Massachusetts Dissolution Form

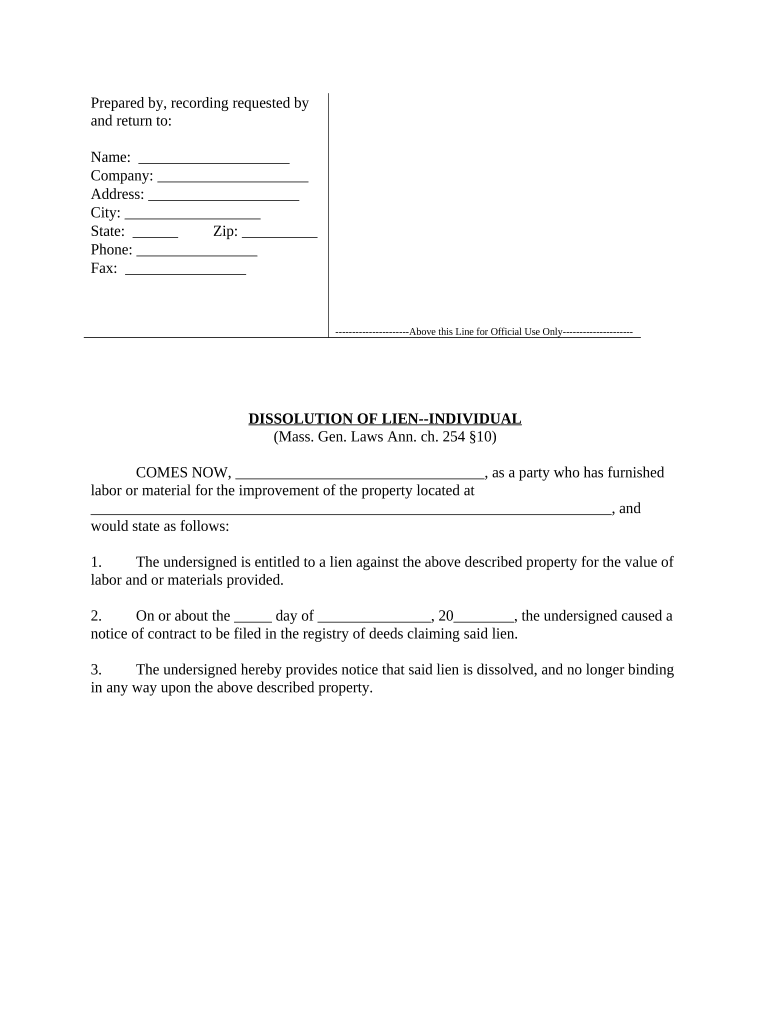

What is the Massachusetts Dissolution Form

The Massachusetts dissolution form is a legal document used by businesses to formally dissolve their entity in the state of Massachusetts. This form is essential for ensuring that all legal obligations are met before a business ceases operations. By filing this form, a business can prevent ongoing tax liabilities and legal complications that may arise from remaining active in the state registry. The dissolution process signifies the end of a business's legal existence and must be completed in accordance with Massachusetts state laws.

How to use the Massachusetts Dissolution Form

To use the Massachusetts dissolution form, businesses must first gather all necessary information, including the business name, the date of dissolution, and any outstanding obligations. Once completed, the form must be submitted to the Massachusetts Secretary of the Commonwealth. It is important to ensure that all required signatures are included, and any necessary fees are paid. After submission, businesses should retain a copy of the filed form for their records, as this serves as proof of dissolution.

Steps to complete the Massachusetts Dissolution Form

Completing the Massachusetts dissolution form involves several key steps:

- Gather required information, including the business name and address.

- Indicate the reason for dissolution, if applicable.

- Provide details regarding the distribution of assets, if necessary.

- Obtain signatures from all required parties, such as business owners or board members.

- Submit the completed form to the Massachusetts Secretary of the Commonwealth, along with any applicable fees.

Following these steps helps ensure a smooth dissolution process and compliance with state regulations.

Legal use of the Massachusetts Dissolution Form

The legal use of the Massachusetts dissolution form is crucial for businesses wishing to formally end their operations. Filing this form ensures that the business is officially recognized as dissolved, which protects owners from future liabilities and obligations. It also provides a clear record of the dissolution for tax and legal purposes. Compliance with state laws during this process is essential to avoid penalties or complications that may arise from improper dissolution.

Required Documents

When filing the Massachusetts dissolution form, certain documents may be required to support the application. These can include:

- The completed dissolution form itself.

- Any necessary financial statements or records related to the business's assets and liabilities.

- Proof of payment for any outstanding taxes or fees.

- Documentation of any required approvals from business partners or board members.

Having these documents ready can streamline the filing process and ensure compliance with legal requirements.

Who Issues the Form

The Massachusetts dissolution form is issued by the Massachusetts Secretary of the Commonwealth. This office oversees the registration and dissolution of business entities within the state. Businesses can obtain the form directly from the Secretary's office or through their official website, where it is made available for download. It is important for businesses to use the most current version of the form to ensure compliance with any changes in state regulations.

Quick guide on how to complete massachusetts dissolution form

Effortlessly Prepare Massachusetts Dissolution Form on Any Device

Digital document management has gained traction among businesses and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the essential tools to quickly create, edit, and eSign your documents without any hold-ups. Manage Massachusetts Dissolution Form on any platform with the airSlate SignNow apps for Android or iOS and elevate any document-related task today.

Edit and eSign Massachusetts Dissolution Form with Ease

- Find Massachusetts Dissolution Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information using specific tools offered by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which only takes a few seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to finalize your changes.

- Select your preferred method for sending your form—via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Massachusetts Dissolution Form to ensure exceptional communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a ma lien form and how can it benefit my business?

A ma lien form is a document used in certain contractual agreements, specifically in real estate transactions. Using airSlate SignNow to manage your ma lien forms can help streamline the signing process, reduce paperwork, and ensure compliance with legal requirements. It empowers businesses to eSign documents effortlessly, thus saving time and enhancing efficiency.

-

How much does it cost to use airSlate SignNow for ma lien forms?

The pricing for airSlate SignNow varies based on the plan selected, but it’s designed to be affordable for businesses of all sizes. You can choose a plan that fits your needs, whether you require basic eSigning features or advanced document management capabilities for ma lien forms. A clear pricing strategy ensures that you get the best value for your money.

-

Can I integrate other software with airSlate SignNow when using ma lien forms?

Yes, airSlate SignNow offers integrations with various software applications, making it easy to incorporate ma lien forms into your existing workflows. Whether you use CRM systems, document storage services, or project management tools, you can connect them seamlessly with SignNow. This enhances your overall operational efficiency and productivity.

-

How secure is the signing process for ma lien forms with airSlate SignNow?

Security is a top priority at airSlate SignNow. When you use the platform to eSign ma lien forms, your documents are protected with advanced encryption methods and secure cloud storage. This ensures that your sensitive information remains confidential and complies with industry standards.

-

What features does airSlate SignNow offer for managing ma lien forms?

AirSlate SignNow provides several features for managing ma lien forms, including customizable templates, real-time tracking of document status, and reminders for signers. The platform’s intuitive interface simplifies the process, making it easier to create, manage, and send your ma lien forms for eSignature.

-

Can multiple people sign a ma lien form using airSlate SignNow?

Absolutely! airSlate SignNow allows multiple signers to co-sign ma lien forms efficiently. You can assign roles to each signer, set the signing order, and track who has completed signing, making complex transactions easier to manage and finalize.

-

How do I create a ma lien form using airSlate SignNow?

Creating a ma lien form with airSlate SignNow is simple. Start by selecting a template or uploading your document, then fill in the necessary fields and add signers. The platform allows you to customize the form as needed before sending it out for signatures.

Get more for Massachusetts Dissolution Form

Find out other Massachusetts Dissolution Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors