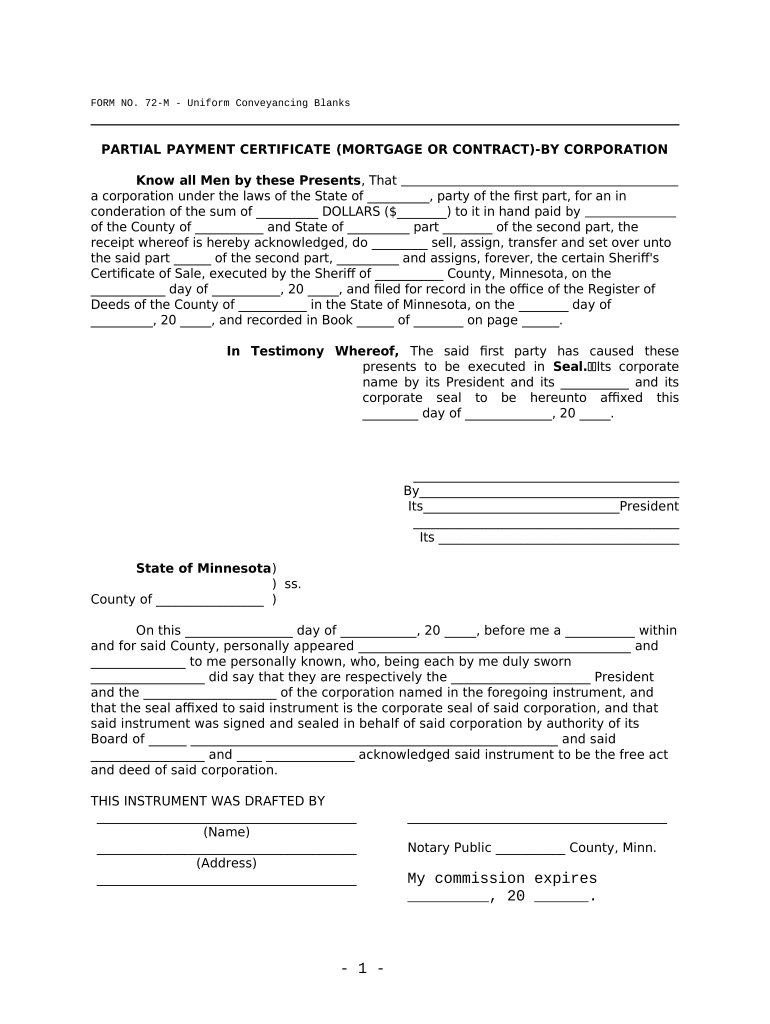

Mn Payment Form

What is the Minnesota Partial Mortgage?

The Minnesota partial mortgage refers to a specific type of mortgage agreement that allows homeowners to make partial payments on their mortgage balance. This arrangement can be beneficial for those who may face temporary financial difficulties but still want to maintain their homeownership. By agreeing to a partial payment, borrowers can avoid default while managing their cash flow more effectively.

Steps to Complete the Minnesota Partial Mortgage

Completing a Minnesota partial mortgage involves several important steps:

- Review your mortgage agreement: Understand the terms and conditions regarding partial payments.

- Contact your lender: Discuss your intention to make partial payments and seek their approval.

- Fill out the necessary forms: Complete any required documentation, such as the partial payment form, ensuring all details are accurate.

- Submit your form: Send the completed form to your lender, either online or by mail, as per their submission guidelines.

- Keep records: Maintain copies of all correspondence and submitted forms for your records.

Legal Use of the Minnesota Partial Mortgage

The legal use of a Minnesota partial mortgage is governed by state laws and the terms set forth in the mortgage contract. It is crucial for borrowers to ensure that their agreement allows for partial payments and to comply with any specific state regulations. This adherence helps protect the borrower's rights and ensures that the lender honors the partial payment arrangement.

Key Elements of the Minnesota Partial Mortgage

Several key elements define a Minnesota partial mortgage:

- Payment terms: The specific amount and frequency of partial payments must be clearly outlined.

- Duration: The period during which partial payments are accepted should be specified.

- Interest implications: Borrowers should understand how partial payments affect interest accrual on the remaining balance.

- Default clauses: Any consequences for failing to meet the agreed-upon payment terms must be detailed.

Required Documents for Minnesota Partial Mortgage

To process a Minnesota partial mortgage, borrowers typically need to provide several documents, including:

- Mortgage agreement: The original contract outlining the mortgage terms.

- Partial payment form: A specific form that requests the lender's approval for partial payments.

- Financial statements: Documentation that demonstrates the borrower's current financial situation.

- Identification: Proof of identity, such as a driver's license or social security number.

Examples of Using the Minnesota Partial Mortgage

Examples of situations where a Minnesota partial mortgage may be applicable include:

- A homeowner facing temporary unemployment who needs to reduce their monthly payments.

- A family experiencing unexpected medical expenses that impact their financial stability.

- A borrower who anticipates a future income increase but requires temporary relief in the present.

Form Submission Methods for Minnesota Partial Mortgage

Borrowers can submit their Minnesota partial mortgage forms through various methods, including:

- Online submission: Many lenders offer secure online portals for submitting forms electronically.

- Mail: Forms can be sent via traditional mail to the lender's designated address.

- In-person: Borrowers may also choose to deliver their forms directly to their lender's office.

Quick guide on how to complete mn payment

Complete Mn Payment effortlessly on any device

Digital document management has become prevalent among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the correct version and securely store it online. airSlate SignNow provides all the features you require to create, modify, and electronically sign your documents swiftly without delays. Manage Mn Payment on any device with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to alter and electronically sign Mn Payment with ease

- Find Mn Payment and then click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize relevant parts of your documents or conceal sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Choose how you wish to send your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Mn Payment and guarantee exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Minnesota partial mortgage?

A Minnesota partial mortgage is a type of mortgage agreement where the borrower takes a loan for a portion of the property's total value, allowing for flexibility in financing. This can be ideal for buyers who want to minimize their initial investment while retaining ownership of the property. Understanding this option is essential for making informed financial decisions.

-

What are the benefits of choosing a Minnesota partial mortgage?

Choosing a Minnesota partial mortgage can provide several advantages, such as lower monthly payments and the ability to invest remaining funds elsewhere. This financing option often requires less upfront capital, making it accessible for a wider range of buyers. Additionally, it allows you to manage your mortgage more effectively as market conditions change.

-

How does pricing work for a Minnesota partial mortgage?

The pricing for a Minnesota partial mortgage typically depends on various factors including the property's value, the amount borrowed, and prevailing interest rates. Borrowers should expect to pay interest only on the portion of the mortgage taken, which can make this option more affordable. Consulting with a mortgage specialist can help determine specific costs associated with your unique situation.

-

What features should I look for in a Minnesota partial mortgage?

When exploring a Minnesota partial mortgage, it's essential to look for features such as flexible payment options, competitive interest rates, and the ability to refinance in the future. Additionally, consider whether the lender offers online account management tools for your convenience. Understanding these features can help you make a more informed choice.

-

How can airSlate SignNow assist me with a Minnesota partial mortgage?

airSlate SignNow can streamline your documentation process when dealing with a Minnesota partial mortgage by allowing you to send and eSign essential documents securely. This solution saves time and reduces paperwork hassles, making the financing process smoother. Our platform is designed to empower users with efficiency and convenience throughout their transaction.

-

What integrations does airSlate SignNow offer for Minnesota partial mortgage processing?

airSlate SignNow integrates with various tools and platforms that can enhance your Minnesota partial mortgage process, including CRM systems and project management software. These integrations make it easier to manage your documents and workflows seamlessly. Leveraging these tools can improve overall efficiency and organization.

-

Are there any risks associated with a Minnesota partial mortgage?

While a Minnesota partial mortgage can be beneficial, potential risks include fluctuations in property value and the possibility of owing more than the property is worth. It's also important to consider the long-term implications of taking a smaller mortgage. Potential borrowers should evaluate their financial situation and market conditions to mitigate these risks.

Get more for Mn Payment

- Perm 61 form

- Nationality form

- Ca workers compensation officer waiver form amtrust financial

- Form certificate of medical necessity for oxygen mc 4602

- Lesson 7 skills practice solve inequalities by multiplication or division answer key form

- Multi count uniform traffic ticket sconet state oh

- Small estate affidavit small estate affidavit to the secretary of the state of illinois form

- Risk assessment templates ampamp formssafetycultureabout risk assessmentus epaabout risk assessmentus epaa complete guide to

Find out other Mn Payment

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document