Bsp Kids Account Opening Form

What is the BSP Bank Account Application Form?

The BSP bank account application form is a crucial document used to initiate the process of opening a new bank account with BSP. This form collects essential information from the applicant, including personal identification details, contact information, and financial background. It serves as the foundation for the bank to assess the applicant's eligibility for account types, such as personal or business accounts.

Steps to Complete the BSP Bank Account Application Form

Filling out the BSP bank account application form involves several key steps to ensure accuracy and compliance. Begin by gathering necessary documents, such as identification and proof of address. Next, carefully fill out the form, ensuring all required fields are completed. Double-check the information for any errors before submitting the form. Finally, sign and date the application to validate your submission.

Required Documents for the BSP Bank Account Application Form

To successfully complete the BSP bank account application form, applicants must provide specific documents. Typically required documents include:

- Government-issued identification (e.g., driver's license, passport)

- Social Security number or Tax Identification Number

- Proof of residence (e.g., utility bill, lease agreement)

- Initial deposit amount, if applicable

Having these documents ready will facilitate a smoother application process.

Legal Use of the BSP Bank Account Application Form

The BSP bank account application form must be completed in accordance with legal requirements to ensure its validity. This includes providing accurate personal information and adhering to banking regulations. Misrepresentation or incomplete information can lead to denial of the application or legal repercussions. Understanding the legal implications of the information provided is essential for a successful application.

Form Submission Methods for the BSP Bank Account Application Form

Applicants can submit the BSP bank account application form through various methods, depending on their preference and the bank's policies. Common submission methods include:

- Online submission via the bank's secure website

- Mailing the completed form to the designated bank address

- In-person submission at a local bank branch

Choosing the appropriate submission method can impact the processing time of the application.

Eligibility Criteria for the BSP Bank Account Application Form

Eligibility criteria for the BSP bank account application form vary based on the type of account being opened. Generally, applicants must meet the following requirements:

- Be at least eighteen years old for personal accounts

- Provide valid identification and proof of residency

- Meet any minimum deposit requirements set by the bank

Understanding these criteria is vital for ensuring a successful application process.

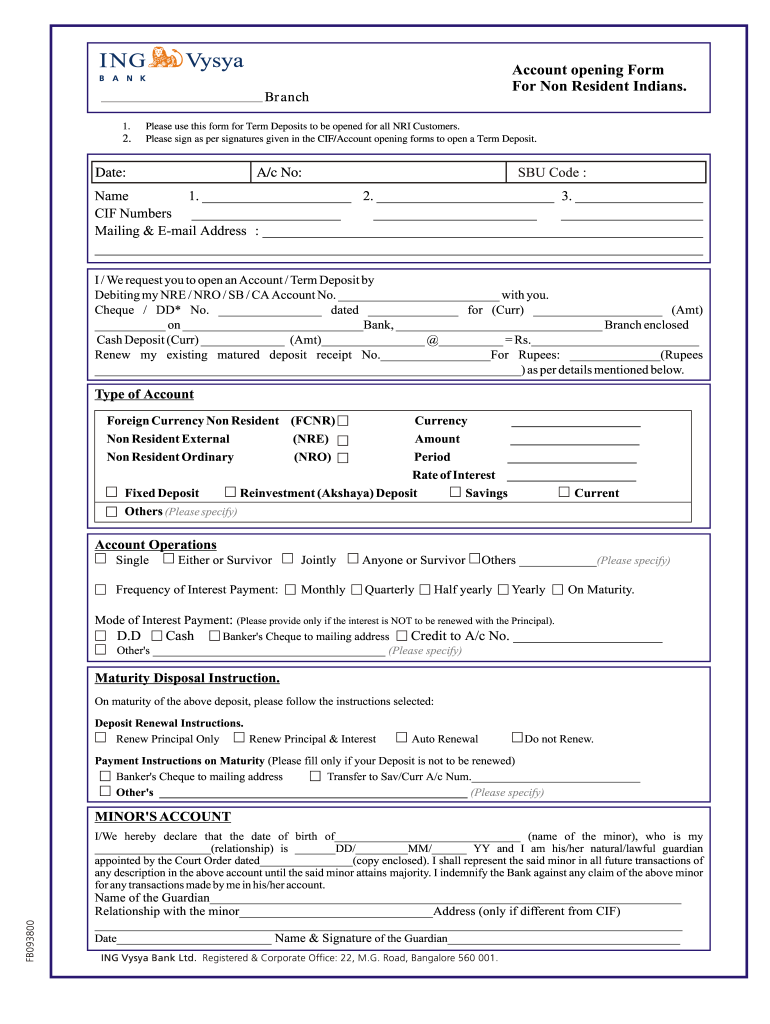

Quick guide on how to complete account opening form for non resident indians ing vysya bank

The optimal method to obtain and sign Bsp Kids Account Opening Form

Across your entire organization, ineffective workflows concerning document authorization can consume a signNow amount of working hours. Signing documents such as Bsp Kids Account Opening Form is a standard aspect of operations in every sector, which is why the effectiveness of each agreement’s lifecycle is critical to the overall productivity of the company. With airSlate SignNow, signing your Bsp Kids Account Opening Form can be incredibly simple and rapid. You will discover with this platform the most recent version of nearly any form. Even better, you can sign it instantly without having to install external applications on your device or printing anything as physical copies.

Steps to acquire and sign your Bsp Kids Account Opening Form

- Browse our collection by category or use the search tool to locate the form you need.

- Examine the form preview by clicking Learn more to ensure it matches your requirements.

- Click Get form to start editing immediately.

- Fill out your form and include any necessary information using the toolbar.

- Upon completion, click the Sign tool to endorse your Bsp Kids Account Opening Form.

- Select the signature option that suits you best: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to finish editing and proceed to document-sharing options as needed.

With airSlate SignNow, you have everything required to manage your documents efficiently. You can locate, complete, edit, and even distribute your Bsp Kids Account Opening Form within a single tab without any difficulties. Optimize your workflows by utilizing a unified, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

Which are the best banks for NRIs to open a Non-Resident Indian bank account?

GO FOR AN NRI-ONLY BRANCH of State Bank of India. Each major city has one of those dedicated NRI branches. They provide much better service than regular SBI. And SBI forex rates are the best. Other than that, all major banks, private and public offer similar basic Nri services in types of accounts and on line functions.Another option is foreign banks like HSBC or CITI : they give you good dedicated service, you can open premier NRI accts with them but they don't give good forex rates and their fixed deposit interest rates are lower too.

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

How do I fill out the Andhra Bank account opening form?

Follow the step by step process for filling up the Andhra Bank account opening form.Download Account Opening FormIf you don't want to read the article, watch this video tutorial or continue the post:Andhra Bank Account Opening Minimum Balance:The minimum amount required for opening Savings Account in Andhra Bank isRs. 150Andhra Bank Account Opening Required Documents:Two latest passport size photographsProof of identity - Passport, Driving license, Voter’s ID card, etc.Proof of address - Passport, Driving license, Voter’s ID card, etc. If temporary address and permanent address are different, then both addresses will have to submitted.PAN cardForm 16 (only if PAN card is not available)See More Acceptable Documents for Account OpeningNow Finally let's move to filling your Andhra Bank Account Opening Form:Step 1:Step 2:Read More…

-

How do I fill out the Allahabad Bank account opening form?

Follow the step by step process for filling up the Allahabad Bank account opening form.Download Account Opening FormIf you don't want to read the article, watch this video tutorial or continue the post:Allahabad Bank Account Opening Minimum Balance:The minimum amount required to open a savings account is as follows: The minimum balance to open an account in rural and sub-urban branches isRs.500The minimum balance to open an account in all other branches isRs.1,000For issue of cheque book, an additional Rs.100 is to be paid in rural and sub-urban branches.Allahabad Bank Account Opening Required Documents:Two latest passport size photographsProof of identity - Passport, Driving license, Voter’s ID card, etc.Proof of address - Passport, Driving license, Voter’s ID card, etc. If temporary address and permanent address are different, then both addresses will have to submitted.PAN cardForm 16 (only if PAN card is not available)Step 1:Continue Reading…

-

How do you open a bank account in the UK for a non-resident?

You ask about how to open a UK bank account as a non-resident, but you don’t say whether you’re asking about a personal or a business bank account. You can open a personal UK bank account as a non-resident, but normally you’ll be asked for proof of ID and residential address in the UK. Alternatively, you could open a sterling account in your country of residence.It is practically essential to have a UK residential address for a personal bank account, or proof of incorporation in the UK and a registered office address in order to open a business bank account. The documentation required to open a bank account of any sort these days is quite strictly enforced as banks must follow the Know your Customer (KYC) legislation to combat money laundering and terrorism. This means that the source of the money and the owner of the money should readily link up without the need for forensics. However, even if you can’t meet the normal requirements for opening a bank account in the UK, you may still be able to open what’s known as a basic bank account, which a number of banks offer.To open a personal UK bank account you need something to verify your current address and your identity:For ID, your passport will do, and any national ID card may help as well;For proof of ID and proof of address, a UK driving license (if applicable);For proof of address at least two documents no more than three months’ old showing your name and address, e.g. a utility bill and council tax bill, in your name, and sent to your residential address will suffice.If you are about to start a job with an employer in the UK and have the right to work in the UK, and your employer has already provided you with a contract of employment or pay slip with the place you are currently staying on it, you may be able to use that. Alternatively, the notification of your tax code, HMRC P2 PAYE Coding Notice, is usually accepted as proof of address alongside a passport and another form of ID.Should you be looking to open a business bank account, then the rules are slightly different. If you are an overseas owner of a UK-registered company, three UK banks offer account services to international clients: Lloyds, Barclays, and HSBC. Each of these banks has slightly different rules, e.g. for Lloyds at least one director must reside in the UK, whereas for HSBC and Barclays this isn’t so; at Barclays you must place on deposit £25,000 after the first month of opening the account.To open a business bank account you’ll need to provide ID and proof of incorporation in the UK.For Lloyds: proof of at least one director’s UK address;Passport and names and addresses of directors;UK driving license (if applicable);Proof of UK registered company: registered office address; certificate of incorporation; memorandum of association; share certificate.We can help you set up a business and open a bank account, we’ve helped hundreds of non-UK residents do the same and then nurtured them and their businesses.

-

In the United States, how can a non-US citizen/non-resident set up a bank account online?

First of all it depends whether you are looking for a business check in account or Individual account?Being one of the most compliant country, USA too has KYC ( know your customer)/ AML ( Anti Money laundering) law. And to follow that physical presence of account holder is must. You need to be physically present in front of bank official to complete required formalities.Even just being physically present is also not guaranteed to have a confirmed bank account as it also requires certain KYC documents and professional reference to have this done smoothly.We at OCP has helped numerous customers to have this done.“OCP” Overseas Corporate Professional is a multinational organization which is serving for last 18 years in India.“OCP” team is lead by global professionals who makes doing overseas business a reality. They provide solutions to all requirements which arise while doing business. It helps client to run his business smoothly without any worries.They help clients to not only setting up a business overseas but also to ensure to provide support at all business levels.‘Overseas Corporate Professional (“OCP”)’ , an organization specialized in leading business solutions, such as Company formation, Tax Registration and compliance, Banking and Merchant services, E commerce business, Business consulting, Accounting & Taxes, Short & Long term financing, Business acquisition, Employment & Payroll processing, Business web presence overseas etc.For more information you may visit on www.ocpbiz.com, or email at info@uscorporatesolution.com

Create this form in 5 minutes!

How to create an eSignature for the account opening form for non resident indians ing vysya bank

How to generate an electronic signature for your Account Opening Form For Non Resident Indians Ing Vysya Bank in the online mode

How to make an eSignature for your Account Opening Form For Non Resident Indians Ing Vysya Bank in Google Chrome

How to create an eSignature for putting it on the Account Opening Form For Non Resident Indians Ing Vysya Bank in Gmail

How to generate an eSignature for the Account Opening Form For Non Resident Indians Ing Vysya Bank from your smart phone

How to make an eSignature for the Account Opening Form For Non Resident Indians Ing Vysya Bank on iOS

How to create an electronic signature for the Account Opening Form For Non Resident Indians Ing Vysya Bank on Android devices

People also ask

-

What is a BSP deposit slip?

A BSP deposit slip is a document used to facilitate deposits into a Bank of the Philippine Islands (BSP) account. With airSlate SignNow, you can easily create, send, and eSign a BSP deposit slip, streamlining your banking process and ensuring accuracy.

-

How can airSlate SignNow help me with BSP deposit slips?

airSlate SignNow simplifies the creation and signing of BSP deposit slips. By using our platform, you can generate custom deposit slips, collect signatures electronically, and store them securely, making the process efficient and hassle-free.

-

Are there any costs associated with using airSlate SignNow for BSP deposit slips?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our pricing is competitive and designed to provide a cost-effective solution for managing BSP deposit slips and other document workflows efficiently.

-

What features does airSlate SignNow offer for BSP deposit slip management?

airSlate SignNow provides features such as customizable templates, electronic signing, document tracking, and secure storage for your BSP deposit slips. These functionalities help streamline your financial processes while ensuring compliance and security.

-

Can I integrate airSlate SignNow with other applications for managing BSP deposit slips?

Yes, airSlate SignNow offers seamless integrations with various applications such as CRM systems, payment platforms, and cloud storage services. This enhances the management of BSP deposit slips by linking different tools in your workflow.

-

What are the benefits of using airSlate SignNow for BSP deposit slips over traditional methods?

Using airSlate SignNow for your BSP deposit slips presents several benefits, including increased efficiency, reduced paperwork, and faster processing times. Additionally, electronic signatures enhance security and provide a more eco-friendly approach to document handling.

-

Is the electronic signature on a BSP deposit slip legally binding?

Yes, the electronic signature provided through airSlate SignNow is legally binding and compliant with international e-signature laws. This means your BSP deposit slips signed electronically are valid and enforceable, ensuring your transactions are secure.

Get more for Bsp Kids Account Opening Form

Find out other Bsp Kids Account Opening Form

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online