Minnesota 514 Form

What is the Minnesota 514

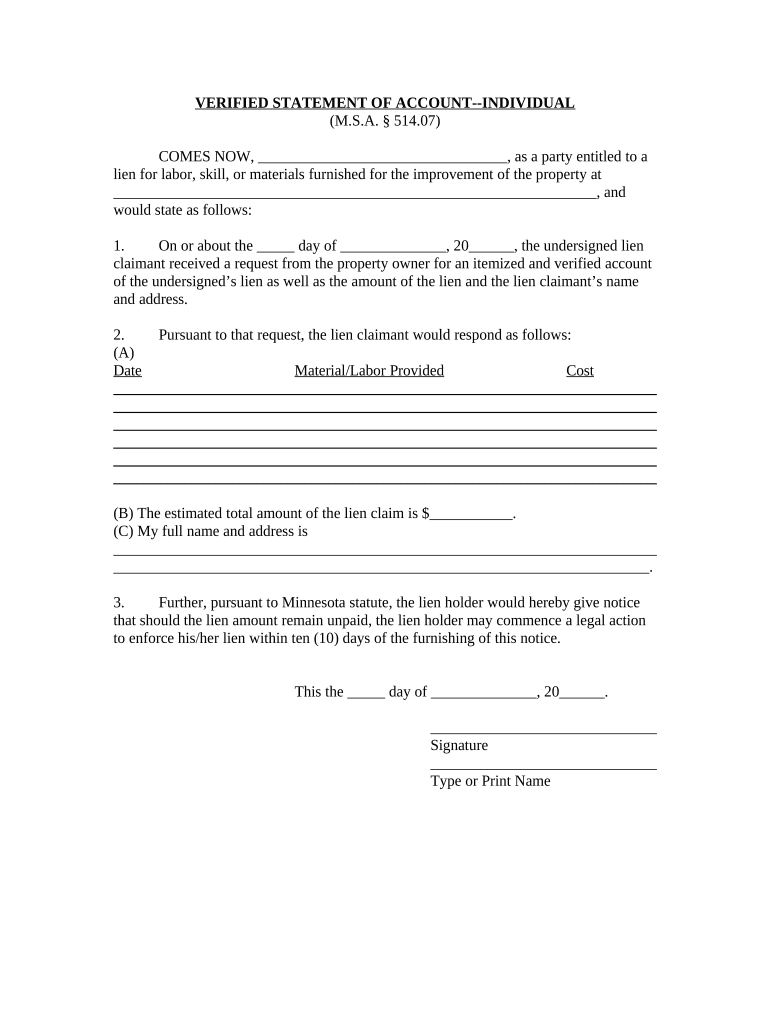

The Minnesota 514 form is a crucial document used for reporting specific tax information in the state of Minnesota. This form is primarily utilized by individuals and businesses to disclose income, deductions, and other pertinent financial details to the Minnesota Department of Revenue. It plays a vital role in ensuring compliance with state tax laws and regulations.

How to use the Minnesota 514

To effectively use the Minnesota 514 form, individuals and businesses must first gather all necessary financial information, including income statements, deductions, and any relevant tax credits. Once the information is compiled, users can fill out the form accurately, ensuring that all entries align with the provided guidelines. The completed form can then be submitted either electronically or via mail, depending on the preferred method of filing.

Steps to complete the Minnesota 514

Completing the Minnesota 514 form involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and other income statements.

- Review the instructions provided with the form to understand the requirements and sections.

- Fill out the form carefully, ensuring that all information is accurate and complete.

- Double-check calculations and ensure all necessary signatures are included.

- Submit the form electronically through the appropriate state portal or mail it to the designated address.

Legal use of the Minnesota 514

The Minnesota 514 form must be completed and submitted in accordance with state tax laws to ensure its legal validity. Compliance with the Minnesota Department of Revenue's guidelines is essential for the form to be accepted. Utilizing electronic signature solutions can enhance the legal standing of the document, as they provide a secure method for signing and submitting forms.

Key elements of the Minnesota 514

Key elements of the Minnesota 514 form include:

- Personal identification information, such as name and Social Security number.

- Details of income sources, including wages, dividends, and other earnings.

- Applicable deductions and credits that can reduce overall tax liability.

- Signature section to validate the authenticity of the submission.

State-specific rules for the Minnesota 514

Each state has unique rules governing the use of tax forms, and the Minnesota 514 is no exception. It is important for users to familiarize themselves with Minnesota-specific regulations, including filing deadlines and eligibility criteria. Adhering to these rules ensures that the form is processed efficiently and accurately by the Minnesota Department of Revenue.

Quick guide on how to complete minnesota 514

Prepare Minnesota 514 effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely keep them online. airSlate SignNow furnishes you with all the tools necessary to create, modify, and electronically sign your documents swiftly without setbacks. Manage Minnesota 514 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

How to modify and eSign Minnesota 514 easily

- Locate Minnesota 514 and then click Get Form to initiate the process.

- Utilize the tools available to fill out your document.

- Emphasize relevant sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or errors that require printing out additional copies. airSlate SignNow satisfies all your document management needs in just a few clicks, accessible from any device you prefer. Edit and eSign Minnesota 514 to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Minnesota 514 and how does it relate to airSlate SignNow?

Minnesota 514 is a key statutory provision regarding electronic signatures in Minnesota. airSlate SignNow fully complies with Minnesota 514, ensuring that your electronic documents are legally binding and secure. This means businesses in Minnesota can confidently use airSlate SignNow for their eSigning needs.

-

What features does airSlate SignNow offer for users in Minnesota?

airSlate SignNow provides users in Minnesota with a range of features including document templates, custom workflows, and real-time tracking. These features streamline the process of sending and signing documents while ensuring compliance with Minnesota 514 legislation. This makes it an ideal solution for businesses seeking efficiency.

-

How does pricing for airSlate SignNow cater to Minnesota businesses?

airSlate SignNow offers flexible pricing plans tailored for Minnesota businesses, ensuring that you get the best value for your eSigning needs. With cost-effective solutions, companies can choose a plan that meets their specific requirements while staying compliant with Minnesota 514. This affordability helps businesses save on costs without compromising on quality.

-

Can airSlate SignNow integrate with other software used by Minnesota businesses?

Yes, airSlate SignNow seamlessly integrates with various software applications commonly used by Minnesota businesses, such as CRM systems, document management tools, and cloud storage. These integrations enhance workflow efficiency and help maintain compliance with Minnesota 514. This makes airSlate SignNow a valuable tool in a modern business environment.

-

What are the benefits of using airSlate SignNow for electronic signatures in Minnesota?

Using airSlate SignNow for electronic signatures in Minnesota offers numerous benefits, including improved speed, easy access to documents, and reduced reliance on paper. By adhering to Minnesota 514, users can trust that their signed documents are legitimate and secure, streamlining their business operations. The platform also enhances overall productivity.

-

How secure is airSlate SignNow for Minnesota businesses?

airSlate SignNow ensures top-notch security for users in Minnesota by employing robust encryption protocols and strict compliance with Minnesota 514. You can trust that your documents and signatures are protected from unauthorized access. This commitment to security gives businesses peace of mind when managing sensitive information.

-

Is airSlate SignNow easy to use for first-time users in Minnesota?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy for first-time users in Minnesota to navigate the platform. The intuitive interface and helpful resources ensure a smooth onboarding experience as you begin leveraging the functionalities that comply with Minnesota 514.

Get more for Minnesota 514

Find out other Minnesota 514

- Sign Mississippi New Hire Onboarding Simple

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy