in approximately two to three weeks—without getting a loan. You can find an organization willing to help you prepare and file your taxes for free by calling the Center for Economic Progress at 312-252-0280 or visiting this website for resources near you: http://irs.treasury.gov/freetaxp....You can find IRS policies regarding refund anticipation loans here: Tax Refund Related ProductsMy advice is to simply file the return. If you file early enough, you’ll get your refund faster than you probably expected. It’s not worth the cost and added risk of a refund anticipation loan to get a smaller tax refund a few weeks sooner.

-

What percent of people don't have the intelligence to fill out tax forms?

Recent statistics that I've seen indicate that about 66% of electronically filed returns are filed by paid preparers. This doesn't necessarily mean that these filers don't have the intelligence but it does indicate that they have a level of discomfort and anxiety and prefer the solace of having a paid preparer fill out and transmit the forms. It all depends on the level of complexity of the form. For the young wage earner living at home with his or her parents, who is able to operate a computer and can operate simple tax return software, I would think that 80% should be intelligent enough to fill out tax forms. Especially because the software is designed to prompt and assist (and check the arithmetic).One of America's most respected jurists, Judge Learned Hand, offers a more thoughtful observation on the law of taxation: ‘In my own case the words of such an act as the Income Tax ... merely dance before my eyes in a meaningless procession; cross-reference to cross-reference, exception upon exception—couched in abstract terms that offer no handle to seize hold of—leave in my mind only a confused sense of some vitally important, but successfully concealed, purport, which it is my duty to extract, but which is within my power, if at all, only after the most inordinate expenditure of time. I know that these monsters are the result of fabulous industry and ingenuity, plugging up this hole and casting out that net, against all possible evasion; yet at times I cannot help recalling a saying of William James about certain passages of Hegal [sic]: that they were no doubt written with a passion of rationality; but that one cannot help wondering whether to the reader they have any significance save that the words are strung together with syntactical correctness.’ Ruth Realty Co. v. Horn, 222 Or. 290, 353 P.2d 524, 526 n. 2 (Or. 1960) (citing 57 Yale L.J. 167, 169 (1947)), overruled on other grounds by Parr v. DOR, 276 Or. 113, 553 P.2d 1051 (Or. 1976). The Humorist Dave Barry had this observation "The IRS is working hard to develop a tax form so scary that merely reading it will cause the ordinary taxpayer's brain to explode.” His candidate for the best effort so far is Schedule J Form 1118 "Separate Limitation Loss Allocations and Other Adjustments Necessary to Determine Numerators of Limitations fraction, Year end Recharacterization Balance and Overall Foreign Loss Account Balances"And don’t forget this observation from Albert Einstein “The hardest thing to understand in the world is the income tax. “ So if Al had trouble understanding taxes, I don't see how a mere mortal has any chance.

-

Why is the alternative minimum tax form of 6251 so onerous to fill out?

To make things simpler, ironically.The purpose of the AMT is to ensure that the uber rich pay at least a minimum amount of taxes, but has since morphed into something that hits the upper middle classes*. It does that by having fewer tax brackets, fewer allowed deductions and a higher standard deduction. What you owe is whatever causes you to pay more taxes.However, this needs to be done in addition to the traditional tax calculation. So you need to take your calculations of your various income measures, and put back in various deductions that are disallowed under AMT rules. Or have to be recalculated. It’s a pain.Either someone decided that this was easier than having a completely separate tax form to calculate your AMt tax or someone lobbied to have mor complicated taxes so you’d go to one of the tax places or download tax software.*With the Trump tax changes, AMT affects fewer people.

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

-

How long does it take to get a refund of wrongly withheld Social Security taxes and Medicare taxes from IRS after the filing of form 843?

I have seen it take up to 2 years to get a refund processed, but you can contact the IRS to check on the status. I would not start at the taxpayer advocate office as they will not help you until you have tried the normal IRS channels first. Start with Contact Your Local IRS Office

Create this form in 5 minutes!

How to create an eSignature for the business tax refund application illinois department of tax illinois

How to make an eSignature for your Business Tax Refund Application Illinois Department Of Tax Illinois online

How to generate an eSignature for your Business Tax Refund Application Illinois Department Of Tax Illinois in Chrome

How to generate an electronic signature for signing the Business Tax Refund Application Illinois Department Of Tax Illinois in Gmail

How to generate an electronic signature for the Business Tax Refund Application Illinois Department Of Tax Illinois right from your smart phone

How to generate an eSignature for the Business Tax Refund Application Illinois Department Of Tax Illinois on iOS

How to make an eSignature for the Business Tax Refund Application Illinois Department Of Tax Illinois on Android OS

People also ask

-

What is the BUSINESS TAX REFUND APPLICATION Illinois Department Of Tax Illinois?

The BUSINESS TAX REFUND APPLICATION Illinois Department Of Tax Illinois is a form that allows eligible businesses in Illinois to apply for refunds on overpaid taxes. This application is essential for business owners looking to reclaim funds and optimize their tax positions. Utilizing this application can lead to signNow financial relief for your business.

-

How can airSlate SignNow assist with the BUSINESS TAX REFUND APPLICATION Illinois Department Of Tax Illinois?

airSlate SignNow streamlines the process of completing the BUSINESS TAX REFUND APPLICATION Illinois Department Of Tax Illinois by allowing users to eSign documents securely and efficiently. Our platform simplifies document management, ensuring that you can focus on your business while we handle the paperwork. With our intuitive interface, submitting your application becomes a hassle-free experience.

-

Is there a cost associated with using airSlate SignNow for the BUSINESS TAX REFUND APPLICATION Illinois Department Of Tax Illinois?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including those filing the BUSINESS TAX REFUND APPLICATION Illinois Department Of Tax Illinois. Our plans are designed to be cost-effective, providing excellent value for the features we offer. You can choose a plan that fits your budget while benefiting from our powerful eSigning capabilities.

-

What features does airSlate SignNow offer for managing the BUSINESS TAX REFUND APPLICATION Illinois Department Of Tax Illinois?

airSlate SignNow includes features such as customizable templates, secure electronic signatures, and document tracking, all of which enhance the process of managing the BUSINESS TAX REFUND APPLICATION Illinois Department Of Tax Illinois. These features ensure that your application is completed accurately and submitted on time. Additionally, our platform is user-friendly, making it accessible for businesses of all sizes.

-

How secure is the airSlate SignNow platform for submitting the BUSINESS TAX REFUND APPLICATION Illinois Department Of Tax Illinois?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption and complies with industry standards to protect your sensitive information during the submission of the BUSINESS TAX REFUND APPLICATION Illinois Department Of Tax Illinois. You can trust that your data is secure while using our eSigning services.

-

Can I integrate airSlate SignNow with other software for the BUSINESS TAX REFUND APPLICATION Illinois Department Of Tax Illinois?

Absolutely! airSlate SignNow offers seamless integrations with various third-party applications, enhancing your workflow for the BUSINESS TAX REFUND APPLICATION Illinois Department Of Tax Illinois. By integrating with tools you already use, you can streamline the process and improve efficiency in managing your tax refund application.

-

What benefits does eSigning provide for the BUSINESS TAX REFUND APPLICATION Illinois Department Of Tax Illinois?

eSigning through airSlate SignNow offers numerous benefits for the BUSINESS TAX REFUND APPLICATION Illinois Department Of Tax Illinois, including faster processing times and reduced paperwork. It eliminates the need for printing, signing, and scanning documents, saving you time and resources. This digital approach ensures that your application is submitted promptly and efficiently.

Get more for BUSINESS TAX REFUND APPLICATION Illinois Department Of Tax Illinois

Find out other BUSINESS TAX REFUND APPLICATION Illinois Department Of Tax Illinois

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free