Missouri Trust Form

What is the Missouri Trust

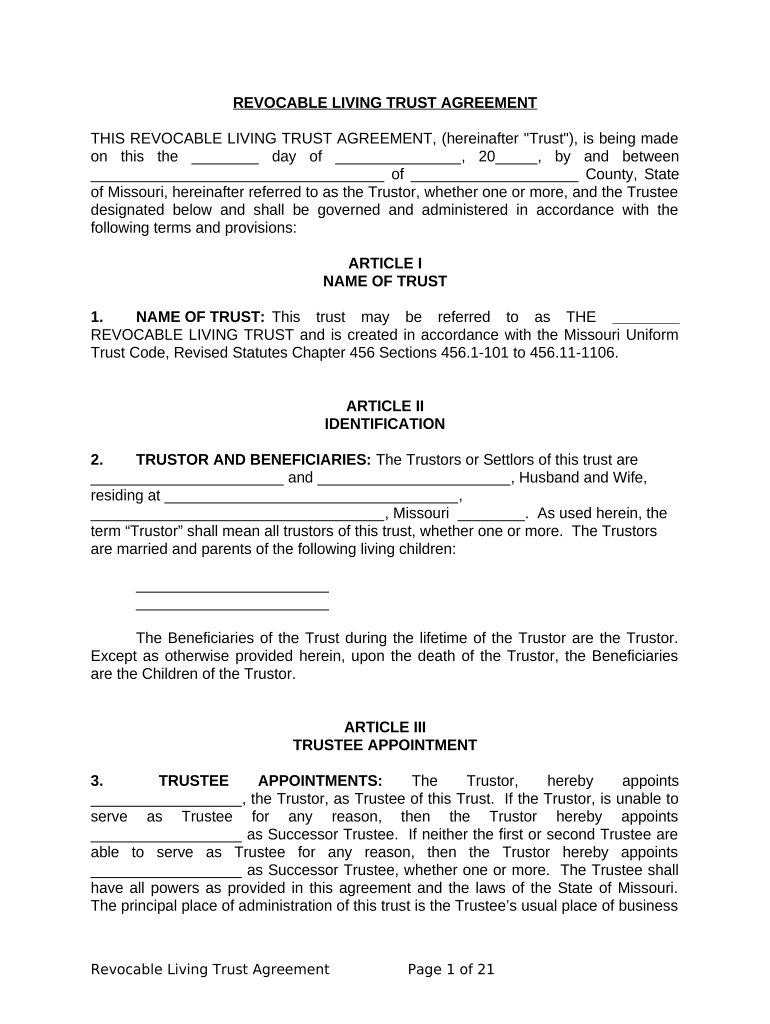

The Missouri Trust is a legal arrangement that allows individuals to manage and distribute their assets according to specific terms set forth by the grantor. This type of trust can be used for various purposes, including estate planning, asset protection, and tax benefits. By establishing a Missouri Trust, individuals can ensure that their wishes regarding asset distribution are honored, while also potentially avoiding probate and minimizing estate taxes.

How to use the Missouri Trust

Using a Missouri Trust involves several steps, including drafting the trust document, transferring assets into the trust, and appointing a trustee to manage the trust's assets. The trust document outlines the terms of the trust, including how assets will be managed and distributed. Once the trust is established, the grantor can transfer ownership of assets, such as real estate or financial accounts, into the trust, allowing the trustee to manage these assets according to the grantor's wishes.

Steps to complete the Missouri Trust

Completing a Missouri Trust involves a series of steps to ensure its legality and effectiveness:

- Determine the type of trust needed based on personal circumstances and goals.

- Draft the trust document, including terms for asset management and distribution.

- Choose a reliable trustee who will manage the trust in accordance with the grantor's wishes.

- Transfer assets into the trust, ensuring proper documentation is completed.

- Review and update the trust periodically to reflect any changes in circumstances or laws.

Legal use of the Missouri Trust

The Missouri Trust is legally recognized and can be used to achieve various objectives, such as protecting assets from creditors or ensuring that beneficiaries receive their inheritance in a structured manner. To ensure legal compliance, the trust must adhere to Missouri state laws regarding trusts, including proper documentation and execution. It is advisable to consult with a legal professional when establishing a trust to navigate the complexities of trust law.

Key elements of the Missouri Trust

Several key elements define a Missouri Trust, including:

- Grantor: The individual who creates the trust and transfers assets into it.

- Trustee: The person or entity responsible for managing the trust's assets and carrying out the terms of the trust.

- Beneficiaries: Individuals or entities designated to receive benefits from the trust.

- Trust document: A legal document that outlines the terms and conditions of the trust.

State-specific rules for the Missouri Trust

Missouri has specific laws governing trusts that must be followed to ensure validity. These include requirements for the trust document, the powers of the trustee, and the rights of beneficiaries. Understanding these state-specific rules is crucial for anyone looking to establish a Missouri Trust. It is recommended to seek legal guidance to navigate these regulations effectively.

Quick guide on how to complete missouri trust 497313345

Complete Missouri Trust effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage Missouri Trust on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign Missouri Trust with ease

- Find Missouri Trust and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal standing as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you select. Modify and electronically sign Missouri Trust and guarantee excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Missouri trust and how does it work?

A Missouri trust is a legal arrangement where a trustee holds and manages assets on behalf of beneficiaries. The trust is created through a legal document that outlines the terms and conditions of management. airSlate SignNow simplifies the process of establishing a Missouri trust by allowing users to electronically sign necessary documents securely and efficiently.

-

How can airSlate SignNow help in creating a Missouri trust?

airSlate SignNow streamlines the creation of a Missouri trust by providing tools for easy document preparation and signature collection. With our user-friendly platform, you can draft, send, and track trust documents in minutes. This ensures that your Missouri trust is established without unnecessary delays or complications.

-

What are the costs associated with establishing a Missouri trust?

The costs of establishing a Missouri trust can vary widely based on the complexity and size of the trust. While legal fees and filing costs apply, using airSlate SignNow can reduce expenses related to document management. Our affordable eSigning solution offers excellent value, making it easier to manage the finances of your Missouri trust.

-

What features does airSlate SignNow offer for managing a Missouri trust?

airSlate SignNow offers a variety of features that facilitate the efficient management of a Missouri trust, including document collaboration, secure eSignatures, and automated workflows. Users benefit from real-time notifications and tracking, ensuring all parties remain informed throughout the process. These features help maintain Transparency and compliance in handling your Missouri trust.

-

Are there specific benefits to using airSlate SignNow for a Missouri trust?

Yes, using airSlate SignNow for a Missouri trust provides several benefits, including enhanced security and legal compliance for your documents. Our platform helps you streamline the signing process, minimize errors, and reduce turnaround time signNowly. Additionally, our integrated solutions make it easier to manage and access trust documents at any time.

-

Can I integrate airSlate SignNow with other tools for my Missouri trust?

Absolutely! airSlate SignNow seamlessly integrates with various applications and software, helping you manage your Missouri trust more efficiently. Whether you need to connect with CRM systems, cloud storage, or accounting software, our platform provides the flexibility needed for easy collaboration and data sharing.

-

Is airSlate SignNow compliant with Missouri trust regulations?

Yes, airSlate SignNow complies with all relevant regulations and legal standards when it comes to managing and signing documents for a Missouri trust. Our platform uses advanced encryption and security measures to ensure your sensitive information is protected. You can trust airSlate SignNow to help you adhere to compliance requirements in Missouri.

Get more for Missouri Trust

- Name date pdr oswestry neck pain questionnaire this questionnaire is designed to enable us to understand how much your neck form

- Aetna international dental claim form

- Dp3 real property damage form

- Bank kenya form

- Apartment application shamco management corp form

- Empty seat procedure form haltonbus

- 735 6883 form

- Management fee agreement template form

Find out other Missouri Trust

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online