Minnesota Mortgage Form

What is the Minnesota Mortgage Form

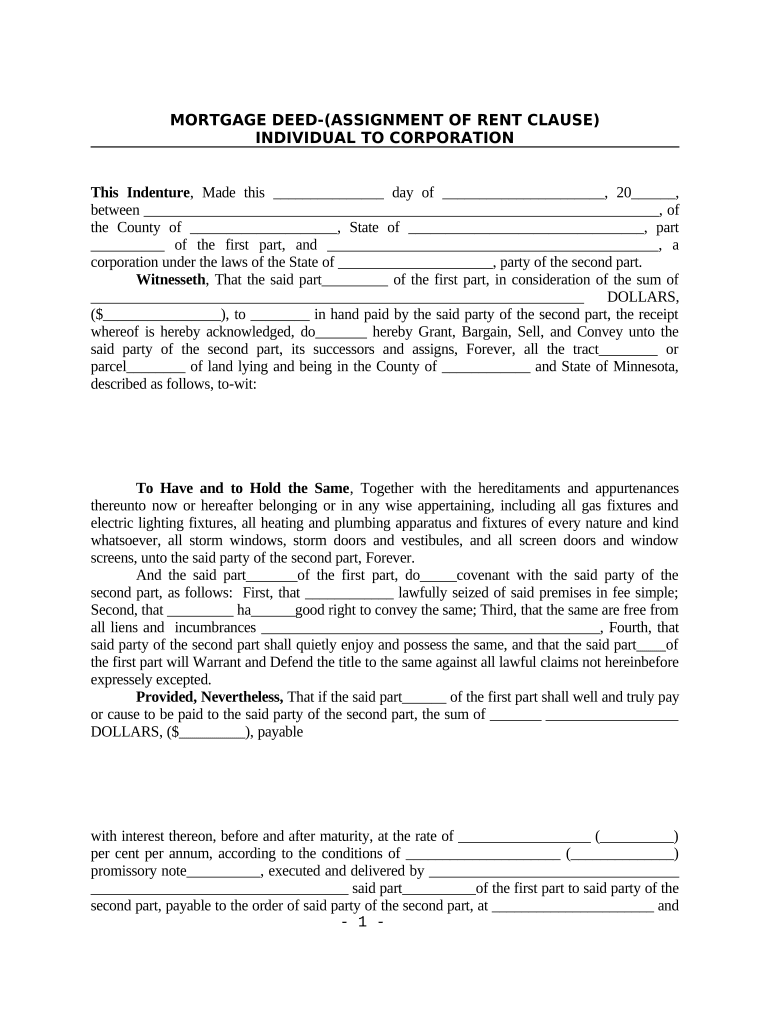

The Minnesota mortgage form is a legal document used in the state of Minnesota to secure a loan against real property. This form outlines the terms of the mortgage agreement between the borrower and the lender, detailing the obligations of both parties. It includes essential information such as the loan amount, interest rate, repayment schedule, and property description. Understanding this form is crucial for anyone looking to finance a home or property in Minnesota, as it serves as the foundation of the mortgage transaction.

How to use the Minnesota Mortgage Form

Using the Minnesota mortgage form involves several steps to ensure that all necessary information is accurately provided. First, gather relevant details about the property and the loan. This includes the legal description of the property, the borrower's personal information, and the lender's details. Next, fill out the form completely, ensuring that all sections are addressed. After completing the form, both the borrower and lender must sign it, either in person or electronically, to validate the agreement. It is advisable to keep a copy of the signed form for personal records.

Steps to complete the Minnesota Mortgage Form

Completing the Minnesota mortgage form requires careful attention to detail. Follow these steps for a smooth process:

- Gather necessary documentation, including proof of income, credit history, and property details.

- Fill in the borrower’s information, including full names and addresses.

- Provide the lender’s information accurately.

- Detail the loan amount, interest rate, and repayment terms.

- Include a legal description of the property being mortgaged.

- Review the form for accuracy and completeness.

- Sign the form in the presence of a notary public, if required.

Legal use of the Minnesota Mortgage Form

The Minnesota mortgage form is legally binding once it is signed by both parties and recorded with the appropriate county office. To ensure legal compliance, the form must meet specific state requirements, including proper notarization and adherence to Minnesota laws governing mortgage agreements. Utilizing a reliable eSignature solution can facilitate the signing process while maintaining compliance with relevant legal frameworks, such as the ESIGN Act and UETA.

Key elements of the Minnesota Mortgage Form

Several key elements are essential to the Minnesota mortgage form. These include:

- Borrower Information: Names and addresses of all parties involved.

- Lender Information: Details of the financial institution providing the loan.

- Loan Amount: The total amount being borrowed.

- Interest Rate: The percentage charged on the borrowed amount.

- Property Description: A detailed legal description of the property being mortgaged.

- Repayment Terms: The schedule and conditions for repayment.

How to obtain the Minnesota Mortgage Form

The Minnesota mortgage form can be obtained through various channels. It is typically available at local county recorder's offices, where you can request a physical copy. Additionally, many online resources provide downloadable versions of the form. It is important to ensure that you are using the most current version of the form to comply with state regulations. Consulting with a legal professional or a mortgage advisor can also provide guidance on obtaining and completing the form correctly.

Quick guide on how to complete minnesota mortgage form

Prepare Minnesota Mortgage Form effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed documents, as you can easily locate the right form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, alter, and eSign your documents promptly without delays. Manage Minnesota Mortgage Form on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The simplest way to edit and eSign Minnesota Mortgage Form without hassle

- Locate Minnesota Mortgage Form and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important parts of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and then click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worries of lost or mislaid documents, tedious form hunting, or errors that require printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from a device of your selection. Edit and eSign Minnesota Mortgage Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Minnesota mortgage form?

A Minnesota mortgage form is a legal document used when a borrower takes out a mortgage to purchase property in Minnesota. This form outlines the terms of the loan, including repayment details and interest rates. Understanding this document is crucial for any homeowner in Minnesota.

-

How can airSlate SignNow help with Minnesota mortgage forms?

airSlate SignNow provides an easy-to-use platform for creating, sending, and eSigning Minnesota mortgage forms. This digital solution streamlines the process, making it simple for lenders and borrowers to manage documents efficiently. With airSlate SignNow, you can ensure that all your mortgage forms are legally compliant and securely processed.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to fit different business needs. Our plans are designed to be cost-effective while providing all essential features you need to manage Minnesota mortgage forms. You can choose a monthly or annual subscription to find a plan that works best for your budget.

-

Are there any features specific to managing Minnesota mortgage forms?

Yes, airSlate SignNow includes features tailored for handling Minnesota mortgage forms. These features include customizable templates, automated workflows, and secure storage. Our platform ensures that every document is easily accessible and compliant with Minnesota regulations.

-

What are the benefits of using airSlate SignNow for mortgage forms?

Using airSlate SignNow for your Minnesota mortgage forms offers numerous benefits, including improved efficiency, reduced paper usage, and enhanced security. Our platform allows you to complete transactions quickly, ensuring that you can focus more on your clients and less on paperwork. Additionally, eSigning is legally binding and recognized in Minnesota, providing peace of mind.

-

Can I integrate airSlate SignNow with other tools?

Absolutely! airSlate SignNow offers seamless integrations with various other tools and platforms, enhancing your ability to manage Minnesota mortgage forms effectively. Whether you use CRM systems, payment processors, or other document management software, airSlate SignNow can fit into your ecosystem effortlessly.

-

Is airSlate SignNow secure for processing Minnesota mortgage forms?

Yes, airSlate SignNow prioritizes security, implementing robust measures to protect your Minnesota mortgage forms. We utilize encryption and secure access protocols to ensure that your sensitive data remains confidential. You can trust our platform to keep your documents safe throughout the signing process.

Get more for Minnesota Mortgage Form

- Pertinent vaccine information statements viss to the childs parentampnbsp odh ohio

- Self represented written answer and verification form

- Annamalai university convocation form

- Misp photosynthesis worksheet answers form

- Raindrop handbook bspiralscoutsb international spiralscouts form

- Dependent care receipt template form

- Attendant id form

- Using cellphones and computers to transmit information readworks answer key pdf

Find out other Minnesota Mortgage Form

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple