Owner's Request for Lien Information Corporation or LLC Minnesota

What is the Owner's Request For Lien Information Corporation Or LLC Minnesota

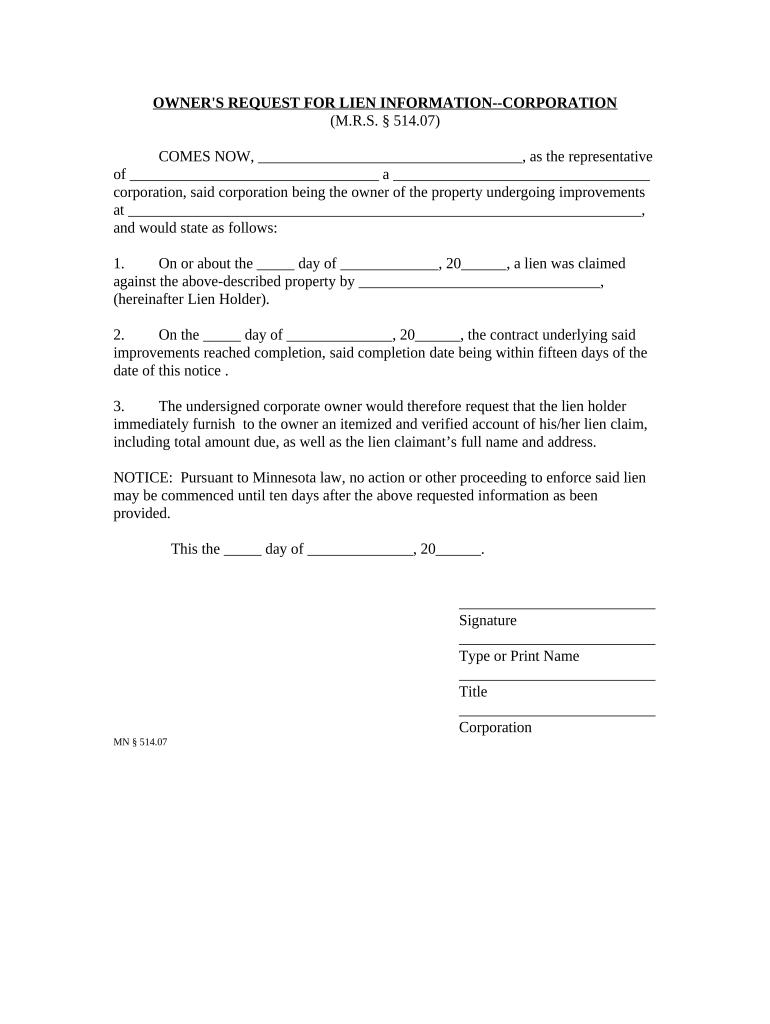

The Owner's Request For Lien Information for a Corporation or LLC in Minnesota is a formal document used by business owners to obtain information about any existing liens against their corporation or limited liability company. This request is essential for maintaining transparency and ensuring that the business is not encumbered by undisclosed financial obligations. It serves as a protective measure for owners, allowing them to understand any potential risks associated with their business assets.

How to use the Owner's Request For Lien Information Corporation Or LLC Minnesota

Using the Owner's Request For Lien Information involves a straightforward process. First, the business owner must complete the request form, providing necessary details such as the corporation or LLC name, registration number, and contact information. Once filled out, the form can be submitted to the appropriate state agency, typically the Secretary of State's office. This submission can often be done online, by mail, or in person, depending on the agency's procedures. After processing, the agency will provide the requested lien information, which can be crucial for financial planning and decision-making.

Steps to complete the Owner's Request For Lien Information Corporation Or LLC Minnesota

Completing the Owner's Request For Lien Information involves several key steps:

- Gather necessary information about your corporation or LLC, including the official name and registration number.

- Access the request form from the Minnesota Secretary of State's website or office.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form through the designated method: online, by mail, or in person.

- Await confirmation from the agency regarding the status of your request.

Key elements of the Owner's Request For Lien Information Corporation Or LLC Minnesota

When completing the Owner's Request For Lien Information, certain key elements must be included to ensure the request is processed efficiently. These elements typically include:

- The legal name of the corporation or LLC.

- The business registration number issued by the state.

- The owner's contact information, including address and phone number.

- A clear statement indicating the purpose of the request.

Legal use of the Owner's Request For Lien Information Corporation Or LLC Minnesota

The legal use of the Owner's Request For Lien Information is grounded in the need for business owners to stay informed about their financial standing. By obtaining lien information, owners can ensure compliance with state regulations and protect their interests. This document can also be used in legal proceedings to demonstrate due diligence in managing the corporation or LLC’s affairs.

State-specific rules for the Owner's Request For Lien Information Corporation Or LLC Minnesota

In Minnesota, specific rules govern the submission and processing of the Owner's Request For Lien Information. These rules include:

- Requests must be submitted to the Minnesota Secretary of State's office.

- There may be a nominal fee associated with the request, depending on the method of submission.

- Response times can vary; owners should check the agency's website for current processing times.

Quick guide on how to complete owners request for lien information corporation or llc minnesota

Complete Owner's Request For Lien Information Corporation Or LLC Minnesota effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to locate the appropriate template and securely save it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and eSign your documents quickly and without delays. Manage Owner's Request For Lien Information Corporation Or LLC Minnesota on any device using airSlate SignNow Android or iOS applications and streamline any document-related procedures today.

The easiest way to alter and eSign Owner's Request For Lien Information Corporation Or LLC Minnesota effortlessly

- Locate Owner's Request For Lien Information Corporation Or LLC Minnesota and click Get Form to begin.

- Use the features we provide to finalize your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, laborious form searches, or errors requiring the printing of new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Owner's Request For Lien Information Corporation Or LLC Minnesota and guarantee outstanding communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Owner's Request For Lien Information for a Corporation or LLC in Minnesota?

An Owner's Request For Lien Information for a Corporation or LLC in Minnesota is a formal document that allows business owners to inquire about any existing liens against their corporation or LLC. This process helps ensure that there are no outstanding debts or claims that could hinder business operations. Utilizing airSlate SignNow simplifies this request process with secure e-signature capabilities.

-

How can airSlate SignNow assist with Owner's Request For Lien Information for my business?

airSlate SignNow streamlines the process of submitting an Owner's Request For Lien Information for your Corporation or LLC in Minnesota. Our platform allows you to easily create, send, and eSign the necessary documents, saving you time and reducing the complexity of handling legal paperwork. You can acknowledge receipt of lien information quickly and efficiently.

-

What features does airSlate SignNow offer for handling lien information requests?

With airSlate SignNow, you’ll benefit from features like customizable templates, secure e-signatures, document tracking, and automated workflows. These features are specifically designed to aid in the completion of an Owner's Request For Lien Information for a Corporation or LLC in Minnesota. Additionally, our solution is user-friendly, making it easier than ever to manage your documents.

-

Is there any pricing information available for airSlate SignNow’s services?

Yes, airSlate SignNow offers flexible pricing plans tailored to different business needs. Whether you are a small business asking for an Owner's Request For Lien Information for a Corporation or LLC in Minnesota or a larger organization, we have plans that can accommodate you. Visit our pricing page for detailed information on each plan.

-

Can I use airSlate SignNow on mobile devices?

Absolutely! airSlate SignNow is fully optimized for mobile use, allowing you to handle your Owner's Request For Lien Information for your Corporation or LLC in Minnesota wherever you are. Our mobile app offers the same robust features found on our desktop platform, ensuring you stay productive on the go.

-

What are the benefits of using airSlate SignNow for lien information requests?

Using airSlate SignNow for your Owner's Request For Lien Information for a Corporation or LLC in Minnesota enhances efficiency and reduces errors in document handling. Our electronic signature process is legally binding, and you can track the status of your requests in real-time. This leads to faster turnaround times and improved compliance.

-

Does airSlate SignNow integrate with other applications?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing your workflow when processing an Owner's Request For Lien Information for a Corporation or LLC in Minnesota. You can connect it with CRM systems, cloud storage services, and more to ensure all your essential tools work together in harmony.

Get more for Owner's Request For Lien Information Corporation Or LLC Minnesota

- C86 form 253685183

- Credit check authorization letter sample 63954 form

- Fccjc physical form

- Resume rubric for high school students form

- Mcs 150 biennial update form

- Transcript request form st matthews university

- Port bahamas scholarships form

- Pa 40 nrc nonresident consolidated income tax return pa 40 nrc formspublications

Find out other Owner's Request For Lien Information Corporation Or LLC Minnesota

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement