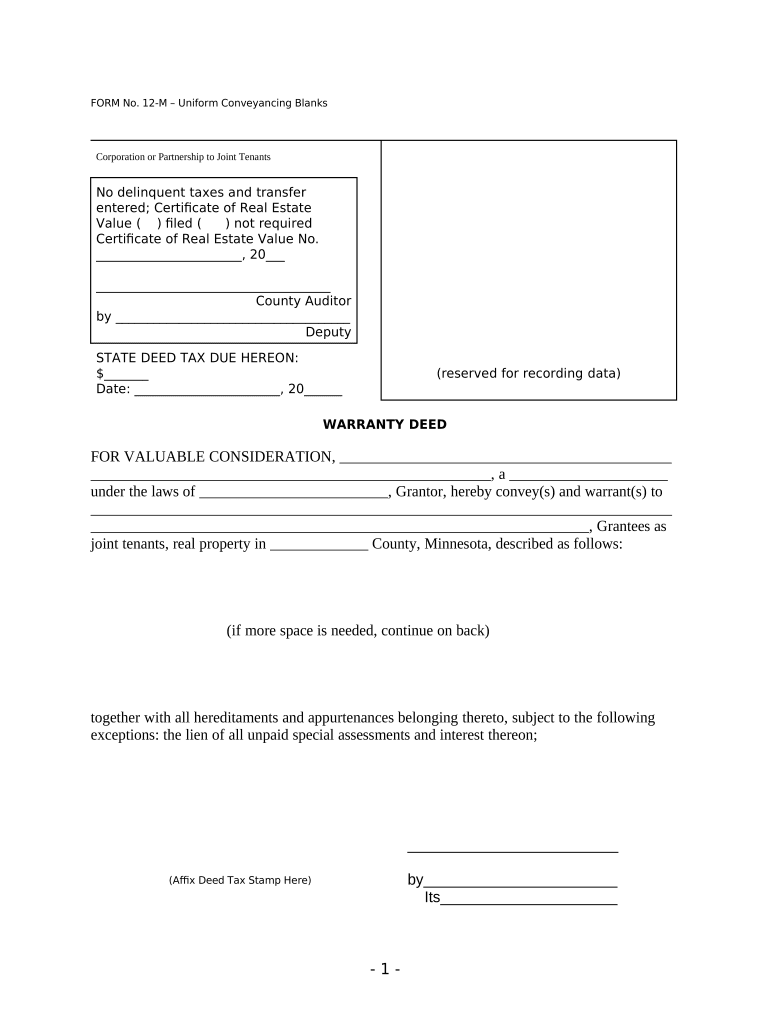

Business Entity Joint Form

What is the Business Entity Joint

The business entity joint refers to a specific legal structure where two or more parties come together to conduct business under a shared entity. This arrangement can take various forms, including partnerships, limited liability companies (LLCs), or corporations. Each participant in a business entity joint typically shares profits, losses, and responsibilities according to the terms outlined in their agreement. Understanding the nature of this entity is crucial for compliance with state laws and for effectively managing the business operations.

How to use the Business Entity Joint

Utilizing a business entity joint requires careful planning and adherence to legal guidelines. Initially, parties must draft a comprehensive agreement that outlines the roles, responsibilities, and profit-sharing mechanisms. This document serves as the foundation for the business relationship. Once established, the joint entity can operate under its name, conduct transactions, and enter into contracts. It is essential to maintain accurate records and comply with state regulations to ensure the entity remains in good standing.

Steps to complete the Business Entity Joint

Completing the formation of a business entity joint involves several key steps:

- Identify the type of business entity that best suits your needs, such as an LLC or partnership.

- Draft a partnership agreement or operating agreement that details the structure and operational guidelines.

- Register the business entity with the appropriate state agency, ensuring compliance with local laws.

- Obtain any necessary licenses or permits required for your specific industry.

- Open a business bank account to manage finances separately from personal accounts.

Legal use of the Business Entity Joint

The legal use of a business entity joint is governed by state laws and regulations. It is essential to ensure that all agreements are legally binding and compliant with relevant statutes. This includes adhering to the terms outlined in the operating agreement and fulfilling any reporting requirements. Additionally, the entity must operate within the scope of its stated purpose to avoid legal complications. Consulting with a legal professional can help clarify obligations and ensure compliance.

Required Documents

To establish a business entity joint, several documents are typically required:

- Partnership agreement or operating agreement

- Articles of incorporation or organization

- Employer Identification Number (EIN) application

- State-specific registration forms

- Any applicable business licenses or permits

State-specific rules for the Business Entity Joint

Each state has its own regulations governing business entity joints. These rules can dictate the formation process, required documentation, and ongoing compliance obligations. It is crucial for business owners to familiarize themselves with their state's specific requirements to ensure proper registration and operation. This may include filing annual reports, maintaining certain records, and adhering to tax obligations. Consulting state resources or legal experts can provide clarity on these regulations.

Quick guide on how to complete business entity joint

Effortlessly prepare Business Entity Joint on any device

Web-based document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and safely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and without holdups. Manage Business Entity Joint on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Business Entity Joint with minimal effort

- Obtain Business Entity Joint and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your updates.

- Select your preferred method to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or mislaid documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management requirements in just a few clicks from any device of your choice. Edit and eSign Business Entity Joint to ensure outstanding communication at any stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a business entity joint?

A business entity joint refers to a collaboration between two or more business units that come together to achieve common goals. This structure can enhance productivity and innovation, allowing businesses to pool resources. Understanding the implications of a business entity joint is essential for optimized operations.

-

How can airSlate SignNow assist with business entity joint agreements?

airSlate SignNow simplifies the process of creating, signing, and managing business entity joint agreements. With our intuitive platform, you can effortlessly send and eSign documents, ensuring that all stakeholders are aligned. This minimizes misunderstandings and streamlines the collaborative process.

-

What features does airSlate SignNow provide for managing a business entity joint?

airSlate SignNow offers various features tailored for business entity joint management, such as document templates, real-time tracking, and automated reminders. These features ensure that all parties stay informed and engaged throughout the collaboration. Additionally, enhanced security measures protect sensitive information.

-

Is there a cost associated with using airSlate SignNow for business entity joint projects?

Yes, there is a pricing structure for using airSlate SignNow, though it is designed to be cost-effective. We offer various plans that cater to different needs, ensuring that businesses, whether small or large, can manage their business entity joint activities without exceeding their budget. You can choose a plan that offers the best value based on your requirements.

-

What benefits does airSlate SignNow provide for a business entity joint?

By leveraging airSlate SignNow for your business entity joint, you can enjoy quick turnaround times and enhanced collaboration. Our platform fosters better communication among all parties involved, which contributes to greater efficiency. Furthermore, the ability to track document status in real-time adds transparency to the joint venture.

-

Can airSlate SignNow integrate with other software for business entity joint management?

Absolutely! airSlate SignNow integrates seamlessly with a variety of third-party applications, enhancing your experience in managing business entity joint efforts. Popular integrations include CRMs, project management tools, and cloud storage solutions. This connectivity enables a smoother workflow and better data management.

-

How secure is airSlate SignNow for handling business entity joint documents?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption protocols and compliance with industry standards to protect all business entity joint documents. You can rest assured that your sensitive information remains confidential and only accessible to the appropriate stakeholders.

Get more for Business Entity Joint

Find out other Business Entity Joint

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement