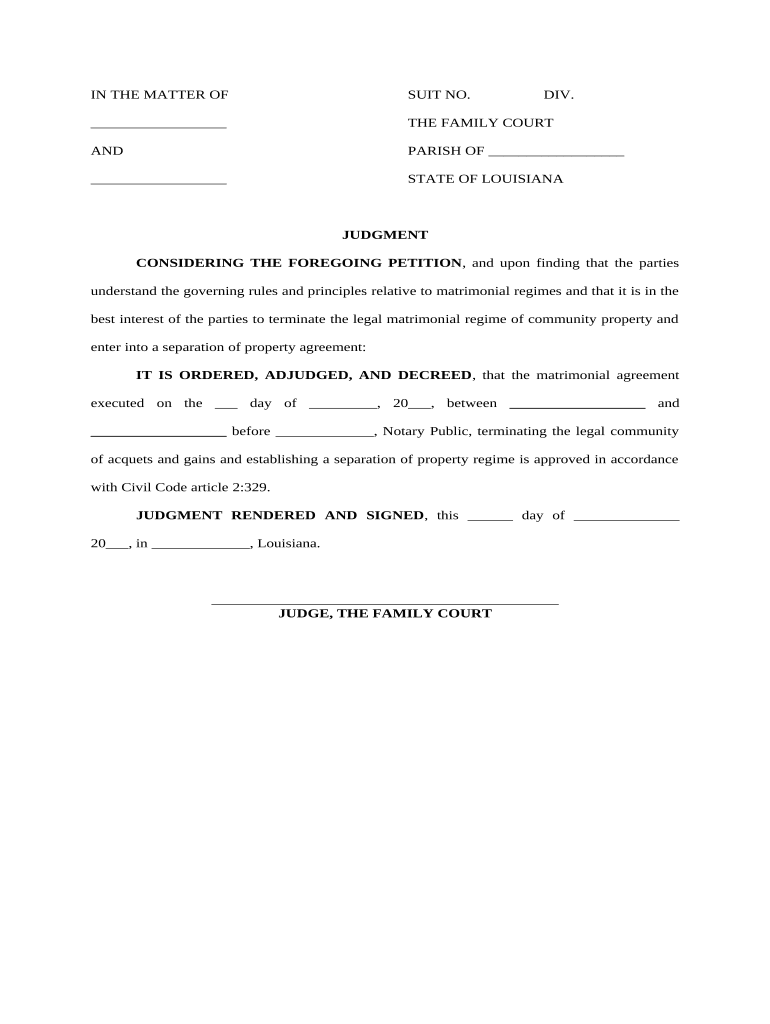

Separation Property Regime Form

What is the separation property regime?

The separation property regime is a legal framework that governs the ownership of property between spouses during and after a marriage. Under this regime, each spouse retains individual ownership of their respective assets, which may include real estate, personal property, and financial accounts. This approach contrasts with community property laws, where assets acquired during the marriage are jointly owned. Understanding the separation property regime is essential for couples to navigate their financial responsibilities and rights in the event of a divorce or separation.

How to use the separation property regime

Utilizing the separation property regime involves clearly defining and documenting the ownership of assets before or during marriage. Couples can create a prenuptial or postnuptial agreement that outlines the terms of property ownership and division. This agreement should specify which assets are considered separate and how they will be managed. Proper documentation is crucial to ensure that each spouse's rights are protected and to avoid disputes in the future.

Steps to complete the separation property regime

To effectively implement the separation property regime, couples should follow these steps:

- Identify all assets owned individually and jointly.

- Draft a prenuptial or postnuptial agreement that outlines the separation of property.

- Consult with a legal professional to ensure compliance with state laws.

- Sign the agreement in the presence of witnesses or a notary public.

- Keep copies of the agreement in a safe place for future reference.

Key elements of the separation property regime

Several key elements define the separation property regime, including:

- Individual Ownership: Each spouse maintains ownership of their assets acquired before and during the marriage.

- Documentation: Clear records of ownership and agreements are essential for legal protection.

- Legal Compliance: The regime must adhere to state-specific laws governing property rights.

- Flexibility: Couples can modify agreements as circumstances change, ensuring ongoing relevance.

Legal use of the separation property regime

The legal use of the separation property regime allows spouses to protect their individual assets from claims by the other spouse in the event of divorce or separation. It is particularly beneficial for individuals with substantial pre-marital assets or those entering second marriages. Courts generally uphold prenuptial and postnuptial agreements as long as they are fair, voluntary, and properly executed. It is advisable to seek legal counsel to ensure that the agreement is enforceable and compliant with local laws.

Examples of using the separation property regime

Here are a few scenarios illustrating the application of the separation property regime:

- A couple enters into a prenuptial agreement before marriage, specifying that all assets acquired prior to the marriage will remain separate property.

- A spouse inherits a family home during the marriage, and the agreement states that the home will remain the sole property of the inheriting spouse.

- In a divorce, a couple refers to their prenuptial agreement to determine that certain investments made by one spouse are not subject to division.

Quick guide on how to complete separation property regime 497309447

Effortlessly prepare Separation Property Regime on any device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage Separation Property Regime on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The simplest way to modify and eSign Separation Property Regime with ease

- Locate Separation Property Regime and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Generate your eSignature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Alter and eSign Separation Property Regime and guarantee effective communication at every phase of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a separation property regime?

A separation property regime is a legal framework that allows spouses to maintain ownership of their individual assets during marriage. This regime is particularly important for couples who wish to manage their finances independently. With airSlate SignNow, you can easily create and sign documents related to your separation property regime.

-

How can airSlate SignNow help with the separation property regime?

airSlate SignNow simplifies the process of drafting, sending, and eSigning documents associated with the separation property regime. Whether you need agreements or disclosures, our platform enables a seamless flow of communication between parties. This ensures that all documents are securely stored and easily accessible.

-

Is there a cost associated with using airSlate SignNow for separation property regime documents?

Yes, airSlate SignNow offers various pricing plans tailored to fit your needs. Our cost-effective solution allows users to choose a plan that best serves their requirements for managing documents related to the separation property regime. We also offer a free trial to explore our features.

-

What features does airSlate SignNow offer for managing separation property regimes?

airSlate SignNow provides a range of features ideal for managing separation property regimes, including customizable templates, real-time notifications, and a user-friendly interface. You can easily track the status of your documents and receive updates when they are viewed or signed, ensuring smooth communication.

-

Can I integrate airSlate SignNow with other applications for my separation property regime?

Absolutely! airSlate SignNow supports integration with various applications that businesses commonly use, enhancing the management of your separation property regime. This seamless integration allows you to streamline workflows and improve efficiency by connecting with tools like CRM systems and cloud storage.

-

What are the benefits of using airSlate SignNow for separation property regime documentation?

Using airSlate SignNow for separation property regime documentation brings multiple benefits, including time savings, enhanced security, and reduced paper usage. Our platform allows for easy tracking and management of documents, ensuring that all parties involved remain informed throughout the process.

-

Is airSlate SignNow secure for managing sensitive separation property regime documents?

Yes, airSlate SignNow prioritizes the security of your documents, including those related to the separation property regime. We use advanced encryption methods and secure storage solutions to protect your sensitive information, giving you peace of mind when handling legal agreements.

Get more for Separation Property Regime

Find out other Separation Property Regime

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer