Bank Account Reactivation Letter Sample Form

What is the bank account reactivation letter sample?

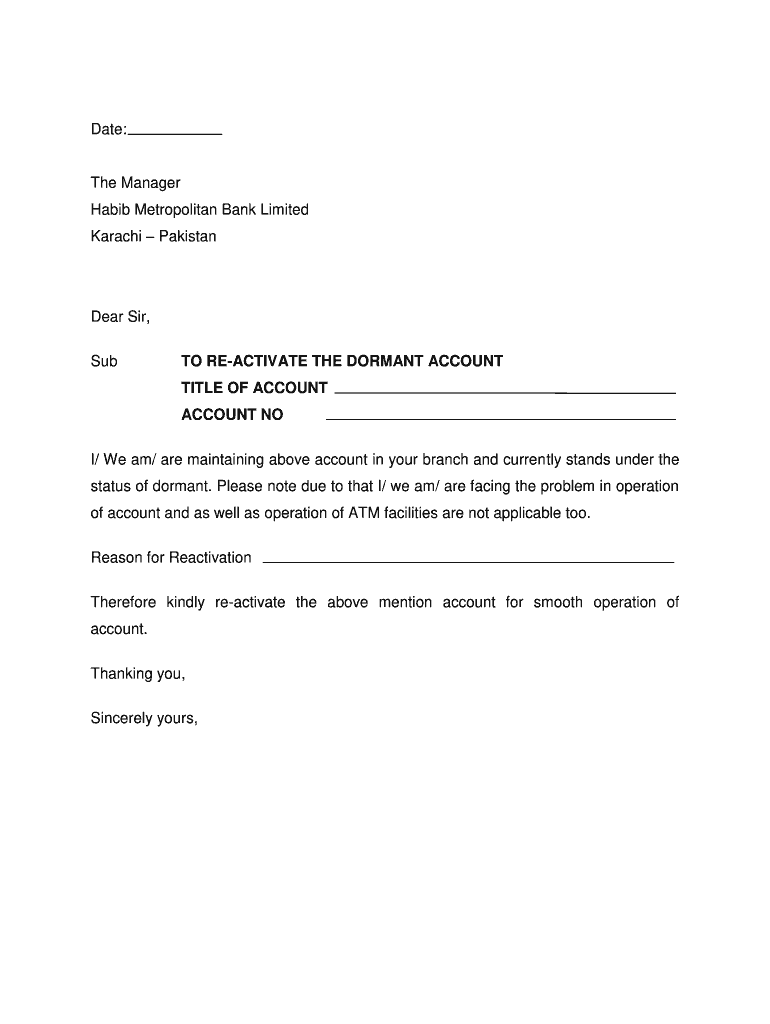

A bank account reactivation letter is a formal document that individuals or businesses use to request the reactivation of a dormant or inactive bank account. This type of letter typically includes essential information such as the account holder's name, account number, and a clear statement requesting the reactivation. It may also outline the reasons for the inactivity and any actions the account holder intends to take to ensure the account remains active moving forward. Using a sample can help ensure all necessary details are included and presented in a professional manner.

Steps to complete the bank account reactivation letter sample

Completing a bank account reactivation letter involves several straightforward steps:

- Gather necessary information: Collect your bank account details, including the account number and any identification required by the bank.

- Draft the letter: Start with your contact information, followed by the bank's address. Clearly state your request to reactivate the account.

- Include identification: Attach copies of identification or documents that verify your identity and ownership of the account.

- Review and edit: Ensure the letter is clear, concise, and free of errors before sending it.

- Submit the letter: Send the letter via the preferred method outlined by your bank, whether by mail, email, or through an online portal.

Key elements of the bank account reactivation letter sample

When creating a bank account reactivation letter, it is crucial to include specific key elements to ensure clarity and effectiveness:

- Account holder's details: Full name, address, and contact information.

- Account information: The account number and type of account (e.g., checking or savings).

- Request statement: A clear request for reactivation, including any relevant dates of inactivity.

- Reason for inactivity: A brief explanation of why the account has been inactive, if applicable.

- Signature: A handwritten signature to authenticate the request.

Legal use of the bank account reactivation letter sample

The bank account reactivation letter serves as a legal document that requests the bank to reactivate an account. To ensure its legal validity, the letter must adhere to specific guidelines:

- Compliance with bank policies: Each bank may have its own requirements for reactivation requests, so it is important to follow those closely.

- Proper identification: Include identification documents as required by the bank to verify ownership and identity.

- Retention of records: Keep a copy of the letter and any correspondence with the bank for your records.

How to use the bank account reactivation letter sample

Using a bank account reactivation letter sample can simplify the process of drafting your request. Here’s how to effectively utilize a sample:

- Choose a reliable sample: Select a sample that aligns with your bank's requirements and includes all necessary elements.

- Personalize the content: Replace placeholder information with your specific details, ensuring the letter reflects your situation accurately.

- Follow formatting guidelines: Maintain a professional tone and format, including proper salutations and closings.

- Double-check for accuracy: Review the completed letter for any errors or omissions before submission.

Examples of using the bank account reactivation letter sample

Examples of bank account reactivation letters can provide valuable insights into how to structure your request. Here are a few scenarios:

- Individual account holder: A person who has not used their personal checking account for an extended period may write a letter requesting reactivation.

- Business account: A business owner may need to reactivate a company bank account that has been inactive due to a lack of transactions.

- Joint account holders: In cases of joint accounts, both parties may need to sign the letter to reactivate the account.

Quick guide on how to complete how to write a letter to bank manager to reopen my account form

The optimal method to obtain and sign Bank Account Reactivation Letter Sample

At the scale of your whole organization, ineffective procedures regarding paper approvals can consume a signNow amount of working hours. Signing documents like Bank Account Reactivation Letter Sample is an inherent part of operations in any company, which is why the effectiveness of each agreement’s lifecycle impacts the organization’s overall performance so heavily. With airSlate SignNow, executing your Bank Account Reactivation Letter Sample is as straightforward and quick as it can be. You will find on this platform the most current version of virtually any form. Even better, you can sign it instantly without the need for external software on your device or printing any hard copies.

Steps to obtain and sign your Bank Account Reactivation Letter Sample

- Explore our collection by category or use the search option to find the document you require.

- Examine the form preview by clicking Learn more to ensure it’s the correct one.

- Click Get form to begin editing immediately.

- Fill out your form and input any necessary information using the toolbar.

- When finished, click the Sign tool to finalize your Bank Account Reactivation Letter Sample.

- Select the signature method that is most suitable for you: Draw, Create initials, or upload a photo of your handwritten signature.

- Click Done to finish editing and proceed to document-sharing options as required.

With airSlate SignNow, you have everything needed to manage your documents efficiently. You can find, complete, edit, and even send your Bank Account Reactivation Letter Sample in a single tab with ease. Enhance your processes by utilizing a unified, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How do I write a letter to the bank manager to activate my bank account?

Although there is a prescribed format available in the branch. All informations are there , you just have to mention reason for not operating and request for reactivation with your signature.Otherwise on a blank paper write letter likeTOThe Chief/Senior/Branch Manager(that bank’s name)(that bank’s branch name)(Location)(Date)Subject:- about reactivation of my account number (your account number)Sir/MadamThis is to inform you that my account number (mention account number) in your branch is in DORMANT state.Do the needful in reactivation of the same.Thanking you.Your trulySIGNATURENameAccount numbercustomer Id____So give this letter along with passbook and a kyc document i.e. SELF ATTESTED xerox of AADHAAR CARD.(Kindly carry original with it also)

-

How do I write a letter to a bank manager for my hold account for reactivation?

In order to be the most helpful…I would suggest calling the bank manager or sending an email to find out if there is a form or certain information that is required by him to reactivate the account. Usually, there is a form or specific account info required to address such an issue.A formal letter (which could be sent) will likely be a waste of your time since you will likely not include all the information required.Once you have HIS requirements, THEN you can send or drop off a letter. It may not have to be formal at all…just addressing the specific account info and your desire to reactivate.

-

How do I write a letter to a bank manager to transfer my due loan amount to my account?

See the manager

-

How do I write a letter for a bank manager to convert my general account to my savings account?

There is no such thing as a “General Account” in banks. There are types like savings, current, fixed deposit, recurring deposit, overdraft, etc. Nothing as such as general account. So your question is unclear for a perfect answer.In any case, you can always write a letter in a A4 size white paper by hand or typing, requesting the same, with your signature, and submit it to your branch manager.

-

How do I write a letter to a bank manager to return my money in an account?

First call the bank tell the problems and ask concerned officer for their mail address.Try to use formal mail instead of letter. Use formal words. Give complete details about the causes you lost money from your bank account including account number, date, reason etc. Keep CC of your mail to higher authority than your mail recipient as far as possible. They will instantly investigate the matter and your account will be credited if it is genuine.

Create this form in 5 minutes!

How to create an eSignature for the how to write a letter to bank manager to reopen my account form

How to generate an eSignature for the How To Write A Letter To Bank Manager To Reopen My Account Form in the online mode

How to create an electronic signature for your How To Write A Letter To Bank Manager To Reopen My Account Form in Google Chrome

How to generate an electronic signature for signing the How To Write A Letter To Bank Manager To Reopen My Account Form in Gmail

How to make an eSignature for the How To Write A Letter To Bank Manager To Reopen My Account Form from your mobile device

How to generate an electronic signature for the How To Write A Letter To Bank Manager To Reopen My Account Form on iOS

How to create an electronic signature for the How To Write A Letter To Bank Manager To Reopen My Account Form on Android

People also ask

-

What is a company bank account reactivation letter sample?

A company bank account reactivation letter sample is a template that businesses can use to formally request the reactivation of a dormant bank account. This sample typically includes key details such as the account number, reason for reactivation, and any necessary authorization. Using a well-structured letter helps streamline the process with the bank.

-

How can I create a company bank account reactivation letter sample?

Creating a company bank account reactivation letter sample involves outlining the necessary information and ensuring clarity. You can use our templates in airSlate SignNow, which offer customizable options to fit your business needs. This tool simplifies the writing and signing process for your reactivation request.

-

Why is a company bank account reactivation letter important?

A company bank account reactivation letter is crucial because it formally documents your request to the bank, ensuring that all legal and procedural requirements are met. By providing the necessary details in your letter, you improve the chances of a successful reactivation. A good sample will guide you in crafting the letter effectively.

-

Does airSlate SignNow offer templates for a company bank account reactivation letter?

Yes, airSlate SignNow provides a variety of templates, including a sample for a company bank account reactivation letter. These templates are designed to help you easily create effective documents that fulfill your business needs. You can customize the sample to suit specific requirements.

-

Can I eSign a company bank account reactivation letter using airSlate SignNow?

Absolutely! With airSlate SignNow, you can eSign your company bank account reactivation letter directly within the platform. This feature not only saves you time but also ensures that your request is securely signed and legally binding, facilitating faster communication with your bank.

-

What are the benefits of using airSlate SignNow for my reactivation letter?

Using airSlate SignNow for your company bank account reactivation letter offers numerous benefits, including ease of use and cost-effectiveness. You can quickly create, customize, and send your letter, ensuring it is delivered promptly. Additionally, the platform enhances document security and tracking.

-

Is there a cost associated with using your company bank account reactivation letter sample?

airSlate SignNow offers competitive pricing plans, giving you access to the company bank account reactivation letter sample and other templates. Depending on your chosen plan, you might also enjoy additional features such as unlimited eSigning and document storage. Check our pricing page for detailed information.

Get more for Bank Account Reactivation Letter Sample

- Arizona alternative dispute resolution statement to the court form

- Az deposit form

- Arizona settlement statement form

- Arizona arizona installments fixed rate promissory note secured by personal property form

- Durable power attorney form az

- Arizona will form

- California form construction

- California hvac contract for contractor form

Find out other Bank Account Reactivation Letter Sample

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal