Asn 4 2014-2026

What is the ASN 4?

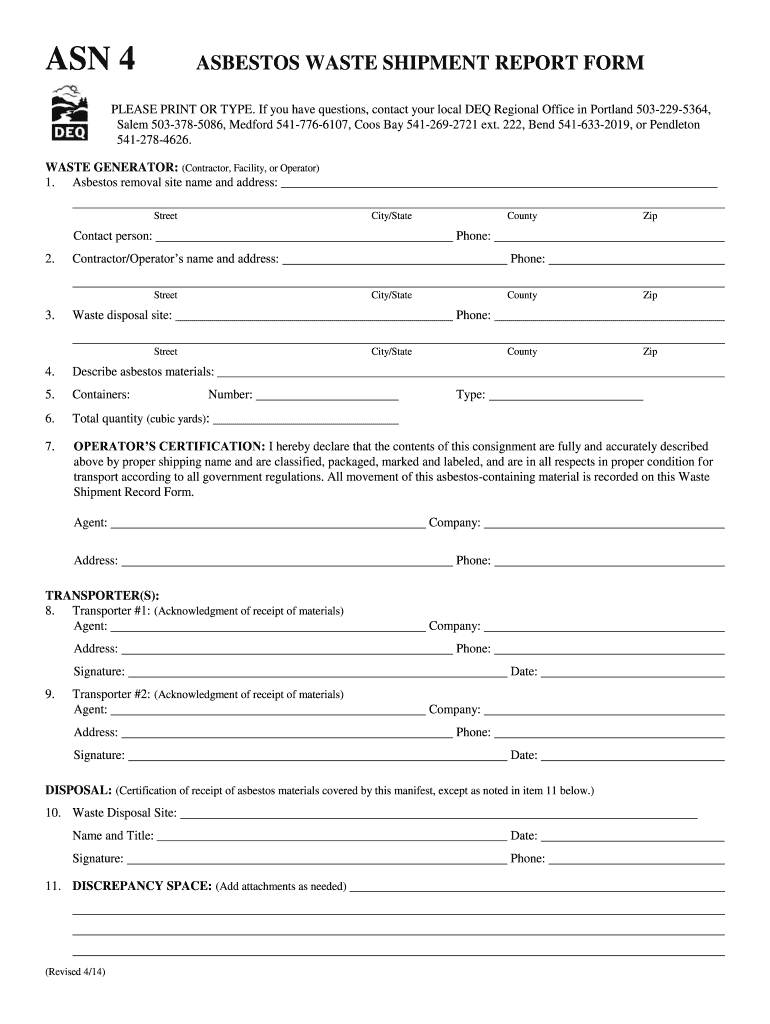

The ASN 4 form, also known as the Asbestos Shipment Notification form, is a crucial document used in the management and transportation of asbestos materials. This form ensures that all parties involved in the handling of asbestos are aware of its presence, thereby promoting safety and compliance with environmental regulations. The ASN 4 is typically required by state and federal agencies to track the movement of asbestos, ensuring that it is handled and disposed of properly to protect public health.

Steps to Complete the ASN 4

Completing the ASN 4 form involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding the asbestos being transported, including the type, quantity, and location of the material. Next, fill out the form with details such as the names and addresses of both the generator and the transporter of the asbestos. Ensure that all signatures are obtained from the relevant parties, as this confirms their acknowledgment of the shipment. Finally, submit the completed form to the appropriate regulatory agency, either electronically or via mail, depending on state requirements.

Legal Use of the ASN 4

The ASN 4 form must be used in accordance with federal and state regulations governing the handling of asbestos. This includes compliance with the Environmental Protection Agency (EPA) guidelines and any specific state laws that may apply. The legal use of the ASN 4 ensures that all parties involved are informed about the risks associated with asbestos and that proper safety measures are in place during transportation. Failure to comply with these regulations can result in significant penalties and legal repercussions.

Key Elements of the ASN 4

Several key elements must be included in the ASN 4 form to ensure its validity. These elements typically include:

- Generator Information: Name, address, and contact details of the entity generating the asbestos.

- Transporter Information: Name, address, and contact details of the entity responsible for transporting the asbestos.

- Disposal Site Information: Name and address of the facility where the asbestos will be disposed of.

- Asbestos Description: Detailed information about the type and quantity of asbestos being shipped.

- Signatures: Required signatures from the generator, transporter, and disposal facility to confirm acknowledgment and responsibility.

Examples of Using the ASN 4

There are various scenarios in which the ASN 4 form is utilized. For instance, a construction company that discovers asbestos during renovation must complete the ASN 4 before transporting the material to a disposal site. Another example includes a waste management company that handles asbestos waste from multiple sources; they must ensure that each shipment is accompanied by a properly completed ASN 4 form to maintain compliance with regulatory requirements. These examples illustrate the importance of the ASN 4 in facilitating safe and legal asbestos management.

Form Submission Methods

The ASN 4 form can typically be submitted through various methods, depending on state regulations. Common submission methods include:

- Online Submission: Many states offer electronic submission options through their environmental agency websites.

- Mail: Completed forms can often be mailed to the appropriate regulatory agency.

- In-Person: Some states may require or allow in-person submissions at designated offices.

Quick guide on how to complete asn 4 form

Finalize Asn 4 effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the resources required to create, edit, and electronically sign your documents promptly without holdups. Handle Asn 4 on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest way to edit and eSign Asn 4 without hassle

- Locate Asn 4 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Forge your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a standard wet ink signature.

- Verify all details and then click the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and eSign Asn 4 and ensure excellent communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out a W-4 form?

The main thing you need to put on your W-4 besides your name, address and social security number is whether you are married or single and the number of exemptions you wish to take to lower the amount of money with held for taxes from your paycheck. The number of exemptions refers to how many people you support, i. e. children. Say you are single and have 3 children, you can put down 4 exemptions, 1 for your self and 1 for each child. This means you will have more pay to take home because you aren’t having it with held from your paycheck. If you are single and have no children, you can either take 1 or 0 exemptions. If you make decent money, take 0 deductions, if you are barely making it you could probably take 1 exemption. Just realize that if you take exemptions, and not enough money is taken out of your check to pay your taxes, you will be liable for it come April 15th.If you are married and have no children and you make decent money, take 0 deductions. If you have children, only one spouse should take them as exemptions and it should be the one who makes the most money. For example, say your spouse is the major bread winner and you have 2 children, your spouse could take 4 exemptions (one for each member of the family) and then you would take 0 exemptions.Usually, it’s best to err on the side of caution and take the smaller amount of deductions so that you won’t owe a lot of money come tax time. If you’ve had too much with held it will come back to you as a refund.

-

How do I fill up the ITR 4 form?

Guidance to File ITR 4Below are mentioned few common guidelines to consider while filing your ITR 4 form:If any schedule is not relevant/applicable to you, just strike it out and write —NA— across itIf any item/particular is not applicable/relevant to you, just write NA against itIndicate nil figures by writing “Nil” across it.Kindly, put a “-” sign prior to any negative figure.All figures shall be rounded off to the nearest one rupee except figures for total income/loss and tax payable. Those shall be rounded off to the nearest multiple of ten.If you are an Employer individual, then you must mark Government if you are a Central/State Government employee. You should tick PSU if you are working in a public sector company of the Central/State Government.Sequence to fill ITR 4 formThe easiest way to fill out your ITR-4 Form is to follow this order:Part AAll the schedulesPart BVerificationModes to file ITR 4 FormYou can submit your ITR-4 Form either online or offline. It is compulsory to file ITR in India electronically (either through Mode 3 or Mode 4) for the following assesses:Those whose earning exceeds Rs. 5 lakhs per yearThose possessing any assets outside the boundary of India (including financial interest in any entity) or signing authority in any account outside India.Those claiming relief under Section 90/90A/91 to whom Schedule FSI and Schedule TR applyOffline:By furnishing a return in a tangible l paper formBy furnishing a bar-coded returnThe Income Tax Department will issue you an acknowledgment as a form of response/reply at the time of submission of your tangible paper return.Online/Electronically:By furnishing the return electronically using digital signature certificate.By sending the data electronically and then submitting the confirmation of the return in Return Form ITR-VIf you submit your ITR-4 Form by electronic means under digital signature, the acknowledgment/response will be sent to your registered email id. You can even download it manually from the official income tax website. For this, you are first required to sign it and send it to the Income Tax Department’s CPC office in Bangalore within 120 days of e-filing.Keep in mind that ITR-4 is an annexure-less form. It means you don’t have to attach any documents when you send it.TaxRaahi is your income tax return filing online companion. Get complete assistance and tax saving tips from experts.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

Why did my employer give me a W-9 Form to fill out instead of a W-4 Form?

I wrote about the independent-contractor-vs-employee issue last year, see http://nctaxpro.wordpress.com/20...Broadly speaking, you are an employee when someone else - AKA the employer - has control over when and where you work and the processes by which you perform the work that you do for that individual. A DJ or bartender under some circumstances, I suppose, might qualify as an independent contractor at a restaurant, but the waitstaff, bus help, hosts, kitchen aides, etc. almost certainly would not.There's always risk in confronting an employer when faced with a situation like yours - my experience is that most employers know full well that they are violating the law when they treat employees as independent contractors, and for that reason they don't tolerate questions about that policy very well - so you definitely should tread cautiously if you want to keep this position. Nonetheless, I think you owe it to yourself to ask whether or not the restaurant intends to withhold federal taxes from your checks - if for no other reason than you don't want to get caught short when it comes to filing your own return, even if you don't intend to challenge the policy.

-

How should I fill out my w-2 or w-4 form?

To calculate how much you should withhold you need to calculate two things. Step 1 - Estimate your TaxFirst go to Intuit's TaxCaster (Link -> TurboTax® TaxCaster, Free Tax Calculator, Free Tax Refund Estimator) and put in your family's information and income (estimate what you'll make in 2016 before taxes and put zero for federal and state taxes withheld, don't worry that the TaxCaster is for 2015, you're just trying to get a general number). Once you enter in your correct information it will tell you what you would owe to the federal government.Step 2 - Estimate your Tax Withholding Based on Allowances ClaimedSecond go to Paycheck City (Link -> Salary Paycheck Calculator | Payroll Calculator | Paycheck City) select the correct state, enter in your pay information. Select married filing jointly then try putting in 3 or 4 for withholdings. Once you calculate it will tell you how much taxes are being withheld. Set the pay frequency to annual instead of bi-monthly or bi-weekly since you need a total number for the year. Try changing the Federal withholding allowance until you have enough Federal taxes withheld to cover the amount calculated in the TaxCaster. The Federal withholding allowance number that covers all taxes owed should be the number claimed on your W-4.Don't worry too much about your state. If you claim the same as Federal what will usually happen is you might get a small refund for Federal and owe a small amount for State. I usually end up getting a Federal refund for ~$100 and owing state for just over $100. In the end I net owing state $20-40.Remember, the more details you can put into the TaxCaster and Paycheck City the more accurate your tax estimate will be.

-

How much do accountants charge for helping you fill out a W-4 form?

A W-4 is a very simple form to instruct your employer to withhold the proper tax. It's written in very plain English and is fairly easy to follow. I honestly do not know of a CPA that will do one of these. If you're having trouble and cannot find a tutorial you like on line see if you can schedule a probing meeting. It should take an accounting student about 10 minutes to walk you through. There is even a worksheet on the back.If you have mitigating factors such as complex investments, partnership income, lies or garnishments, talk to your CPA about those, and then ask their advice regarding the W4 in the context of those issues.

-

How do I fill out tax form 4972?

Here are the line by line instructions Page on irs.gov, if you still are having problems, I suggest you contact a US tax professional to complete the form for you.

Create this form in 5 minutes!

How to create an eSignature for the asn 4 form

How to generate an electronic signature for your Asn 4 Form in the online mode

How to make an electronic signature for your Asn 4 Form in Chrome

How to generate an eSignature for putting it on the Asn 4 Form in Gmail

How to generate an eSignature for the Asn 4 Form right from your smart phone

How to generate an eSignature for the Asn 4 Form on iOS devices

How to create an eSignature for the Asn 4 Form on Android OS

People also ask

-

What is Asn 4 and how does it relate to airSlate SignNow?

Asn 4 is a powerful feature within airSlate SignNow that enhances document signing and management capabilities. It streamlines the eSigning process, making it quicker and easier for users to get documents signed securely. With Asn 4, businesses can improve their workflow efficiency and ensure compliance with legal standards.

-

What are the pricing options for airSlate SignNow with Asn 4 features?

airSlate SignNow offers flexible pricing plans that include access to Asn 4 features. There are different tiers available to cater to various business needs, from individual users to large teams. Each plan provides a cost-effective solution to streamline document workflows and eSigning processes.

-

What benefits does Asn 4 provide for businesses using airSlate SignNow?

Asn 4 offers numerous benefits, including enhanced security, faster document turnaround times, and ease of use. By utilizing Asn 4, businesses can minimize errors and ensure that all documents are signed promptly, improving overall productivity. This feature ultimately leads to better customer satisfaction due to quicker service delivery.

-

Can I integrate Asn 4 with other software tools?

Yes, Asn 4 within airSlate SignNow seamlessly integrates with various software tools and applications. This compatibility helps businesses streamline their workflows by connecting eSigning with CRM systems, document management platforms, and more. Integration with Asn 4 ensures a cohesive experience across different tools.

-

How does Asn 4 improve the document signing experience?

Asn 4 enhances the document signing experience by providing a user-friendly interface and quick access to signing options. It simplifies the process for both senders and signers, allowing for smooth navigation and immediate notifications. The result is a more efficient signing process that saves time for all parties involved.

-

Is Asn 4 compliant with legal standards for eSignatures?

Absolutely! Asn 4 ensures compliance with eSignature laws and regulations, making it a reliable solution for businesses. airSlate SignNow adheres to the ESIGN Act and UETA, ensuring that all eSignatures processed through Asn 4 hold legal validity and enforceability.

-

What types of documents can I sign using Asn 4?

With Asn 4, you can sign a wide variety of documents, including contracts, agreements, and forms. This feature supports various document formats, allowing users to handle everything from simple forms to complex contracts effortlessly. Asn 4’s versatility makes it an essential tool for any business.

Get more for Asn 4

- Alaska warranty deed form

- Warranty deed from husband to himself and wife alaska form

- Quitclaim deed from husband to himself and wife alaska form

- Quitclaim deed from husband and wife to husband and wife alaska form

- Warranty deed from husband and wife to husband and wife alaska form

- Revocation of postnuptial property agreement alaska alaska form

- Alaska property agreement form

- Alaska postnuptial agreement form

Find out other Asn 4

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form