Mississippi Foreclosure Form

What is the Mississippi Foreclosure

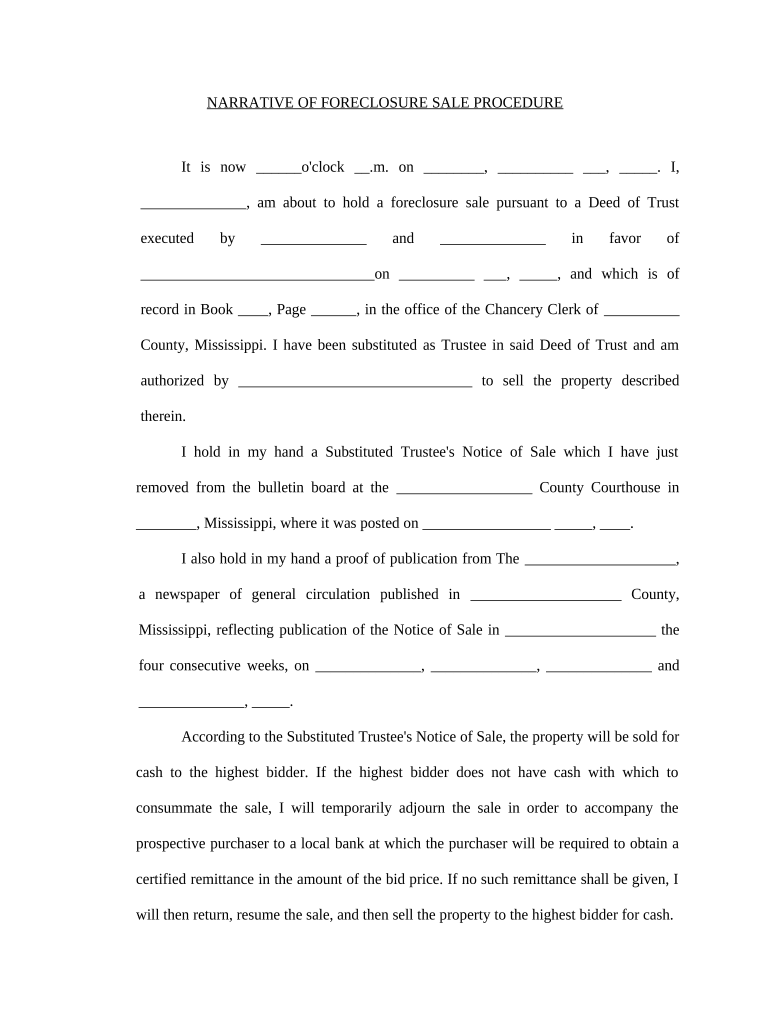

The Mississippi foreclosure process is a legal procedure through which a lender can reclaim property when the borrower defaults on their mortgage payments. This process typically involves several steps, including notifying the borrower, filing a lawsuit, and conducting a public auction. Understanding this process is essential for both borrowers facing foreclosure and lenders seeking to recover their investment.

Steps to Complete the Mississippi Foreclosure

Completing the Mississippi foreclosure process involves a series of important steps:

- Notice of Default: The lender must send a notice to the borrower, informing them of the default and the intention to foreclose.

- Filing a Lawsuit: If the borrower does not respond or remedy the default, the lender can file a lawsuit in the appropriate court.

- Court Hearing: A court hearing will be scheduled where both parties can present their case.

- Judgment: If the court rules in favor of the lender, a judgment will be issued, allowing the lender to proceed with the foreclosure.

- Public Auction: The property will be sold at a public auction to the highest bidder, typically starting at the amount owed on the mortgage.

- Eviction: If the borrower does not vacate the property voluntarily, the new owner may initiate eviction proceedings.

Legal Use of the Mississippi Foreclosure

The legal framework governing foreclosures in Mississippi is established by state law. It is crucial for lenders and borrowers to adhere to these regulations to ensure the process is conducted fairly and legally. This includes providing proper notifications, adhering to timelines, and following court procedures. Failure to comply with legal requirements can result in delays or dismissal of the foreclosure action.

Key Elements of the Mississippi Foreclosure

Several key elements define the Mississippi foreclosure process:

- Default Notification: A formal notice must be sent to the borrower, detailing the default and potential consequences.

- Judicial Process: Mississippi requires a judicial foreclosure process, meaning the lender must go through the court system.

- Right to Redemption: Borrowers may have the right to redeem their property by paying the outstanding debt before the foreclosure sale.

- Public Auction: Foreclosed properties are sold at public auctions, ensuring transparency in the process.

State-Specific Rules for the Mississippi Foreclosure

Mississippi has specific rules that govern the foreclosure process. These include timelines for notifications, requirements for court filings, and the rights of borrowers. Understanding these state-specific regulations is vital for both lenders and borrowers to navigate the process effectively. Additionally, certain protections may be available for borrowers, such as the ability to contest the foreclosure in court.

Required Documents

To initiate a foreclosure in Mississippi, several documents are typically required:

- Notice of Default: Document proving that the borrower has defaulted on the loan.

- Loan Agreement: The original loan agreement outlining the terms of the mortgage.

- Proof of Ownership: Documentation establishing the lender's legal right to foreclose.

- Court Filing Documents: All necessary forms required by the court to initiate the foreclosure process.

Quick guide on how to complete mississippi foreclosure

Complete Mississippi Foreclosure effortlessly on any device

Online document administration has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents swiftly without delays. Manage Mississippi Foreclosure on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and eSign Mississippi Foreclosure with ease

- Locate Mississippi Foreclosure and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to deliver your form, via email, text (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Mississippi Foreclosure and ensure exceptional communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the impact of a Mississippi foreclosure on my credit score?

A Mississippi foreclosure can signNowly impact your credit score, typically causing it to drop by 100 points or more. This negative mark can remain on your credit report for up to seven years, making it harder to secure future loans or credit. Understanding the implications of a foreclosure is crucial for regaining financial stability.

-

How can airSlate SignNow assist with documentation during a Mississippi foreclosure?

airSlate SignNow provides an efficient way to send and eSign important foreclosure-related documents. By streamlining the paperwork process, it helps you manage your documents without unnecessary delays. This can be particularly helpful during a stressful time like a Mississippi foreclosure.

-

What features does airSlate SignNow offer for foreclosure professionals in Mississippi?

airSlate SignNow offers a suite of features tailored for foreclosure professionals in Mississippi, including document templates, automated workflows, and advanced eSignature options. These tools can enhance productivity and ensure that all paperwork complies with local laws and requirements. This makes managing a Mississippi foreclosure process more straightforward.

-

Is there a free trial available for airSlate SignNow for addressing Mississippi foreclosure needs?

Yes, airSlate SignNow offers a free trial, allowing you to explore its features for handling Mississippi foreclosure documents without any initial investment. This trial period enables you to assess how the platform can streamline your workflows and documentation needs. It's a risk-free way to see if it fits your requirements.

-

How secure is the signing process with airSlate SignNow for Mississippi foreclosure documents?

The signing process with airSlate SignNow is highly secure, featuring bank-level encryption and compliance with advanced security standards. This ensures that your Mississippi foreclosure documents remain confidential and protected throughout the signing process. You can confidently manage sensitive information without fear of data bsignNowes.

-

Can airSlate SignNow integrate with other tools for managing Mississippi foreclosures?

Absolutely! airSlate SignNow seamlessly integrates with various platforms such as CRM systems, document management software, and more. This makes it easier for professionals managing Mississippi foreclosures to maintain consistency across their operations. The integrations help optimize workflows and enhance efficiency.

-

What are the pricing options for airSlate SignNow regarding Mississippi foreclosure services?

airSlate SignNow offers flexible pricing plans designed to cater to different business needs, including those dealing with Mississippi foreclosures. The plans are competitive and cost-effective, ensuring you only pay for the features you require. This affordability allows businesses managing foreclosures to utilize top-notch signing solutions without breaking the bank.

Get more for Mississippi Foreclosure

- Fmla leave notice request amp approval fmla city of memphis form

- Lenmed health zamokuhle private hospital admission form

- The wonderful day dra form

- Title and registration manual application form

- H e a t walkthrough form cachefly

- Bladder diary uro log national association for continence archive nafc form

- Dormer 80 patch test english form

- Nda confidentiality agreement template form

Find out other Mississippi Foreclosure

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter