Garnishment Wages Form

Understanding Garnishment of Property Other Than Wages

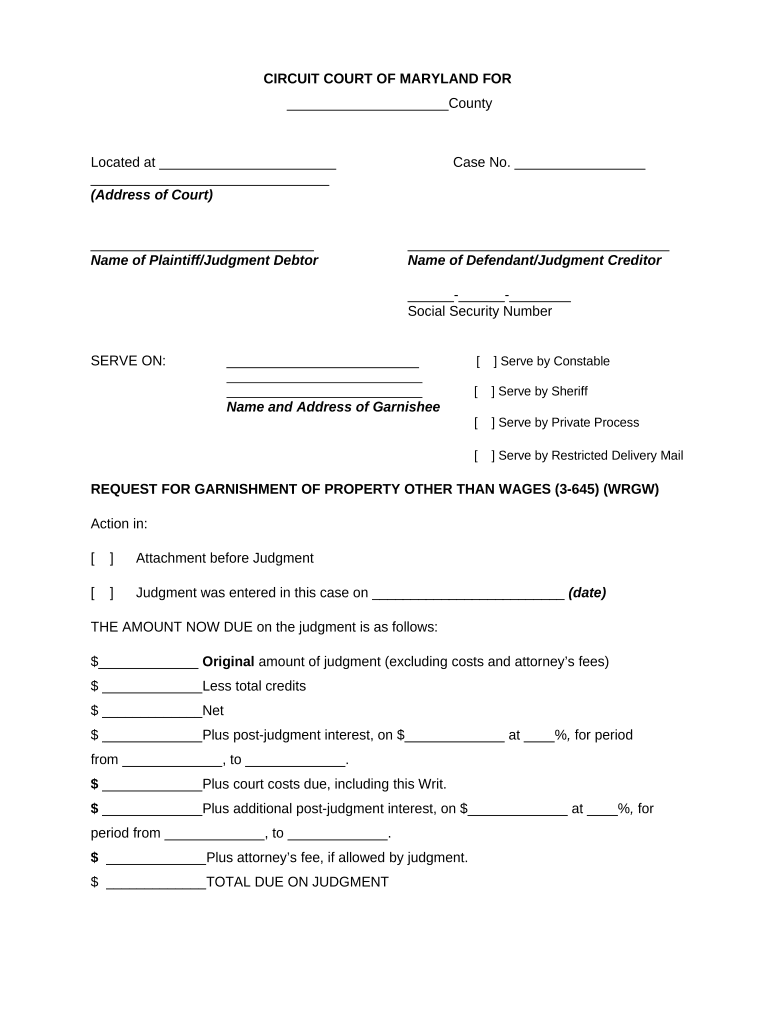

Garnishment of property other than wages refers to a legal process where a creditor can claim a debtor's non-wage assets to satisfy a debt. This can include various types of property, such as bank accounts, real estate, or personal property. The process typically begins with a court order, which allows the creditor to seize the specified assets. Understanding the legal framework surrounding this type of garnishment is essential for both creditors and debtors to ensure compliance with state laws.

Steps to Complete the Garnishment Process

Completing the garnishment process involves several key steps. First, the creditor must file a request for garnishment with the appropriate court, detailing the debt and the property to be garnished. Once the court issues a writ of garnishment, the creditor must serve this writ to the third party holding the debtor's property, such as a bank. The third party is then required to freeze the debtor's assets and notify them of the garnishment. Finally, a hearing may be scheduled to determine the validity of the garnishment and any objections raised by the debtor.

Legal Use of Garnishment of Property

The legal use of garnishment of property other than wages is governed by federal and state laws. Creditors must adhere to specific regulations, including providing proper notice to debtors and following court procedures. Failure to comply with these legal requirements can result in penalties for the creditor. Additionally, certain types of property may be exempt from garnishment under state law, such as essential household items or a portion of retirement accounts. Understanding these legal parameters is crucial for ensuring that garnishment actions are valid and enforceable.

Required Documents for Garnishment

To initiate a garnishment of property other than wages, several key documents are typically required. These include:

- A completed garnishment request form, detailing the debt and property involved.

- A copy of the court order or judgment that establishes the debt.

- Any supporting documentation that verifies the creditor's claim, such as contracts or invoices.

Having these documents prepared and organized can streamline the garnishment process and help avoid delays.

State-Specific Rules for Garnishment

Each state has its own rules and regulations regarding the garnishment of property other than wages. These rules can dictate the types of property that can be garnished, the exemptions available to debtors, and the procedures creditors must follow. It is important for both creditors and debtors to familiarize themselves with their state's specific laws to ensure compliance and understand their rights and obligations during the garnishment process.

Examples of Garnishment of Property Other Than Wages

Examples of property that may be subject to garnishment include:

- Bank accounts, where funds can be frozen and withdrawn to satisfy a debt.

- Real estate, which may be subject to liens or forced sale under certain conditions.

- Personal property, such as vehicles or valuable collectibles, which can be seized and sold.

Understanding these examples can help both creditors and debtors navigate the garnishment process more effectively.

Quick guide on how to complete garnishment wages

Complete Garnishment Wages effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly, without delays. Manage Garnishment Wages on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Garnishment Wages with ease

- Locate Garnishment Wages and click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight pertinent sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method to deliver your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to missing or lost documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Garnishment Wages and ensure effective communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is garnishment property other than wages?

Garnishment property other than wages refers to the legal process where a creditor can claim an individual’s property, assets, or money that is not derived from salary or wages. This can include bank accounts, real estate, or other forms of income. Understanding this concept is crucial when utilizing platforms like airSlate SignNow to manage related documents effectively.

-

How can airSlate SignNow assist with garnishment property other than wages?

airSlate SignNow provides an easy-to-use platform for businesses to eSign and send necessary documents related to garnishment property other than wages. Users can streamline the preparation of legal documents, making it simpler to comply with garnishment laws while ensuring all parties have documented consent.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to suit different business needs, ensuring cost-effectiveness for managing documents related to garnishment property other than wages. Each plan includes features that enhance collaboration and compliance, enabling businesses to choose the right fit for their operations.

-

Does airSlate SignNow integrate with other software?

Yes, airSlate SignNow integrates seamlessly with numerous software and applications, which is beneficial for businesses handling garnishment property other than wages. These integrations allow for more efficient workflows and help businesses manage all related documents within their existing systems.

-

What security features does airSlate SignNow offer?

To protect sensitive information related to garnishment property other than wages, airSlate SignNow implements robust security features, including encryption and audit trails. This ensures that all documents are secure and that users can verify the authenticity of signatures, which is vital in legal matters.

-

Can airSlate SignNow expedite the process of handling garnishment documents?

Absolutely! airSlate SignNow can signNowly expedite the process of preparing and signing garnishment documents by automating many tasks. This efficiency not only speeds up business operations but also helps maintain compliance with legal requirements surrounding garnishment property other than wages.

-

Is airSlate SignNow user-friendly for those unfamiliar with eSigning?

Yes, airSlate SignNow is designed with user experience in mind, making it exceptionally user-friendly for those unfamiliar with eSigning. The intuitive interface allows users to easily navigate through the process of signing and sending important documents, including those related to garnishment property other than wages.

Get more for Garnishment Wages

Find out other Garnishment Wages

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure

- Electronic signature Maryland Rental agreement lease Myself

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms

- Can I Electronic signature New Mexico Rental lease agreement forms

- How Can I Electronic signature Minnesota Rental lease agreement

- Electronic signature Arkansas Rental lease agreement template Computer

- Can I Electronic signature Mississippi Rental lease agreement

- Can I Electronic signature Missouri Rental lease contract

- Electronic signature New Jersey Rental lease agreement template Free

- Electronic signature New Jersey Rental lease agreement template Secure

- Electronic signature Vermont Rental lease agreement Mobile

- Electronic signature Maine Residential lease agreement Online

- Electronic signature Minnesota Residential lease agreement Easy

- Electronic signature Wyoming Rental lease agreement template Simple

- Electronic signature Rhode Island Residential lease agreement Online

- Electronic signature Florida Rental property lease agreement Free

- Can I Electronic signature Mississippi Rental property lease agreement