Living Trust for Husband and Wife with No Children Montana Form

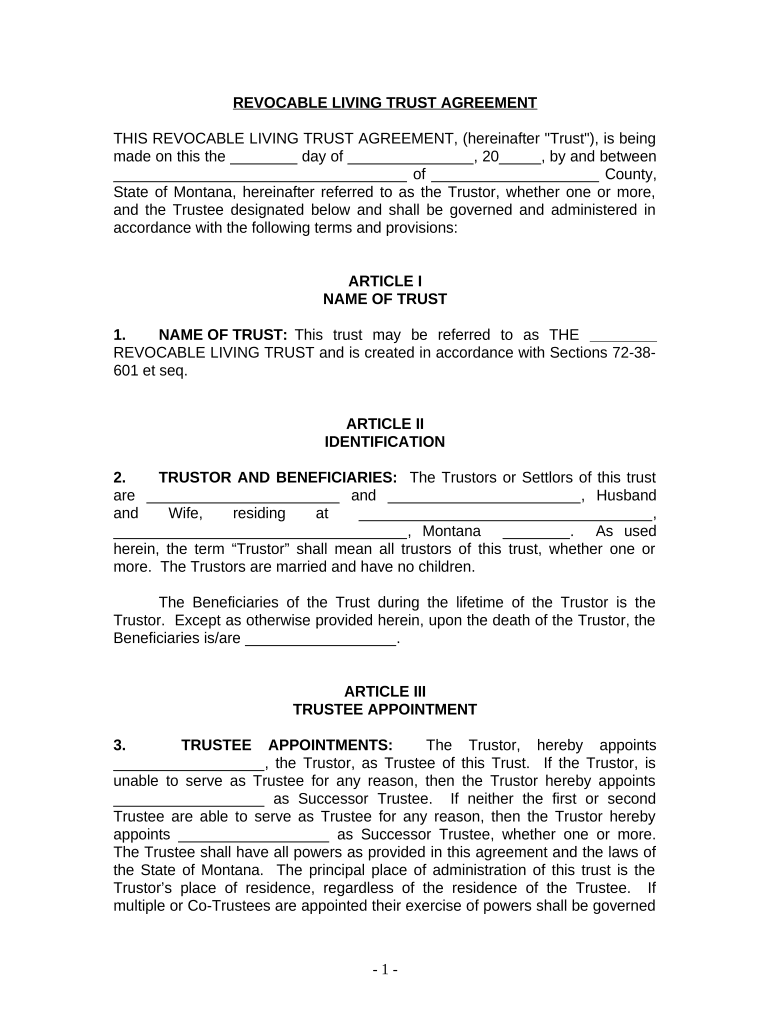

What is the Living Trust for Husband and Wife with No Children in Montana

A living trust for husband and wife with no children in Montana is a legal document that allows couples to manage their assets during their lifetime and dictate how those assets will be distributed after their passing. This type of trust is particularly beneficial for couples without children, as it simplifies the estate planning process. By establishing a living trust, couples can avoid probate, maintain privacy regarding their assets, and ensure that their wishes are honored without the need for court intervention.

How to Use the Living Trust for Husband and Wife with No Children in Montana

Using a living trust involves several steps, including drafting the trust document, transferring assets into the trust, and designating beneficiaries. Couples should start by consulting with an estate planning attorney to create a trust that meets their specific needs. Once the trust is established, they must retitle their assets, such as bank accounts and real estate, in the name of the trust. This ensures that the assets are managed according to the terms of the trust and can be distributed as intended without going through probate.

Steps to Complete the Living Trust for Husband and Wife with No Children in Montana

Completing a living trust involves the following steps:

- Consult with an estate planning attorney to draft the trust document.

- Identify and list all assets to be included in the trust.

- Retitle assets, such as property and bank accounts, in the name of the trust.

- Designate a successor trustee who will manage the trust after both spouses pass away.

- Review and update the trust periodically to reflect any changes in circumstances or laws.

Key Elements of the Living Trust for Husband and Wife with No Children in Montana

The key elements of a living trust for husband and wife without children include:

- Trust Document: This outlines the terms of the trust, including how assets are managed and distributed.

- Trustee: The person or entity responsible for managing the trust assets, typically one or both spouses.

- Successor Trustee: An individual or institution designated to take over management of the trust upon the death of the original trustees.

- Beneficiaries: Individuals or entities that will receive the trust assets after the death of the trustees.

State-Specific Rules for the Living Trust for Husband and Wife with No Children in Montana

In Montana, living trusts must comply with state laws regarding estate planning. This includes ensuring that the trust document is properly executed, which typically requires the signatures of the trustees and witnesses. Additionally, Montana law allows for the creation of revocable living trusts, meaning that the couple can modify or revoke the trust during their lifetime. It is essential to consult with a legal professional familiar with Montana's estate laws to ensure compliance and effectiveness.

Legal Use of the Living Trust for Husband and Wife with No Children in Montana

The legal use of a living trust in Montana allows couples to manage their assets efficiently and plan for the future. By establishing a living trust, couples can avoid the lengthy probate process, which can be costly and time-consuming. The trust becomes effective immediately upon creation, allowing for seamless management of assets during the couple's lifetime. Furthermore, upon the death of both spouses, the trust can distribute assets directly to designated beneficiaries, ensuring that their wishes are carried out without legal complications.

Quick guide on how to complete living trust for husband and wife with no children montana

Effortlessly prepare Living Trust For Husband And Wife With No Children Montana on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed paperwork, enabling you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without interruptions. Handle Living Trust For Husband And Wife With No Children Montana on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to edit and eSign Living Trust For Husband And Wife With No Children Montana with ease

- Find Living Trust For Husband And Wife With No Children Montana and click on Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Living Trust For Husband And Wife With No Children Montana to guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Husband And Wife With No Children in Montana?

A Living Trust For Husband And Wife With No Children in Montana is a legal document that allows couples to manage their assets during their lifetime and seamlessly transfer them upon death. This type of trust helps avoid probate, ensuring a faster and smoother distribution of assets according to the couple's wishes.

-

What are the benefits of establishing a Living Trust For Husband And Wife With No Children in Montana?

The primary benefits of a Living Trust For Husband And Wife With No Children in Montana include avoiding probate, maintaining privacy, and providing efficient asset management. Additionally, it allows for flexible control over your assets during your lifetime and can help reduce estate taxes.

-

How much does it cost to create a Living Trust For Husband And Wife With No Children in Montana?

The cost of creating a Living Trust For Husband And Wife With No Children in Montana can vary based on complexity and the services of the attorney or provider you choose. However, with airSlate SignNow's streamlined process, couples can save costs by using our user-friendly platform to create and manage their trust documents efficiently.

-

Can I modify my Living Trust For Husband And Wife With No Children in Montana after creation?

Yes, you can modify your Living Trust For Husband And Wife With No Children in Montana at any time during your lifetime. This flexibility allows you to adapt to changes in circumstances, such as acquiring new assets or changes in your wishes regarding asset distribution.

-

What assets can be included in a Living Trust For Husband And Wife With No Children in Montana?

You can include a variety of assets in your Living Trust For Husband And Wife With No Children in Montana, such as real estate, bank accounts, investments, and personal property. Including your assets in the trust ensures they are managed and distributed according to your instructions without going through probate.

-

Does a Living Trust For Husband And Wife With No Children in Montana provide tax benefits?

While a Living Trust For Husband And Wife With No Children in Montana does not directly provide tax benefits, it can help manage estate taxes more effectively. By strategically placing assets in the trust, couples can potentially reduce their overall tax burden and simplify the estate settlement process.

-

Is it necessary to have a lawyer to create a Living Trust For Husband And Wife With No Children in Montana?

While it is not necessary to have a lawyer to create a Living Trust For Husband And Wife With No Children in Montana, consulting with one can ensure the trust is set up correctly according to state laws. Alternatively, airSlate SignNow provides easy-to-use templates, allowing couples to create their trust documents without legal assistance if they prefer.

Get more for Living Trust For Husband And Wife With No Children Montana

Find out other Living Trust For Husband And Wife With No Children Montana

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe