Sole Trader Financial Statements on Words Form

IRS Guidelines

The IRS provides specific guidelines for obtaining and using an employer identification number (EIN), also known as an IRS employer identification. This number is essential for businesses operating in the United States, as it serves as a unique identifier for tax purposes. To obtain an EIN, businesses must complete Form SS-4, which requires basic information about the entity, including its legal structure, reason for applying, and the responsible party's details. The application can be submitted online, by fax, or by mail, and the IRS typically processes applications quickly, often issuing the EIN immediately if applied for online.

Required Documents

When applying for an IRS employer identification, certain documents and information are necessary to ensure a smooth application process. Applicants must provide details such as the legal name of the business, the type of entity (e.g., sole proprietorship, partnership, corporation), and the address of the business. Additionally, the responsible party's name and Social Security number or Individual Taxpayer Identification Number (ITIN) are required. Having this information readily available can expedite the application process and help avoid delays.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the IRS employer identification is crucial for compliance. Businesses must apply for an EIN before they can file certain tax returns or hire employees. Generally, it is advisable to obtain the EIN well in advance of any tax-related deadlines to ensure that all necessary documentation is in order. For example, if a business plans to hire employees, it should apply for the EIN before the first payroll date to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

There are several methods for submitting the application for an IRS employer identification. The most efficient way is to apply online through the IRS website, where businesses can receive their EIN immediately upon completion. Alternatively, applications can be submitted by fax or mail, but these methods may result in longer processing times. It is important to choose the method that best suits the urgency of the application, especially if the EIN is needed for immediate business operations.

Penalties for Non-Compliance

Failure to obtain an IRS employer identification when required can lead to significant penalties for businesses. The IRS may impose fines for not filing tax returns or for failing to report employee wages accurately. Additionally, businesses without an EIN may face difficulties in opening bank accounts or applying for loans. Understanding the importance of compliance with IRS regulations can help businesses avoid these potential issues and maintain smooth operations.

Eligibility Criteria

Eligibility for obtaining an IRS employer identification is generally broad, as most businesses in the United States are required to have an EIN. This includes sole proprietorships, partnerships, corporations, and non-profit organizations. Even if a business does not have employees, an EIN may be necessary for certain tax filings or to open a business bank account. It is essential for business owners to assess their specific needs to determine if applying for an EIN is necessary.

Taxpayer Scenarios (e.g., self-employed, retired, students)

Different taxpayer scenarios can influence the necessity and process of obtaining an IRS employer identification. For instance, self-employed individuals typically need an EIN to report income and pay self-employment taxes. Retired individuals may not need an EIN unless they start a business or engage in freelance work. Students who operate a business while in school should also consider applying for an EIN to separate their business finances from personal finances. Understanding these scenarios can help individuals make informed decisions regarding their tax obligations and business operations.

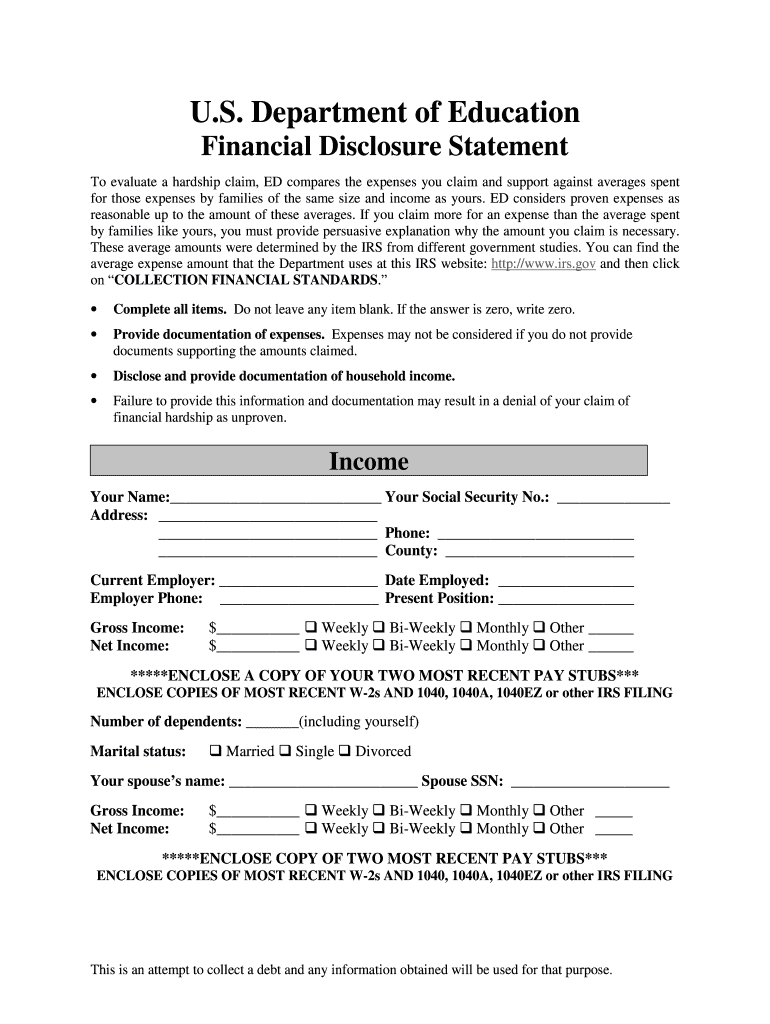

Quick guide on how to complete education financial statement form

Discover the easiest method to complete and endorse your Sole Trader Financial Statements On Words

Are you still spending time creating your official paperwork on physical forms instead of online? airSlate SignNow provides a superior method to complete and endorse your Sole Trader Financial Statements On Words and other forms for public services. Our advanced eSignature platform equips you with all the tools necessary to handle documents swiftly and in accordance with official standards - robust PDF editing, managing, safeguarding, signing, and sharing options all readily accessible within a user-friendly interface.

Only a few steps are required to finalize the completion and signing of your Sole Trader Financial Statements On Words:

- Insert the fillable template into the editor using the Get Form button.

- Review the information you need to include in your Sole Trader Financial Statements On Words.

- Move between the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the sections with your details.

- Update the content with Text boxes or Images from the upper toolbar.

- Emphasize what is truly signNow or Obscure areas that are no longer relevant.

- Click on Sign to create a legally recognized eSignature using any method you prefer.

- Add the Date beside your signature and finish up with the Done button.

Keep your completed Sole Trader Financial Statements On Words in the Documents section of your profile, download it, or transfer it to your preferred cloud storage. Our service also offers adaptable file sharing. There’s no need to print your templates when submitting them to the relevant public authority - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

FAQs

-

Do I need to fill out a financial statement form if I get a full tuition waiver and RA/TA?

If that is necessary, the university or the faculty will inform you of that. These things can vary from university to university. Your best option would be to check your university website, financial services office or the Bursar office in your university.

-

When is it mandatory to fill out a personal financial statement for one's bank? The form states no deadline about when it must be returned.

The only time I know that financial statements are asked for is when one applies for a business or personal loan, or applying for a mortgage. Each bank or credit union can have their own document requirements, however for each transaction. It really is at their discretion.

-

Can I use broker statements to fill out form 8949 instead of a 1099-B?

Yes you can. Should you? Perhaps, but remember that the 1099 is what the IRS is going to receive. There could be differences.You may receive a 1099 which is missing basis information. You will indicate that, and use your records to fill in the missing information.My suggestion is to use the 1099, cross-referencing to your statements.

-

How can I apply for an education loan from SBI online?

Step 1: Go to GyanDhan’s website. Check your loan eligibility here.Step 2: Apply for loan with collateral at GyanDhanStep3: Fill the Complete Application form.Done ! You will get a mail from SBI that they have received your application along with a mail from GyanDhan which will contain the details of the branch manger and the documents required.GyanDhan is in partnership with SBI for education loan abroad. GyanDhan team has technically integrated their systems so that customer can fill the GyanDhan’s form and it automatically get applied to SBI. The idea is to make education loan process so simple via GyanDhan that students don’t have to worry finances when they think of higher education abroad.GyanDhan is a marketplace for an education loan abroad and are in partnership with banks like SBI, BOB, Axis and many more.PS: I work at GyanDhan

-

How does Ivy League schools’ need-based financial aid policy work? Do they offer aid to everybody who can not afford costs?

The eight colleges that play sports together in the Ivy athletic league (Ivy League ) and many of the other elite Private universities like MIT, Duke, Stanford, Caltech, etc. offer Up To full financial aid to any student who Requested financial aid during the application process. (see below about Need-blind and need-aware).Most of those universities are Need-Blind for US citizens, permanent residents and legal refugees. However, most of those universities are Need-Aware in the admissions process for international applicants. Most need-aware colleges will Never provide financial aid to an undergraduate student if they did Not request financial aid during the initial application process (freshman application or transfer application). Whereas a Need-Blind university will provide financial aid whenever a student applies for the aid.However, the application can be a tedious process since the applicant and All of her/his parents must fill out a daunting amount of forms which must be verified by an independent agency in the applicant’s country (for the USA, the colleges rely upon the Federal IRS. Twice I had to wait for IRS verification when my son was requesting financial aid from Villanova in 2012 and 2013). You all fill out the FAFSA forms (US only) and the PROFILE forms (everyone else) and there may be another set of forms that are used.FAFSA - Free Application for Federal Student AidApply for College Financial Aid (PROFILE)I know families that:The college demanded complete bank statements for all of the siblings (under the age of 16) of the applicant to make certain that the family was not hiding money in the siblings’ namesThe college demanded a huge amount of additional paperwork for families that owned a small business. Many colleges look at small businesses as places to hide moneyThe Plus side is that some applicants get full financial aid. For example recently MIT stated that 35% of the MIT undergraduates received financial aid in excess of the cost of tuition (i.e. MIT was also assisting with the cost of room and board and books/supplies)NOTE: All of the colleges look to the Family and the Applicant to determine an Expected Family Contribution (EFC). The colleges all expect that the student will contribute to that EFC. Therefore, do Not think that each Summer you will be lying on the beach somewhere for the entire Summer. The student is Expected to get a Summer Job each and every Summer prior to being an undergraduate at college and Earn several Thousand dollars (US) from that and Contribute that money to their education. Or, Borrow from the Federal Government (Direct Loans). Indeed, roughly 30% of the 2017 MIT graduating students with bachelors degrees owed an average of $20,000 in student loans. And this is at a college that guarantees up to full student aid. Every student has “skin in the game”.I did Not borrow money to attend MIT as an undergraduate (1969 - 1973) and I worked an average of 10 hours per week as an intramural sport referee/umpire to make spending money. I graduated with no loans, but times were different back then.Need-Blind admission process, then you can apply for financial aid at Any time as an undergraduate.Need-Aware admission process, then you must apply for financial aid when you apply to the college or you may Never apply for financial aid from the college.FAFSA and PROFILE forms. Go online and read. Also use the net-price calculators that US universities are Mandated by the Federal Government to provide.Enjoy the financial aid application process (and for the males that includes registering with the Selective Service for the draft…) it is part of your overall education.

-

How do I fill out the application form for an educational loan online?

Depending on which country you are in and what kind of lender you are going for. There are bank loans and licensed money lenders. If you are taking a large amount, banks are recommended. If you are working, need a small amount for your tuition and in need of it fast, you can try a licensed moneylender.

Create this form in 5 minutes!

How to create an eSignature for the education financial statement form

How to generate an electronic signature for the Education Financial Statement Form in the online mode

How to make an electronic signature for the Education Financial Statement Form in Chrome

How to generate an eSignature for putting it on the Education Financial Statement Form in Gmail

How to make an eSignature for the Education Financial Statement Form from your smart phone

How to generate an eSignature for the Education Financial Statement Form on iOS devices

How to generate an eSignature for the Education Financial Statement Form on Android devices

People also ask

-

What is an IRS employer identification number and why do I need it?

An IRS employer identification number (EIN) is a unique identifier assigned to a business entity for tax purposes. It is essential for filing taxes, opening bank accounts, and applying for business licenses. If you plan to hire employees or operate as a corporation or partnership, obtaining an IRS employer identification number is crucial.

-

How can airSlate SignNow help with IRS employer identification documentation?

airSlate SignNow provides an intuitive platform for sending and eSigning critical documents related to your IRS employer identification. You can easily create, manage, and track documents ensuring compliance and efficient filing. Our solution streamlines the paperwork process associated with acquiring and maintaining your EIN.

-

What are the pricing plans for airSlate SignNow in relation to IRS employer identification forms?

airSlate SignNow offers various pricing plans that cater to different business needs, including those who deal with IRS employer identification forms. Our competitive pricing ensures that you have access to all features necessary for electronic signing and document management at an affordable rate. Contact our sales team for specific pricing details based on your requirements.

-

Are there any specific features of airSlate SignNow that assist with IRS employer identification?

Yes, airSlate SignNow offers features that enhance the management of documents related to IRS employer identification. Users can customize templates, track recipient actions, and automate workflows to ensure timely submissions. These capabilities simplify the complexities surrounding tax-related documentation.

-

Can airSlate SignNow integrate with other tools for managing IRS employer identification?

Absolutely! airSlate SignNow seamlessly integrates with various tools like CRM systems and accounting software, making it easier to handle your IRS employer identification paperwork. These integrations ensure that you can manage your business processes more efficiently while keeping all documentation organized in one place.

-

What benefits does airSlate SignNow provide for businesses handling IRS employer identification?

Using airSlate SignNow for IRS employer identification offers numerous benefits including enhanced security, ease of use, and cost-effectiveness. Our electronic signing solution ensures that your documents are securely signed and stored, reducing the risk of errors and improving compliance. Additionally, it saves time and resources compared to traditional methods.

-

Is airSlate SignNow user-friendly for first-time users dealing with IRS employer identification?

Yes, airSlate SignNow is designed to be user-friendly, even for first-time users handling IRS employer identification. Our intuitive interface allows you to easily navigate the document signing process and access helpful resources. Furthermore, we offer customer support to assist you in maximizing the benefits of our platform.

Get more for Sole Trader Financial Statements On Words

- Satisfaction cancellation or release of mortgage package alaska form

- Premarital agreements package alaska form

- Painting contractor package alaska form

- Framing contractor package alaska form

- Foundation contractor package alaska form

- Plumbing contractor package alaska form

- Brick mason contractor package alaska form

- Roofing contractor package alaska form

Find out other Sole Trader Financial Statements On Words

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online

- Can I Sign Idaho Affidavit of No Lien

- Sign New York Affidavit of No Lien Online

- How To Sign Delaware Trademark License Agreement

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License