Mn Llc Company Form

What is the Mn LLC Company

The Mn LLC company refers to a limited liability company registered in Minnesota. This business structure combines the benefits of both a corporation and a partnership. It provides owners, known as members, with personal liability protection while allowing for flexible management and pass-through taxation. This means that profits and losses can be reported on the members' personal tax returns, avoiding double taxation that typically applies to corporations.

Steps to Complete the Mn LLC Company

Completing the Mn LLC company form involves several key steps to ensure proper registration and compliance with state laws. The following steps outline the process:

- Choose a unique name for your LLC that complies with Minnesota's naming requirements.

- Designate a registered agent who will receive legal documents on behalf of the LLC.

- File the Articles of Organization with the Minnesota Secretary of State, which includes essential information about your LLC.

- Draft an operating agreement that outlines the management structure and operating procedures of your LLC.

- Obtain any necessary licenses and permits required for your specific business activities.

Legal Use of the Mn LLC Company

The legal use of the Mn LLC company structure provides various advantages. Members enjoy limited liability, meaning their personal assets are generally protected from business debts and lawsuits. Additionally, the LLC can enter contracts, own property, and conduct business in its name. Compliance with state regulations and proper documentation is crucial to maintain this legal status and protect the members' interests.

Required Documents

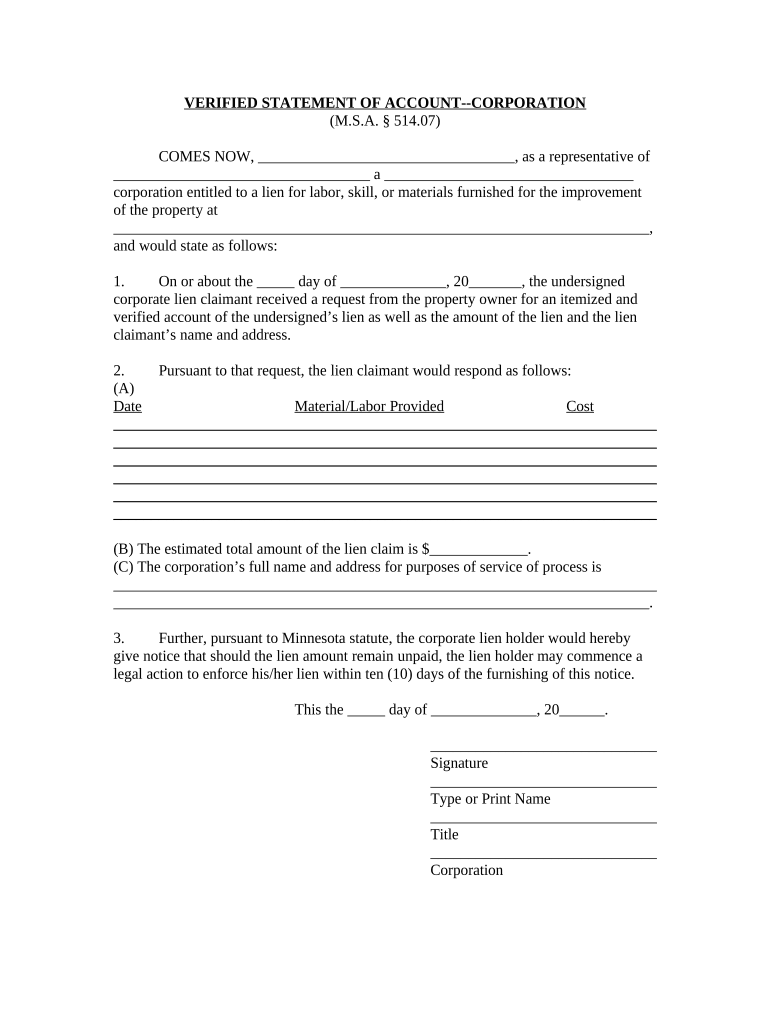

To successfully register a Mn LLC company, several documents are required. These include:

- Articles of Organization: This form officially establishes your LLC and must be filed with the state.

- Operating Agreement: While not mandatory, this document is highly recommended to outline the management and operational guidelines of the LLC.

- Employer Identification Number (EIN): This is necessary for tax purposes and can be obtained from the IRS.

- State-specific licenses and permits: Depending on your business activities, you may need additional documentation to operate legally.

State-Specific Rules for the Mn LLC Company

Each state has its own regulations governing LLCs, and Minnesota is no exception. Some specific rules include:

- The name of the LLC must include "Limited Liability Company" or abbreviations like "LLC" or "L.L.C."

- At least one member must be designated as the registered agent, who must have a physical address in Minnesota.

- Annual renewal is required to keep the LLC in good standing, including filing an annual renewal form with the Secretary of State.

How to Obtain the Mn LLC Company

Obtaining a Mn LLC company involves the process of registration with the Minnesota Secretary of State. This can be done online or by mail. The following steps outline how to obtain your LLC:

- Visit the Minnesota Secretary of State's website to access the online filing system.

- Complete the Articles of Organization form with the required information.

- Pay the filing fee, which can vary based on the method of submission.

- Receive confirmation of your LLC's registration once the application is processed.

Quick guide on how to complete mn llc company

Prepare Mn Llc Company effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can easily locate the appropriate template and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Mn Llc Company on any device with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to edit and electronically sign Mn Llc Company seamlessly

- Obtain Mn Llc Company and click Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Choose how you would like to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that require printing new document copies. airSlate SignNow fulfills all your document management demands in just a few clicks from your device of choice. Edit and electronically sign Mn Llc Company and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an MN LLC company?

An MN LLC company refers to a limited liability company formed in Minnesota. This business structure provides personal liability protection for its owners while allowing flexibility in management and taxation. If you're looking to start an MN LLC company, you can benefit from the available legal protections and operational efficiencies.

-

How much does it cost to create an MN LLC company?

The cost to create an MN LLC company varies depending on several factors like filing fees and necessary licenses. In Minnesota, the filing fee to register your MN LLC company with the Secretary of State is approximately $155 online. Additional costs may include annual renewal fees and any business permits or licenses required for your industry.

-

What are the benefits of forming an MN LLC company?

Forming an MN LLC company provides various benefits such as limited liability protection, flexibility in management, and pass-through taxation. This means your personal assets are generally protected from business debts and lawsuits. Additionally, an MN LLC company is relatively simpler to maintain compared to corporations.

-

What features does airSlate SignNow offer for MN LLC companies?

airSlate SignNow offers features that are highly beneficial for MN LLC companies, such as easy eSigning and document management. You can send, sign, and store important business documents securely and efficiently. This streamlines operations and helps you maintain compliance with legal requirements.

-

Are there integrations available for MN LLC companies using airSlate SignNow?

Yes, airSlate SignNow provides numerous integrations to support MN LLC companies. You can connect it with popular tools like Google Drive, Salesforce, and other applications to enhance your workflow. This capability allows you to streamline document processes and manage your business more effectively.

-

How can airSlate SignNow help with compliance for my MN LLC company?

airSlate SignNow helps ensure compliance for your MN LLC company by providing legally binding electronic signatures and secure document storage. This service maintains audit trails and records that can be crucial during business audits. By using airSlate SignNow, you can effectively manage compliance with local and federal regulations.

-

What documents can an MN LLC company sign using airSlate SignNow?

An MN LLC company can sign a variety of important documents using airSlate SignNow, including contracts, agreements, and tax forms. This platform allows you to prepare, send, and sign documents electronically, saving time and resources. It is particularly useful for any business files that require signatures for legal validity.

Get more for Mn Llc Company

Find out other Mn Llc Company

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast