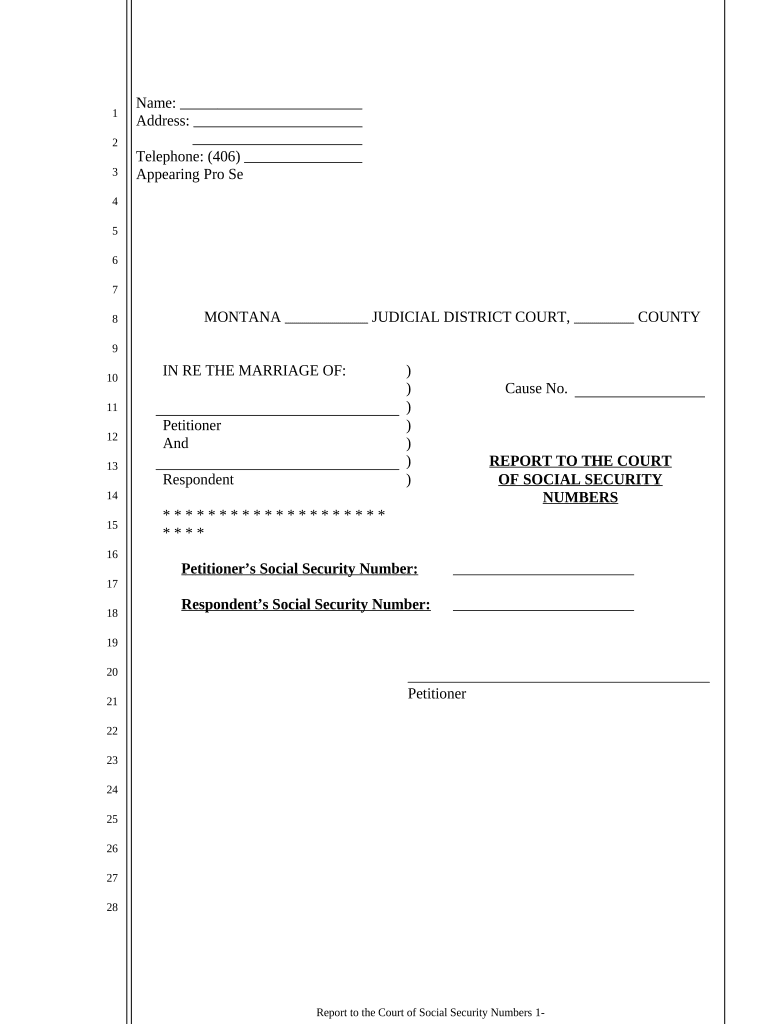

Montana Social Security Form

What makes the montana social security form legally binding?

As the world ditches office working conditions, the execution of documents more and more occurs online. The montana social security form isn’t an exception. Dealing with it using digital means is different from doing so in the physical world.

An eDocument can be viewed as legally binding provided that specific requirements are fulfilled. They are especially vital when it comes to signatures and stipulations associated with them. Entering your initials or full name alone will not guarantee that the institution requesting the form or a court would consider it performed. You need a trustworthy solution, like airSlate SignNow that provides a signer with a digital certificate. Furthermore, airSlate SignNow maintains compliance with ESIGN, UETA, and eIDAS - key legal frameworks for eSignatures.

How to protect your montana social security form when filling out it online?

Compliance with eSignature laws is only a portion of what airSlate SignNow can offer to make document execution legitimate and safe. In addition, it provides a lot of opportunities for smooth completion security smart. Let's quickly go through them so that you can stay assured that your montana social security form remains protected as you fill it out.

- SOC 2 Type II and PCI DSS certification: legal frameworks that are established to protect online user data and payment information.

- FERPA, CCPA, HIPAA, and GDPR: major privacy regulations in the USA and Europe.

- Two-factor authentication: adds an extra layer of security and validates other parties identities via additional means, such as a Text message or phone call.

- Audit Trail: serves to catch and record identity authentication, time and date stamp, and IP.

- 256-bit encryption: sends the information securely to the servers.

Completing the montana social security form with airSlate SignNow will give better confidence that the output document will be legally binding and safeguarded.

Quick guide on how to complete montana social security

Complete Montana Social Security effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documentation, allowing you to access the necessary form and securely archive it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Manage Montana Social Security on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Montana Social Security with ease

- Obtain Montana Social Security and click Get Form to initiate.

- Use the tools available to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all information carefully and click the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and electronically sign Montana Social Security to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are Montana social numbers and why are they important?

Montana social numbers refer to specific identification numbers assigned to residents for various official purposes. These numbers are crucial for accurate record-keeping and are often required for tax filings, social services, and employment verification. Understanding their importance helps ensure compliance with state regulations.

-

How does airSlate SignNow help with documents requiring Montana social numbers?

airSlate SignNow simplifies the process of signing and sending documents that include Montana social numbers. Our platform allows users to securely collect and manage these sensitive numbers within legally binding documents. This ensures that compliance is maintained while providing a user-friendly eSigning experience.

-

What features does airSlate SignNow offer for managing Montana social numbers?

Our platform offers features like customizable templates, real-time tracking, and advanced security protocols to manage documents containing Montana social numbers. These functionalities enhance your workflow and ensure that sensitive information is handled with care. Additionally, digital signatures are legally valid, making your process even more efficient.

-

Is using airSlate SignNow cost-effective for businesses needing Montana social numbers?

Yes, airSlate SignNow provides a cost-effective solution for businesses needing to manage documents with Montana social numbers. Our pricing plans are designed to fit various budgets while offering robust features that enhance productivity. With our solution, you save time and money while ensuring compliance.

-

Can I integrate airSlate SignNow with other tools for managing Montana social numbers?

Absolutely! airSlate SignNow offers seamless integrations with various applications that help manage documents involving Montana social numbers. This connectivity ensures that you can streamline workflows and improve efficiency by integrating with your existing software tools. Check out our integrations page to learn more.

-

What types of documents can I eSign that include Montana social numbers?

You can eSign a wide variety of documents that may require Montana social numbers, such as tax forms, employment contracts, and verification documents. airSlate SignNow supports these types of documents, ensuring they are legally binding and compliant with state regulations. This flexibility meets diverse business needs.

-

How secure is airSlate SignNow when handling Montana social numbers?

Security is a priority at airSlate SignNow, especially when handling sensitive information like Montana social numbers. We employ advanced encryption and authentication protocols to safeguard your documents. Our commitment to data security ensures that your information remains confidential and protected from unauthorized access.

Get more for Montana Social Security

- Cumulative patient profile sample 1 form

- Site visit checklist 404383662 form

- Sf78 form

- Supreme court civil form form 109 affidavit supreme court civil form form 109 affidavit

- Notice of discontinuance sample form

- Fl 304 info how to reschedule a hearing in family court form

- Petition for change of registered name due to marriage form

- Edward joyceeducational psychologistchartered ps form

Find out other Montana Social Security

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word