Discharge Irs Form

What is the Discharge IRS?

The discharge IRS refers to a specific form used by taxpayers to request a discharge of their tax liabilities. This form is essential for individuals seeking relief from certain tax obligations, particularly in cases of bankruptcy or insolvency. The discharge process helps taxpayers clear their debts with the IRS, allowing them to move forward financially. Understanding the purpose and implications of this form is crucial for anyone navigating tax issues.

How to Obtain the Discharge IRS

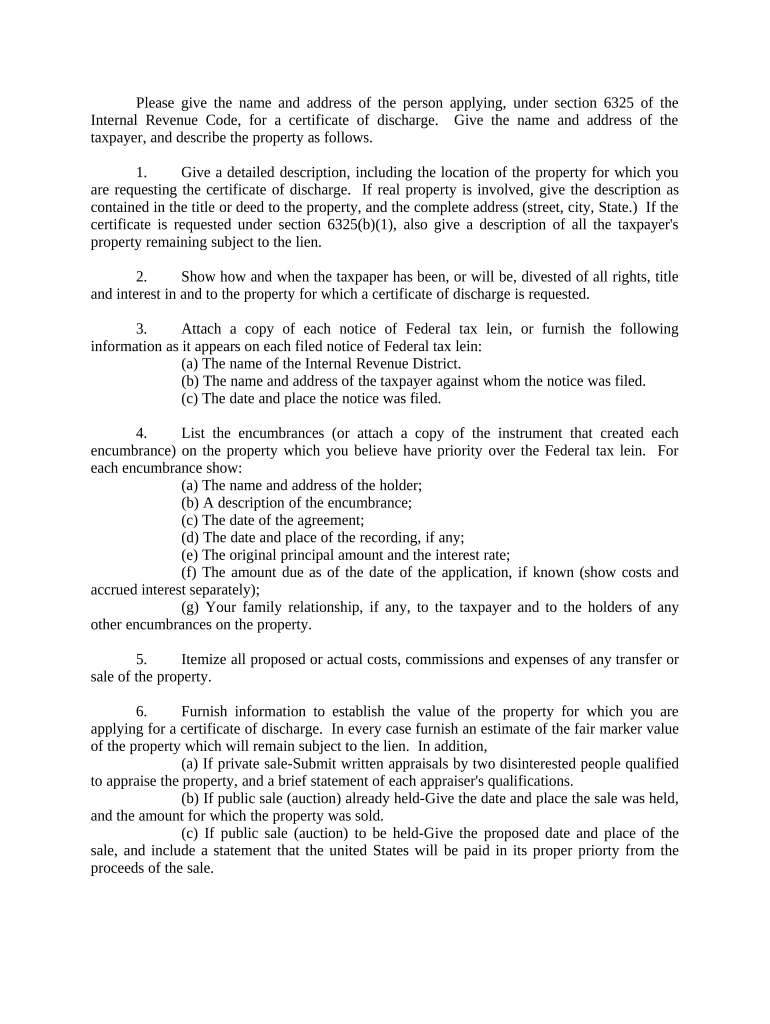

To obtain the discharge IRS form, individuals must first determine their eligibility based on their financial situation. The form can typically be acquired directly from the IRS website or through a tax professional who can provide guidance. It is important to ensure that all necessary documentation is gathered before submitting the request. This may include financial statements, proof of income, and any relevant legal documents related to bankruptcy proceedings.

Steps to Complete the Discharge IRS

Completing the discharge IRS form involves several key steps:

- Gather all necessary documents, including financial records and any court documents related to bankruptcy.

- Fill out the discharge IRS form accurately, ensuring that all information is complete and correct.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate IRS office, either electronically or by mail, based on the instructions provided.

- Keep a copy of the submitted form and any correspondence for your records.

Legal Use of the Discharge IRS

The discharge IRS form is legally binding when completed correctly and submitted according to IRS guidelines. It is essential to understand that the discharge may not apply to all tax debts, and certain conditions must be met for it to be valid. Compliance with all legal requirements is crucial to ensure that the discharge is recognized by the IRS and that taxpayers are protected from future liability for the discharged amounts.

Key Elements of the Discharge IRS

Several key elements must be included in the discharge IRS form for it to be valid:

- Accurate personal information, including name, address, and taxpayer identification number.

- A clear statement of the tax liabilities being discharged.

- Supporting documentation that verifies the taxpayer's financial situation.

- Signature of the taxpayer or authorized representative, confirming the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the discharge IRS form can vary based on individual circumstances, such as the type of bankruptcy filed. It is crucial to be aware of any specific deadlines set by the IRS or the court. Generally, taxpayers should aim to submit the form as soon as they are eligible to ensure timely processing and to avoid any penalties or complications related to late submissions.

Quick guide on how to complete discharge irs

Complete Discharge Irs with ease on any device

Managing documents online has gained popularity among companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the resources you require to create, modify, and electronically sign your documents promptly without delays. Handle Discharge Irs on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign Discharge Irs effortlessly

- Locate Discharge Irs and click Get Form to begin.

- Utilize the tools we provide to fill in your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to share your form, either via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or missing documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Discharge Irs to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process to discharge IRS tax liabilities using airSlate SignNow?

To discharge IRS tax liabilities using airSlate SignNow, you can begin by preparing the necessary documents and information related to your tax situation. Our platform allows you to securely sign and send these documents to the relevant parties for review and approval, helping expedite the discharge IRS process.

-

How does airSlate SignNow help simplify document signing for discharge IRS forms?

airSlate SignNow simplifies the signing of discharge IRS forms by providing an intuitive, user-friendly interface to electronically sign documents. With features like templates and reminders, you can ensure that all necessary forms are completed correctly and submitted on time.

-

Are there any costs associated with using airSlate SignNow for discharge IRS documentation?

Yes, airSlate SignNow offers various pricing plans to cater to different needs. Each plan includes features that allow you to efficiently manage and sign documents required for the discharge IRS process, ensuring you get the best value for your investment.

-

Can I integrate airSlate SignNow with other tools for a smoother discharge IRS experience?

Absolutely! airSlate SignNow can integrate with numerous third-party applications like Google Drive, Dropbox, and CRM systems. These integrations can enhance your ability to manage documents efficiently, making it easier to track and handle your discharge IRS requirements.

-

What benefits does airSlate SignNow offer for those looking to discharge IRS claims?

airSlate SignNow provides several benefits for users aiming to discharge IRS claims, including secure document handling, compliance with e-signature laws, and easy collaboration with professionals. These advantages streamline the process and reduce the overall time needed to address IRS issues.

-

Is airSlate SignNow compliant with IRS regulations for electronic signatures?

Yes, airSlate SignNow is fully compliant with IRS regulations for electronic signatures. This means that when you discharge IRS-related documents through our platform, you can rest assured that your e-signed documents are legally valid and recognized by the IRS.

-

How do I get started with airSlate SignNow to discharge my IRS debts?

Getting started with airSlate SignNow to discharge your IRS debts is easy! Simply sign up for an account, choose a pricing plan that fits your needs, and start uploading your IRS documents. From there, you can use our e-signature tools to complete the process quickly and securely.

Get more for Discharge Irs

Find out other Discharge Irs

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy