Assignment of Lien Corporation or LLC Missouri Form

What is the Assignment Of Lien Corporation Or LLC Missouri

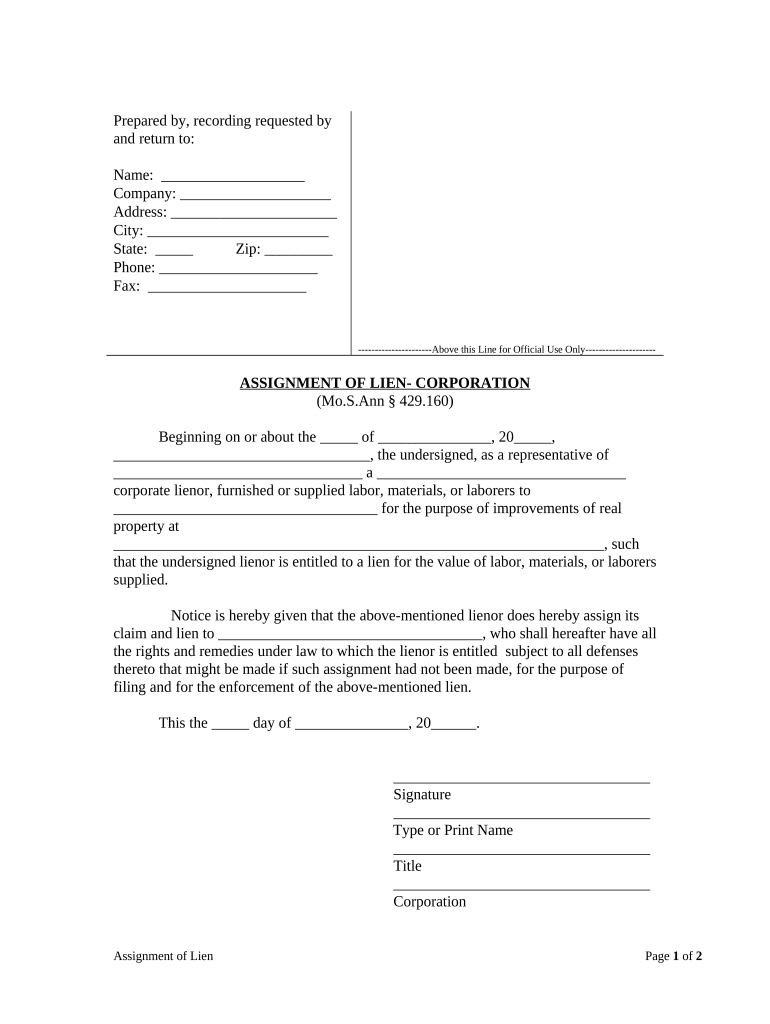

The Assignment of Lien Corporation or LLC Missouri form is a legal document used to transfer a lien from one entity to another within the state of Missouri. This form is essential for businesses that have secured a lien on property or assets and wish to assign that lien to another corporation or limited liability company (LLC). The assignment process ensures that the new entity assumes the rights and responsibilities associated with the lien, which may include repayment obligations or claims against the property.

Steps to Complete the Assignment Of Lien Corporation Or LLC Missouri

Completing the Assignment of Lien Corporation or LLC Missouri form involves several key steps to ensure it is legally binding and properly executed:

- Gather necessary information: Collect details about the original lien holder, the assignee, and the property or assets involved.

- Fill out the form: Accurately complete all sections of the form, including the names of the parties involved and the description of the lien.

- Obtain signatures: Both the assignor and assignee must sign the document. Ensure that signatures are dated and include printed names.

- Notarization: Depending on state requirements, you may need to have the document notarized to validate the assignment.

- Submit the form: File the completed form with the appropriate state or local authority to ensure the assignment is officially recognized.

Legal Use of the Assignment Of Lien Corporation Or LLC Missouri

The Assignment of Lien Corporation or LLC Missouri form serves a vital legal purpose in the context of business transactions. It provides a clear record of the transfer of lien rights, which can protect the interests of all parties involved. Legally, the assignment must comply with Missouri state laws governing liens and property rights. Failure to adhere to these regulations can lead to disputes or challenges regarding the validity of the lien assignment.

Key Elements of the Assignment Of Lien Corporation Or LLC Missouri

When preparing the Assignment of Lien Corporation or LLC Missouri form, it is crucial to include several key elements to ensure its effectiveness:

- Identifying information: Names and addresses of both the assignor and assignee.

- Description of the lien: A detailed description of the lien being assigned, including any relevant account numbers or identifiers.

- Effective date: The date on which the assignment becomes effective.

- Signatures: Signatures of both parties, along with the date of signing.

- Notary acknowledgment: If required, a notary public's acknowledgment to validate the document.

State-Specific Rules for the Assignment Of Lien Corporation Or LLC Missouri

Missouri has specific rules that govern the assignment of liens, which must be followed to ensure compliance. These rules may include requirements for notarization, specific language that must be included in the assignment, and the need to file the assignment with a particular governmental body. It is essential for businesses to familiarize themselves with these regulations to avoid legal complications and ensure that the assignment is enforceable.

Examples of Using the Assignment Of Lien Corporation Or LLC Missouri

There are various scenarios in which the Assignment of Lien Corporation or LLC Missouri form may be utilized. For instance:

- A construction company may assign a lien on a property to a subcontractor who completed work on the project.

- A bank may transfer a lien on a commercial property to another financial institution as part of a loan agreement.

- A business may assign its lien on equipment to a leasing company as collateral for a financing arrangement.

Quick guide on how to complete assignment of lien corporation or llc missouri

Manage Assignment Of Lien Corporation Or LLC Missouri effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to locate the necessary form and securely retain it online. airSlate SignNow provides all the resources you need to create, alter, and eSign your documents swiftly without any holdups. Handle Assignment Of Lien Corporation Or LLC Missouri on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Assignment Of Lien Corporation Or LLC Missouri effortlessly

- Obtain Assignment Of Lien Corporation Or LLC Missouri and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details, then click on the Done button to save your updates.

- Select your preferred delivery method for your form, whether by email, text (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, laborious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign Assignment Of Lien Corporation Or LLC Missouri and guarantee excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Assignment Of Lien Corporation Or LLC Missouri?

An Assignment Of Lien Corporation Or LLC Missouri is a legal document that allows a corporation or LLC in Missouri to transfer its lien rights to another party. This process can simplify transactions and improve the efficiency of business operations. It's important to properly execute this document to ensure compliance with local laws and regulations.

-

How does airSlate SignNow facilitate the Assignment Of Lien Corporation Or LLC Missouri?

airSlate SignNow provides an intuitive platform for creating, sending, and eSigning the Assignment Of Lien Corporation Or LLC Missouri documents. With easy document management features, users can streamline their workflow and ensure that all parties sign in a timely manner. The platform is designed for simplicity, making the process both secure and efficient.

-

Is there a cost associated with using airSlate SignNow for Assignment Of Lien Corporation Or LLC Missouri?

Yes, there is a cost for using airSlate SignNow; however, it offers a variety of pricing plans to accommodate different business needs. The pricing reflects the comprehensive features provided, making it a cost-effective solution for managing Assignment Of Lien Corporation Or LLC Missouri transactions. You can review our pricing page for specific details.

-

What features does airSlate SignNow offer for managing legal documents like Assignment Of Lien Corporation Or LLC Missouri?

airSlate SignNow offers a range of features including customizable templates, in-app document editing, and eSignature capabilities. These features enhance the process of creating and managing the Assignment Of Lien Corporation Or LLC Missouri documents, ensuring that businesses can operate more smoothly. Additionally, it provides options for tracking document status and reminders for signers.

-

Can airSlate SignNow integrate with other software for Assignment Of Lien Corporation Or LLC Missouri?

Yes, airSlate SignNow offers integrations with various software applications and platforms to enhance your document workflow for Assignment Of Lien Corporation Or LLC Missouri. Integrating with tools like CRM systems and cloud storage allows for a seamless process, ensuring that your documents are easily accessible and manageable across different platforms.

-

What are the benefits of using airSlate SignNow for Assignment Of Lien Corporation Or LLC Missouri?

Using airSlate SignNow for Assignment Of Lien Corporation Or LLC Missouri offers many benefits, including improved efficiency in document management and enhanced compliance with legal standards. Businesses can save time and reduce errors by using electronic signatures and real-time tracking. The platform also ensures a secure environment for sensitive documents.

-

How secure is the Assignment Of Lien Corporation Or LLC Missouri process through airSlate SignNow?

airSlate SignNow prioritizes security in the Assignment Of Lien Corporation Or LLC Missouri process by implementing advanced encryption protocols and secure user authentication methods. This ensures that your documents are safe during transmission and storage. With compliance to industry standards, you can trust that your legal documents are protected.

Get more for Assignment Of Lien Corporation Or LLC Missouri

Find out other Assignment Of Lien Corporation Or LLC Missouri

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online