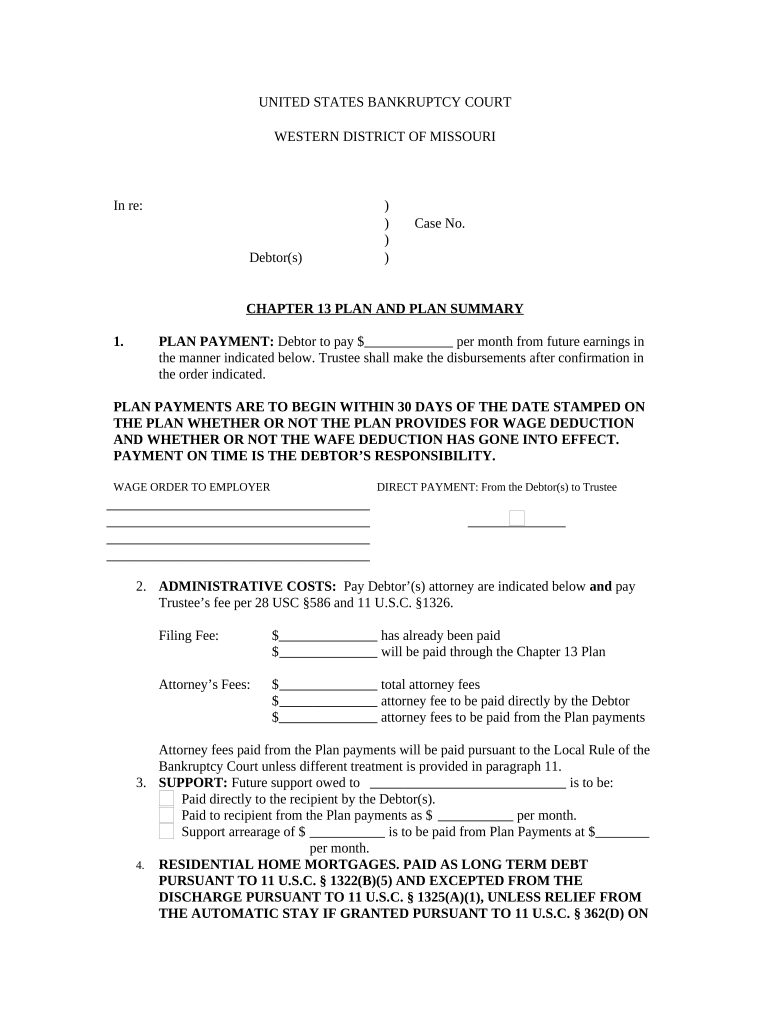

Chapter 13 Plan Form

What is the Chapter 13 Plan

The Chapter 13 Plan is a legal framework that allows individuals with a regular income to reorganize their debts and create a repayment plan over a period of three to five years. This plan is particularly beneficial for those who wish to avoid foreclosure or repossession of their assets while managing their debts. Under this plan, debtors propose a repayment schedule to the bankruptcy court, which must be approved before it can be executed. The plan typically covers secured debts, unsecured debts, and priority debts, ensuring that creditors receive payments in a structured manner.

Key elements of the Chapter 13 Plan

Several essential components make up a Chapter 13 Plan. These include:

- Payment Amount: The plan must specify how much the debtor will pay each month and for how long.

- Debt Classification: Debts are categorized as secured, unsecured, or priority, each with different treatment under the plan.

- Feasibility: The plan must be feasible, meaning the debtor must have a reliable income to make the proposed payments.

- Best Interest of Creditors: Creditors must receive at least as much as they would in a Chapter 7 liquidation scenario.

Steps to complete the Chapter 13 Plan

Completing a Chapter 13 Plan involves several steps:

- Gather Financial Information: Collect all relevant financial documents, including income statements, tax returns, and a list of debts.

- Consult with a Bankruptcy Attorney: Seek legal advice to ensure compliance with bankruptcy laws and to help draft the plan.

- Draft the Plan: Outline the repayment terms, including payment amounts and duration.

- File with the Bankruptcy Court: Submit the plan along with the bankruptcy petition to the appropriate court.

- Attend the Confirmation Hearing: Present the plan to the court and address any objections from creditors.

Legal use of the Chapter 13 Plan

The Chapter 13 Plan is legally binding once it is confirmed by the bankruptcy court. This means that both the debtor and the creditors are obligated to adhere to the terms of the plan. Failure to comply with the plan can lead to dismissal of the bankruptcy case or conversion to a Chapter 7 bankruptcy. It is crucial for debtors to understand their rights and responsibilities under the plan to ensure successful completion.

Eligibility Criteria

To qualify for a Chapter 13 Plan, individuals must meet specific eligibility requirements. These include:

- Regular Income: The debtor must have a steady income source to make the proposed payments.

- Debt Limits: Unsecured debts must be less than a specified amount, and secured debts must also fall within certain limits.

- Previous Bankruptcy Filings: Individuals who have previously filed for bankruptcy must meet specific timeframes before filing again.

Form Submission Methods

The Chapter 13 Plan can be submitted through various methods, including:

- Online: Many courts allow electronic filing for bankruptcy documents, making it convenient for debtors.

- Mail: Physical copies of the plan can be mailed to the bankruptcy court.

- In-Person: Debtors may also choose to file the plan in person at the courthouse.

Quick guide on how to complete chapter 13 plan 497313308

Handle Chapter 13 Plan seamlessly on any gadget

Web-based document management has become increasingly favored by businesses and individuals alike. It presents an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly and without holdups. Manage Chapter 13 Plan on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Chapter 13 Plan effortlessly

- Obtain Chapter 13 Plan and then click Get Form to commence.

- Make use of the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes just seconds and bears the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Leave behind concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from a device of your choice. Modify and eSign Chapter 13 Plan and achieve excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a chapter 13 plan?

A chapter 13 plan is a legal proposal that individuals can use to repay their debts over a period of three to five years. It allows you to keep your property while reorganizing your debts. By filing a chapter 13 plan, you can work towards financial stability and avoid foreclosure.

-

How does airSlate SignNow assist with creating a chapter 13 plan?

airSlate SignNow streamlines the document signing process for your chapter 13 plan by allowing you to easily send and eSign necessary documents securely. This simplifies the communication between you and your attorney or creditors. With airSlate SignNow, you can manage your chapter 13 plan documentation efficiently.

-

What features does airSlate SignNow offer for chapter 13 plan documents?

airSlate SignNow offers features such as customizable templates, advanced security options, and real-time tracking to monitor the status of your chapter 13 plan documents. You can also integrate electronic signatures, which streamline the approval process. These features enhance the usability of documents related to your chapter 13 plan.

-

What are the benefits of using airSlate SignNow for my chapter 13 plan?

Using airSlate SignNow for your chapter 13 plan provides a user-friendly experience and saves you time and resources. Its cost-effective solution ensures that you can manage your legal documents without hassle. Moreover, the platform’s reliability fosters trust with your creditors while handling your chapter 13 plan.

-

Is there a cost associated with using airSlate SignNow for chapter 13 plan documents?

Yes, airSlate SignNow offers various pricing plans to suit different needs. You can choose a plan that fits your budget while benefiting from features specifically helpful for processing chapter 13 plan documents. Check their pricing page for detailed information and select a plan that best meets your needs.

-

Can I integrate airSlate SignNow with other tools for my chapter 13 plan?

Absolutely! airSlate SignNow integrates with various applications to enhance your workflow related to your chapter 13 plan. You can connect it with CRM systems, cloud storage, and other tools to keep all your important documents organized and easily accessible.

-

What types of documents can be signed related to a chapter 13 plan?

You can sign various documents related to your chapter 13 plan, such as repayment agreements, creditor agreements, and bankruptcy petitions. airSlate SignNow offers templates for these documents, ensuring you have everything you need to properly manage your chapter 13 plan while complying with legal requirements.

Get more for Chapter 13 Plan

- Passenger list template form

- Which coast of the united states has the larger population map skills answers form

- Credit card authorization form 100099948

- Samsung claim form 76330788

- Neis income statement form about training abouttraining edu

- Informed consent for laparoscopic cholecystectomy

- Pest control pricing sheet form

- Colorado residential rental lease agreement 4729424 form

Find out other Chapter 13 Plan

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself